Market News and Charts for December 30, 2019

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

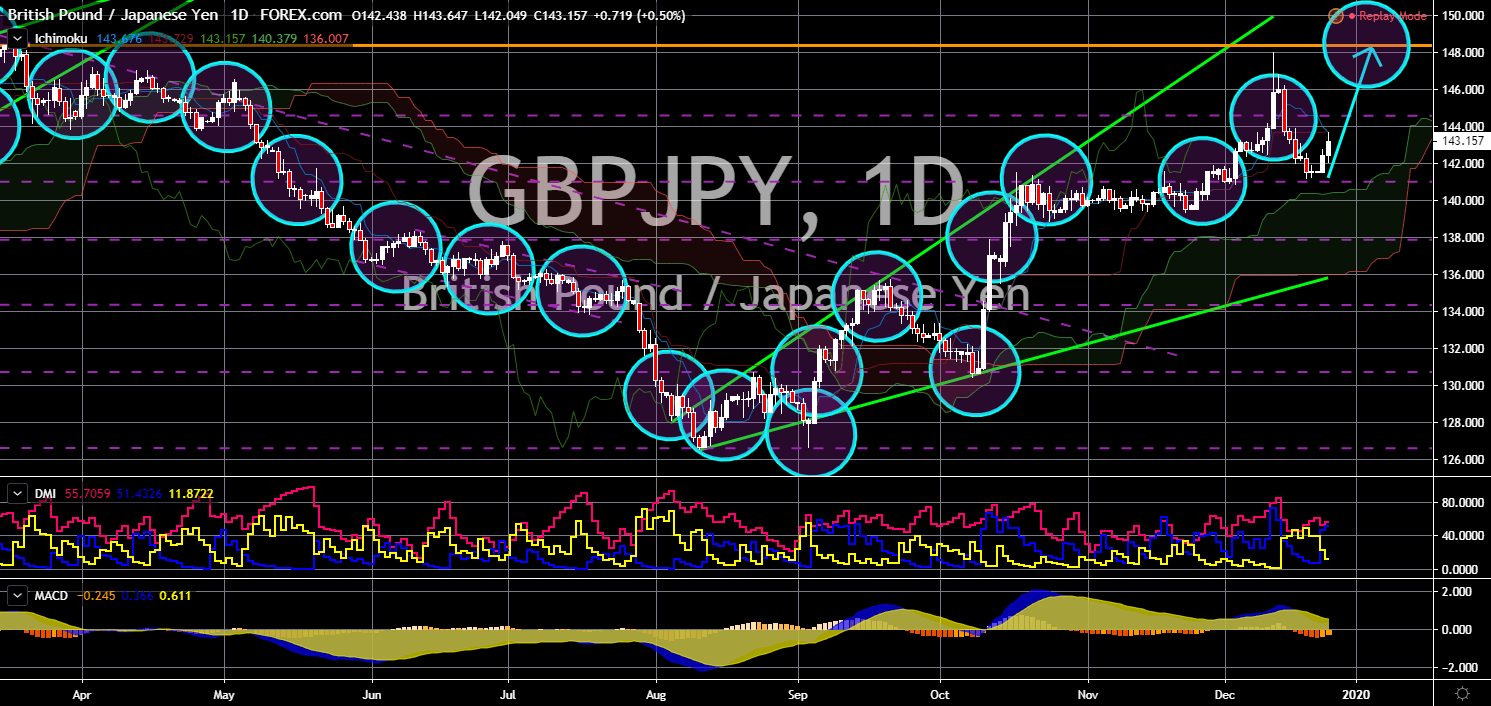

AUD/CAD

The pair will end its week-long rally as it is expected to go back inside the sideways channel at the start of 2020. 2019 has become an uncertain year for Australia and Canada. These two (2) countries were affected by the US-China trade war and has been struggling with their economies. Australia and Canada were heavily exposed to the US dollar, making their central banks to run for their life. However, only Canada was able to weigh down pressures and decided to hold onto its interest rate of 1.75% throughout 2019. Meanwhile, Australia cut its rate twice in 2019. However, the uncertainty over the USMCA (United States-Mexico-Canada) deal is putting weight on the Canadian dollar. Despite this, the Canadian dollar is expected to perform well against the Australian Dollar in coming sessions amid the looming withdrawal of the United Kingdom on the European Union through which Canada is expected to decide which trading deal to prioritize.

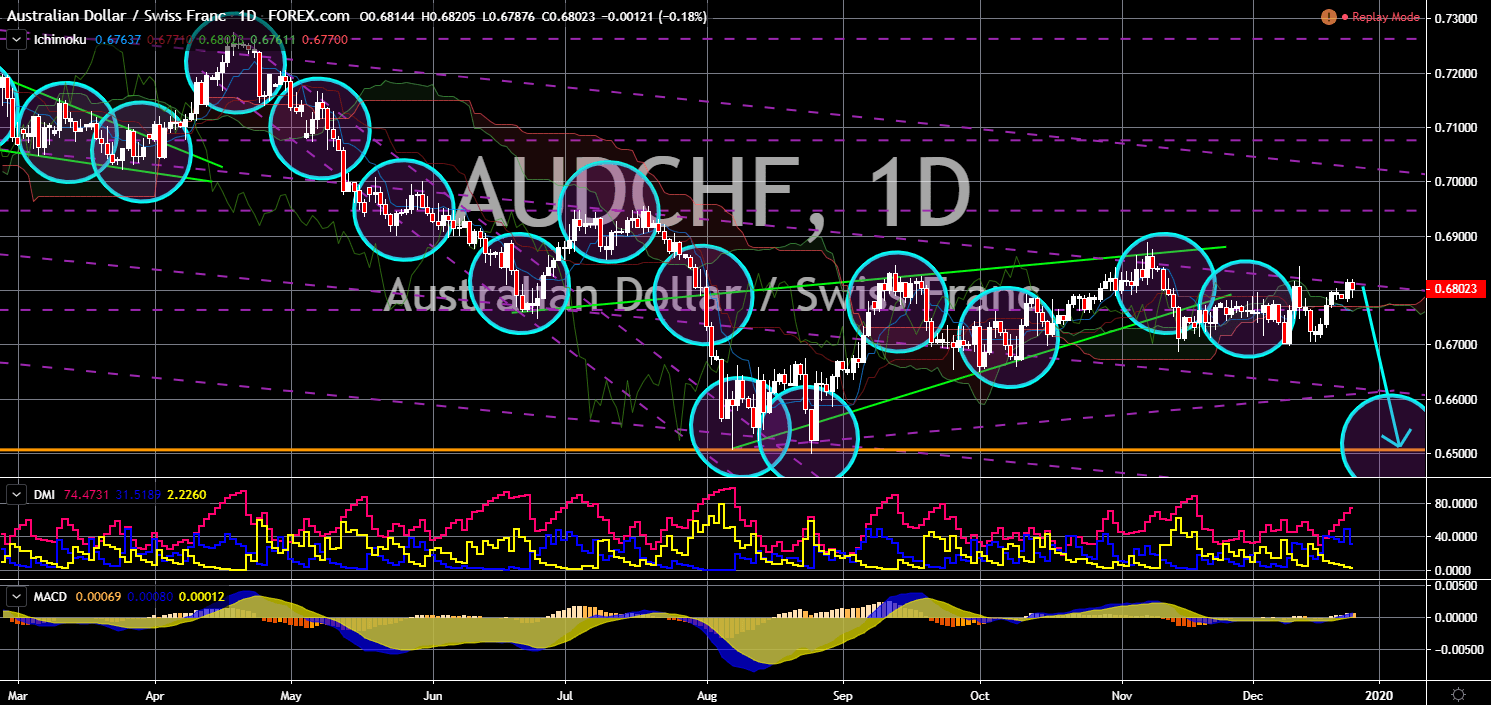

AUD/CHF

AUD/CHF

The pair is expected to move lower in the following days after a series of weak candles. Switzerland today, December 30, publish its KOF Leading Indicators Index report, which predicts the direction of the economy over the next six (6) months. On its report, the KOF showed positive figure of 96.4, beating its 92.6 record in the previous month and topping the index’s five (5)-month high. Aside from this, an announcement from the Swiss National Bank (SNB) is also helping the Swiss Franc after the central bank said it is considering leaving the negative territory in 2020. Moreover, the win of UK Prime Minister Boris Johnson during the UK election puts uncertainty in Europe to rest. Meanwhile, Australia was still struggling with is relations with the European Union after it signed a post-Brexit trade agreement with the UK while having an on-going trade agreement with the largest trading bloc in the world.

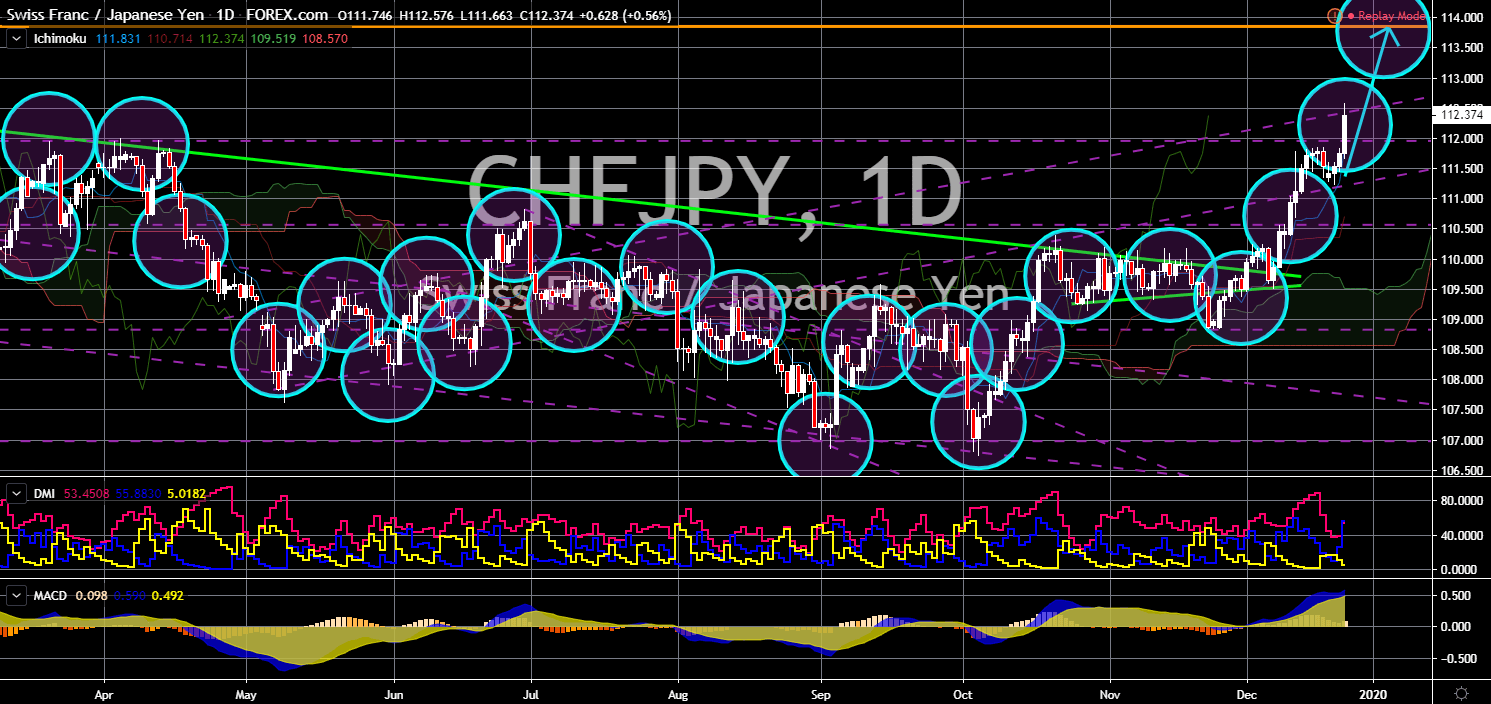

CHF/JPY

The pair broke out of a major resistance line in yesterday’s trading session, which will further send the pair higher in the following days. Japan is being shaken by the news that Carlos Ghosn has fled the country. Ghosn was accused of financial misconduct that roots from his chairmanship and being an executive officer from the Renault–Nissan–Mitsubishi Alliance. The alliance was considered as the largest automobile group in the world and Ghosn helped these companies to dodge bankruptcy with his cost-cutting programs. With a 99% conviction rate in Japan, the Brazilian-born French businessman of Lebanese ancestry is supposed to serve 15 years in prison. This event has raised concern among analysts and investors on the ability of Japan to persecute finance offenders. Along with this was the pressure with the Bank of Japan (BOJ) to further cut its benchmark interest rate and introduced another quantitative easing.

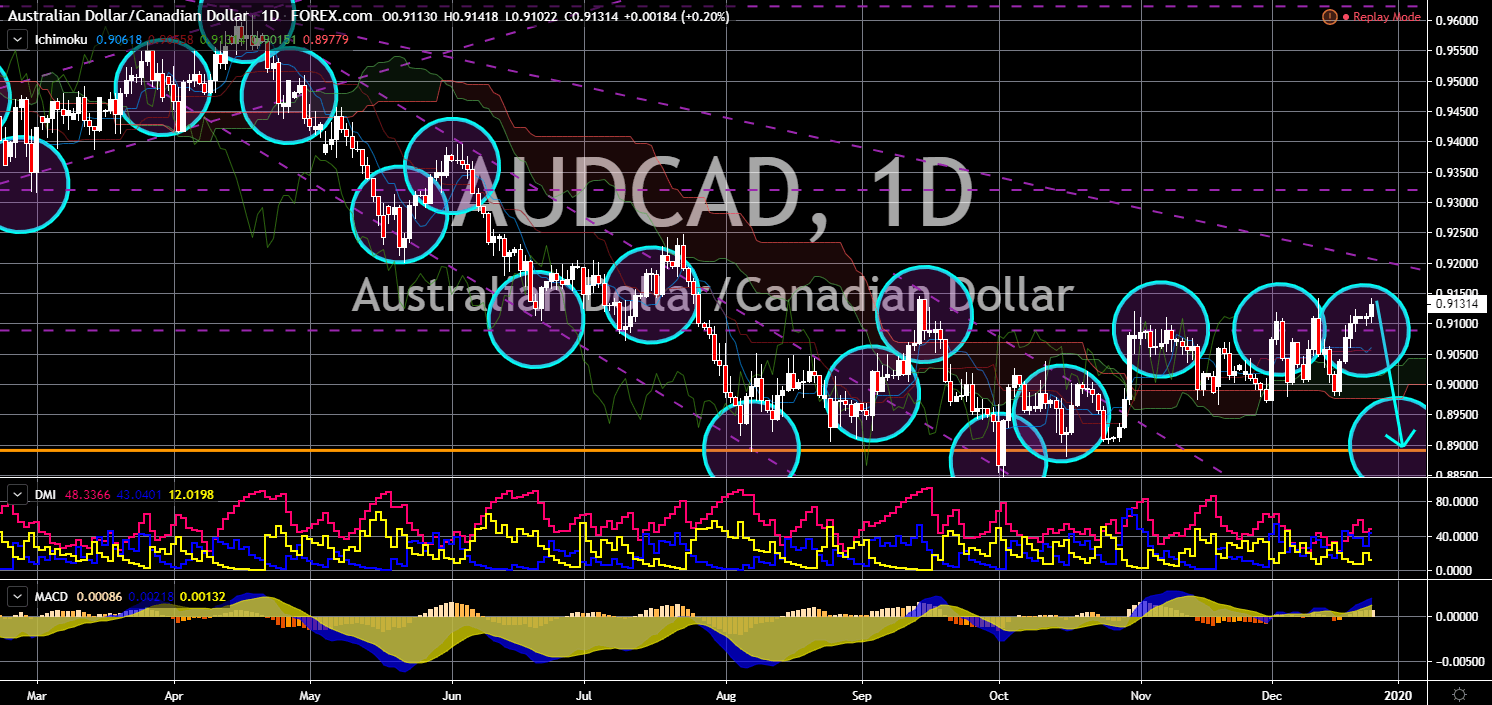

GBP/JPY

The pair will continue to move higher in the following days after it bounced back from a major support line. The win of UK Prime Minister Boris Johnson during the December 12 election has officially put certainty over the future of the United Kingdom. With the Conservative party winning the majority of seats, 365 out of 650, a withdrawal of the UK from the EU on January 31 had its highest possibility since the 2016 Brexit referendum. The seats won by the Conservative Party was the highest percentage by any party since 1979. On the other hand, the 262 seats by the Labour Party represents their lowest result in a century. The UK election along with the recently signed US-China phase one trade deal caused the safe-haven assets appeal to falter. A finalized trade deal between the two (2) largest economies in the world is expected to be signed by January 2020. Japan is also facing pressure to cut its interest rate and introduce a Quantitative Easing.