Oil and Natural Gas: Risk of completely suspended

- During Asian trade, the price of crude oil rose.

- The gas price continues its bullish consolidation that started yesterday at $ 6.00.

- The Energy Information Administration will not release further data, the agency said in an update of long-awaited inventories that were due to be released last Wednesday.

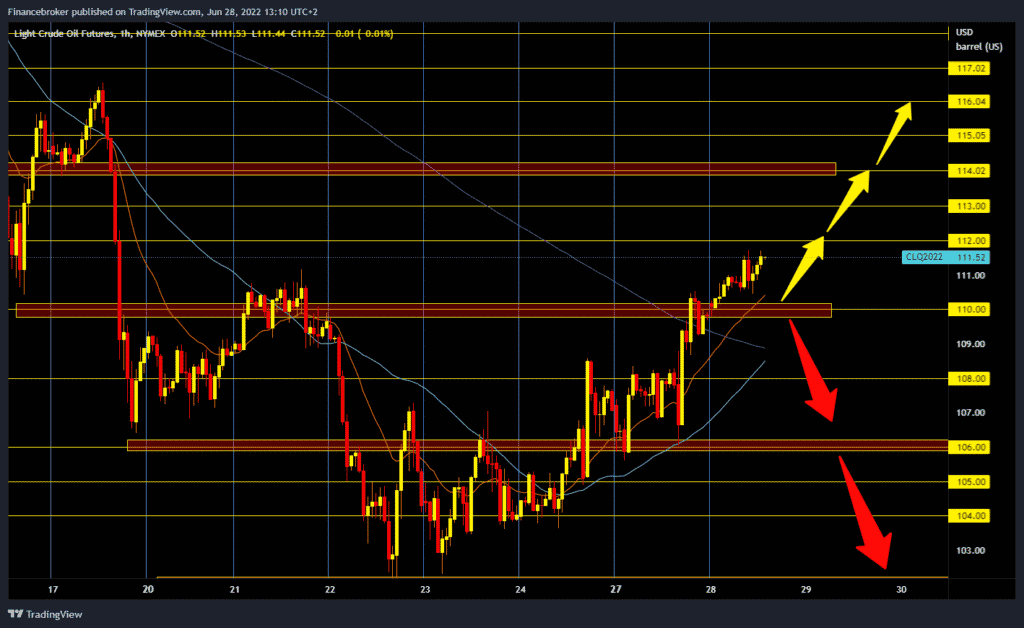

Oil chart analysis

During Asian trade, the price of crude oil rose. An OPEC member, Libya, announced yesterday that it might have to stop exports in the area of the Gulf of Sirte within 72 hours due to unrest that limited production. He added Ecuador to supply problems, where oil production could be completely suspended within 48 hours due to anti-government protests in which at least six people lost their life.

Crude oil is trading at $ 111.50 a barrel, up 1.71% from trading tonight. At 22:30, the figure of the American Petroleum Institute on the state of crude oil stocks in the USA will be published. For the bullish option, we need a continuation of the current positive consolidation and a break above the $ 112.00 level. After that, the oil price could continue further toward $ 113.00 and $ 114.00 levels. We need a negative consolidation and a pullback to the $ 110.00 level for the bearish option. A fall below this support zone opens up space for us towards $ 108.00 and maybe towards a $ 106.00 support zone.

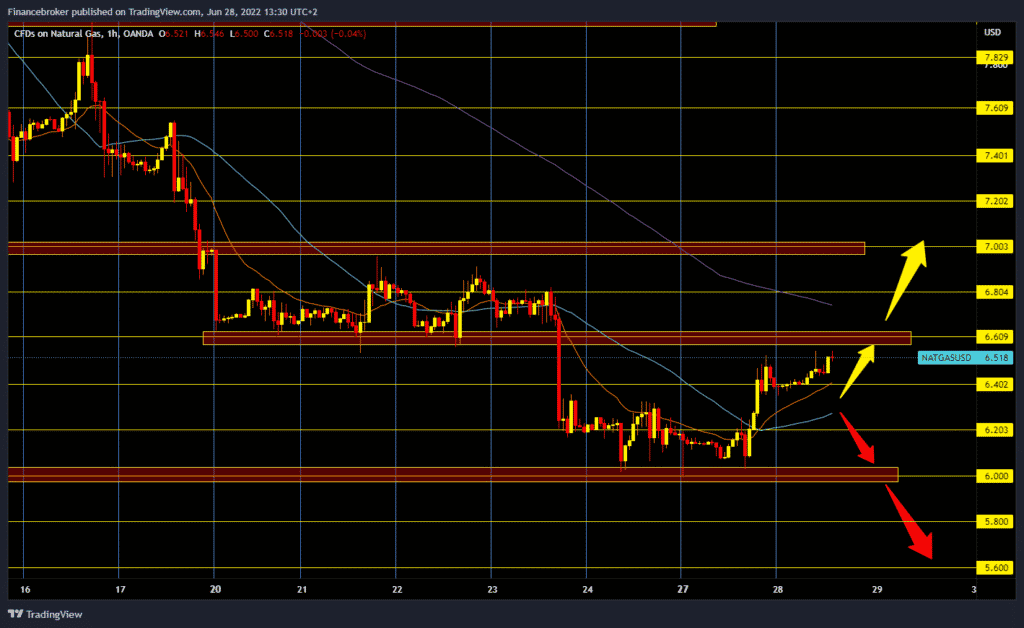

Natural gas chart analysis

The gas price continues its bullish consolidation that started yesterday at $ 6.00. We are now at $ 6.53 and approaching the $ 6.60 very important level for the price of gas. If we climb above, the price could continue further towards the $ 7.00 level. At that level, we expect the next higher resistance. For the bearish option, I need a negative consolidation and withdrawal below $ 6.40. After that, we can expect the price to be directed towards the $ 6.00 level.

Market overview

The Energy Information Administration will not release further data, the agency said in an update of long-awaited inventories that were due to be released last Wednesday.

The data was not released last week after the EIA discovered a voltage irregularity, which caused hardware failures on two of our main processing servers.

This failure prevented the EIA from processing and publishing several reports last week, including the highly sought-after Weekly Oil Report, which publishes not only data on crude oil stocks in the U.S. but also gasoline and diesel stocks, as well as refinery utilization data. Last week also lacked weekly data on crude oil production in the United States.

The EIA did not provide a timeline for when the data would be released, nor did they comment on whether their systems would be in place to release this week’s oil status report.