NZD/CAD forecast for December 3,2020

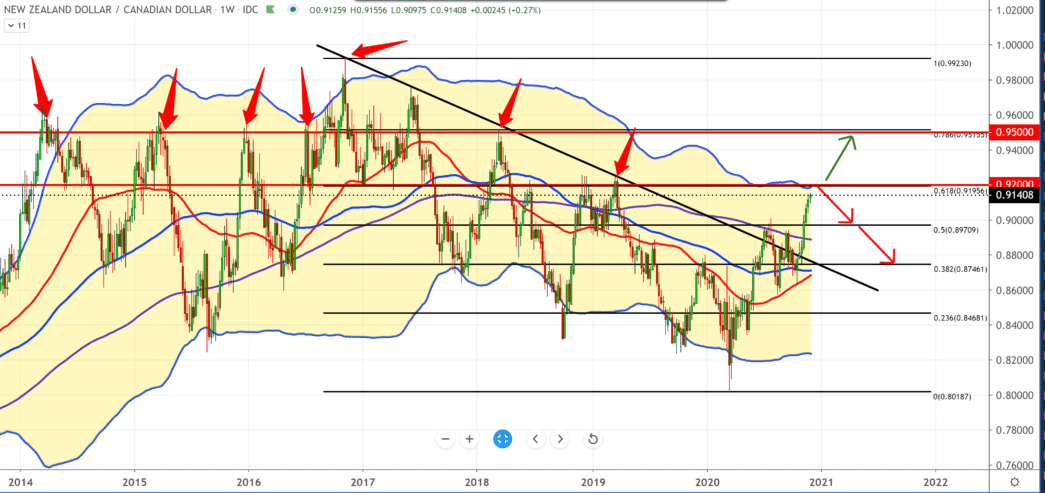

First of all, looking at the chart on the weekly time frame, we can see that the NZD/CAD pair has been moving bullish since mid-March 2020 with good support for the moving averages MA50 and MA100, and last month a break was made above MA200.

The Bollinger bands 100 indicators can also be useful. We see that the NZD/CAD pair is moving within its limits and that the set parameters are respected and that candlesticks patterns can be used well for trading. Based on this, we can see that NZD/CAD reaches the upper limit of BB100, which can be a potential resistance on 0.92000; if the candlestick closes out of the upper limit, BB100 bullish trend can be continued to the zone 0.95000, where it has already been rejected many times.

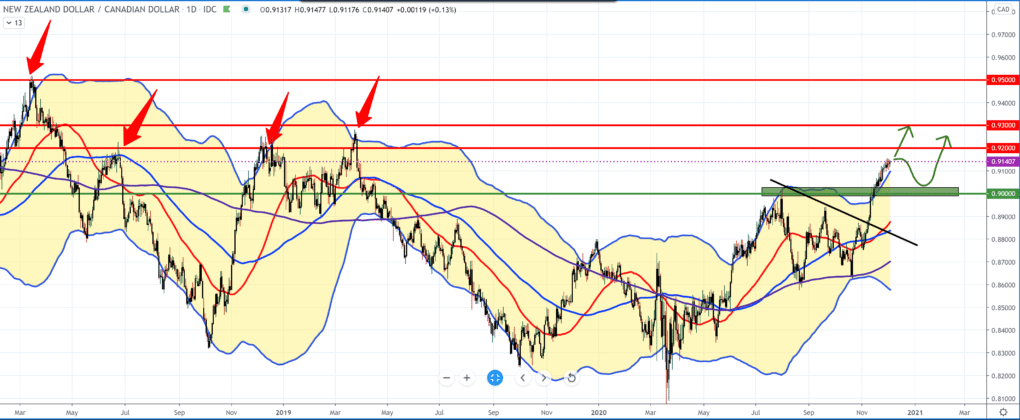

The daily time frame tells us that the bullish momentum is slower because the shifts upwards daily are small; there are no stronger impulses. NZD/CAD has the support of all three moving averages and is outside the limits of BB100, which tells us that bullish momentum is still strong despite minor shifts.

GBP/JPY forecast for December 03,2020

For the bearish scenario, we need a break and return within the BB100 indicator, and a bar breaks MA50 for better confirmation to sell to support at 0.90000. And if we see a break above 0.92000, we will quickly find ourselves close to 0.93000.

On the four-hour chart, we have a strong bullish trend from mid-October with support for moving averages MA50 and MA100 in early November. We also see that the NZD/CAD pair has found support at 0.91000 and is going towards 0.92000, which we will see soon.

From the important news this week for the NZD/CAD currency pair, we can single out the following: The total number of building permits issued in New Zealand increased seasonally adjusted by 8.8 percent compared to the month in October, followed by a growth of 3.6 percent in September. For the Canadian dollar, the Employment Change report for November is expected tomorrow.

-

Support

-

Platform

-

Spread

-

Trading Instrument