Oil and Natural Gas: New Higher High

- During the Asian trading session, the price of oil managed to form a new higher high at the $95.80 level.

- The price of natural gas is in the range of $9.20-$9.40 for the second day in a row.

- Oil rose on Thursday on growing concerns about supply shortages due to a cut in Russian exports, possible output cuts by major producers, and partial US refinery shutdowns.

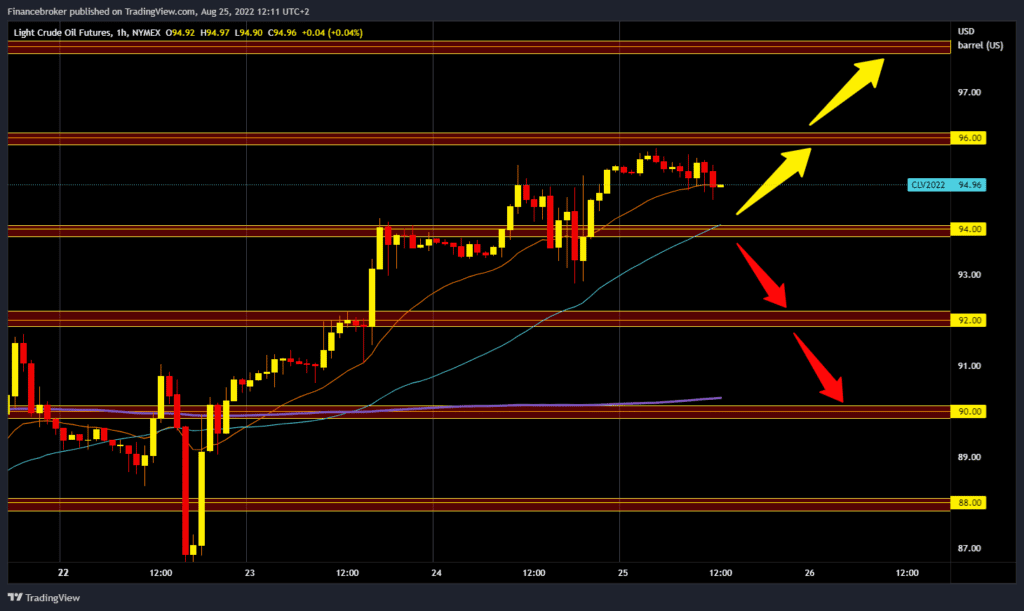

Oil chart analysis

During the Asian trading session, the price of oil managed to form a new higher high at the $95.80 level. After that, the price went into a pullback and is now at the $94.65 level. We are looking for support at the $94.00 level, and additional support at that point is the MA50 moving average. For a bearish option, we need a continuation of the current negative consolidation and a drop in the price to the $94.00 support level. Break prices below would increase the negative pressure on oil, and the price could fall even lower. Potential lower targets are $93.00 and $92.00 levels. We need a positive consolidation and break of oil prices above the $96.00 level for a bullish option. After that, we need to stay above in order to continue on. Potential higher targets are the $97.00 and $98.00 levels.

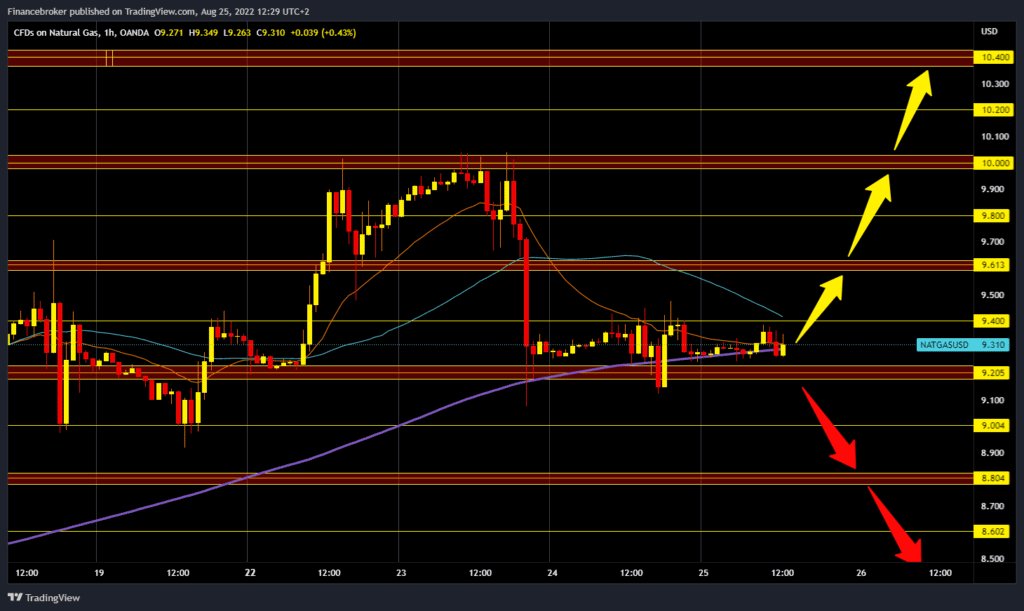

Natural gas chart analysis

The price of natural gas is in the range of $9.20-$9.40 for the second day in a row. During that time, we did not have any significant bounce, and the price managed to return to this sideways channel. More pressure on the gas price could be if it stays below the MA200 moving average for longer. We need a negative consolidation and a break below the $9.20 level for a bearish option. After that, the price could continue to retreat. Potential lower support targets are $9.00 and $8.80 levels. For a bullish option, we need a positive consolidation and growth of the gas price to the $9.60 level. After that, we must stay above the $9.40 level and form a new bottom. After that, we would probably see a break above the $9.60 level. Potential higher targets are $9.80 and $10.00 levels.

Market overview

Oil rose on Thursday on growing concerns about supply shortages due to a cut in Russian exports, possible output cuts by major producers, and partial US refinery shutdowns. Both benchmark contracts hit three-week highs on Wednesday after Saudi Arabia’s energy minister raised the possibility that the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, would cut production to support prices. In addition, discussions on an agreement on Iran’s nuclear program remain at a standstill, calling into question any resumption of exports, although negotiations are underway. In the United States, BP reported the shutdown of some facilities at its Whiting, Indiana refinery after a fire on Wednesday. The facility, which produces 430,000 barrels per day, is a key fuel supplier to the Midwest and the city of Chicago. Falling inventories of crude oil and petroleum products in the US also added price pressure. Oil reserves fell by 3.3 million barrels in the previous week.