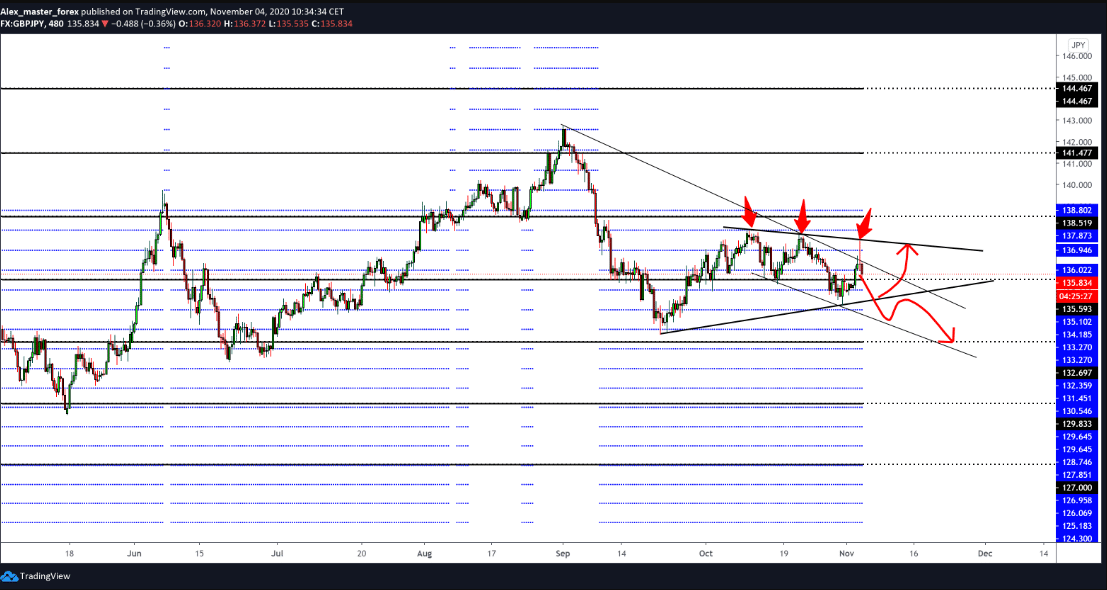

GBP/JPY without a new higher high

Yesterday, we had an attempt by the pound to go on the offensive and make the jump above 138,000. As the Asian market began to operate, the pound began to lose strength, and the bears took the initiative. As we have a trend line from the top, so we have from the bottom.

This can give us a potential direction in a short period. At the moment, the pair is in the middle of the triangle that makes these two trend lines. If we look at the bearish scenario, a safer sign may be for us if the price falls below 135,000, on the lower trend line where we wait for consolidation and the continuation of the fall below the trend line.

From today news, we have The Composite PMI Index measures and The Services Purchasing Managers ’Index (PMI) measures that are likely to affect this pair. UK Prime Minister Johnson announced new one-month restrictions this weekend, starting on Thursday and lasting until December 2, after he told the public that the death rate of the second the coronavirus wave could be twice as large as the first. Deputies will vote on the plan on Wednesday on the new measures.

Despite the coronavirus’s problems, talks on Brexit continue, and there is still a big dispute regarding fisheries and territorial waters. The Japanese currency is generally stable and strong; this chaos does not affect the yen.

Investors find security in it for their capital. The governor of the Bank of Japan Haruhiko Kuroda, said that the central bank would keep its measures of easing the policy on Wednesday. He comments that it will facilitate without hesitation if necessary. It is crucial to create an environment in which companies affected by pandemic points encounter a financial crisis and can continue to operate.

The comment is that the Japanese economy is growing, but it remains in a difficult situation due to the pandemic’s impact. Trade tensions between the US and China do not have a serious impact on the global economy for now, and Global markets remain volatile due to uncertainty regarding the global economic outlook caused by the coronavirus.

-

Support

-

Platform

-

Spread

-

Trading Instrument