Candlestick Chart Patterns: Chapter 3 The Indecision and Continuation Patterns

On our previous two chapters, we’ve discussed (1) bullish reversal candlestick pattern and (2) the bearish reversal candlestick pattern. Continue reading and familiarize yourself with the candlestick patterns that we’ll be talking about today.

To continue learning the candlestick chart pattern, we’ll discuss two other set of patterns. In this post, we’ll discuss the indecision patterns and continuation patterns. Let’s now begin by the indecision patterns.

The Indecision Candlestick Patterns

Indecision candlestick patterns occur within the market chart indicating that both selling and buying pressure is at steadiness. There are two types of indecision pattern. We’ll explain both further.

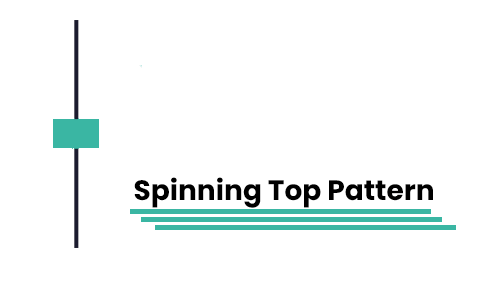

The Spinning Top Pattern

Spinning top pattern is an indecision pattern forming whenever both selling and buying pressure is battling to have control in the market.

Spinning top pattern is an indecision pattern forming whenever both selling and buying pressure is battling to have control in the market.

There are two ways to recognize a spinning top pattern candlestick. One, the candle have a long upper and lower shadow. Two, the candle have a small body.

The spinning top pattern indicates two things. Firstly, when the market opens, buyers and sellers both aggressively. Both are wanting to take control resulting in upper and lower shadows. Secondly, looking at forward at the end of the session neither gains in the upper hand.

Simply put, the spinning top indicates significant volatility within the market without a clear outcome who wins between the buyers and sellers.

The Doji Pattern

Even though Doji is an indecision pattern, there are different importance. There are two types of Doji pattern.

- Dragonfly Doji

Dissimilar with the regular Doji in which opens and closing close the middle of the range. Dragonfly Doji opens and closes close the highs of the range with long lower shadow.

Dragonfly Doji occurs whenever there’s a rejection of lower prices while buying pressure steps in to push the market to a higher opening price.

-

Gravestone Doji

Dissimilar with the regular Doji, Gravestone Doji closes open and closes close the lows of the range having a long upper shadow. Gravestone Doji indicates a refusal of higher prices while selling pressure steps in pushing the market lower to the opening price.

The Continuation Candlestick Pattern

Continuation pattern indicates that the market is about to continue trading in the same direction. As an experienced trader, continuation patterns is the best opportunity in the market. In addition, there are four types of continuation pattern.

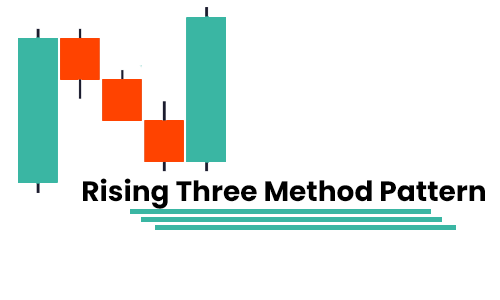

Rising Three Method Pattern

Rising three method is a bullish trend continuation pattern indicating that the market is to continue trading higher. There are three ways to recognize a rising three method pattern. One, the first candle shows a large bullish candle. Two, the following three candles have a smaller body and range. Three, the last candle have a large body closing below the lows of the first candle.

Rising three method is a bullish trend continuation pattern indicating that the market is to continue trading higher. There are three ways to recognize a rising three method pattern. One, the first candle shows a large bullish candle. Two, the following three candles have a smaller body and range. Three, the last candle have a large body closing below the lows of the first candle.

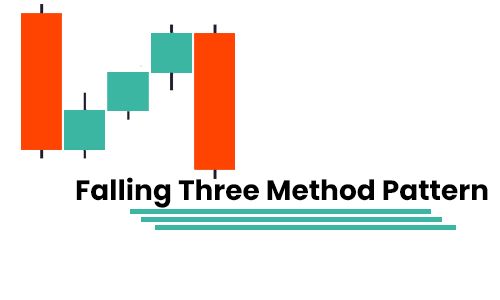

Falling Three Method Pattern

Falling three method indicates three things. Firstly, the first candle tells that the sellers are in control as they close the session strongly lower. Secondly, the following three candles indicate that the sellers are gaining profits leading to a slight advanced. However, it was not a strong rally because there are new sellers entering short. Lastly, the fifth candle shows that the seller’s gain control pushing price to new lows.

Falling three method indicates three things. Firstly, the first candle tells that the sellers are in control as they close the session strongly lower. Secondly, the following three candles indicate that the sellers are gaining profits leading to a slight advanced. However, it was not a strong rally because there are new sellers entering short. Lastly, the fifth candle shows that the seller’s gain control pushing price to new lows.

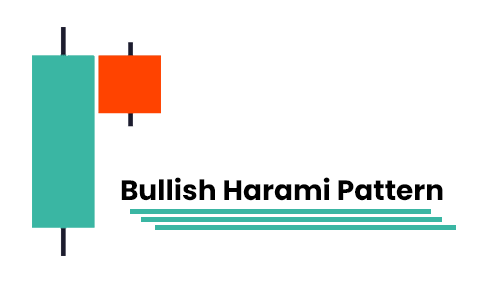

The Bullish Harami

The bullish harami works well as a continuation pattern within the uptrend. It shows that the buyers are taking a break and the price is to trade higher. There are two ways to indicate a bullish harami. One, the first candle is bullish and bigger than the second candle. Two, the next candle have a smaller range and body.

The bullish harami works well as a continuation pattern within the uptrend. It shows that the buyers are taking a break and the price is to trade higher. There are two ways to indicate a bullish harami. One, the first candle is bullish and bigger than the second candle. Two, the next candle have a smaller range and body.

A Bullish harami pattern indicates two things. Firstly, the first candle showing the buying pressure while the candle bullishly closes. Secondly, the second candle indicates indecision while both buying and selling pressure looks alike.

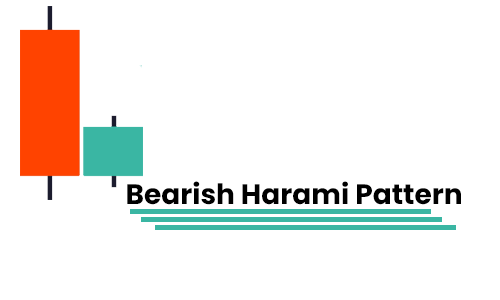

The Bearish Harami

Bearish harami works best within a continuation pattern within the downtrend. It indicates that the sellers take a break. At the same time, the amount is about to trade lower.

Bearish harami works best within a continuation pattern within the downtrend. It indicates that the sellers take a break. At the same time, the amount is about to trade lower.

There are two ways to indicate a bearish harami. One, the first candle is larger and bearish compare with the second one. Two, the following candle have a small range and body.

Bearish harami indicates two things. Firstly, the first candle shows strong selling pressure while the candle closes bearishly. Secondly, the indecision from both (buying and selling) pressure is alike.

Trend Continuation Setups

To further understand the continuation setups, (Rising Three Method, Falling Three Method, Bullish Harami, Bearish Harami) let’s look at them on a sample market chart.

Here’s how to do it. Firstly, whenever the market is in a range, wait for its breakout over the resistance. Secondly, when the market breaks out the resistance, wait for it to form a continuation candlestick pattern. Thirdly, whenever the market creates a continuation candlestick, go long on the breaks the highs. Lastly, perform vice vera for the short setups.

Observe the sample chart below to understand further.

Chapter 4 Understanding Candlestick Pattern>>>

-

Support

-

Platform

-

Spread

-

Trading Instrument