Oil and Natural Gas: The Uptrend didn’t Last Long

- During the Asian trading session, the price of oil managed to stay above the $92.00 level.

- During the Asian trading session, the price of natural gas tried to break above the $9.20 level.

- A slightly weaker US dollar also supported the market, making oil cheaper for buyers holding other currencies.

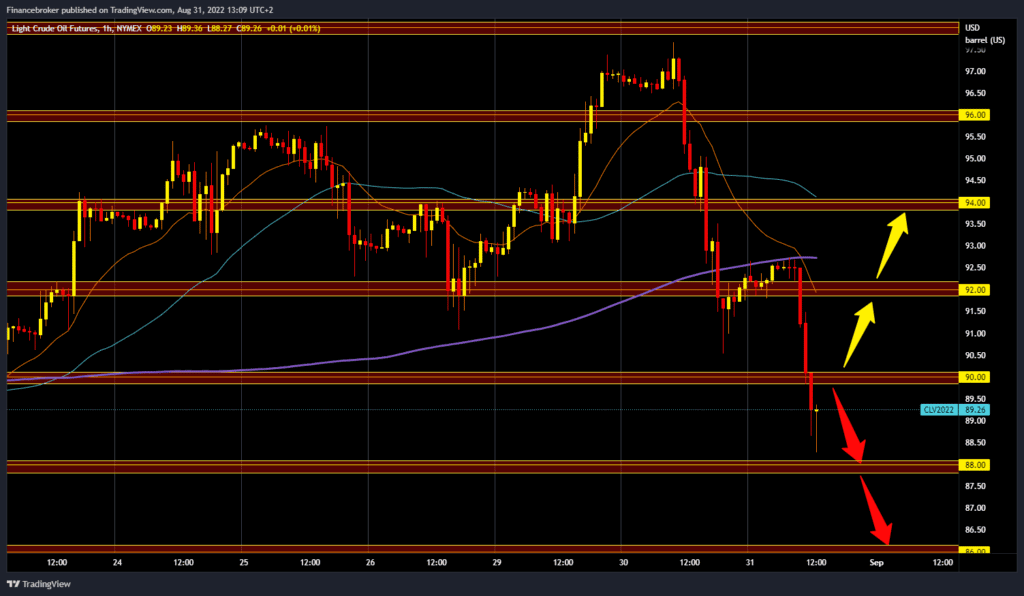

Oil chart analysis

During the Asian trading session, the price of oil managed to stay above the $92.00 level, but that did not last long, as a rapid drop to the $88.20 level followed. The increasing number of closed cities in China has led to a decrease in demand for oil. The reason for this closure is the next meeting of the Communist Party of China in Beijing, and a large number of officials and visitors from all over the country are expected. For a bullish option and oil price recovery, we need a new positive consolidation and a return above the $90.00 level first. The oil price is now at the $89.10 level and could continue its recovery. First, we must climb above $90.00 and try to hold above. In the zone around $92.00, we have additional resistance in the MA20 and MA200 moving averages, while the MA50 moving average is around the $94.00 level. For a bearish option, we need a continuation of negative consolidation and another drop to the $88.00 support level. A price break below could take us to last week’s low at $86.00.

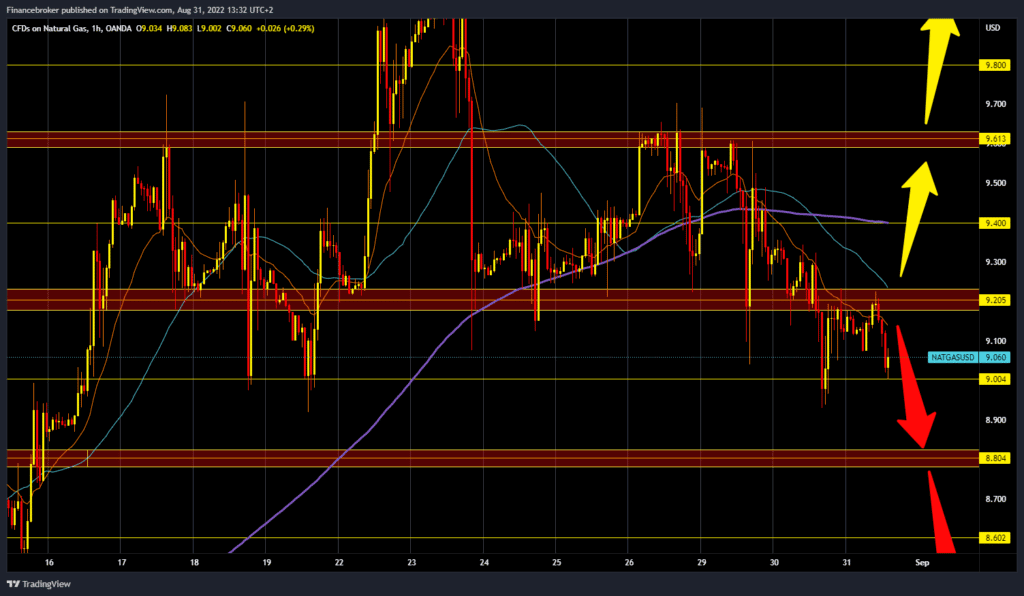

Natural gas chart analysis

During the Asian trading session, the price of natural gas tried to break above the $9.20 level, but without success, and the price retreated to $9.00. Now we need support at this level to start a new bullish recovery. We then need to get back above $9.20 and try to hold above. With a new bullish impulse, the gas price could rise to $9.40. Additional resistance at that level is in the MA200 moving average. We need a continuation of negative consolidation and a price drop below the $9.00 level for a bearish option. After that, the price could revisit the $8.80 support level.

Market overview

A slightly weaker US dollar also supported the market, making oil cheaper for buyers holding other currencies. Supporting market sentiment on Wednesday, data from the American Petroleum Institute showed that gasoline inventories fell by about 3.4 million barrels, while distillate inventories fell by about 1.7 million barrels in the previous week. Distillate inventories were expected to fall by about 1 million barrels. However, API data showed that crude oil inventories rose by about 593,000 barrels. The rise in prices was limited by concerns that some of China’s biggest cities – from Shenzhen to Dalian – will announce quarantines and shutter businesses to contain the pandemic, while the world’s second-largest economy is already experiencing weak growth.