The EUR/GBP pair on November 4, 2020

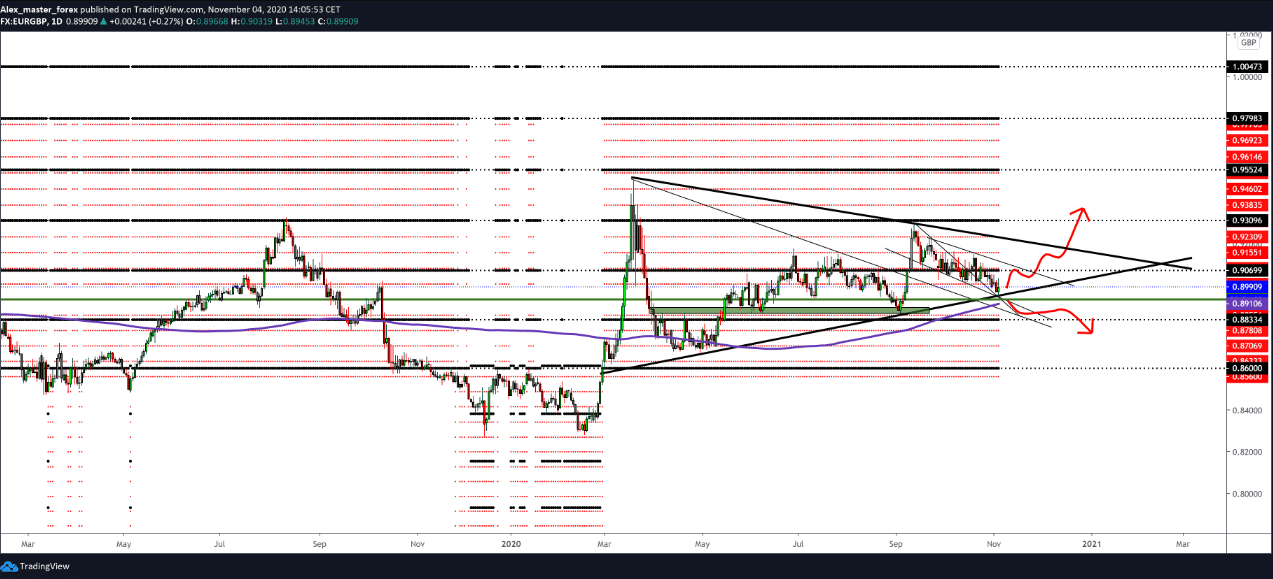

EUR/GBP trend line testing Looking at the chart, in addition to trend line support, we also have support for a moving average of 200. The trend is rising with three higher lows, forming a triangle. For sell trade entry we can expect a lower low and a break below MA 200.

The recovery of the private sector in the eurozone was halted in October. As control measures were reintroduced to fight the second wave of Covid-19 infections, the survey’s final results showed on Wednesday. IHS Markit. The production of the processing industry increased the most during more than two and a half years.

In contrast, service sector activity has declined at the fastest pace since May. Employment fell for the eighth consecutive month in October. and as tightening locking measures, it becomes increasingly difficult to see how the eurozone economy will avoid a return to decline, especially as some countries, including France, Italy, and Spain, re-negotiate new measures and lockdown by December.

“Likely, the Central Bank of Europe will again add a monetary stimulus in December as a continuation of previous economic stimulus,” Paolo Hernandez de Cos, a member of the Governing Council of the European Central Bank, told Spanish MPs yesterday.

This morning, ECB Vice President Luis De Guindos advised that the support measures taken in Spain to deal with COVID-19 should be more selective and focused on helping the people and sectors of the economy most affected.

Tomorrow is an important day for the pound; according to forecasts, it is believed that the BoE at the meeting on Thursday could increase its program of quantitative easing by about 100 billion pounds as an incentive and easing of fiscal policy.

The BoE is expected to increase its bond-purchase incentive program by another £ 100 billion at its November meeting. It is also important to listen to speeches by representatives of the Bank of England on possible next steps on incentives for the economy to combat the effects of coronavirus.

The number of newly infected in both Britain and Europe is at a higher level. The interest rate is forecast to remain at the same level of 0.10%. The market remains dissatisfied with the lack of progress in the Brexit negotiations, as hopes for a last-minute deal to avoid an awkward exit from the Union stay in place.

-

Support

-

Platform

-

Spread

-

Trading Instrument