Market News and Charts for September 17, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

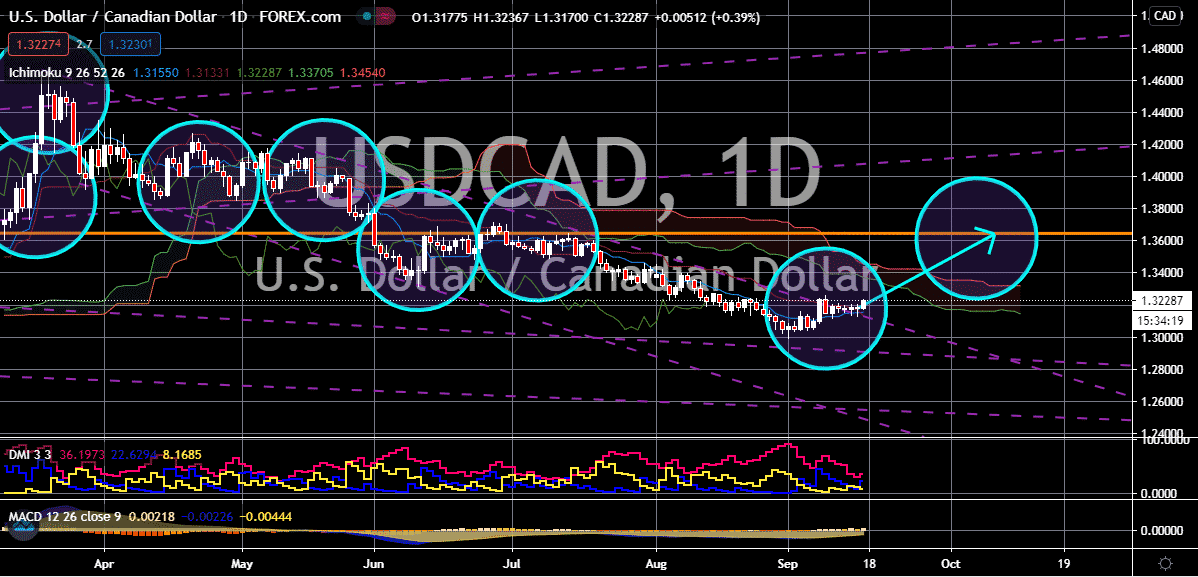

EUR/CHF

The negative sentiment in the global market is helping the Swiss franc’s gravitational pull brings the euro down in the trading sessions. The pair’s prices are bound to crash towards their support levels as bearish sentiment continues to prevail. The big question of the market now is what the next move of the Swiss National Bank would be. Looking at it, the SNB has tried all sorts of methods to prevent the franc from appreciating – deploying negative interest rates, unleashing a quantitative easing program, and asset purchasing of various kinds. As for the bloc’s single currency, a member of the European Central Bank’s executive board told the press that the bank is ready to act if the euro remains strong, not-so-good news for bullish investors. Come to think of it, both of the currencies’ central banks are avoiding their currencies to strengthen, suggesting that if the pair’s prices reach its support, it would be a slightly fairer game for both sides.

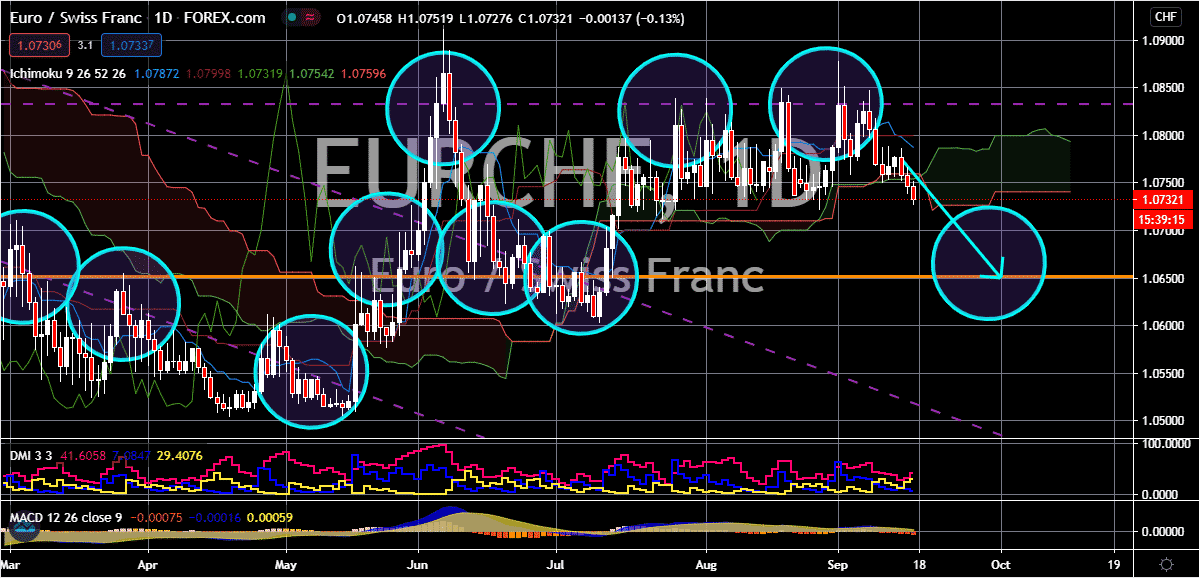

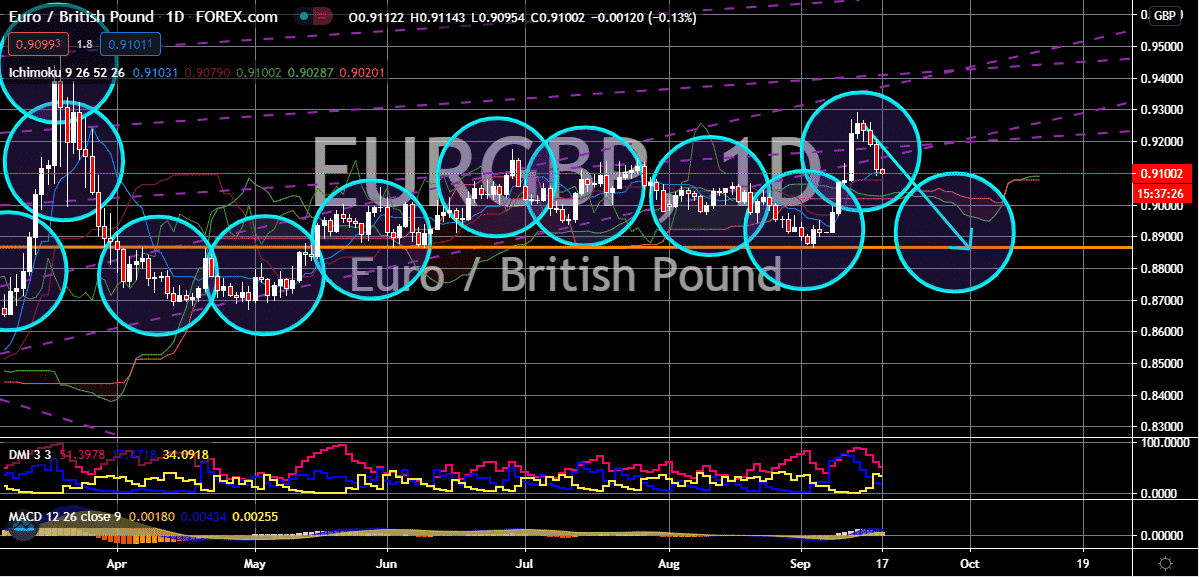

EUR/GBP

The concerns for the single currency outweigh Brexit related woes, dragging the euro to British pound exchange rate in the trading sessions. Prices of the pair are projected to climb down towards its support by the end of the month or by the first few days of October. Meanwhile, recent news about the Brexit negotiators has eased the pressure off of the sterling. See, talks about the divorce agreement have been dragging on for months and months but some experts are still optimistic that the two sides will eventually settle their differences and agree on a trade deal. Moreover, the Bank of England has already slashed its official interest rates to a record low of about 0.1% thanks to the coronavirus pandemic. Aside from that, it has also ramped up its bond-buying program to about 1 trillion US dollars. And now, the BOE is still widely expected to step up its game next month to counter the pandemic’s impact, such a move should slow the pound sterling then.

EUR/JPY

The weakness of both the euro and the US dollar in the trading sessions allows the EURJPY to go down. The exchange rate’s prices are expected to plummet to its support level by the latter half of the month thanks to the recent decisions made by major central banks. Earlier today, the Bank of Japan said that it will maintain its ultra-loose monetary policy as authorities finally see improvements in the country’s economic recovery. Aside from that, the BOJ also didn’t announce any major changes in their stance after the new Prime Minister Yoshihide Suga took to office. The new leader vowed to continue to former leader’s signature programs such as the “Abenomics”. On the other hand, the European Central bank said earlier today that it will be giving eurozone banks relief worth of about 73 billion euros from a key capital requirement to support them with the credit flowing thanks to the pandemic. The ECB will be directly giving 115 banks in the region.

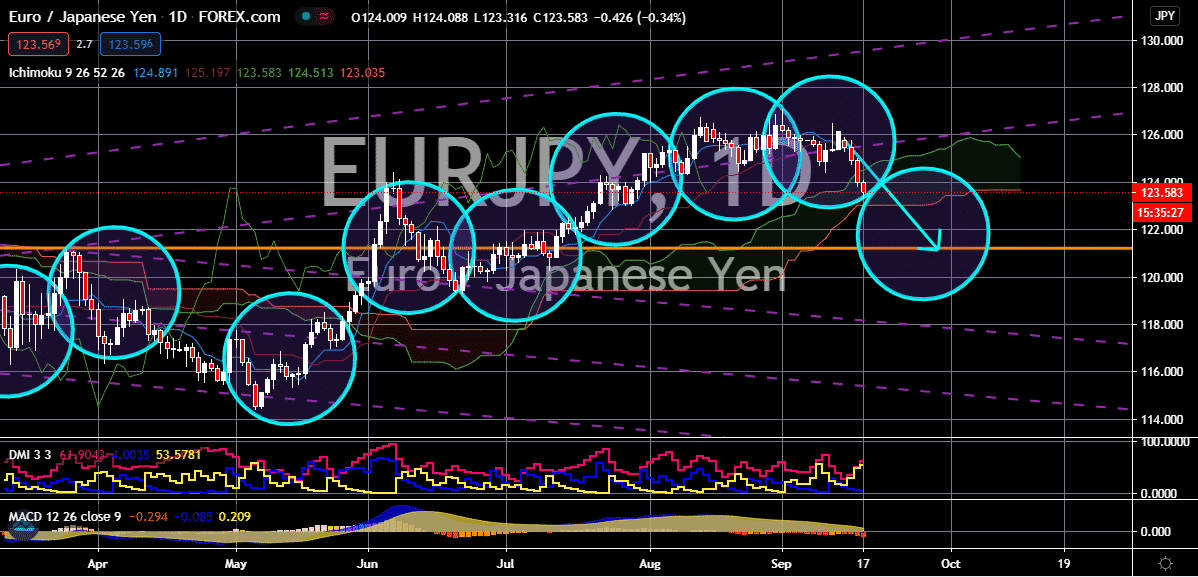

USD/CAD

The US dollar holds its steady recovery path against the Canadian dollar after the highly anticipated meeting of the United States Federal Reserve. In fact, bearish investors were relieved that the Fed didn’t unleash anything major or something that could disrupt the strength of the US dollar. It’s believed that the rebound of the US dollar would be slow and steady considering the fact that the Feds said that it will keep its interest rates near zero through the year 2023 to help the crucial recovery of the economy as the coronavirus pandemic remains as a major threat to everyone. The two-day meeting of the Federal Open Market Committee was not-so-dovish, helping bullish investors regain their confidence somehow. As for the Canadian dollar, it’s seen underperforming against its currency peers in the G-10 group after the meeting of the Federal Reserve. The concerns in the commodity market aren’t also helping its case in the trading sessions.