Market News and Charts for February 14, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

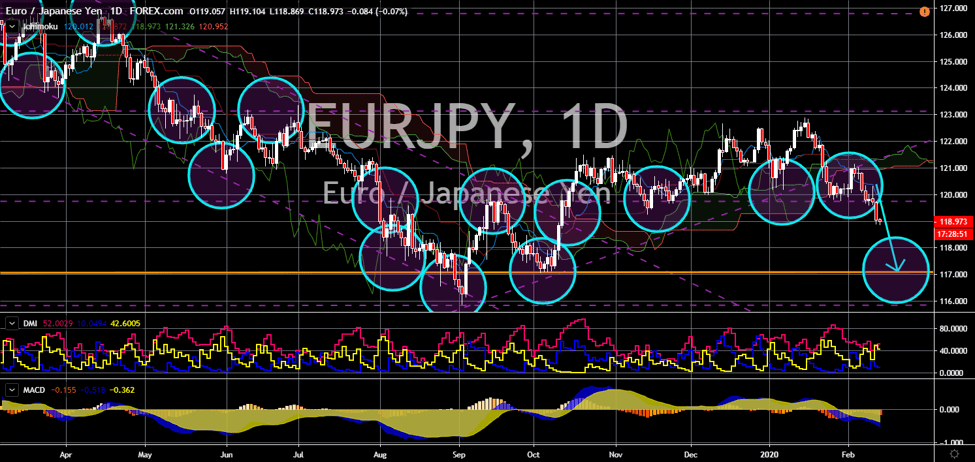

EUR/JPY

The pair will continue to move lower in the following days after it broke down from a key support line. The single currency came under pressure following the withdrawal of the United Kingdom from the bloc on January 31. However, investors might not opt to buy the euro as the trading bloc is set to publish major reports. Today, February 14, the European Union will post figures from its gross domestic product (GDP) and Unemployment report. The report from January 2020 shows the struggle of the EU with its lower employment change. Eurozone Employment Overall report for December is down by 42,000 compared to November’s result. Employment Change were also at its weakest since March 2015. On the other hand, the appeal for the Japanese Yen and other safe-haven assets were increasing amid the coronavirus fear. The COVID-19 has already affected more than 60,000 people globally and has killed 1,367 people.

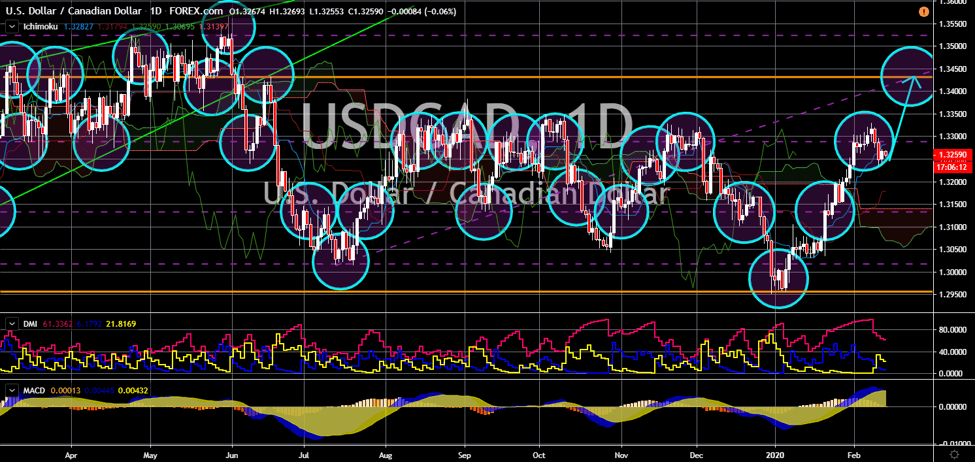

USD/CAD

USD/CAD

The pair will breakout from a key resistance line, which will send the pair higher towards its 9-month high. The Canadian Parliamentary Budget Office said it is expecting Canada’s growth for 2020 to be at 1.5%. Cumulatively, its real GDP growth was already at 1.4% (Q1-Q3 2020) and is still waiting for its fourth quarter. This makes the 1.5% 2020 real GDP projection significantly lower from its 2019 results. Moreover, the budget watchdog warned that the forecast could further go down to 1.2% amid the coronavirus outbreak. Meanwhile, the United States has been weighing down economic uncertainties brought by the COVID-19. Though exports (monthly and yearly bases) drop significantly, its imports are rising. The spike in imports could narrow the trade deficit it had with other countries, specifically with China. Another reason for optimism in the US economy was its signing of the USMCA (United States-Mexico-Canada).

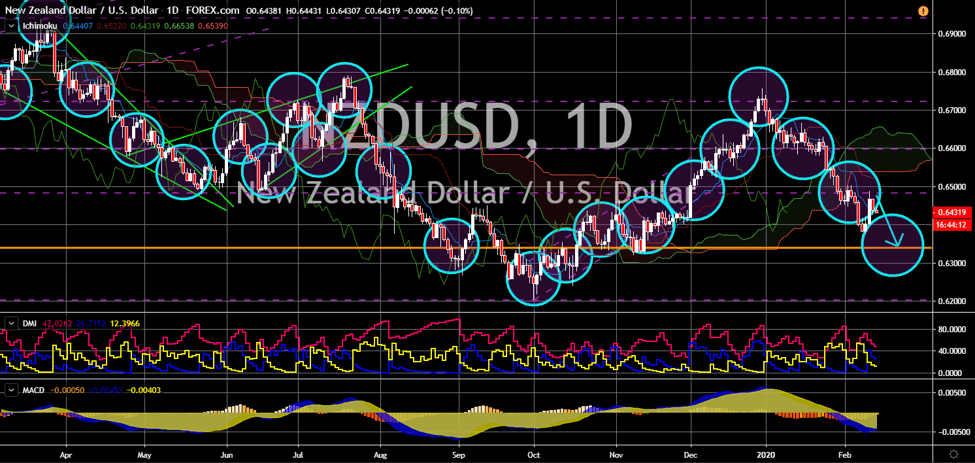

NZD/USD

The pair will move lower towards its October 2019 low to complete the stock cycle. The New Zealand dollar will continue to weaken against the greenback in today’s session. The country’s Purchasing Managers Index (PMI) were still in contraction after it posted 49.6 figure. A reading below 50 indicates that the country’s economy is contracting. Meanwhile, a reading above 50 signifies economic expansion. In the past ten (10) months, New Zealand experienced five (5) expansion and five (5) contraction. The contraction started seven (7) months ago. Despite this, the country will benefit from the United Kingdom’s withdrawal from the European Union in coming months. Currently, the US dollar will gain advantage from the recent Core Retail Sales report. Figure showed retails sales increasing by 0.7% from 0.1% in the previous month. This is also higher from the 0.5% that analysts were expecting from the report.

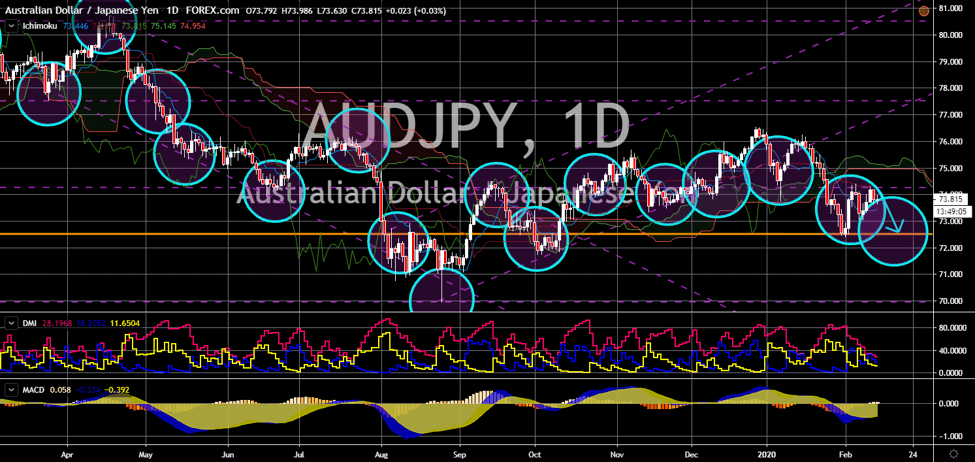

AUD/JPY

The pair will revisit its previous low after it failed to breakout from a key support line. Climate change has been cooling the Australian economy. This was after wildfires had cost Australia $3 billion to $3.5 billion in damage. The Reserve Bank of Australia (RBA) Governor Philip Lowe suggested that the government should explore more renewable energy alternatives. Despite this, the Australian central bank did not cut its benchmark interest rate of 0.75%. However, a new threat is emerging not just in Australia but also across the globe. The coronavirus will hit the tourism industry of countries with high Chinese visitors. Governor Lowe warned that the bushfire and coronavirus could send Australia’s gross domestic product (GDP) to zero. Meanwhile, the Japanese Yen is shining from investors eyes. The coronavirus scare is increasing the demand for safe-haven assets. Investors are now accumulating Japanese shares and bonds.