EUR/USD forecast for February 8, 2021

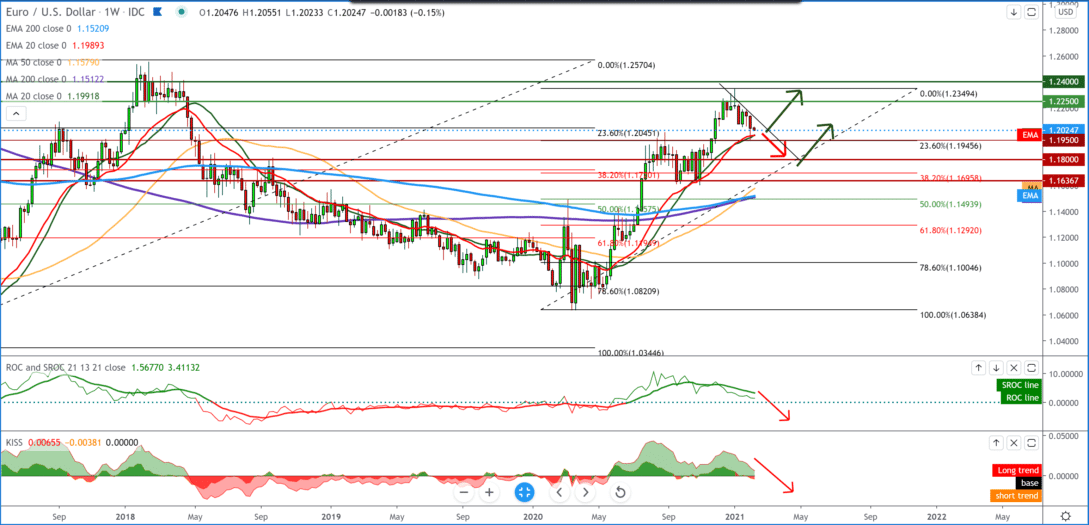

Looking at the chart on the weekly time frame, we see that the day started bearish at the start of the London session continuing in the bearish scenario from last week. The EUR/USD pair is now on the moving averages of the MA20 and EMA20, which have so far proved to be good support for the larger bulls trend. Based on the Fibonacci retracement level, we see that the EUR/USD pair will soon drop to 23.6% level at 1.19500. here we can expect consolidation and even a decline upwards, but first, we will wait for the EUR/USD pair to come to that zone.

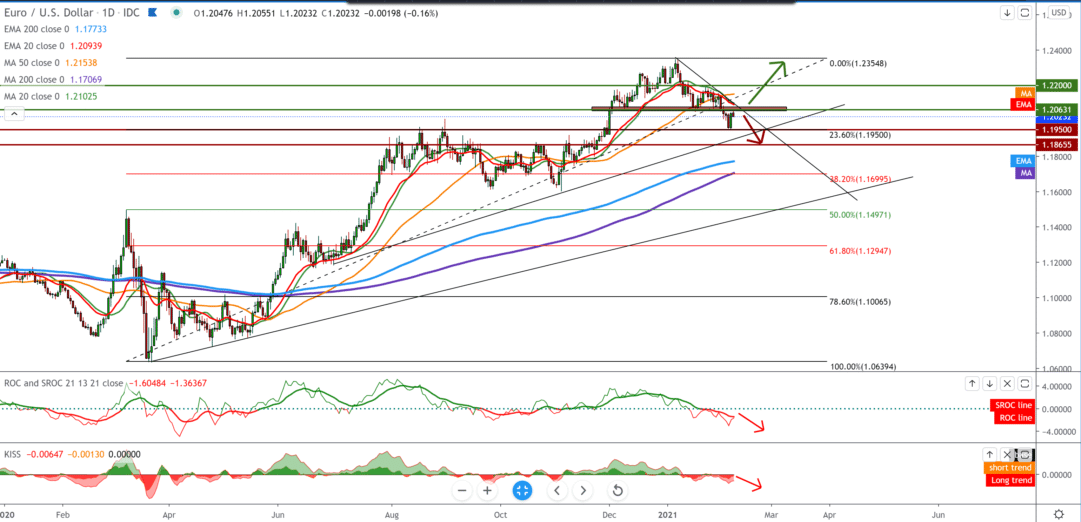

On the daily time frame, we see that the EUR/USD pair made a current retest to the previous lower low at 1.20600. Looking at it, we can expect the bearish trend to continue. The moving averages on the bearish side are for now MA20, EMA20, and MA50, and based on that, see a pair at lower levels below 1.20000. We can expect some support at the Fibonacci level of 23.6% at 1.19500, and a break below that leads us to 1.18000. Otherwise, if the EUR/USD pair holds out and finds support, it breaks us above 1.20700, so we have some sign on the chart for the bullish option.

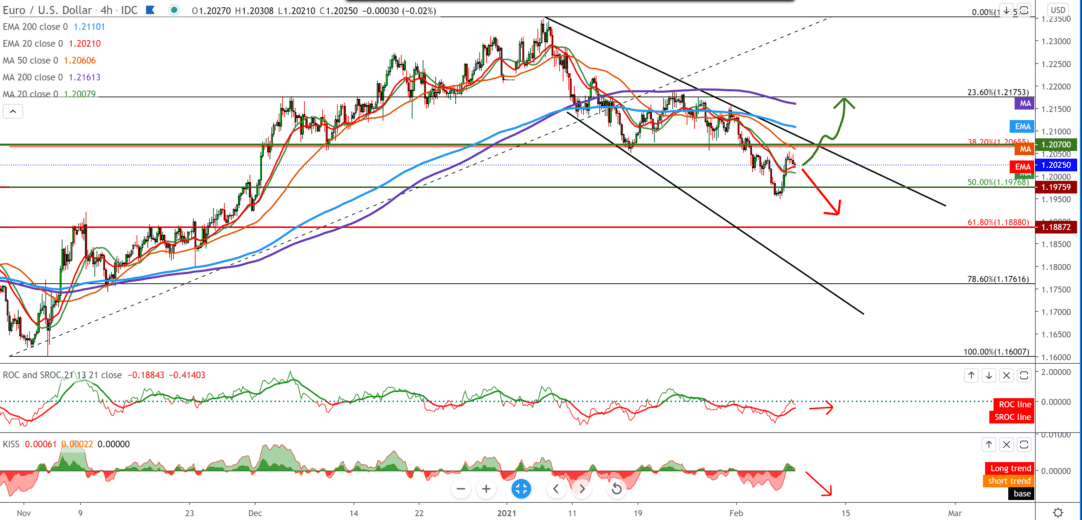

On the four-hour time frame, we see a falling channel forming, with the pressure of moving averages on the bearish side. By setting a lower Fibonacci retracement level, we see that the EUR/USD pair makes a potential retest from the bottom, giving us confirmation to continue the bearish trend. For a possible pullback within the channel, we can expect it up to 1.20700 top channel line.

From the news for the EUR/USD currency pair, we can single out the following: The increase in investors in Europe is dangerous in February because the slow pace of vaccination also reflected the percentage of the current situation and expectations, data on companies showed on Monday. The investor sentiment index unexpectedly fell to -0.2 in February from +1.3 in the previous month. Economists predicted the index to rise to 1.9. The current situation index fell to -27.5 from -26.5 in January. Likewise, the expectation index fell to 31.5 from 33.5. Permanent extension of locking can pose a problem because the difference between sightings and current situations is huge.

German industrial production remained at a steady level in December, Destatis data revealed on Monday. After a revised link of 1.5 from November to November, industrial production is unchanged from the previous month. Economists have proposed 0.3 percent growth for December. On an annual basis, industrial production was considered 1 percent compared to 2.5 days a month ago. Compared to February 2020, a month before starting the restrictions due to the coronary pandemic, production in December was down 3.6 percent.

Data would be shown in 2020. Production in the manufacturing sector was up 8.5 percent from the previous year.

-

Support

-

Platform

-

Spread

-

Trading Instrument