GBP/JPY Forecast for December 03, 2020

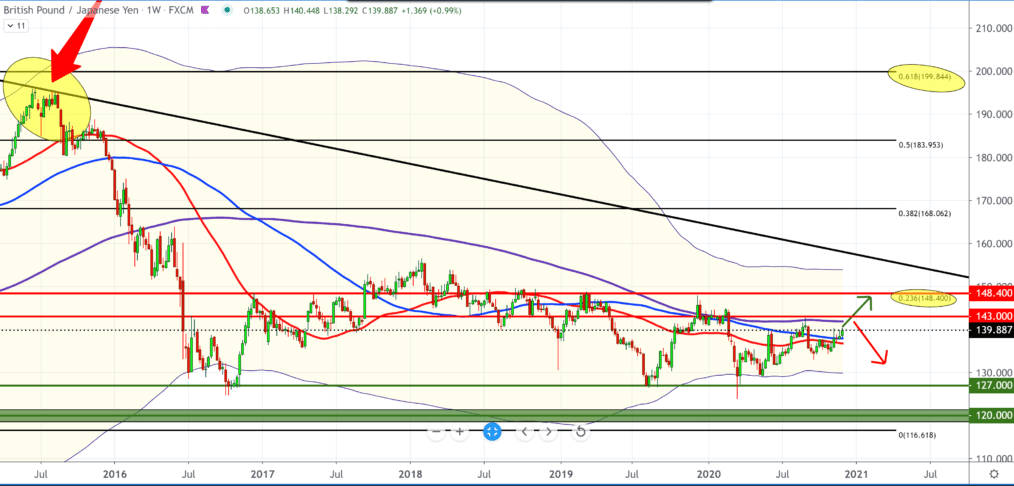

Looking at the chart on the weekly time frame, we see that the GBP/JPY pair has been growing since mid-March 2020 and that after falling from the start of the year from 143.00 to 124.00, it is now at 139.70 and has reduced losses by more than 75%. A bullish scenario is still technically possible because we have support for moving averages MA50 and MA100.

On the upper side, we have more resistance to MA200. Technically speaking, we can see the GBP/JPY pair in the next period in the range from 143.00 to 148.00 if everything goes as it should, of course. The things we can’t influence that can put pressure on this currency pair are first and foremost: the global movement of the coronavirus, the speed of new vaccines, and the result of Brexit, whose deadline for the agreement is 31 December.

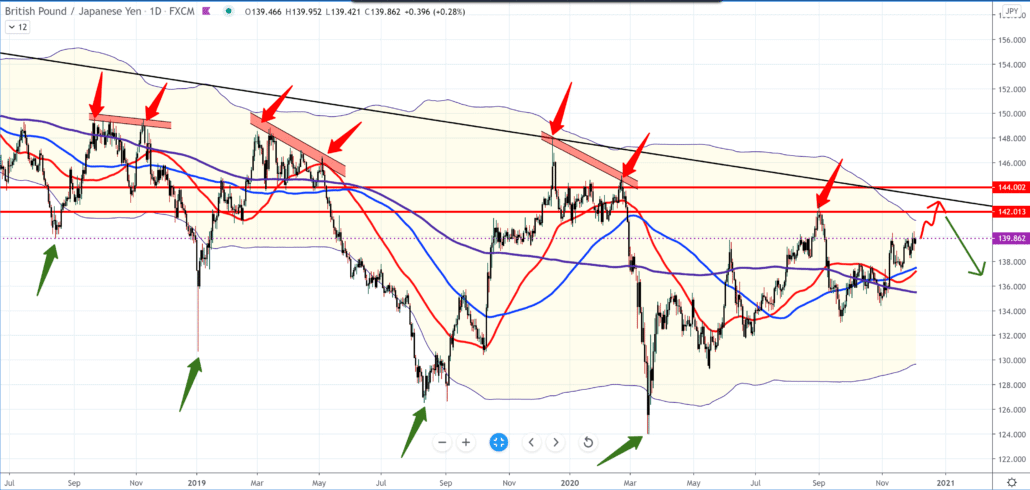

The chart on the daily time frame tells us that each new high is a lower high on the upper side, while on the lower side, we have new lower lows. We can now follow the chart to see if it will make a new lower low below 142.00.

The trend is generally growing and is supported by all three moving averages. The invention of the vaccine attracts investors from the Japanese yen as a safe currency, helping the pound move towards higher goals.

The problem may be the announcement that Britain’s lockdown will be extended until 10 January due to the increase in the number of people infected with the coronavirus. Such a move will impact the UK economy and requires some intervention by the Bank of England with financial incentives, which could then lead to a weakening of the pound.

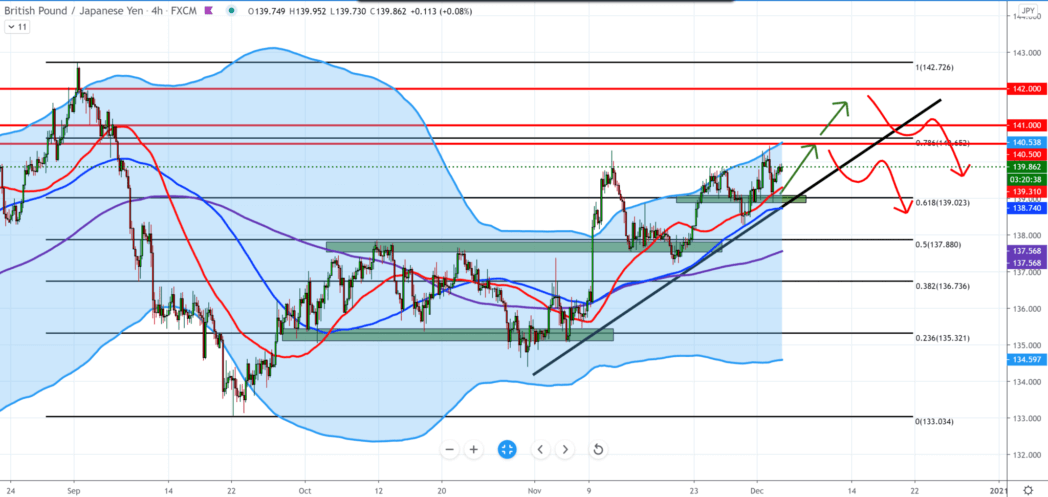

On the four-hour time frame, we have strong bullish momentum with the support of moving averages MA50 and MA100. When we set the Fibonacci level, we see that each level represents support for continuing towards higher goals. The bullish scenario is still known in zone 140-142.00. Today’s news for the pound was positive the Composite PMI Index and The Services Purchasing Managers’ Index (PMI).

-

Support

-

Platform

-

Spread

-

Trading Instrument