AUD/JPY forecast for December 09, 2020

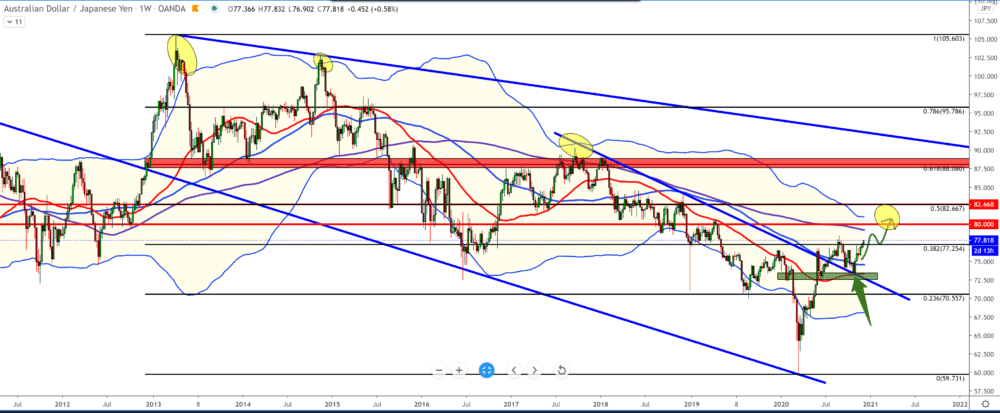

Looking at the chart on the weekly time frame, we can notice that a drop-down channel break and retest for the AUD/JPY pair was made exactly when the first news about discovering the vaccine and its imminent use was published.

On the downside, we have support moving averages of MA50 on the 73.00 and MA100 on the 74.50. Setting the Fibonacci pair is at 32.8% level, and if we do not see any major momentum above, we can expect consolidation at this level.

On the upper side, our target maybe a Fibonacci level of 50.0% at a distant 82.60, but first we need a break in the moving average of the MA200, and there we are close to the upper limit of Bollinger bands 100. The continuation of bulls scenarios is very likely.

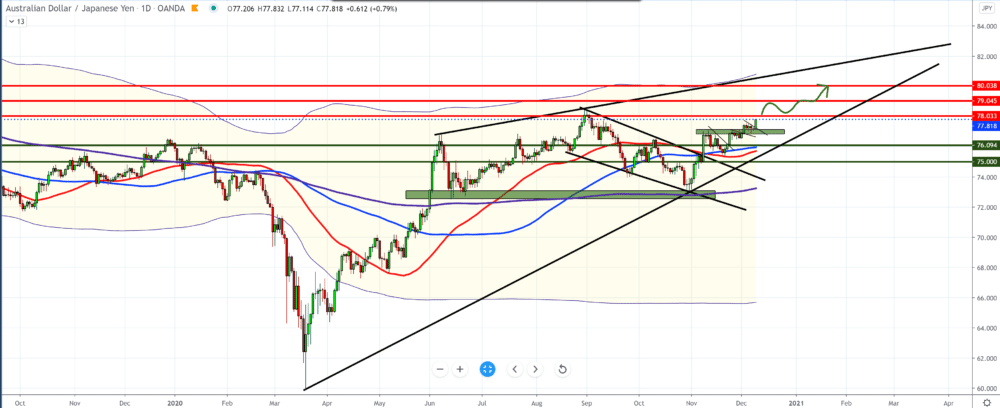

We see that the AUD/JPY pair had three small consolidations and then a bullish momentum on the Daily time frame. The AUD/JPY pair has the support of all three moving averages, and according to that, we should see a further continuation towards higher levels close to 80,000. Our potential resistance maybe the previous high at 78,500.

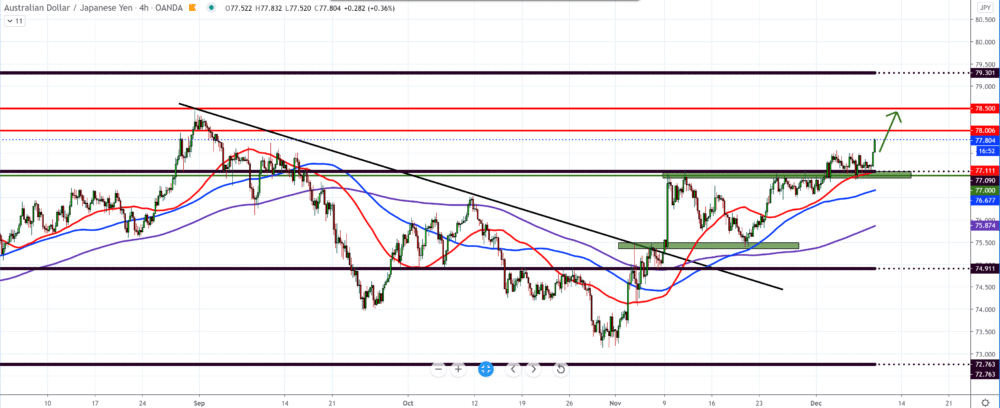

The chart on the four-hour time frame shows us a break above 77.00 with the support of the moving average MA50 and a potential continuation of the bullish trend. Our first target and resistance are the previous high at 78,460. We had this morning from the important economic news: Consumer confidence in Australia reached its highest level in a decade in November after easing control measures Covid-19, data from the Westpac survey showed on Wednesday.

The Westpac-Melbourne Institute’s consumer sentiment index rose 4.1 percent to 112 in December from 107.7 in November. This was the highest reading since October 2010. The Board of the Reserve Bank will meet next time on 02 February.

Although the policy will almost certainly remain unchanged at the meeting, the bank should lower its unemployment forecasts and increase its growth forecasts, said Bill Evans, Westpac’s chief economist. The value of basic machine orders in Japan jumped by 17.1 percent in October.

Annual orders for basic machines rose 2.8 percent – which again easily exceeded expectations for a drop of 11.3 percent after a drop of 11.5 percent in the previous month. Technically, reducing risk at the global level gives the Australian dollar an advantage to advance towards higher levels.

-

Support

-

Platform

-

Spread

-

Trading Instrument