Market News and Charts for December 16, 2019

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

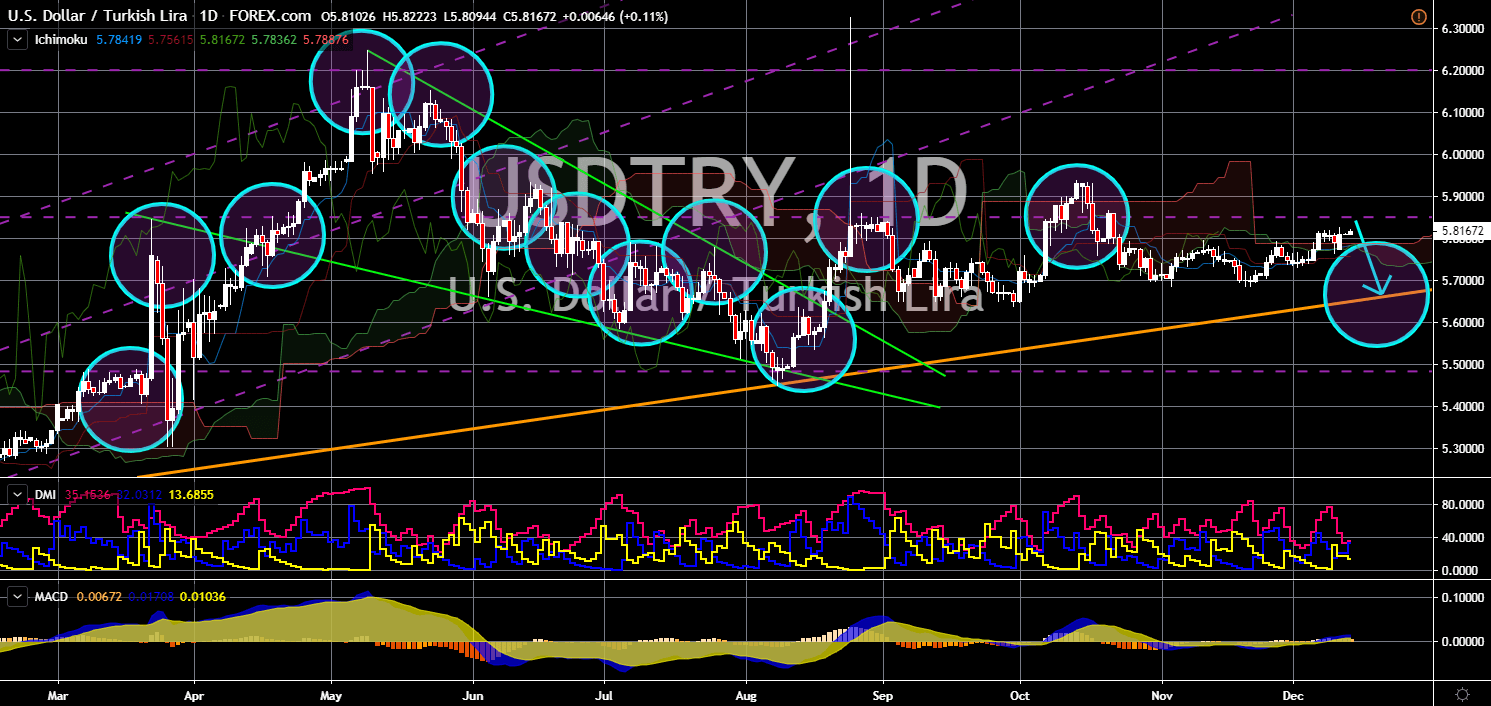

USD/TRY

The pair is expected to trade lower in the following days. The US is set to report the country’s Manufacturing Purchasing Managers Index and Service Purchasing Managers Index today, December 16. On the previous PMI reports, the country was able to beat their previous records. This led to the Federal Reserve holding onto its current benchmark interest rate. Despite the strong economic data, however, the country was struggling to maintain its military dominance. During the recent NATO (North Atlantic Treaty Organization) Alliance, French President Emmanuel Macron took a jab at Trump. This was following his comment that most ISIS fighters were from Europe. Macron was one of the proponents of an EU Army. In addition, the second largest military member of NATO, Turkey, was currently at odds with America. President Recep Tayyip Erdogan warned that he will shut two (2) US military bases if sanctions against the country continue.

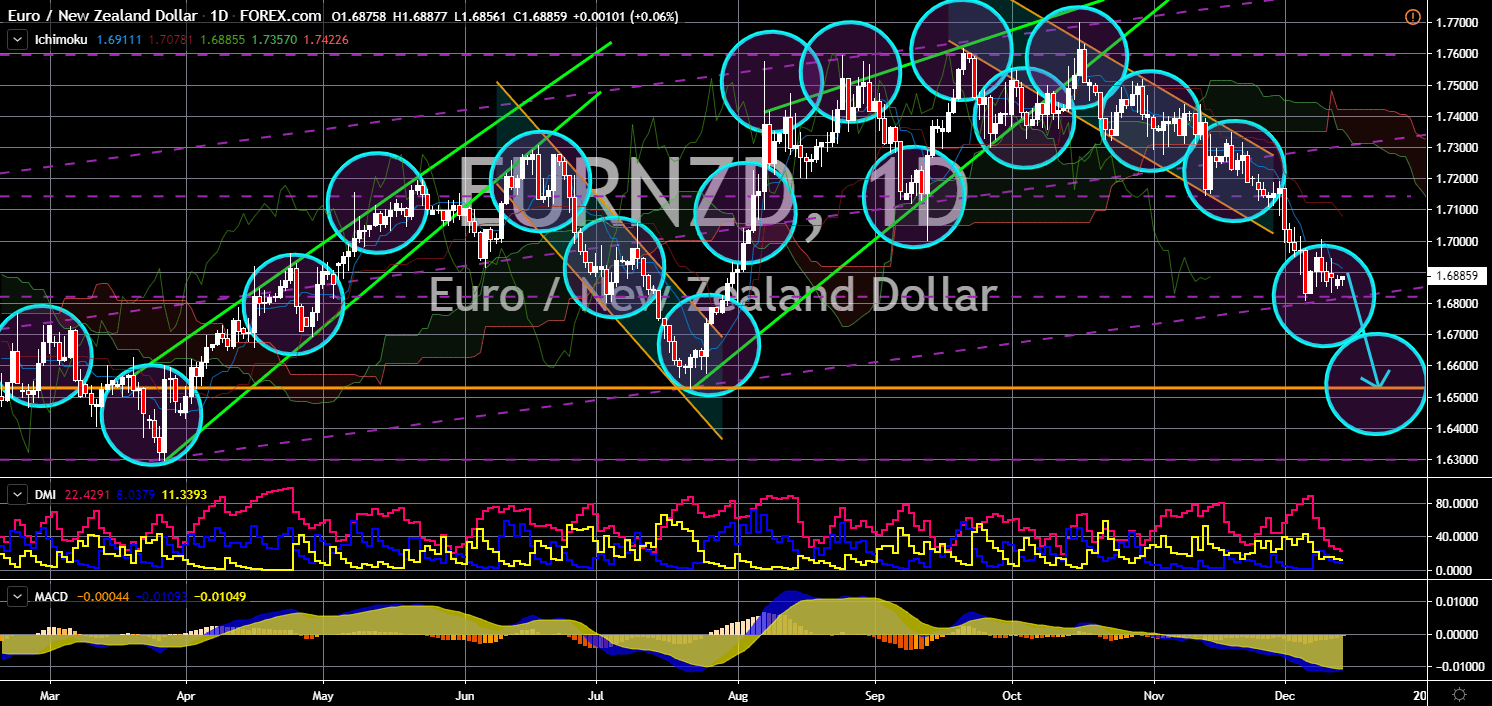

EUR/NZD

EUR/NZD

The pair is expected to break down from a major support line. The European economy was able to keep itself afloat with its recent Purchasing Managers Index (PMI) reports for manufacturing and services. France was able to dodge contraction while Germany’s manufacturing industry continue to suffer. This resulted to a mixed result for the bloc’s Manufacturing and Services PMI. Uncertainty is expected to continue in today’s trading after the European Central Bank (ECB) hold onto its current rates. During the first speech of ECB President Christine Lagarde, she said that the European economy is strong. However, investor’s sentiments are at odds with this statement. Aside from this, UK Prime Minister Boris Johnson won during the general election, which increased the possibility that the UK will leave the bloc on January 31 with or without a deal. The New Zealand economy is expected to benefit from Johnson’s win.

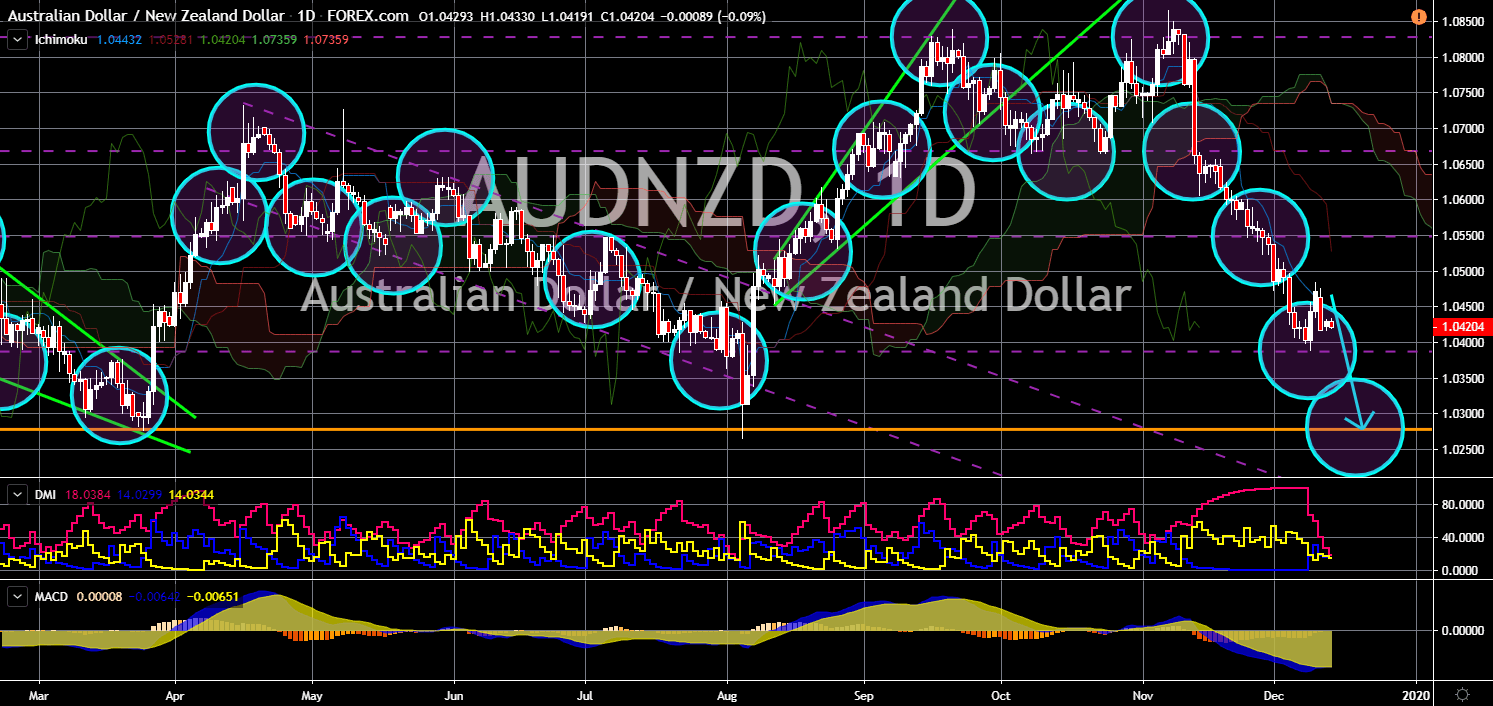

AUD/NZD

The pair is expected to continue its steep decline towards a major support line. The Australian dollar continues to suffer amid the escalating trade war between the United States and China. The two (2) largest economies in the world reached a trading deal on the same day that the US is due to impose duties on Chinese exports. However, analysts were skeptical with the lack of details with the phase one trade deal. The Australia and New Zealand Banking Group Limited (ANZ) is due to report their Business Confidence report for New Zealand today. Analysts were expecting a positive result following the win of Boris Johnson. Trade representatives from the United Kingdom said that New Zealand was the country’s top priority for a post-Brexit trade agreement. New Zealand was the first country to express its interest in making a post-Brexit trade agreement. The country has also an on-going trade agreement with the European Union.

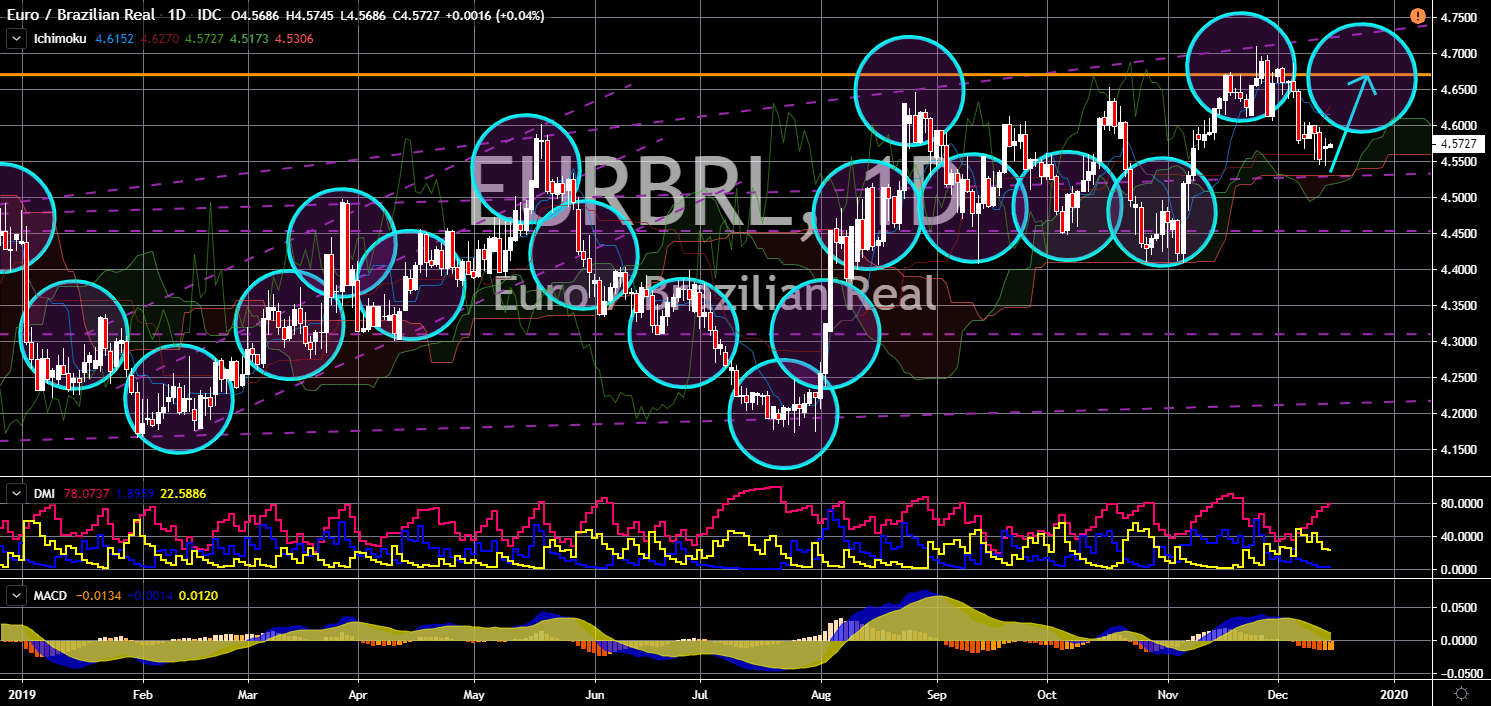

EUR/BRL

The pair will bounce back from a key support line, sending the pair higher towards the nearest resistance line. The phase one trade deal between the United States and China is expected to hurt the Brazilian economy. During the height of trade war, Brazil benefited from the shift of soybean import by China. The country supplied 80% of the total Chinese exports at its height. However, analysts expect that the trade deal will require China to buy US soybean to aid the country’s ailing agriculture. This, in turn, will be a slap to Brazil export. Aside from this, the EU-Mercosur deal is on the brink of uncertainty following the gap between EU member states – Germany and France – and Brazil. The deal was negotiated for 20 years but the burning of the Amazon rainforest is expected to put these negotiations to waste as the EU turns green. The European Union is also exploring other trade alternatives like China and Russia.