AUD/JPY forecast for February 8, 2021

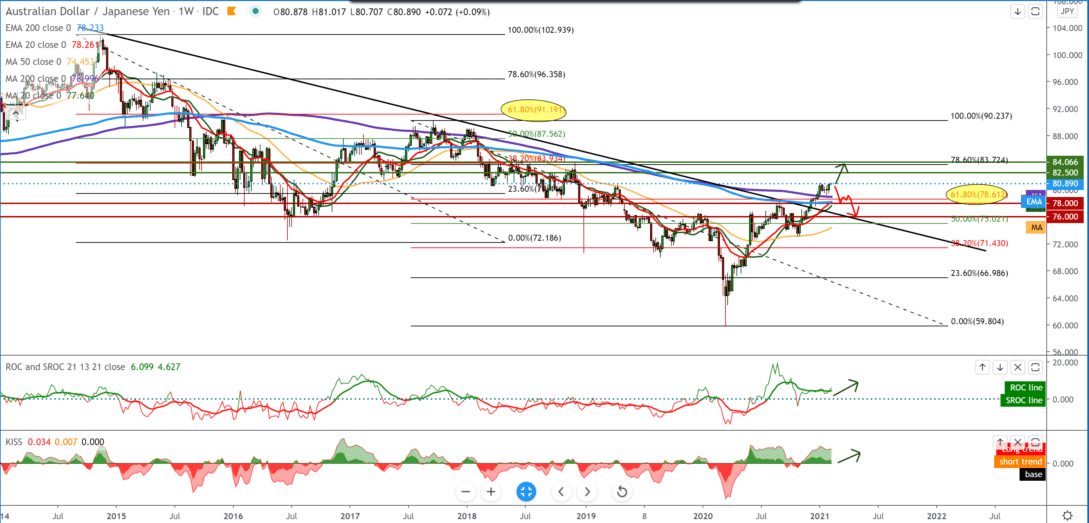

Looking at the chart on the weekly time frame, we see that the AUD/JPY pair made a break of one long-term trend line after that and retest on that break, so based on that, we can conclude that the AUD/JPY pair will continue to higher levels. Looking at moving averages, we see that the pair has managed to surpass the MA200 and EMA 200 very significant resistances in the previous period. In the graph, we see two Fibonacci levels. In the first, we see that the pullback was made at 61.8% level, and in the second Fibonacci level, we see that the pullback crossed above 61.8% at 78.61. Based on that, we can conclude that the pair in the next period, we see Fibonacci level 78.60% at 82.50 and after that at 84.00.

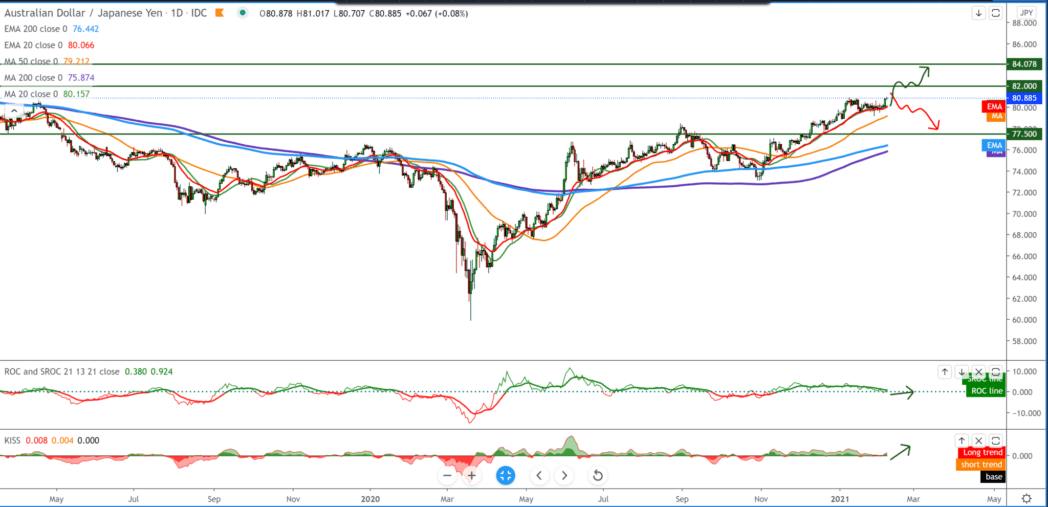

On the daily time frame, we see that the AUD/JPY pair has good support in the moving averages of the MA20 and EMA20, and so far have been a great indicator of the potential direction of the trend. a break above 82.00 is possible in the coming period because the AUD/JPY pair has good momentum. Suppose we look at the bearish side and expect a pullback if we first need a break below MA20 and EMA20, which will show us that another pullback is coming. If this happens as a target, we can look at MA200 and EMA200.

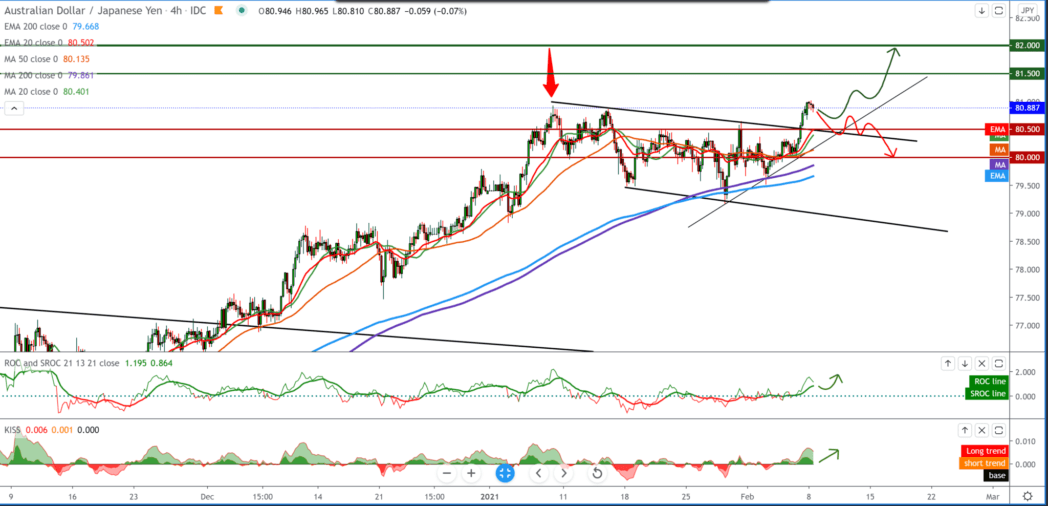

On the four-point time frame, we see that the AUD/JPY pair made a break above the previous high at 80.90 by crossing over the upper trend line, short-term resistance from the upper side. Since the AUD/JPY pair is now at a new high, we can expect a pullback and even a possible retest at 80.00, a psychological level important for investors. If this happens, the 80.00 level coincides with the MA200 and EMA200 as additional support.

From the news for these two currencies, we can single out the following: The measure of public assessment of the Japanese economy decreased for the third month in a row in January. The index of current conditions in the Economic Observer Survey, which measures the economy’s current situation, decreased to 31.2 in January from 34.3 in December. However, reading under 50 suggests pessimism. Fitch Ratings maintained Japan’s sovereign rating on Monday with a ‘negative’ outlook.

The rating was kept at A, citing an advanced and rich economy’s strengths, with appropriate robust management standards and public institutions. Fitch confirmed the “negative” outlook for Japan’s rating, given the continuing negative risks to the macroeconomic and fiscal outlook from the coronavirus shock. After falling 5.3 percent in 2020, Fitch predicted the economy would recover by 3.5 percent in 2021 and 1.5 percent in 2022, supported by continued overseas demand for Japanese exports, which has recovered in recent months.

-

Support

-

Platform

-

Spread

-

Trading Instrument