Gold and Silver: Bullish impulse Pushed the Price

- The price of gold continues its recovery this week with a level of $1,728.

- At the beginning of the week, the price of silver fell to the $18.62 level.

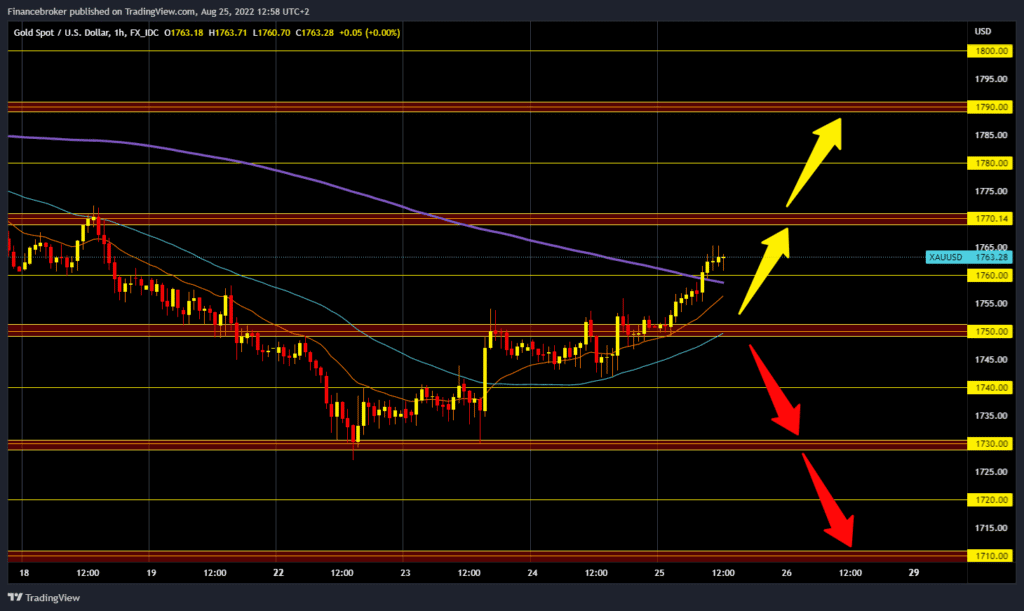

Gold chart analysis

The price of gold continues its recovery this week with a level of $1,728. At the beginning of the Asian session, the price consolidated around $1750, followed by a bullish impulse that pushed the price above the $1760 level, and then we see the formation of this week’s new higher high at the $1765 level. Currently, we have stopped at that level and are moving around the $1760 level.

Additional potential support at that level is in the MA200 moving average. For a bullish option, we need a continuation of the positive consolidation up to the $1770 resistance level. A break above would give us stronger momentum for continued gold price growth. Potential higher targets are $1780 and $1790 levels. We need a negative consolidation and a return to the $1750 support level for a bearish option. Potential lower targets are $1740 and the $1730 level of support from the beginning of the week.

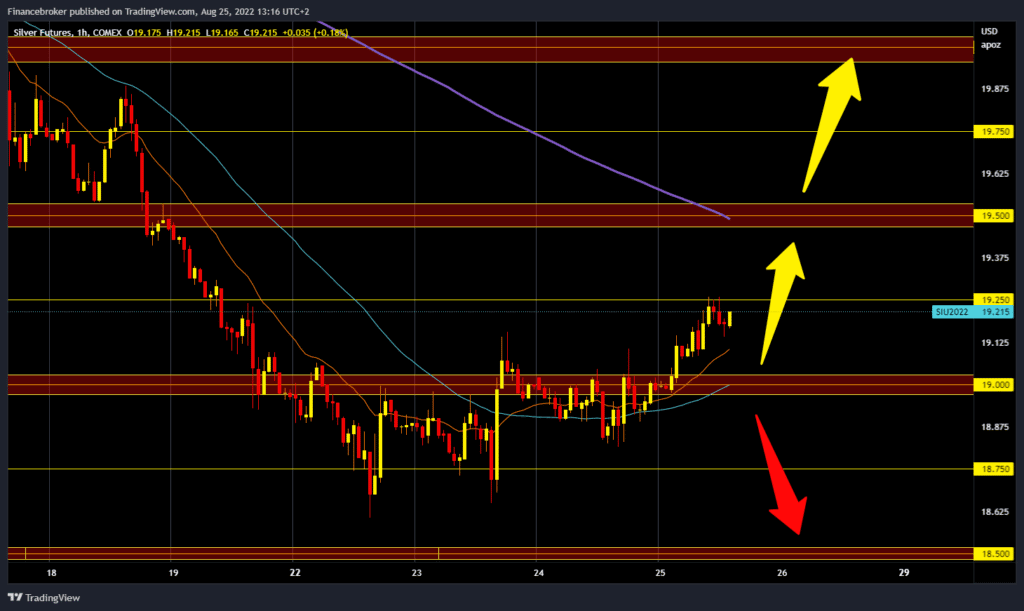

Silver chart analysis

At the beginning of the week, the price of silver fell to the $18.62 level. Since then, we have been in a bullish trend, and the price has managed to rise above the $19.00 level. During the Asian trading session, the price of silver started a new bullish impulse and stopped at the $19.25 level. We now have a minor price pullback to the $19.12 level, but we could expect a continuation of the bullish recovery.

It is important to stay above the $19.00 level. For a bullish option, we need a continuation of this positive consolidation and a break above the $19.25 level. Potential higher targets are the $19.75 and $20.00 levels, and additional resistance at the $20.00 level is in the MA200 moving average. For a bearish option, we need a negative consolidation and price decline to the $19.00 support level. Potential lower targets are $18.75 and $18.50 levels.