NZD/CAD analysis for April 27, 2021

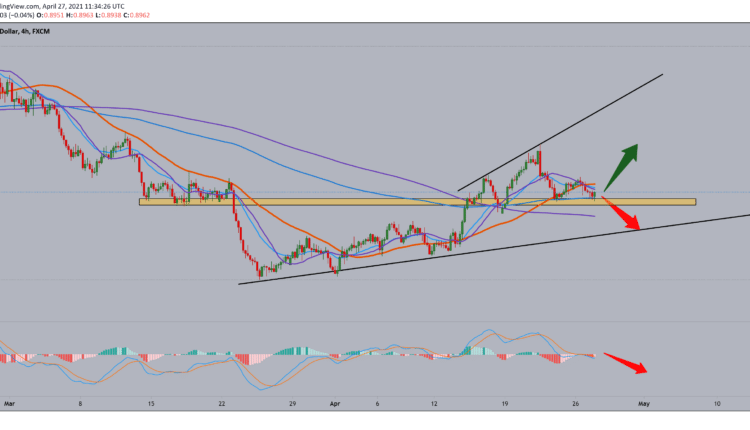

The chart on the four-hour time frame shows that the NZD/CAD pair finds current support on the EMA200, making a pullback with 0.91000. We can expect the NZD/CAD pair to descend to the lower support line in the 0.88500-0.89000 zone.

While for the bullish scenario, we need a break above the moving averages to continue upon the chart.

Looking at the MACD indicator, we are in a bearish trend, and it directs us and tells us that this pullback is not over yet and that we can expect a further descent.

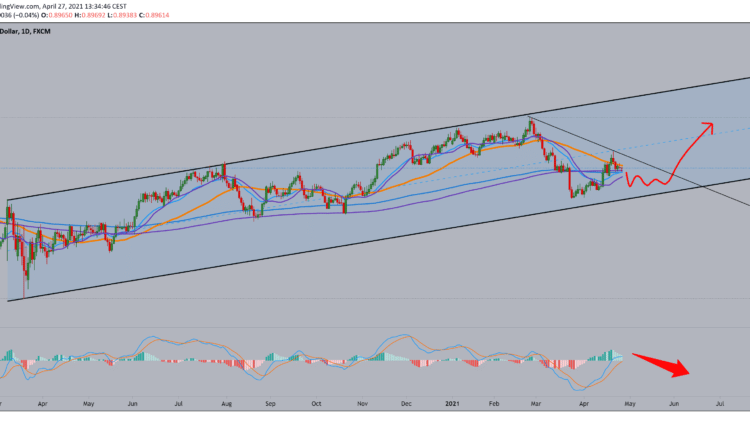

The picture is a little clearer on the daily time frame, the NZD/CAD pair moving in a large growing channel. We are now close to the bottom line of the channel, and we also have moving averages to help, which move to the bullish side, giving support to the NZD/CAD pair by directing it upwards. Break above the previous high at 0.90800. Only then can we expect the NZD/CAD pair to continue towards the previous high at 0.933293. Looking at the MACD indicator, we see that we are in the bullish option, with a smaller, shorter delay until we exit this consolidation.

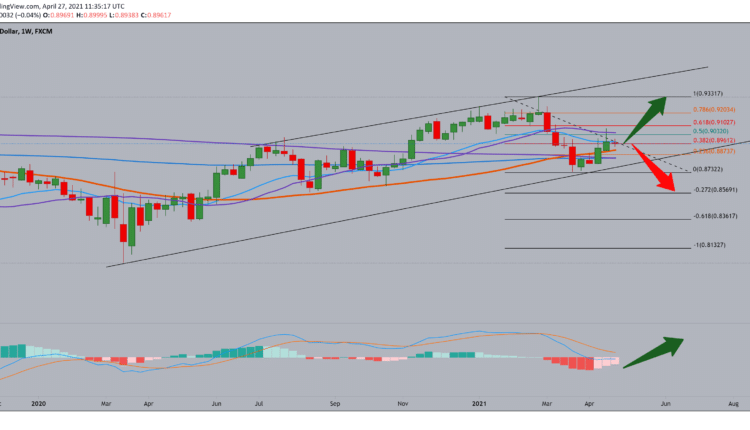

On the weekly time frame, we are also in a big growing channel, but here the moving averages MA20 and EMA20 are our current resistance, while at the bottom, we are supported by the MA50, MA200, and EMA200. After the pullback from the previous high, we see the end of the pullback at 0.87322 support in the bottom line of this channel.

By setting the Fibonacci level, we see that the withdrawal from the bottom line of the channel was up to 61.8% Fibonacci level. Now we could expect less consolidation, and for us, it is very important to follow the channel lines as the direction of the trend. Looking at the MACD indicator, we see that the bearish option is fading and that we are slowly moving into the bullish trend again.

-

Support

-

Platform

-

Spread

-

Trading Instrument