Gold and Silver: Up or down?

- During the Asian session, the price of gold fell.

- The price of silver has been in the bearish trend for the fourth day since it climbed to $ 22.50.

- Fed President Jerome Powell did not speak much during a meeting with US President Joe Biden.

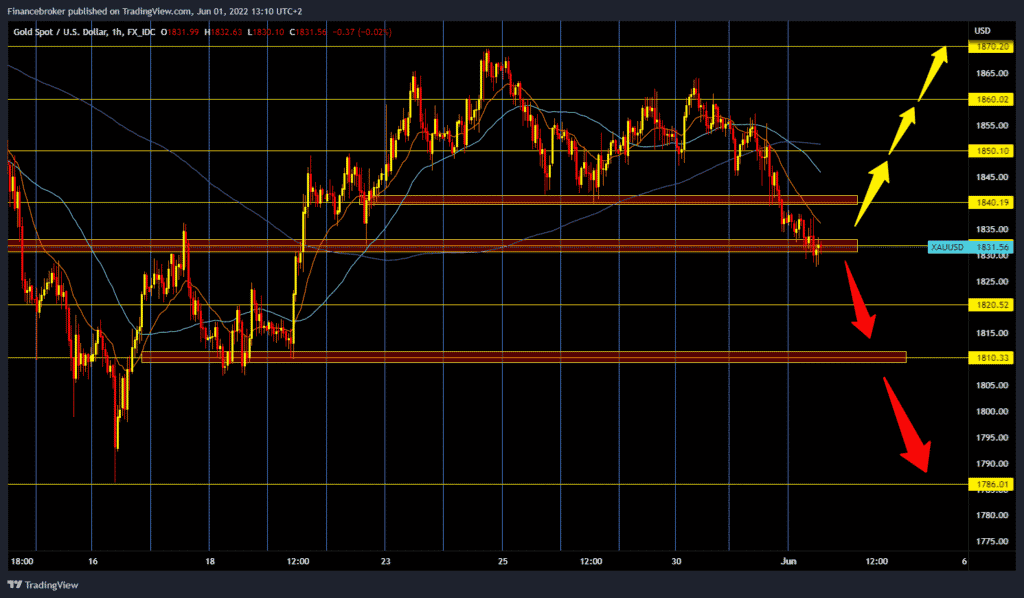

Gold chart analysis

During the Asian session, the price of gold fell. Yesterday, the price of gold withdrew because some investors interpreted the meeting between Joe Biden, the President of the USA, and Jerome Powell, the head of the Fed, as a slight pressure on the American Central Bank to hurry with the increase in the interest rate. Also, one member of the Fed’s monetary board, Christopher Waller, two days earlier, said that the interest rate should be increased by 0.50% in September as well. Another meeting between US President Joe Biden and Fed Chairman Jerome Powell is expected today.

The price of gold is trading around 1832 dollars, which is a drop of 0.24% since the beginning of trading last night. Breaking prices below $ 1830 would increase bearish pressure and open up space to $ 1820, then to $ 1810 level support from May 19th. For bullish options, we need a return below $ 1840. After that, the price needs to continue further to 1850 dollars, where we come across MA50 and MA200 moving averages.

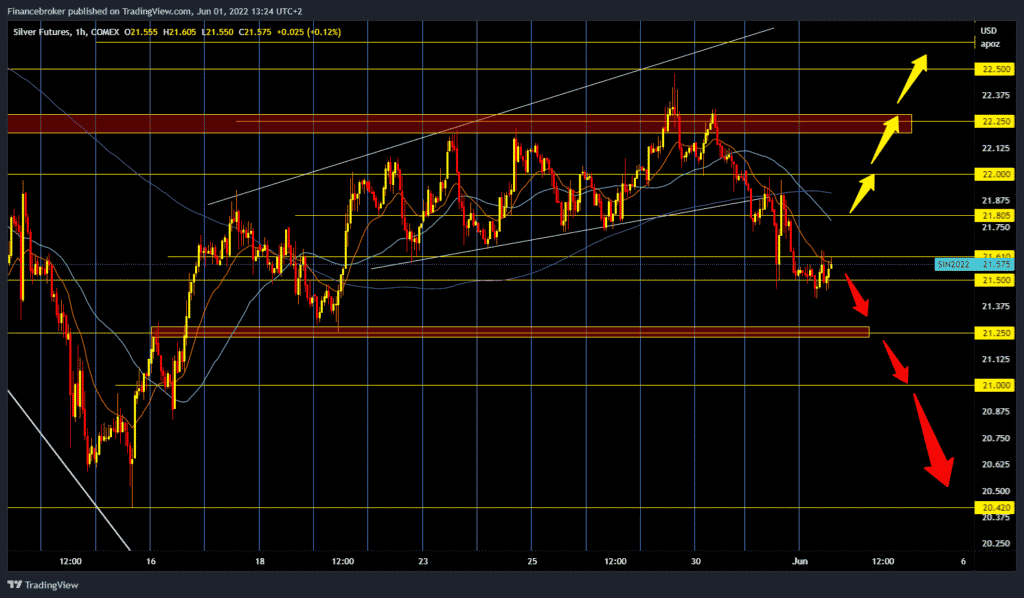

Silver chart analysis

The price of silver has been in the bearish trend for the fourth day since it climbed to $ 22.50. This morning’s minimum price was $ 21.41. Silver found some support at that level and now had a slight recovery to $ 21.60. The dollar has been stable for the last few days and is making smaller gains, which is negatively affecting the price of gold and silver. We need a continuation of the negative consolidation and further withdrawal towards the $ 21.25 level for the bearish option. If this level does not support us and we see a break below, the price of silver could visit the previous low at $ 20.42. We have to climb above the $ 21.80-22.00 zone for the bullish option. Only after that could we expect the recovery to continue towards the previous high at $ 22.50.

Market overview

Fed President Jerome Powell did not speak much during a meeting with US President Joe Biden. Fed Governor Christopher Waller and Atlanta Fed Chairman Rafael Bostic were the latest hawks to renew expectations of faster interest rates.

In addition, the price of gold is influenced by the praise of US President Biden and Finance Secretary Janet Yellen for the Fed’s action and showing the greatest interest in curbing inflation. “US Treasury Secretary Janet Yellen said on Tuesday that she had made mistakes in the past about the inflation path, but said that taming price increases was a top priority for President Joe Biden. He supported Federal Reserve actions to achieve that,” Reuters reported.

Market participants are now looking forward to the US Economic Report, which includes ISM manufacturing PMI and JOLTS Job Openings later during an early session in North America. This, together with the yields on US bonds, will affect the dynamics of USD prices and give a new impetus to gold.