Bitcoin, Ethereum, Dogecoin New Bullish Impulses

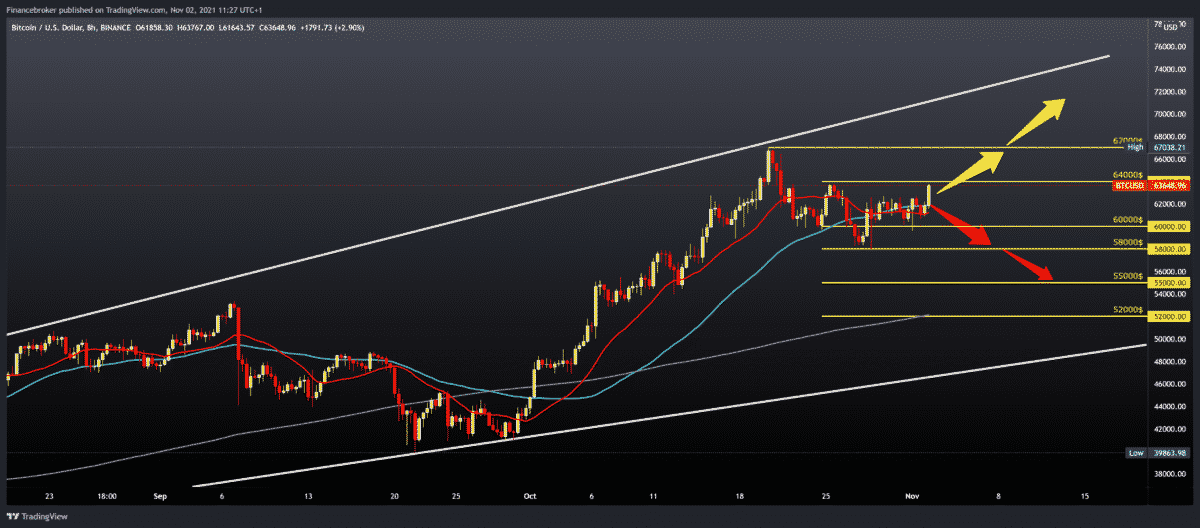

The Bitcoin price came out of a five-day consolidation making a break above $ 62,000, climbing to the current $ 63,500. Moving averages are again directed upwards and increase the bullish pressure.

Bullish scenario:

- The price now has support in the moving averages MA20 and MA50.

- We need a break above the $ 64,000 resistance zone to consider continuing towards the previous high at $ 67,000.

- The mid-resistance is at $ 65,000, then the $ 67,000 previous historical high.

- If the positive consolidation continues, we can expect a potential breakthrough above and the formation of a new historical high.

Bearish scenario:

- We need a new price withdrawal below moving averages to test the zone at $ 60,000.

- A further drop brings us down to the previous low zone at $ 58,000.

- Our next support is at $ 55,000, then $ 52,000 with the MA200 moving average.

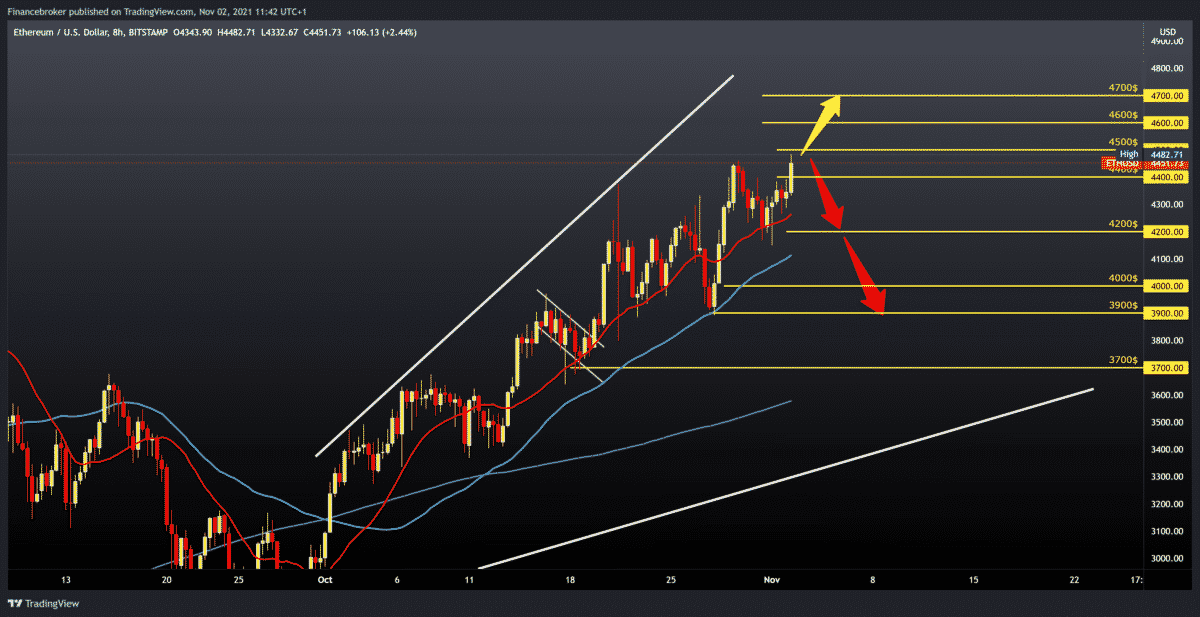

Ethereum chart analysis

The price of Ethereum is currently recording its new historical high at $ 4482.71. Positive consolidation above $ 4200 and moving averages helped Ethereum and pushed the price to new historic levels.

Bullish scenario:

- The price should stay above MA20 and MA50 to stay in the bullish trend.

- Our potential resistance is now a $ 4500 zone that could be psychological resistance.

- If there is a break above the price, it will create a new historical high. our targets are $ 4600, $ 4700.

Bearish scenario:

- We need to pull the price from the current level to $ 4300, to test the MA20 moving average.

- The break below the descent takes us into the $ 4200 zone, approaching the MA50 moving average at $ 4100.

- Our next lower support is $ 4000 psychological level, then $ 3900 previous higher low.

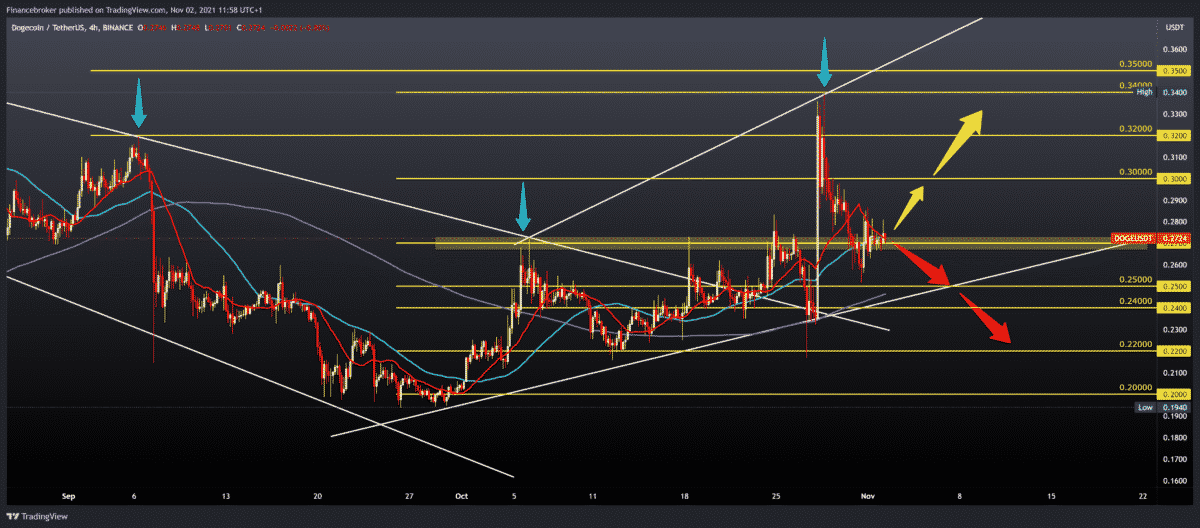

Dogecoin chart analysis

As expected, the price of Dogecoin found support at the previous 0.27000 resistance zone during October. We now hope to continue on the bullish side and record new gains during November.

Bullish scenario:

- The price now needs to make a positive consolidation to move it closer to the next resistance to 0.30000.

- The break above climbs us to the next resistance at 0.32000; then at 0.34000 October higher high.

- We are still in the October growing canal.

Bearish scenario:

- We need a price withdrawal below 0.2700 and MA20 and MA50 moving averages.

- We then descend to the bottom of the support line at 0.25000.

- The break below leads us to a 0.24000 support zone with an MA200 moving average.

Market news

Bitcoin volatility declines after receiving billions from institutional investors. High volatility and constant price changes are two factors that often attract investors to the cryptocurrency industry. But with the advent of institutional funds, bitcoin is slowly becoming a less volatile and more stable asset.

As the price of bitcoin jumped in the last quarter of the year, Micheal Saylor, a famous U.S. entrepreneur and CEO of MicroStrategy, proposed a new look at bitcoin.

In an interview with Squawk On The Street host, the CEO explicitly said this “Bitcoin is growing forever. “

Saylor’s assessment of the royal coin follows its ability to counter several major events that have taken place in the crypto industry. The bitcoin price has survived China’s decline intensively in cryptocurrency mining.

In addition, support from the U.S. SEC and U.S. pioneers in the bitcoin mining industry point to a more bullish trend coming in the next twelve months.

According to the CEO, it seems safest to have a long-term view of the largest cryptocurrency, as it can become the “hardest” and strongest storehouse of value in the next ten years.

Over the years, Microstrategy has kept Bitcoin at a high level as a storehouse of value and treasure reserves, so Saylor noticed this; “Bitcoin is emerging as the world’s digital reserve asset, a long-term store of value and as a hedge against inflation.”

Speaking of digital assets as the most desirable asset class, the CEO suggested that buying a Bitcoin network would be a wise choice to stay ahead of inflation, whether as an individual, family, or organization.

-

Support

-

Platform

-

Spread

-

Trading Instrument