Market News and Charts for December 17, 2019

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

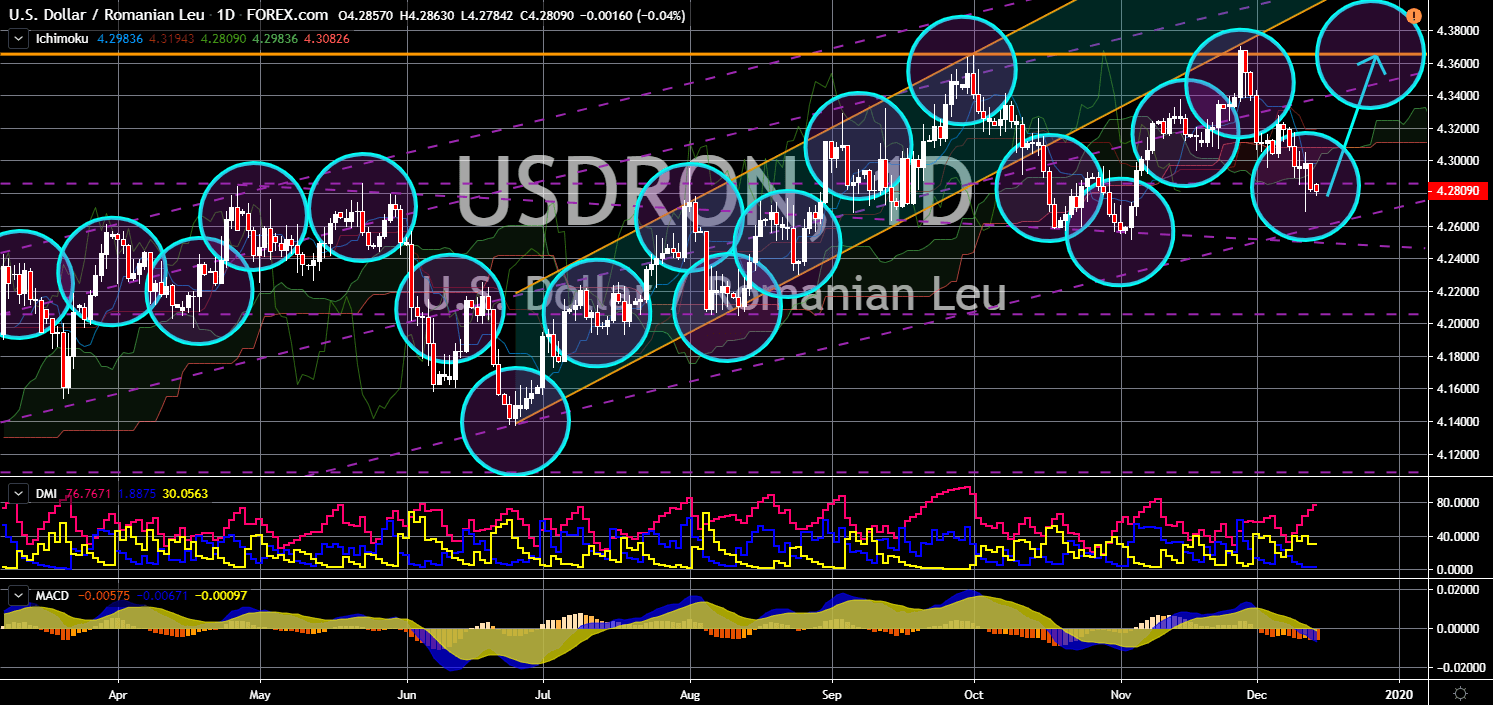

USD/BRL

The pair is expected to bounce back from an uptrend support line. The Central Bank of Brazil’s Monetary Policy Committee (Copom) will be having a meeting today, December 17. Analysts see this as a response to the phase one trade deal between the United States and China. Brazil is among the few countries that benefited during the height of the trade war between the two (2) largest economies in the world. During that time, Brazil accounted for more than 80% of China’s total soybean import. However, the trading agreement signed by the US and China on December 15 requires China to increase its purchase of soybean from the country. Despite this, the United States and Brazil’s relationship continue to grow following the election of the populist Jair Bolsonaro. Bolsonaro was dubbed by the international community as South America’s Trump. During his campaign, he uses “Make Brazil Great Again” which was similar to Trump’s policy.

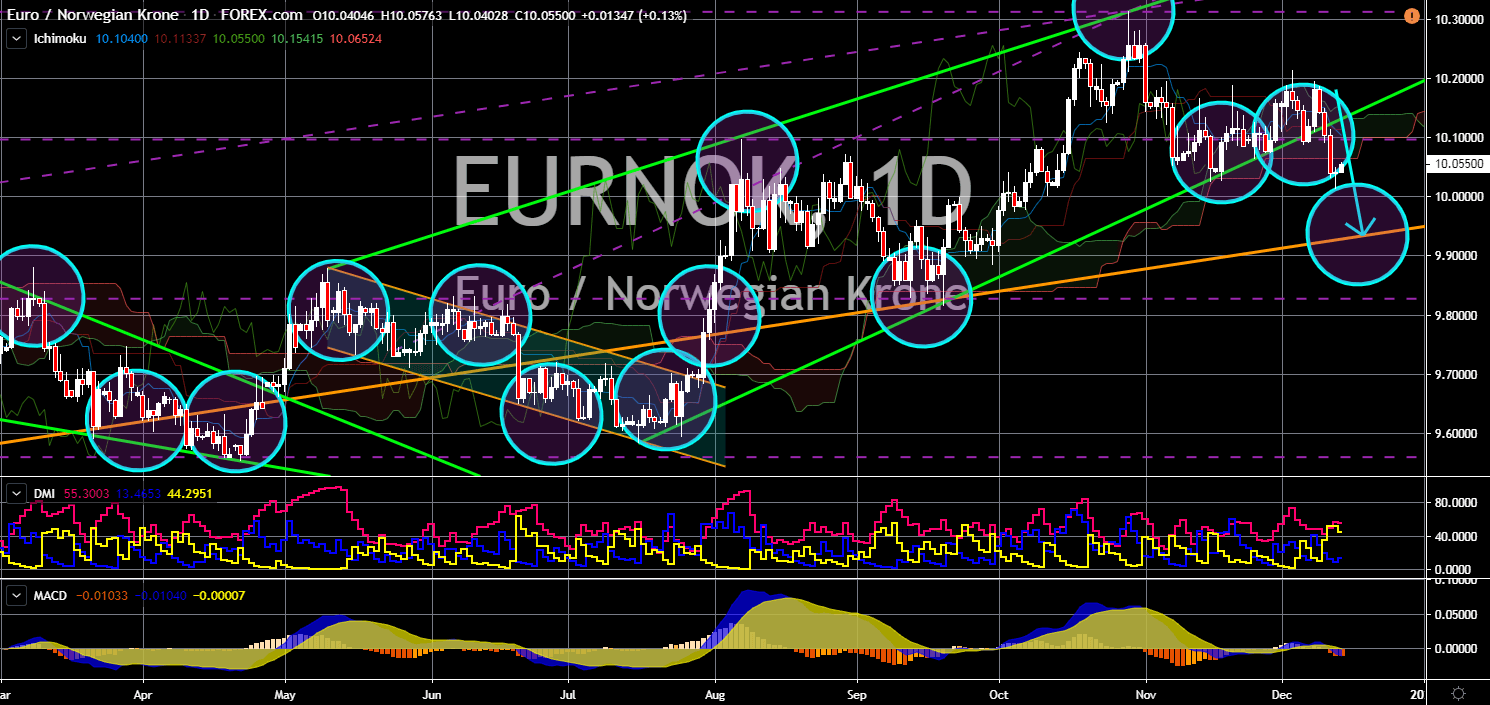

USD/RON

USD/RON

The pair will bounce back from a major support line, sending the pair higher to retest a major resistance line. Romanian President Klaus Iohannis awarded departing US Ambassador to Romania Hans Klemm the country’s higher order. December 14 marks the end of service for the diplomat and has been given the Star of Romania order in the Great Cross degree. He was replaced by Adrian Zuckerman effective on Sunday, December 15. Under Klemm, the relationship between the United States and Romania reach a new high. The US shifted its strategic military defense from Turkey to the eastern bloc. Romania is now hosting a military base and has been a recipient of the most advanced fighter jet and missile defense system. These events helped the demand for the US dollar to increase in eastern Europe. The advancement of US interest in the east Europe is also timely as the gap between the relationship of America and western Europe continue to widen.

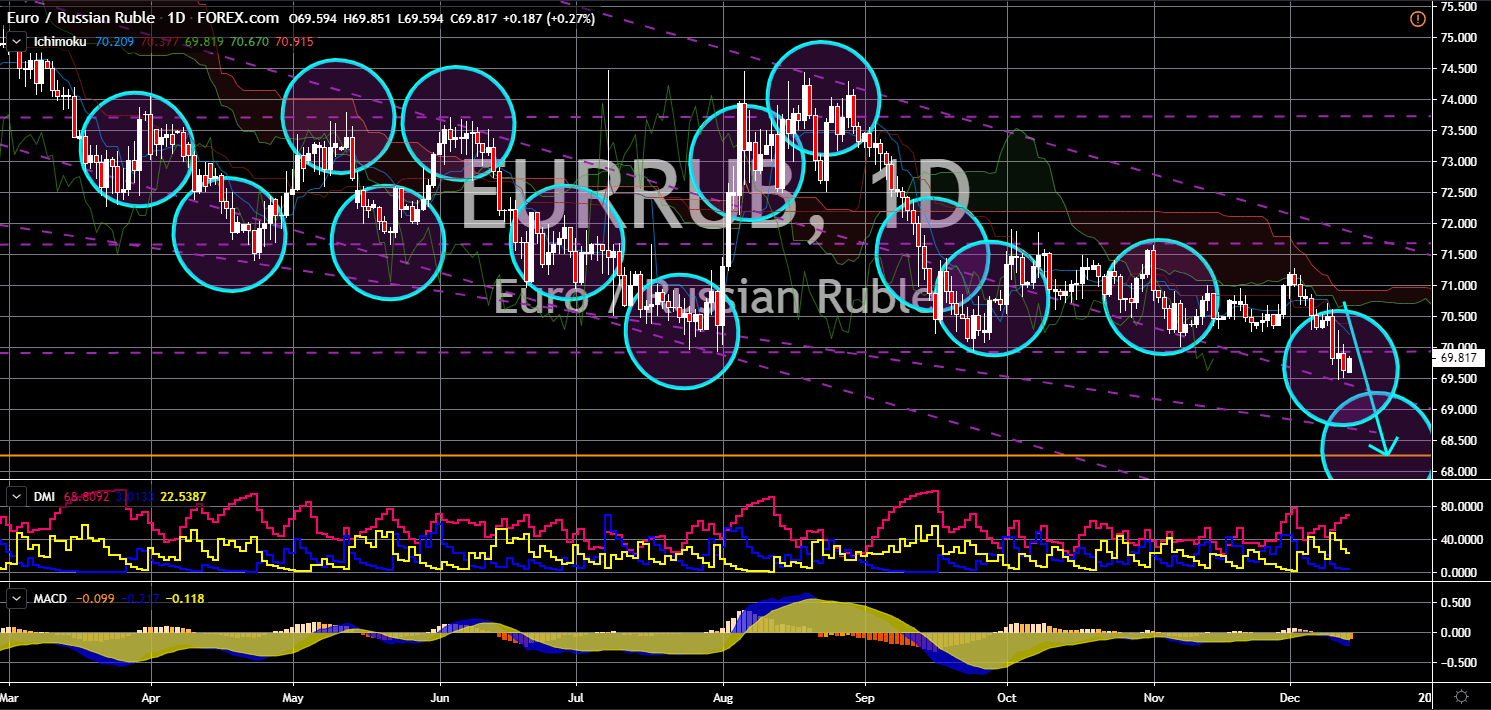

EUR/NOK

The pair will continue to move lower after it broke down from a “Rising Wedge” pattern support line. The single currency is being hit by the slowdown in the bloc’s manufacturing sector. On the heart of the industry was the largest economy in Europe, Germany. For years, Germany has led the bloc to survive economic crisis. However, as the country flirts with recession, EU-member states have no way to power up the bloc’s economic growth. Yesterday’s Manufacturing and Services Purchasing Managers Index (PMI) saw the manufacturing sector to slowly crumble. In addition to this, analysts were expecting that car registration on the United Kingdom, Germany, France, and Italy will continue to slow down. This was amid the commitment of the EU-member states to reduce carbon emissions by 2050. In other news, an agreement between the European Union and Norway has been reached resulting in a 50% reduction in fishing quotas.

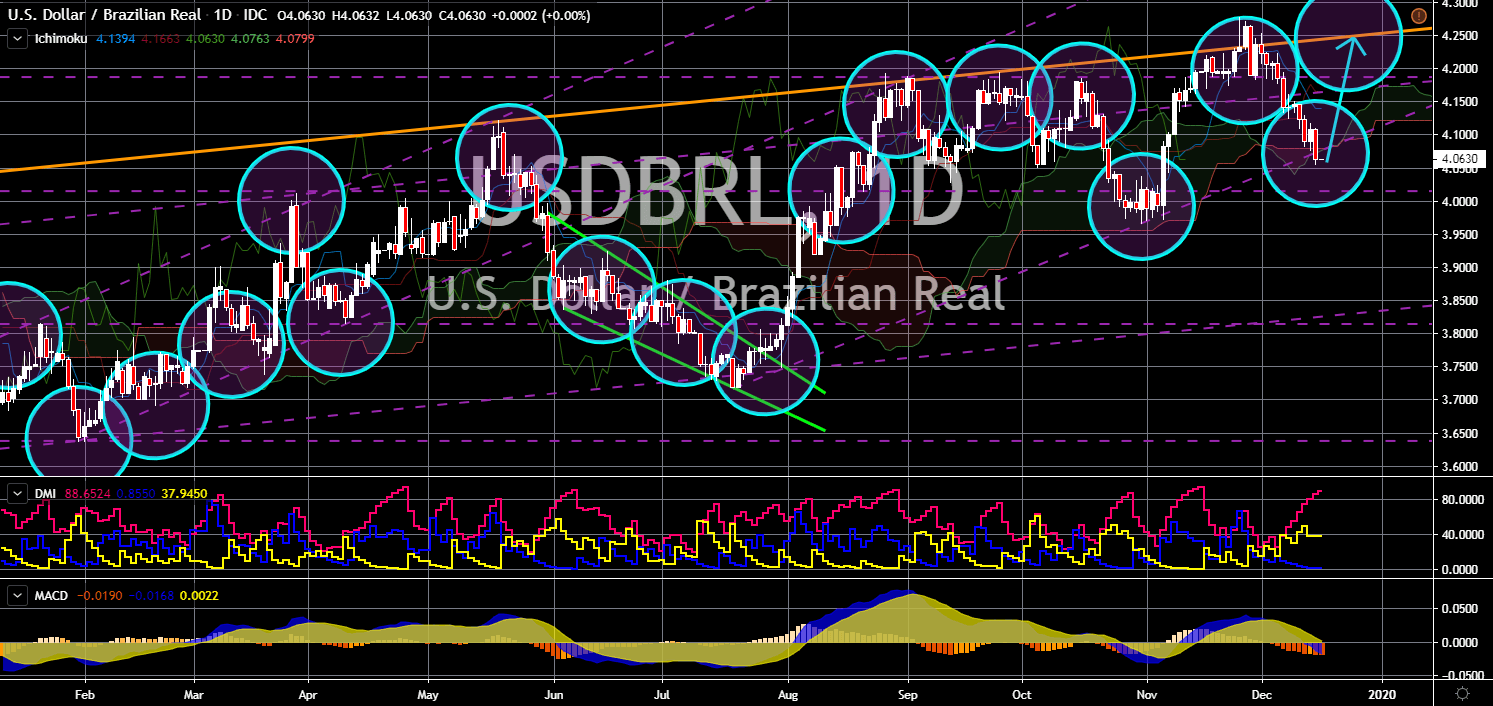

EUR/RUB

The pair broke down from a major support line, sending the pair lower toward its January 2018 low. The European Union is seen shifting its foreign policy from a US ally towards Russia and China friendly bloc. The election of US President Donald Trump has put uncertainty between the US-EU relations. Trump pulled out from major trading pacts and accords including the Trans-Pacific Partnership (TPP) in Asia, 1987 Intermediate-range Nuclear Forces (INF) treaty with Russia, Paris Accord in Europe and many more. This pushed German Chancellor Angela Merkel and French President Emmanuel Macron to increase its relationship with Russia and China. The European Union leaders agreed to extend sanction with Moscow for another six (6) months following its 2014 annexation of Crimea. Despite this, a meeting between the leaders of each party are expected to meet in Ukraine to reach a peace agreement.