Gold and Silver: A Strong Dollar Pushes the Price Lower

- The price of gold recorded a new one-month low at the $1710 level.

- The price of silver fell this morning to a new minimum at the $17.80 level.

- US 10-year Treasury yields continue to rise, and the US Dollar Index gains strength ahead of the release of employment data.

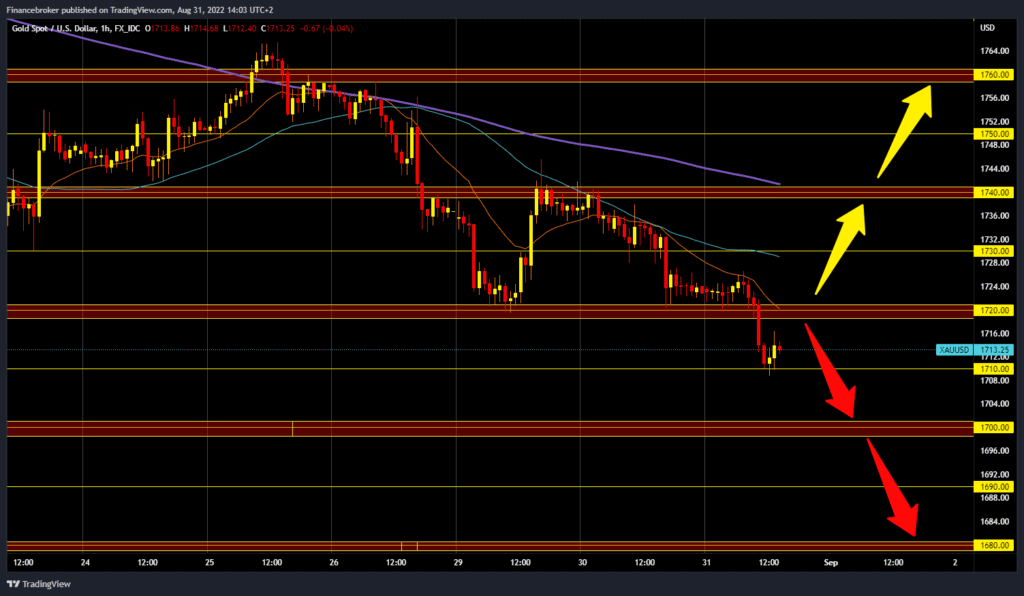

Gold chart analysis

The price of gold recorded a new one-month low at the $1710 level. Currently, we stopped there and moved up to the $1715 level. A strong dollar continues to push the price of gold lower and lower. For the bearish option, we need a continuation of the negative consolidation and a continuation of the pullback towards the $1700 psychological support level. For a bullish option, we need a new positive consolidation and a return above the $1720 level. After that, we could try to climb up to $1730 to get support in the MA50 moving average. Bigger resistance awaits us at the $1740 level because there is additional resistance in the MA200 moving average.

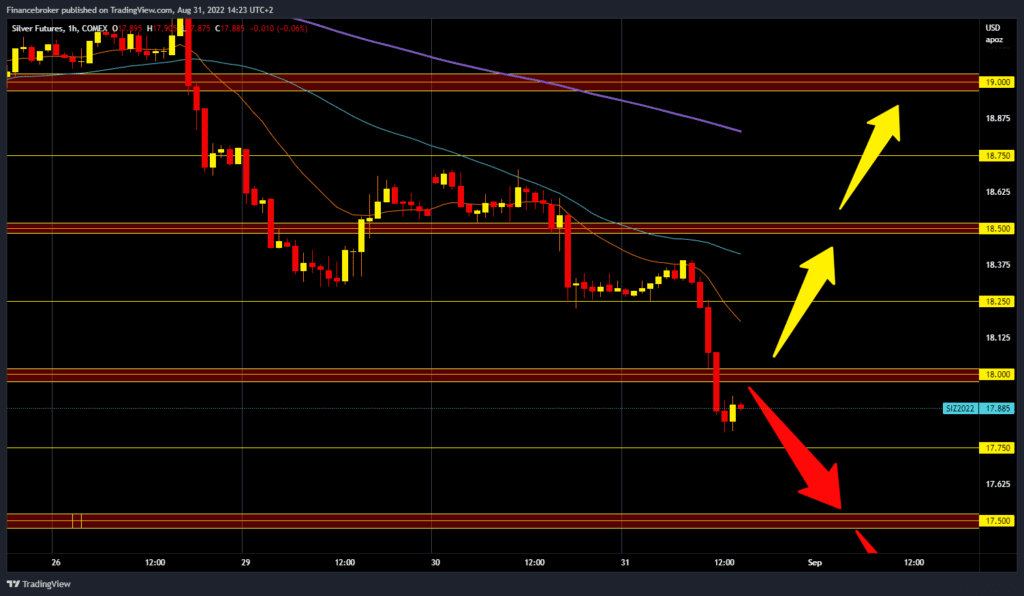

Silver chart analysis

The price of silver fell this morning to a new minimum at the $17.80 level. Now the price is consolidating and has slightly moved towards the $17.90 level. Bearish pressure is very strong and could lower the price of silver even more. We need a continuation of the negative consolidation and a drop to the $17.75 level for the bearish price. A price break below would likely take us down to the $17.50 level. For a bullish option, we need a new positive consolidation and a price return above the $18.00 level. After that, we could see a continuation of the recovery on the bullish side. Potential higher targets are $18.25 and $18.50 levels. If the price of silver managed to stay above the $18.50 level, then it would return to a longer-term bullish trend.

Market Overview

US 10-year Treasury yields continue to rise, and the US Dollar Index gains strength ahead of the release of employment data. All this negatively affects the value of the yellow metal. Investors are increasingly worried about the outlook for gold demand, with China sticking to its zero-Covid policy and now imposing new restrictions in a number of cities.