EUR/AUD forecast for December 10, 2020

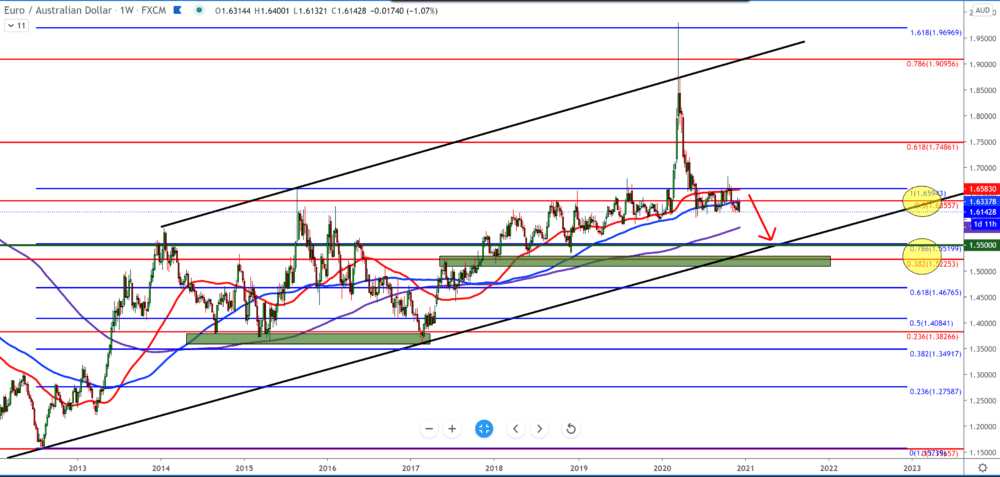

Looking at the chart on the weekly time frame, we see that before the jump at the beginning of the year caused by the market decline due to coronavirus, we can notice that the EUR/AUD pair was moving like a big consolidation around moving averages MA50 and MA100, while at the bottom as stronger support was MA200.

It is now likely that the EUR/AUD pair will touch the MA200 again. After failing to break above 1.64000, we now see the pair on support at 1.60000, and perhaps below that level. The continuation of the bearish scenario is more likely.

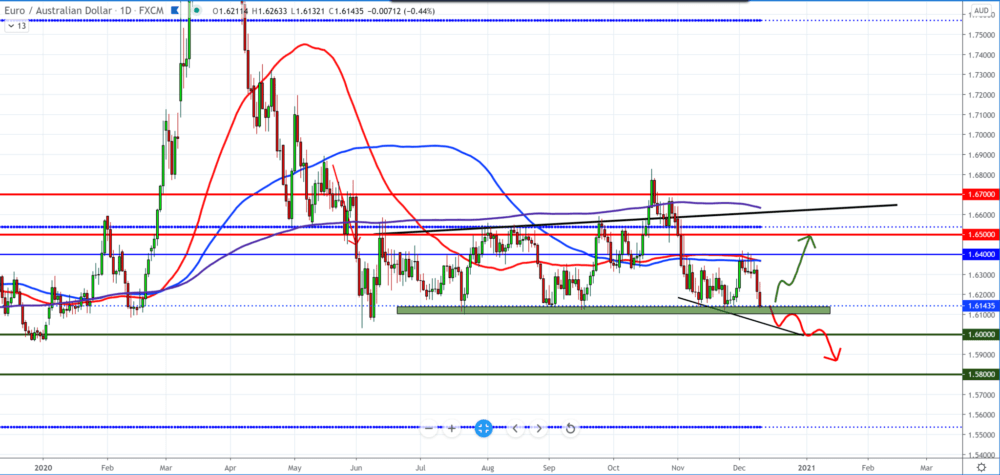

The graph on the daily time frame shows the resistance of the moving averages MA50 and MA100 to 1.64000 and a strong rejection towards lower levels around 1.61000. the couple has bounced off that level several times already. The chart will show us if it works now. The bearish scenario is more likely below that level with a possible test of 1.60000; otherwise, we go up to 1.64000.

On the four-hour time frame, we see that the current bearish moment is strong and pushing the EUR/AUD pair down and that it will soon fall below 1.61000. The break is below all three moving averages, and by combining the previous highs, we get a trend line of resistance from the top. 1.60000 is an important psychological zone for investors for further investments.

The continuation of the bearish scenario is very likely on the H4 chart as well. Today, we have a report from the European Central Bank regarding the interest rate from the economic news. The ECB is projected to add about 500 billion euros to its Pandemic Emergency Purchase Program (PEPP). ECB President Christine Lagarde could comment on the rising euro exchange rate, reducing inflation and exports.

Any hints of a reduction in the deposit rate, which is -0.50%, will lead to a fall in the euro. The European Commission has set out a series of targeted contingency measures to ensure basic reciprocal air, road connectivity, and access to fisheries between the EU and the UK, as there is still significant uncertainty over whether the Brexit agreement will apply 1 January 2021. , according to the latest statement issued by the Commission.

-

Support

-

Platform

-

Spread

-

Trading Instrument