NZD/USD forecast for February 24, 2021

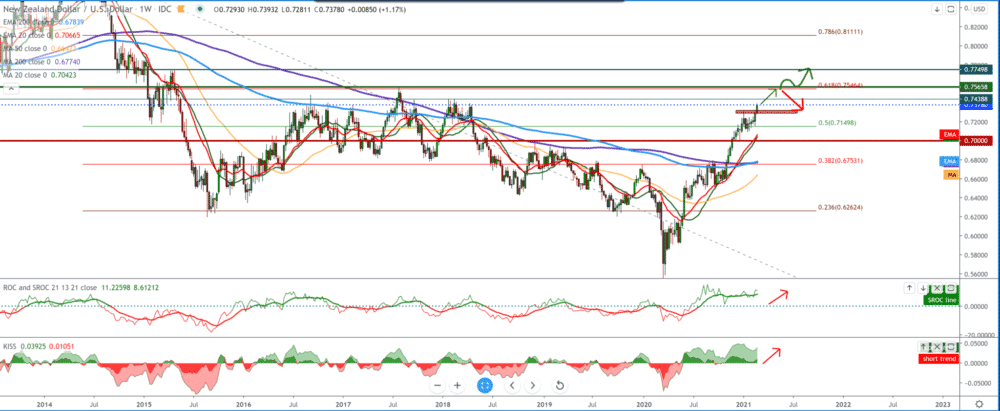

Looking at the NZD/USD pair chart on the weekly time frame, we see that the NZD is unstoppably rushing towards higher levels, approaching the high 0.75000 from July 2017. Technically speaking, when we set the Fibonacci retracement level, we see a retest at 50.0% level and headed up to 61.8% level at 0.75600. Moving averages have long been on the bullish side and will remain so in the coming period. Pullback within a smaller time frame is always possible, while on a larger time frame, the image is very bullish.

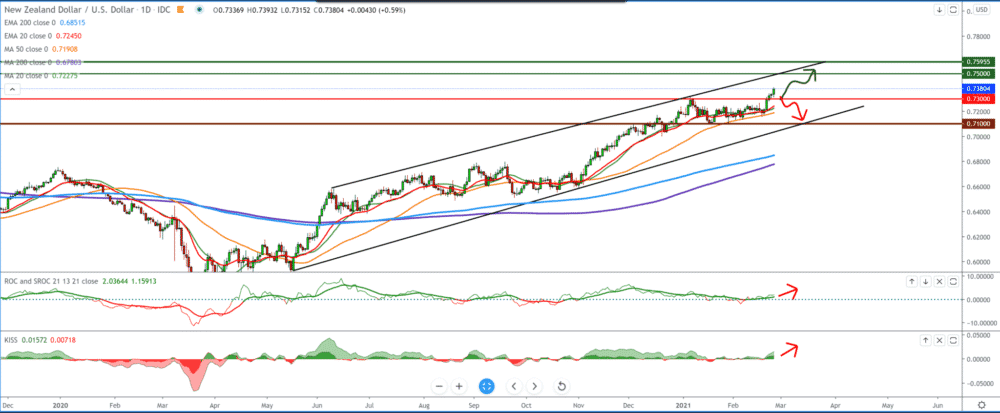

On the daily time frame, we see the NZD/USD pair moving in a rising channel with support for moving averages MA20, EMA20, and MA50. Based on that, 0.75000 is a realistic target at the top of the upper channel line. We see a break above 0.73000 of the previous high, and it is our support or resistance if the NZD/USD pair turns into a bearish scenario to 0.71000.

On the four-hour time frame, we see how the NZD/USD pair made a break of the transitional high to 0.73000, and our resistance is now 0.74000, but only currently as the NZD consolidates. If we see a pullback, we can expect it to zone 0.73000-0.73300, where we can expect a new rejection and the continuation of the bullish trend.

The important news for these two currencies is the following: Kiwi continued to strengthen after the latest meeting of the RBNZ policy. The Reserve Bank of New Zealand acknowledged stronger growth but said that the loose policy should remain. The brighter economic outlook has prompted RBNZ to drop a political signal that additional monetary stimulus may be needed.

However, they have said they are ready to provide additional stimulus if needed. Although we believe that RBNZ is unlikely to further reduce rates, RBNZ stressed that stimulus adjustments would be maintained over a longer period of time until it is confident that employment will reach its maximum sustainable level and inflation will be sustainable around 2%.

According to estimates, purchases of large assets remain at the level of 100 billion New Zealand dollars until June 2022. The New Zealand Reserve Bank maintained its official cash rate (OCR) at 0.25% in the first interest decision this year, as expected.

The severe Covid-19 pandemic is the biggest question mark for the economic outlook, and while New Zealand is doing better than most, travel restrictions and other virus-induced measures continue to affect economic recovery. Effective international distribution of vaccines and other controls to manage the pandemic will play a major role in global recovery’s pace and depth.

-

Support

-

Platform

-

Spread

-

Trading Instrument