| General Information |

|

|---|---|

| Broker Name: | Capital One Markets |

| Broker Type: | Forex |

| Country: | / |

| Operating since year: | 2020 |

| Regulation: | N/A |

| Address: | / |

| Broker status: | Active |

| Customer Service | |

| Phone: | / |

| Email: | [email protected] |

| Languages: | English |

| Availability: | 24/5 |

| Trading | |

| The Trading platforms: | Proprietary |

| Trading platform Time zone: | / |

| Demo account: | / |

| Mobile trading: | / |

| Web-based trading: | Yes |

| Bonuses: | Yes |

| Other trading instruments: | Yes |

| Account | |

| Minimum deposit ($): | 250 |

| Maximal leverage: | 1:100 |

| Spread: | Tight |

| Scalping allowed: | Yes |

Capital One Markets Review 2021 – How Good is this Broker?

REVIEW CONTENT

- GENERAL INFORMATION

- FUNDS TRADING AND SECURITY

- THE TRADING ACCOUNTS

- TRADING CONDITIONS

- TRADING PLATFORM

- CAPITAL ONE MARKETS’ TRADING PRODUCTS

- CUSTOMER SERVICE

- CONCLUSION

General Information

Capital One Markets is a fresh broker that offers a wide array of trading services to its users. The broker provides all the most popular asset classes, although its focus seems to be on forex trading. Even so, the variety definitely looks like it’s there for the broker. In our Capital One Markets review, we’ll help you determine whether they’re the right company for you.

While most brokers try and jump in your face to market themselves, Capital One Markets takes a more minimalistic approach. Namely, its landing page looks quite tame compared to most other brokers. However, the impressive thing is that even with that design, it manages to convey all the necessary info to traders.

As soon as you open Capital One Markets’ website, you see the broker specifications. Because of that, there’s no need to dig around obscure webpages to find out what you need to know. If a broker is upfront about its service and shows it to its customers right away, we take it as a sign of confidence. Naturally, there’s also the element of transparency, which makes us trust the broker more, especially in the current sea of scams.

As such, the first impression the broker left on us is definitely a positive one. That’s without even mentioning the strong trading conditions you can see right away. However, we’ll leave going over those for later in our Capital One Markets review. For now, we’d like to look at some of our favorite features that the company provides:

Funds Trading and Security

Fund safety is one of the crucial areas for any broker. Even the best trading conditions would be worthless if there were a chance of your money disappearing overnight. As such, our Capital One Markets review has security as one of its primary focuses. Luckily, the broker seems to have done better in ensuring trader safety than most of its peers. Still, let’s take a slightly more detailed look at what the broker’s safety measures are.

Naturally, we’ll start with the technical conditions, as they’re far more understandable and easier to judge. They begin with SSL-encryption that protects users from any outside influences, such as hackers. We’ve all heard of massive brokerage hackings that leave either a broker or their users at a heavy deficit. Naturally, nobody wants to be on the receiving end of that, so the fact that the broker has protection against it is significant.

Next, the broker also ensured that your funds and personal info were entirely safe. It keeps funds in top-tier banks, meaning they won’t get stolen and promises not to share any personal data. As such, the brokerage is safe by every technical measure we can think of.

However, another thing worth mentioning is less objective security indicators. While technical security is important, user impressions are what often paints a more precise picture about a broker. Capital One Markets, unfortunately, hasn’t had the time to build a reputation on the scale of some competitors. Still, the user opinions we found were overwhelmingly positive, solidifying our impression of the broker. We’re confident in stating that you shouldn’t have any security issues while using Captial One Markets.

The Trading Accounts

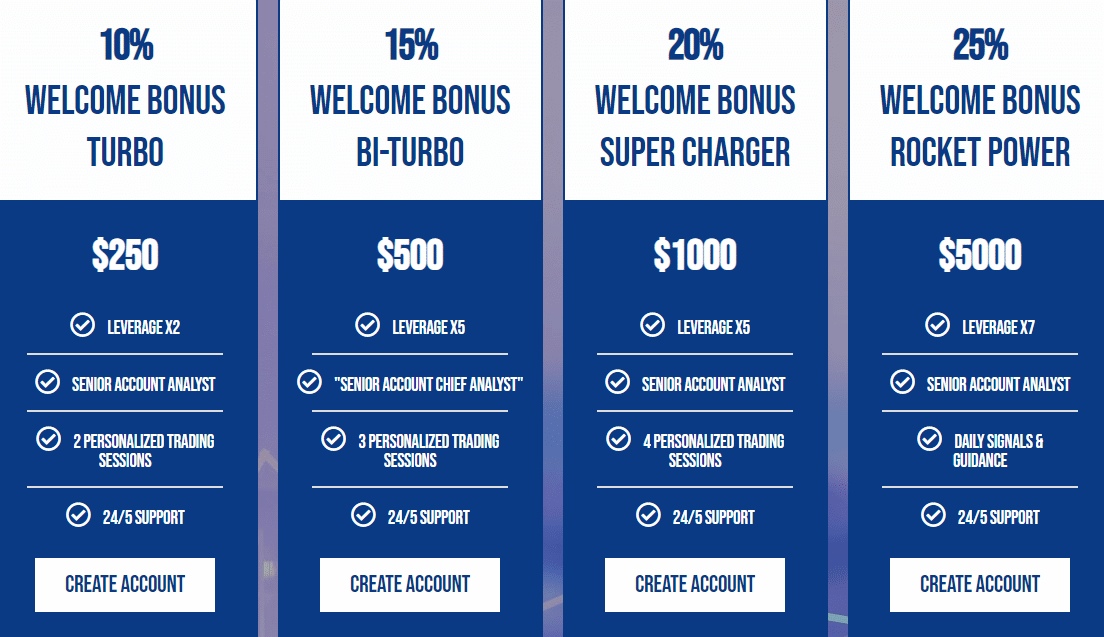

Capital One Markets has multiple different accounts that adhere to users with varying levels of budget. However, the great thing is that the accounts don’t differ too much, creating an even playing field. It’s common for brokers to intentionally weaken lower tiers, forcing users to dump more money. That’s a negative for budget investors, as their service is gimped and often barely functional. However, it’s also a downside for high investors, as they pay more for a service that’s actually regular.

Capital One Markets’ setup allows it to hold nothing back while still rewarding loyalty. The advantages come in the form of a higher leverage rate, more time with expert advisors, and a higher welcome bonus. As such, there are no key features locked behind paywalls and no severe imbalance between accounts.

Even those that decide to stick with the lowest tier forever will get a significantly better trading experience than elsewhere. However, we should note that it’s also possible to progress through accounts naturally by using the broker’s service. Since the accounts are based on your cumulative investment, you don’t need to deposit all your money instantly. Instead, you can trade as you regularly do and let your account go to the next level by depositing money occasionally.

Because of that, there’s no wrong choice of account at Capital One Markets. Choosing an account comes down to personal preference, and here are some specifications to aid your decision:

Turbo

- $250

- Welcome Bonus: 10%

- Leverage X2

- Senior Account Analyst

- 2 Personalized Trading Sessions

Bi-Turbo

- $500

- Welcome Bonus: 15%

- Leverage X5

- Senior Account Chief Analyst

- 3 Personalized Trading Sessions

Super Charger

- $1000

- Welcome Bonus: 20%

- Leverage X5

- Senior Account Analyst

- 4 Personalized Trading Sessions

Rocket Power

- $5000

- Welcome Bonus: 25%

- Leverage X7

- Senior Account Analyst

- Daily Signals & Guidance

Trading Conditions with Capital One Markets

The trading conditions are another area where the broker shines. As we said near the start of our Capital One Markets review, the broker offers competent trading conditions. That starts from its account typing, which lets it adhere to brokers of all skill and experience levels. Then, there’s also the fact that the broker’s spreads are tight, meaning most of your money goes into your trades. Lastly, the leverage is high, meaning even day trading tactics that employ it are entirely viable.

Furthermore, even the secondary conditions are excellent. We already talked about the broker’s security, which acts as a backbone for the trading. We also mentioned the excellent funding options the broker provides, ensuring your money flows freely. On top of that, the broker’s asset variety means you don’t need to compromise with financial instrument quality. Altogether, that means maintaining consistent profits is simple, and the trading experience is enjoyable.

One last thing we should mention are the trader resources integrated into Capital One Markets’ website. The broker has numerous tools that aid their traders in making the right calls. That includes analytical tools, educational ones, as well as news. That makes the COM School, as the broker calls it, useful for traders of all levels.

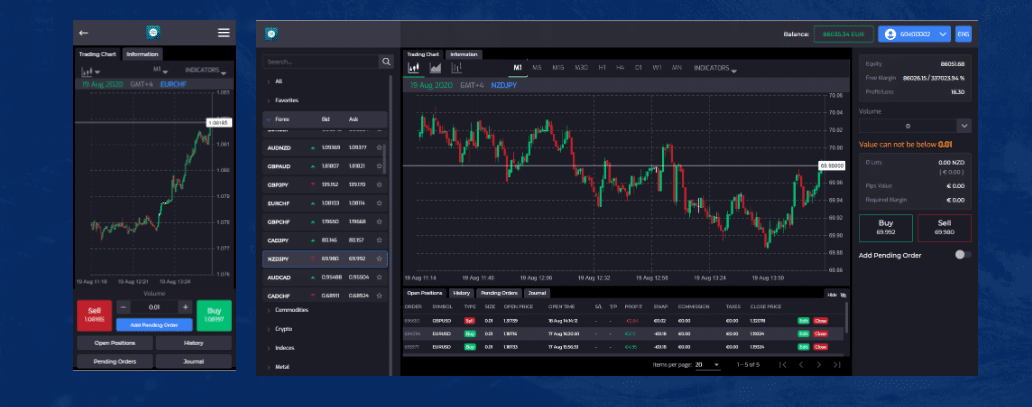

Trading Platform

The trading platform Capital One Markets created for itself can compete with even the best on the market. It’s browser-based, meaning it’ll have its full functionality and optimization tied to web browsers. That places it above most web-traders, which are simply an afterthought to downloadable versions. The broker’s proprietary platform functions smoothly and quickly, even on low-end machines. On top of that, it’s simple to understand and has powerful analytical capabilities.

Capital One Markets’ Trading Products

As we stated earlier in our Capital One Markets review, its assets are a vital component of its service. The variety of the trading materials ensures diversification is simple even when only selecting top-tier assets. It also lets you find some less common trading products, which have a chance of blowing up. That’s where most of the stories of traders getting rich overnight come from. Lastly, the broker covers all of the major asset classes, deeming it a good fit for everyone.

Here are the asset types you’ll see at Captial One Markets:

- Forex

- Digital Currencies

- Stocks

- Indices

- Commodities

Customer Service

Capital One Markets’ support team works hard on resolving your issues and answering questions. It operates 24/5, meaning they’re always available during the workweek. To reach an operative, all you need to do is send the firm an email.

Email: [email protected]

Capital One Markets Review: Conclusion

Capital One Markets is the model other new brokers should follow. It creates an experience where everyone can be competitive. However, it still manages to reward its most loyal customers. It’s one of the few brokerages that succeed in striking that delicate balance without ruining their service.

As a baseline, the broker’s trading conditions are excellent, with tight spreads, high leverage, and asset variety. Its platform is also top-notch, creating a convenient and straightforward experience for traders. It’s quite apparent that we’re impressed with what the broker offers.

To end our Capital One Markets review, we’d like to suggest checking them out yourselves. The welcome bonus is generous towards first-timers, so you don’t have much to lose.

-

Support

-

Platform

-

Spread

-

Trading Instrument

Trusted forex broker

My trusted forex broker. They are honest and did perform well.

Did you find this review helpful? Yes No

Good company

Fast and smooth withdrawals,great customer service and awesome tradin profit awaits every trader here. Good company.

Did you find this review helpful? Yes No

Great broker

Good trading broker. I can give them good reviews base on the trading results they give me.

Did you find this review helpful? Yes No

Good profit

I am lucky to have them as my forex brokers. I have been gaining a really good profit. And had no withdrawal issues so far.

Did you find this review helpful? Yes No