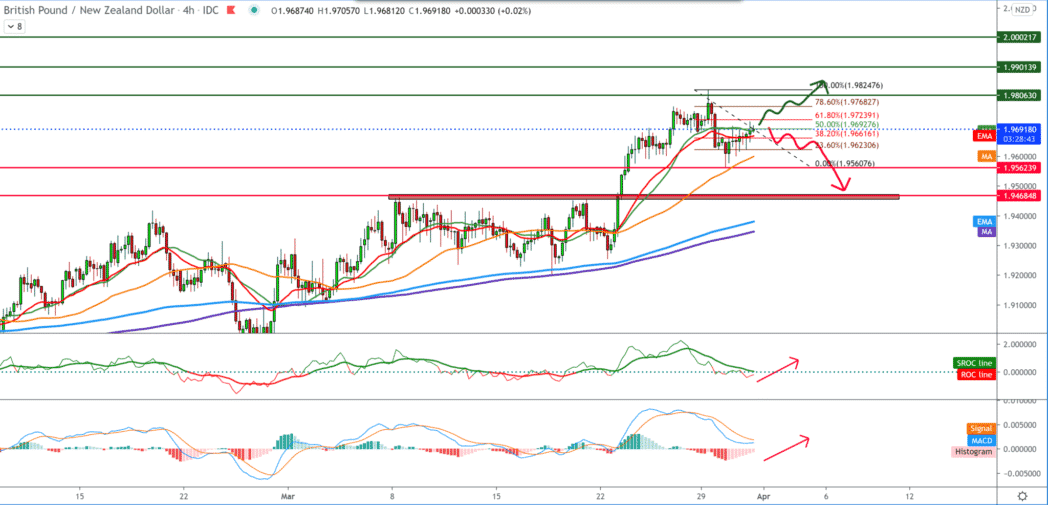

GBP/NZD analysis for March 31, 2021

Looking at the GBP/NZD pair chart on the four-hour time frame, we see that the Pound is progressing solidly against the New Zealand dollar, and we can place smaller Fibonacci, where we will pay attention to 61.8% level 1.97239.

The break above is a sign that we will probably continue in the bullish trend, and we are looking at the previous high at 1.980247 as potential next resistance.

The moving averages of the MA20 and EMA20 we see making a turn again by directing the lines towards continuing the bullish trend. And the poor consolidation and lack of power of the pound will bring us down to the moving average of MA50 to 1.96000, and a little below that is the psychological level of 1.95000.

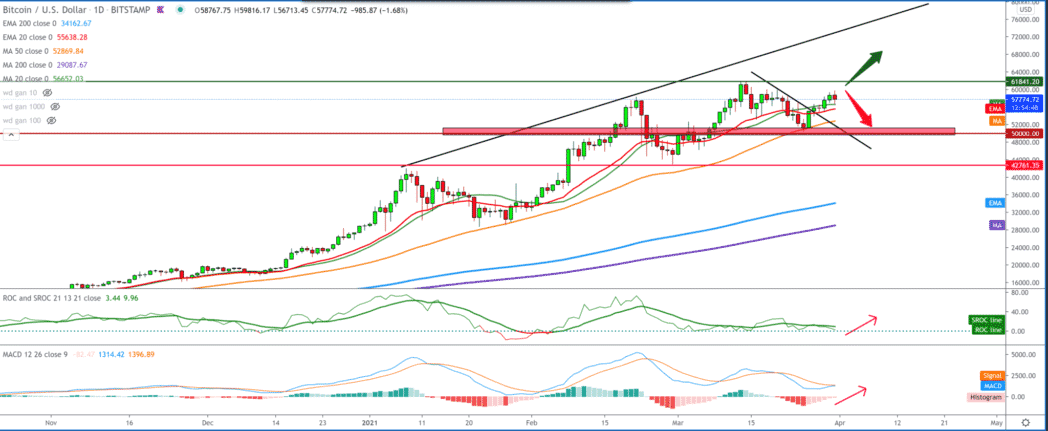

On the daily time frame, we see that the GBP/NZD pair has been moving in a bullish trend since the beginning of the year. Following the moving averages, we see that the MA20 and EMA20 made a break above the MA200 and EMA200 as an additional sign of a strong bullish trend.

By setting the Fibonacci retracement level, we see that we first jumped out of consolidation at 23.6% level and started at 38.2%, around which we now have the next consolidation. The formation of candlesticks creates a potential flag pattern as additional support for the bullish trend. If we see a break above the 38.2% level, it is realistic to continue 50.0% at 2.01600.

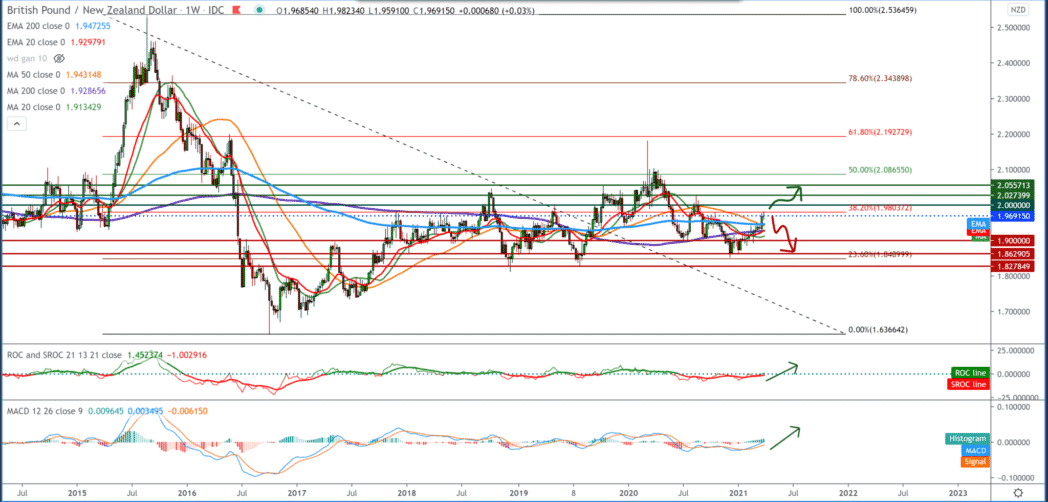

On the weekly time frame, we see that the bullish trend is only in its infancy. We can conclude this based on moving averages, especially the break above the MA200 and EMA200, which can easily become a good signal for a stronger bullish trend. As a resistance, we look at the Fibonacci retracement 38.2% level at 1.98000. The break above leads us to a psychological level of 2.00000 and further conquering higher levels on the chart.

-

Support

-

Platform

-

Spread

-

Trading Instrument