EUR/JPY forecast for December 09, 2020

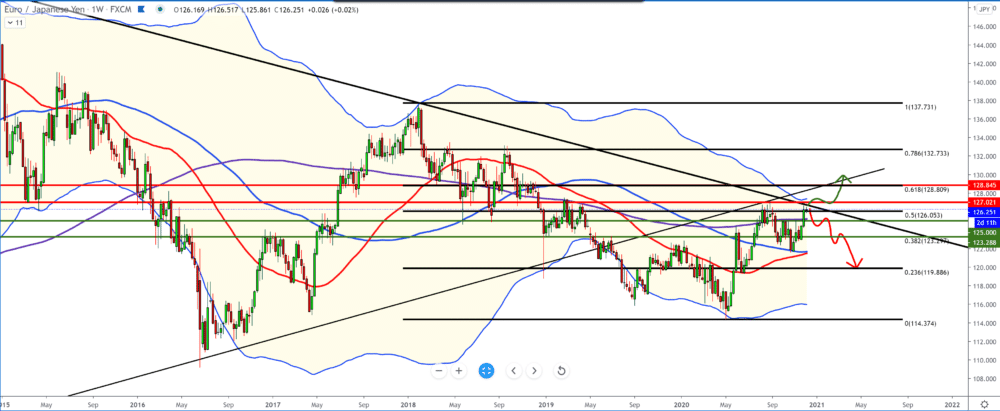

Looking at the chart on the weekly time frame, we see that the EUR/JPY pair has reached the top line of the trend and is now consolidating this week. The resistance was at 126,700, and so far, it has proven to be a good resistance. Just a break above 127.00 and 127.50 can be a good sign for us to continue the bullish scenario.

The EUR/JPY pair can now only test the moving average of the MA200 and the Fibonacci level of 50.0%. If it bounces up, we go to 128.80 Fibonacci level 61.8%; otherwise, we go down to level 38.2% at 123.30.

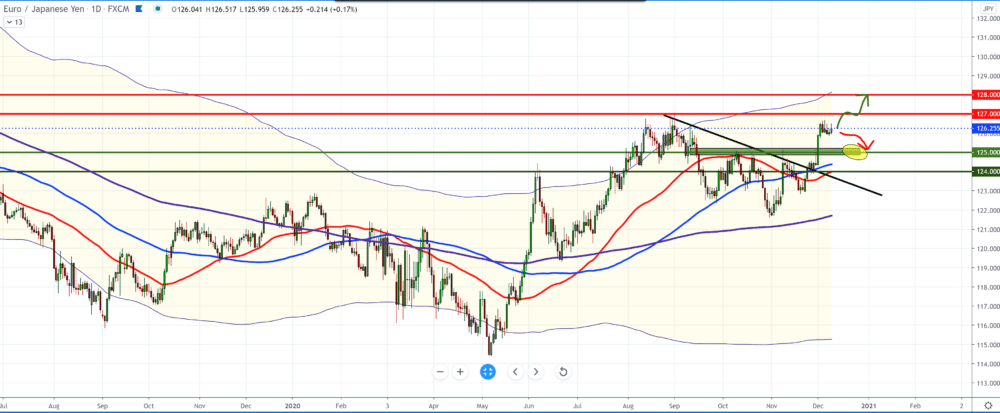

On the daily time frame, the chart shows us the first support on the moving average MA200, then the other two MA50 and MA100, and a break of lower resistance in the form of a trend line. This is how the chart looks like it can make a FLAG pattern and launch a EUR/JPY pair up to 127.00 and beyond in the coming period.

AUD/JPY forecast for December 09, 2020

The failure of the pattern takes us back to the support zone at 125.00 and MA50 and MA100. The trend is still bullish, with possible smaller pullbacks to the support zone.

The four-hour time frame shows us consolidation in a smaller drop channel. We have to pay attention to whether there will be a break from the bottom or top of the channel. On the lower side, we have the support of all three moving averages MA50, MA100, and MA200, while on the upper side, our psychological resistance is the previous high at 127.00.

News about newly infected coronavirus, as well as news about the success and use of vaccines to combat coronavirus, can affect the EUR/JPY pair, and above all, the strength of the Japanese yen. As the Brexit negotiations approach the deadline, we cannot rule out the impact of political statements on the European currency.

-

Support

-

Platform

-

Spread

-

Trading Instrument