Oil and Natural Gas: Up trend or Down trend

- During the Asian trading session, the price of oil jumped from the $ 120.00 barrier, consolidating there.

- After yesterday’s fall in the price of natural gas from $ 9.60 to $ 8.00.

- Investors should keep in mind that OPEC + has promised to inject 648 thousand barrels of oil into the global oil supply in July and August.

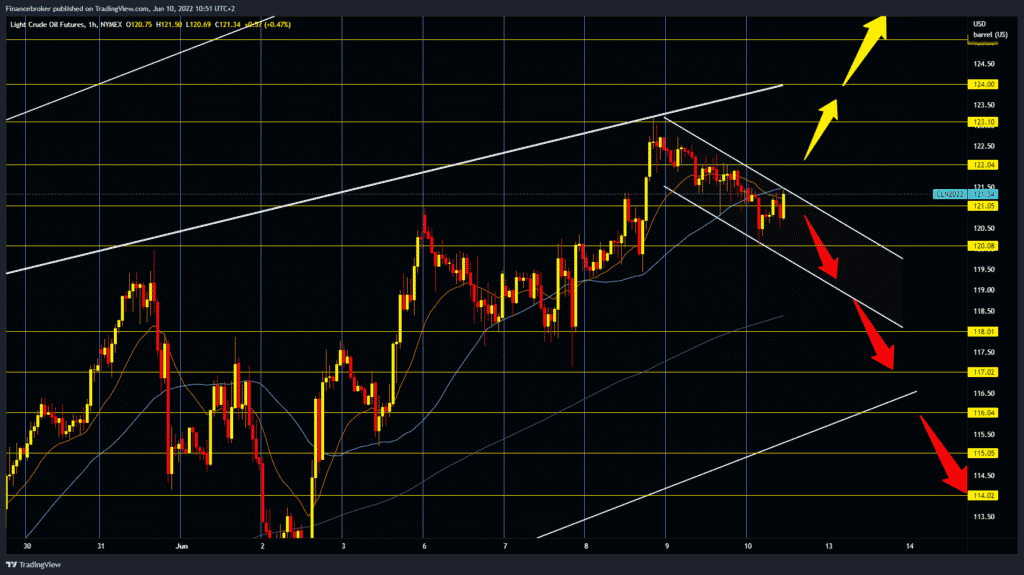

Oil chart analysis

During the Asian trading session, the price of oil jumped from the $ 120.00 barrier, consolidating there. The health situation in China is again partially complicated because places with large public gatherings are being closed in Beijing, and mass testing is being conducted in Shanghai. However, the driving season in the US and Europe has already begun, and the demand for petroleum products remains increasing while stocks of petroleum products are at a very low level in the US and shortages are not ruled out. Saudi Arabia raised prices for its crude oil earlier this week, while OPEC + producers agreed last week to increase production in the next two months partially. Crude oil is trading at $ 121.30 a barrel, down 0.12% from last night.

On Wednesday night, the oil price is in the corrective channel after it stopped at 123.10 dollars. This morning, the oil price has already tested the $ 120.00 level, and since then, it has returned above the $ 121.00 price. If the oil price broke below $ 120.00, it could continue until the next higher support in the $ 118.00 zone.

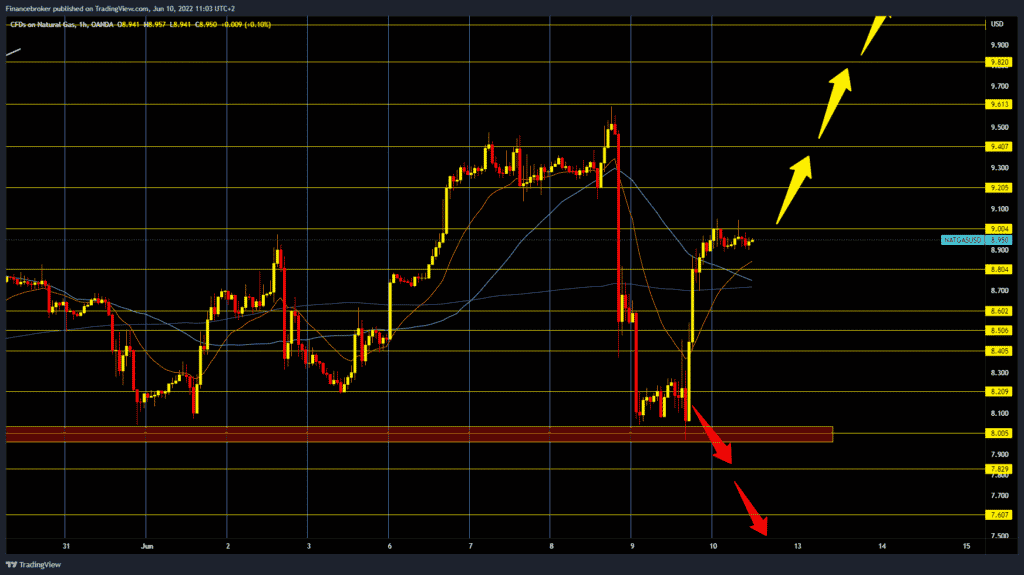

Natural gas chart analysis

After yesterday’s fall in the price of natural gas from $ 9.60 to $ 8.00, the price quickly consolidated and by the end of yesterday, it regained a large part of the losses, rising to $ 9.00. During the Asian trade session, the price was stable and ranged from $ 8.90 to $ 9.00. We are above all moving averages again, and now we could expect the bullish trend to continue.

Our first target is the $ 9.20 level, a support spot on June 7 and 8. From the continuation of the bullish consolidation, the price of gas could rise to $ 9.40 and then test the previous high of $ 9.60. Our main bullish target is the $ 10.00 level. For the bearish option, we need negative consolidation and a drop in price below $ 8.60. Then we would find ourselves below moving averages that would further increase bearish pressure. Potential lower targets are $ 8.50, $ 8.40, $ 8.20 and $ 8.00 previous support zone.

Market overview

Investors should keep in mind that OPEC + has promised to inject 648 thousand barrels of oil into the global oil supply in July and August.

Western leaders’ ban on oil from Moscow did not come with the label of alternative suppliers. Therefore, supply constraints will continue to persist, and oil prices will continue to rise.

Meanwhile, oil inventories by the Energy Information Administration (EIA) unexpectedly rose by 2.025 million barrels on Wednesday, much more than estimates and previous data of -1.917 million barrels.