Bitcoin, Ether, Dogecoin Forecast for Nov 1, 2021

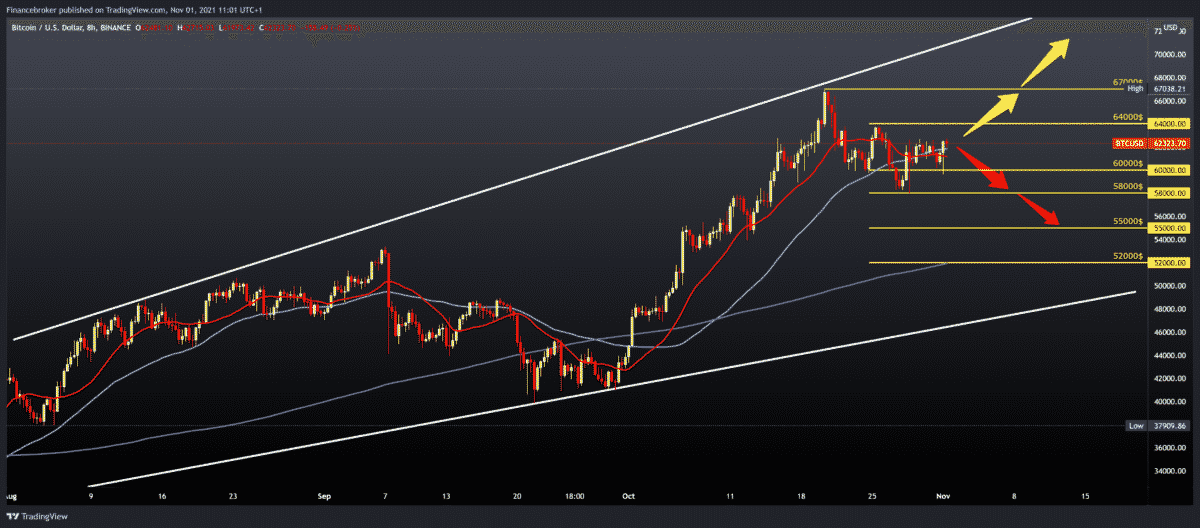

The price of Bitcoin again tested the support zone at $ 60,000 yesterday. We are above moving averages again, and we will start bullish support this week. After yesterday’s withdrawal, to $ 60,000, the price climbed to $ 62,300 today during the Asian session.

Bullish scenario:

- BTCUSD should keep above moving average and zone support at $ 60,000.

- We need a break above $ 62,500, targeting last week’s high at $ 64,000.

- Our next resistance is $ 65,000, and then historically high at $ 67,000.

- The broader picture is that we are in a big growing channel.

Bearish scenario:

- We need a price withdrawal below the MA20 and MA50 moving averages.

- Then we’ll test the previous support again, and the break below us drops to the previous low at $ 58,000.

- The next support set is at $ 55,000, and our maximum bearish target is at the MA200 moving average in the zone, around $ 52,000.

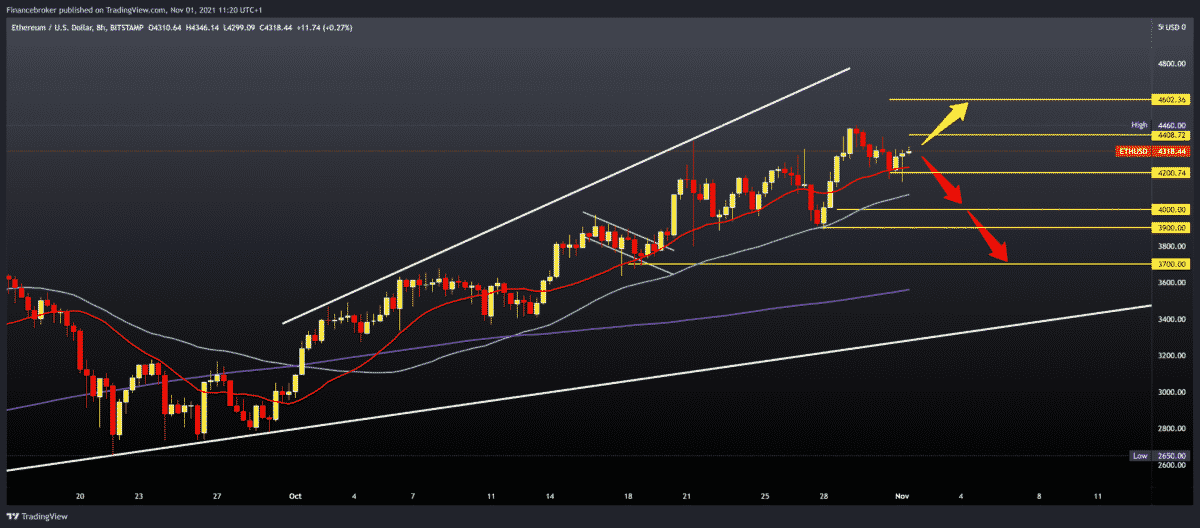

Ethereum chart analysis

The price of ETHUSD tested the zone at $ 4,200 yesterday, found support during the Asian session, and is now at $ 4,330. We are in a solid bullish trend during October, and for now, we have no signs of a possible change in the trend.

Bullish scenario:

- The price must stay above $ 4200 with support in MA20 and MA50 moving averages.

- Our next potential resistance is at $ 4460, a historical high.

- Further positive consolidation sees us at new historical highs.

Bearish scenario:

- First, we need a pullback below $ 4200 and below the MA20 moving average.

- Our next support is the MA50 moving average, which steered the price throughout October.

- A break below MA50 lowers us into the $ 3900 zone of the previous higher low, then the lower below support is at $ 3700.

- The MA200 moving average is the lowest support for the broader bullish trend in the zone, around $ 3600.

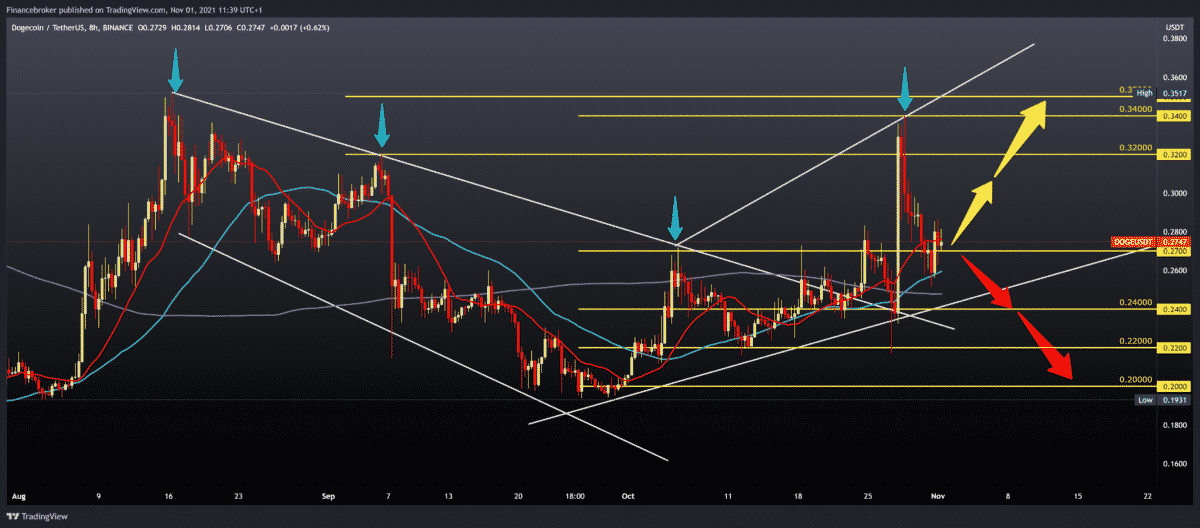

Dogecoin chart analysis

The price of dogecoin consolidated over the weekend in the range of 0.26000-0.28000. It is still in the growing October trend. After last week’s high at 0.34000, we now have an accumulation on the lower trend line, which leads to a potentially stronger momentum on the chart.

Bullish scenario:

- We must stay above moving averages and the October support line.

- The price should make a stronger break above 0.28000 and, with a positive consolidation, continue on the bullish side.

- Our first next resistance is at 0.32000, then 0.34000 October higher high.

Bearish scenario:

- The price should make a negative consolidation below 0.27000.

- The break below us descends into the zone MA50 and MA200 moving averages 0.25000-0.26000.

- Our next support is at 0.24000, then 0.22000, and for the end lower low from October in the zone 0.2000.

Market overview

Data from the Ethereum tracking tool on the Etherchain chain shows that the leading smart contracts platform has eliminated hundreds of thousands of ETH after the London hard fork started live on August 5th.

London hard fork implemented the Ethereum Improvement Proposal 1559, which introduced a fee collection protocol into the Ethereum network that permanently burns a certain amount of ETH from the supply each time a user processes a transaction.

Ethereum has burned 10.04 ETH worth $ 43,484 each minute for the past 24 hours, according to Etherchain. Blockchain has already spent 698.903.60 ETH, the equivalent of $ 3.02 billion at the time of writing.

Money also tracks the speed at which ETH burns in real-time while focusing on the platforms on which the most significant transactions took place.

The Ethereum tracking tool shows that the OpenSea irreplaceable token (NFT) market is responsible for burning the most ETH, burning 91,059.08 ETH worth over $ 394 million.

One more platform on the list of the best is the decentralized stock exchange (DEX) Uniswap (version 2), with 50,964 ETH worth over $ 220 million. The blockchain-based video game Axie Infinity is also on the list, with 14,220 ETH worth $ 61.58 million.

-

Support

-

Platform

-

Spread

-

Trading Instrument