Oil and Natural Gas: Pushing the price up

- Crude oil traded at $ 116.60 a barrel, up 1.67% from trading tonight.

- During the Asian session, the price of natural gas recovered slightly but soon met resistance at $ 8.40.

- In a recent research note, the rising energy prices and the expulsion of Russian crude oil from the global market risk a global recession.

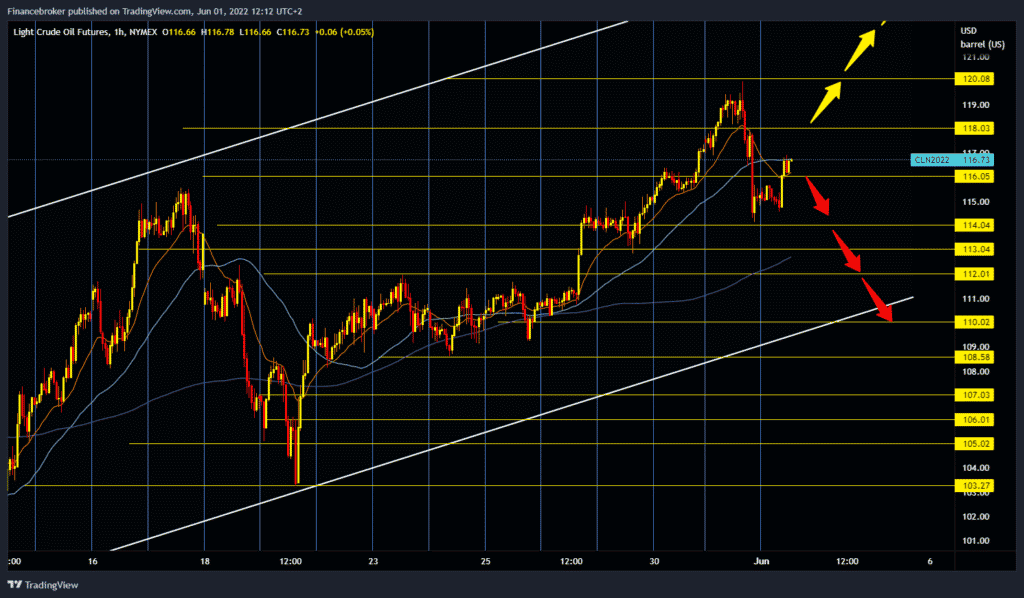

Oil analysis chart

During the Asian trade, the crude oil price rose after yesterday’s withdrawal. Namely, the news spread that some OPEC members may be in favour of excluding Russia from the OPEC + initiative, which was interpreted negatively for the price of oil. The EU has agreed in principle to impose an embargo on oil imports by sea, which would mean about two-thirds of imports from Russia currently, and by the end of the year, 90% of oil imports would be under sanctions. The beginning of the tourist season in the USA and Europe, the opening of Shanghai after the end of the complications of the health crisis, and the low level of oil and derivative stocks are pushing the price of oil up in the long run.

This morning, it published a better indicator of the state of China’s processing industry, which was much better than expected. Crude oil traded at $ 116.60 a barrel, up 1.67% from trading tonight. Tonight at 22:30, the issue of the API on the state of crude oil stocks in the USA will be published. We need the continuation of today’s positive consolidation for the bullish option. Our first target is the $ 118.00 level, and we need to break above for a potential sequel to the $ 120.00 price tag. We need a negative consolidation and a pullback below the $ 115.00 price tag for the bearish option. Potential lower targets are $ 114.00, $ 113.00, $ 112.00 and $ 110.00.

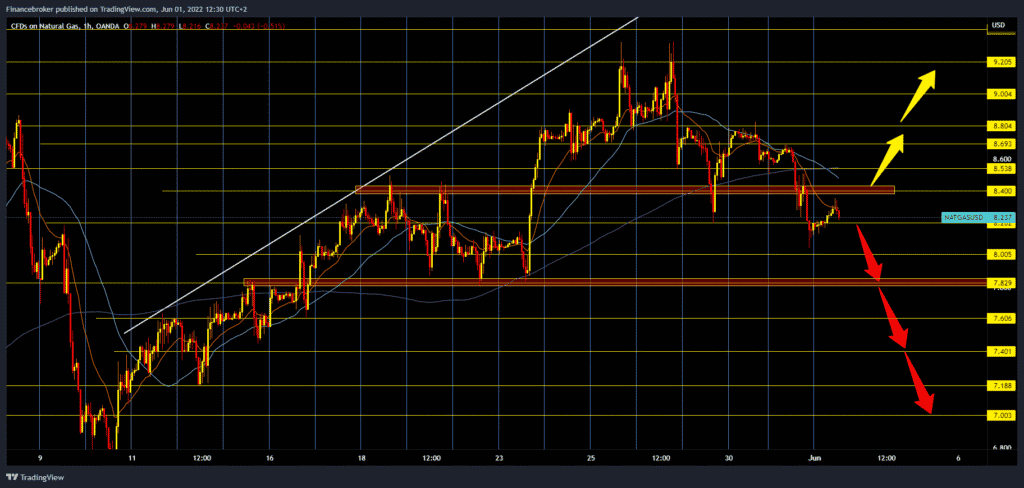

Natural Gas chart analysis

During the Asian session, the price of natural gas recovered slightly but soon met resistance at $ 8.40. Silver has formed a new lower high, which is a sign to us that we can now expect the price to continue to fall. Our potential next target is $ 8.00, then $ 7.80, where we had support last week. Since Tuesday, the sharp drop in natural gas prices has been in tandem with growing open interest and volume, revealing a further correction very shortly, with at risk of falling to the region of $ 7.40. For the bullish option, we need a new positive consolidation and the formation of a new higher high on the chart above $ 8.60. After that, our target is the $ 8.80 level, this week’s resistance zone, and the break above would take us to the May maximum zone.

Market overview

In a recent research note, the rising energy prices and the expulsion of Russian crude oil from the global market risk a global recession, warned Francisco Blanche, head of research for global goods and derivatives at the Bank of America.

In 2023, BoA sees demand for oil approaching pre-Covid levels — but only if Russia’s crude oil and condensate production stays at 10 million barrels a day and OPEC + crude oil production rises.

“With our current insight into our Brent target of $ 120 a barrel, we believe a sharp decline in Russian oil exports could trigger a complete 1980s-style oil crisis and push Brent well above $ 150 a barrel,” Blanche added.

Some industry experts expect that a partial EU ban on Russian imports will increase oil prices above $ 130 per barrel in the short term.