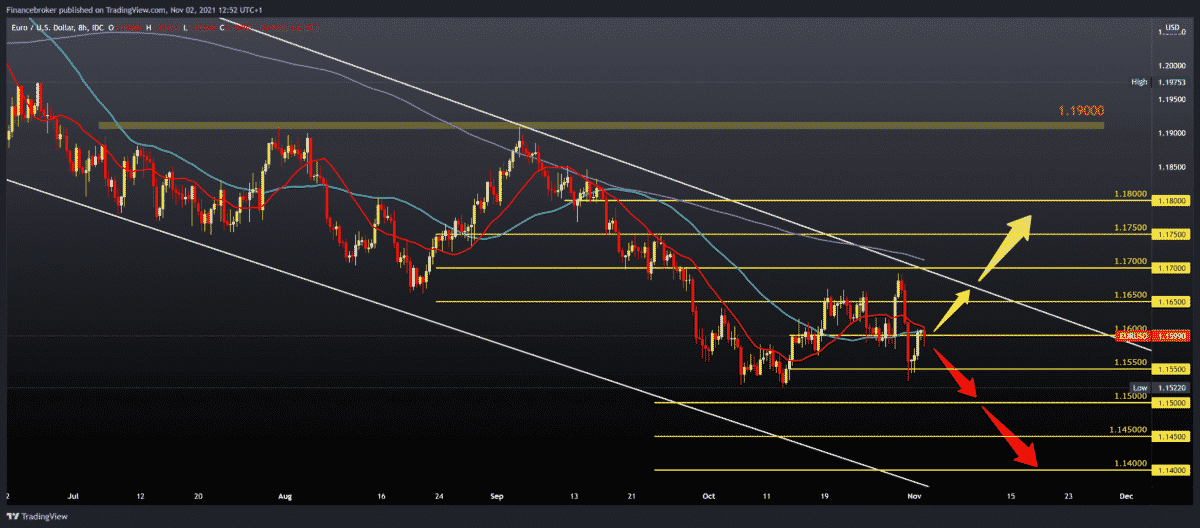

EURUSD, GBPUSD, AUDUSD Forecast for Nov 2, 2021

After yesterday’s support at 1.15500, the EURUSD pair is now consolidating around 1.16000. EURUSD failed to make a lower low but is currently having difficulty making a break above 1.16000. Maybe he needs us a little more time.

Bullish scenario:

- EURUSD must make a break above 1.16000 and MA20 and MA50 moving averages.

- After that, we can expect to test the resistance zone at 1.16500.

- October was bullish for EURUSD and can be solid support on the chart in the coming period.

Bearish scenario:

- We need a price withdrawal to the previous low zone at 1.15200-1.15300.

- After that, the pressure of moving averages from the upper side will increase.

- Then we ask for support at 1.15000 psychological level, and we ask for additional support at 1.14500, then at 1.14000.

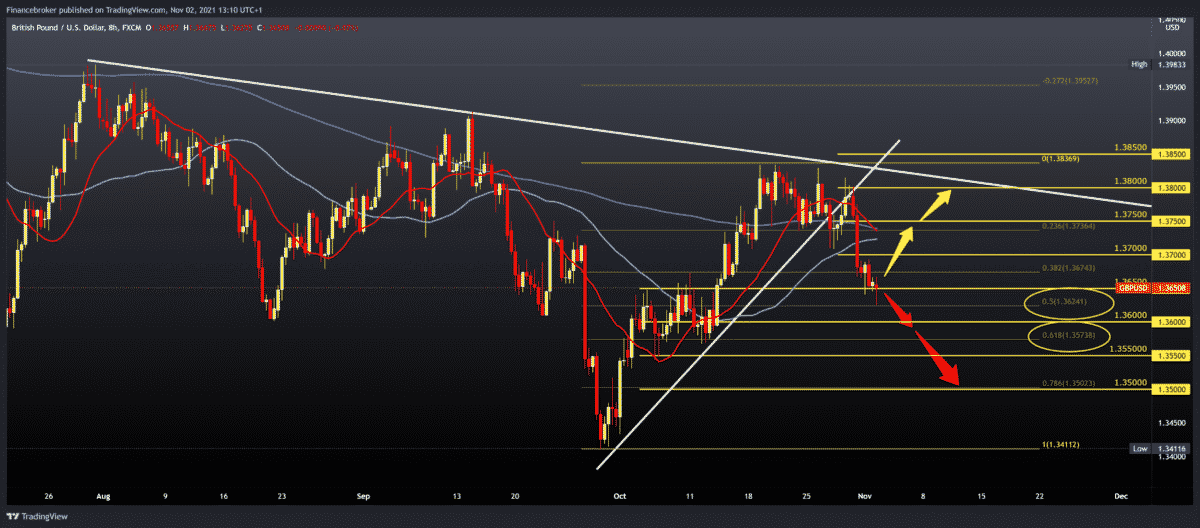

GBPUSD chart analysis

The pound is still under a lot of pressure, and the GBPUSD pair is consolidating around 1,36500 during the Europe session. We are entering a zone of October support that could help the pair return to the bullish trend.

Bullish scenario:

- We first need a positive consolidation that will direct us back to the upper trend line.

- Our first next resistance is the zone at 1.37000.

- Then we come across a zone of moving averages in the range of 1.37300-1.37500.

- The break above us climbs to the previous resistance zone at 1.38000.

Bearish scenario:

- We need continued negative consolidation and descent to 1.36000 potential support.

- Our next support is at 1.35500, then 1.35000, and the October minimum at 1.34300.

- By setting the Fibonacci retracement level, if there is a break below 50.0% level, there is a high probability that we will drop to 61.8% level at 1,35730.

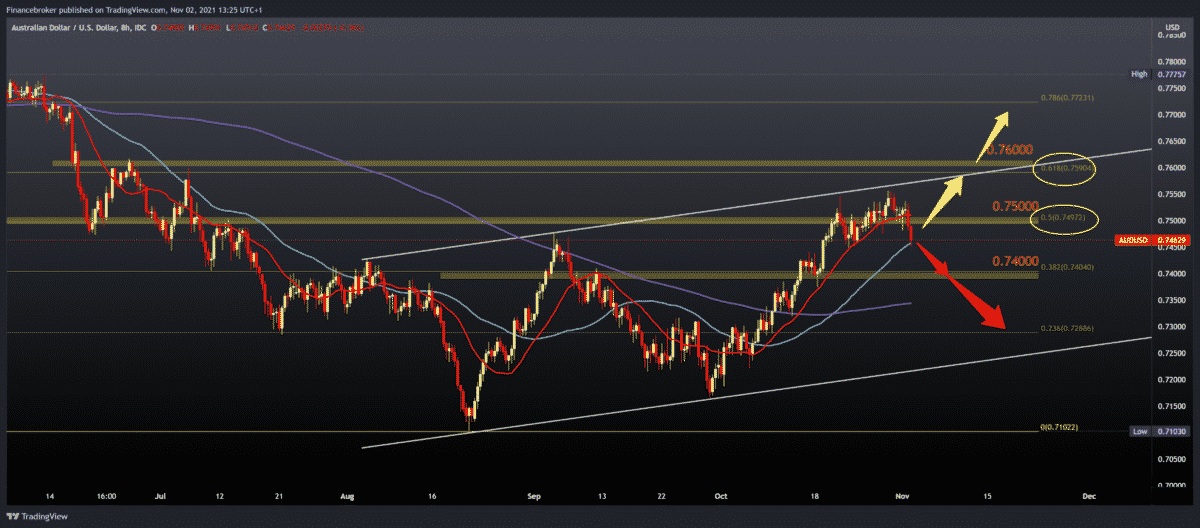

AUDUSD chart analysis

The broader picture tells us that we have encountered resistance in the upper line of the channel and that we will now see a deeper retreat of the AUDUSD pair. Pair managed to make a new higher high at 0.75500 last week, but after that, it makes a retreat to the current 0.74655.

Bullish scenario:

- We are currently testing a potential support zone at 0.74500 with support in the MA50 moving average.

- We need a new positive consolidation and return above 0.75000.

- Then we encounter resistance in the upper channel line at 0.75500, and only a break above us can lead to a 61.8% Fibonacci level at 0.76000.

Bearish scenario:

- We need a continuation of this negative consolidation below the MA50 moving average.

- A further downgrade of AUDUSD brings us to potential support at 0.74000 and 38.2% Fibonacci level.

- Our next supports are on the MA200 moving average in the zone 0.733500, then 0.72880 at 23.6% Fibonacci level.

Market overview

Production activity in the eurozone grew at the slowest pace in eight months in October. As supply chain problems disrupted production schedules and reduced orders, the final results of the IHS Markit survey showed on Tuesday.

The index of purchasing managers in production fell to 58.3 in October from 58.6 in September. The forecast was 58.5. The indicator signaled the slowest improvement in conditions in the manufacturing sector since February.

The average delivery time for incoming deliveries has drastically lengthened. Furthermore, the companies reduced their production, citing difficulties in importing. Although both production and new orders expanded in October, the growth rate has weakened since September. After that, inflationary pressures intensified across the eurozone, with input costs and output prices rising at new record rates in October.

PMI in Germany and France fell to a nine-month low in October. Lack of materials and bottlenecks in supply limited German production and new orders. BME manufacturing PMI reached 57.8 in October, down from 58.4 in September and a current score of 58.2.

Since January, French production fell for the first time, as large supplier delivery delays left many firms with insufficient inputs. PMI in production fell to 53.6 in October from 55.0 in September; the forecast was 53.5.

Italy recorded its third-highest record growth in October, while supply-side challenges and rising inflation in Spain limited growth in October.

-

Support

-

Platform

-

Spread

-

Trading Instrument