AUD/USD forecast for February 24, 2021

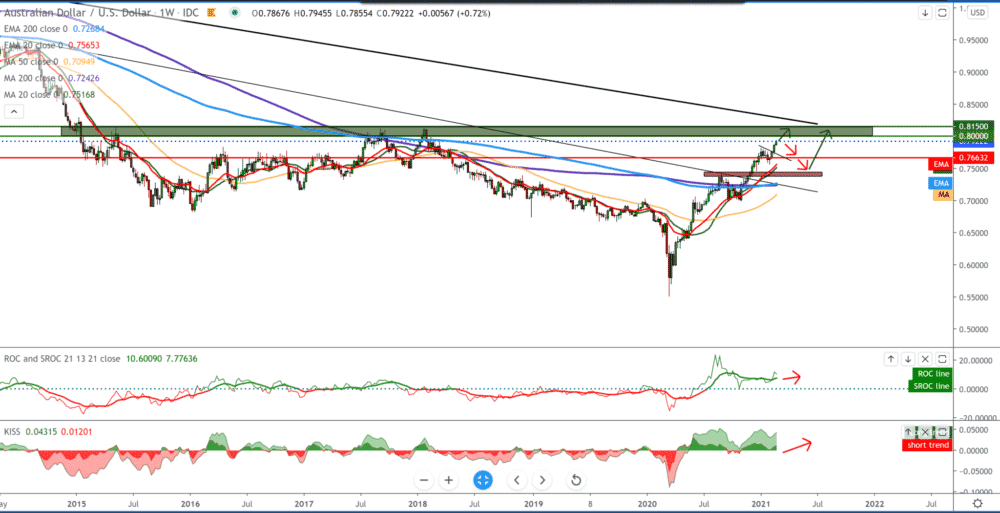

Looking at the chart on the weekly time frame, we see that the AUD/USD pair is recording its new highs from the period from January 2018. We are now very close to that zone, 0.80000-0.81500. Moving averages are down far on the bullish side and, for now, provide support for continuing the growing trend. For the bearish scenario, there are no signs of such a thing for now on the chart.

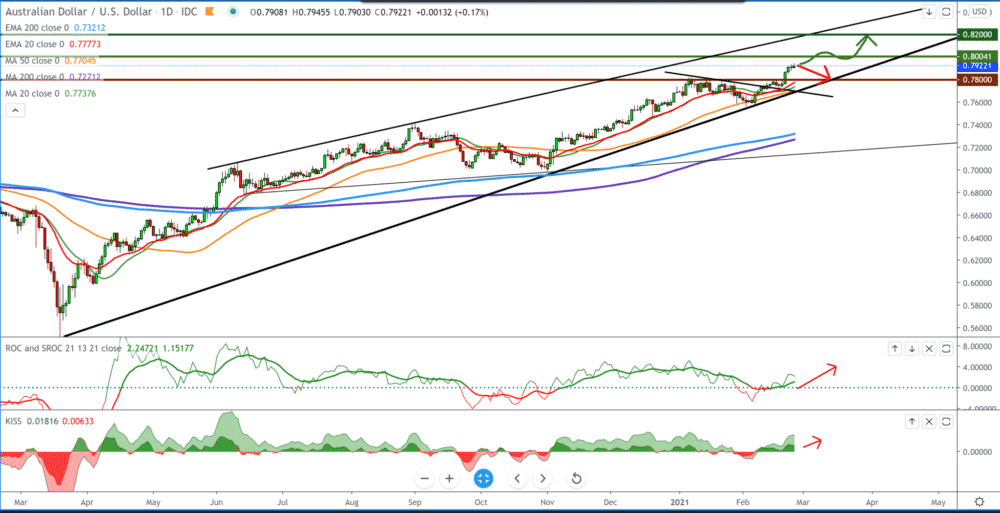

We see that the AUD/USD pair has been consolidating at approximately similar levels for the last two days in the daily time frame. If consolidation continues, it will pressure the Australian dollar, and we can expect a smaller pullback. If we see it, we can expect it to be 0.78000, but we are still looking towards 0.80000. The pair is moving within a growing channel, and for now, we expect the movement of this pair within it in the coming period.

On the four-hour time frame, we see that the AUD/USD pair has good support with moving averages of MA20, EMA20, and MA50. For now, the MA20 and EMA20 are a great support for the AUD/USD pair, pushing it higher and higher on the chart, approaching the psychological level at 0.80000. We need to first break below the moving averages for bearish trend signs, and only then can we look first towards 0.78500 and then towards 0.78200. we can also draw from the bottom one line connecting the previous lows. We can also use it as a support line.

For these two currencies, we will single out the following economic news: The value of total construction work performed in Australia fell seasonally by 0.9 percent compared to the quarter in the fourth quarter of 2020, the Australian Bureau of Statistics announced on Wednesday, with 51.170 billion US dollars. It missed expectations for growth of 1.0 percent after a decrease of 1.8 percent in the previous three months.

Annual construction work fell by 1.4 percent. Wage prices in Australia rose 1.4 percent year-on-year in the fourth quarter of 2020. The Australian Bureau of Statistics said on Wednesday – exceeding expectations for growth of 1.1 percent after rising 1.4 percent in the previous three months.

-

Support

-

Platform

-

Spread

-

Trading Instrument