Market News and Charts for September 18, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

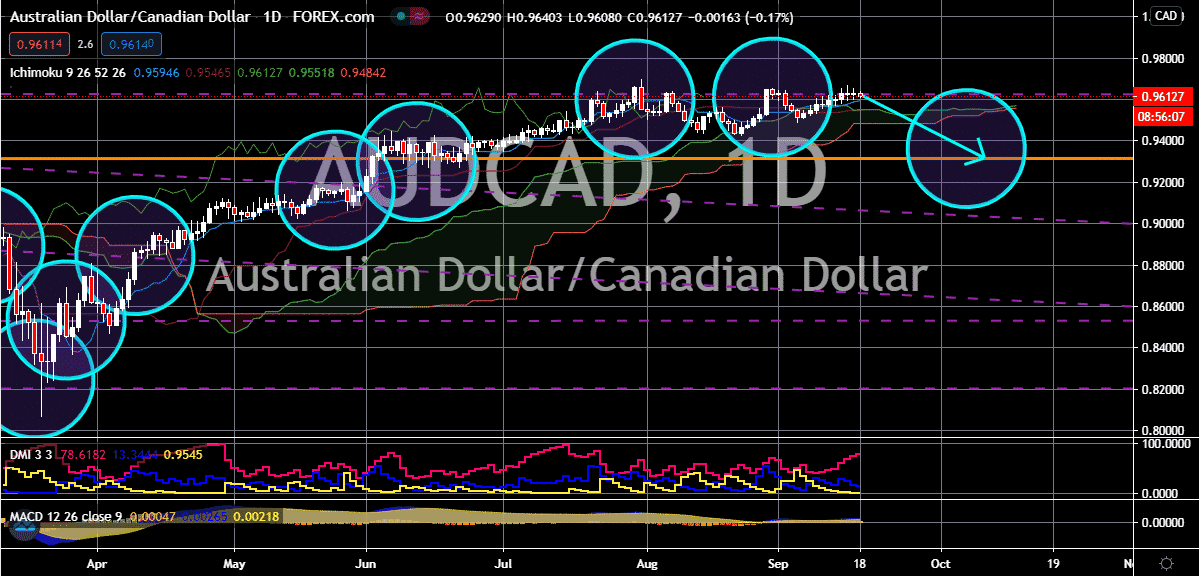

NZD/USD

Despite showing signs of recovery against other currencies thanks to the Federal Reserve’s not-so-dovish meeting, the US dollar still fails to maneuver against the New Zealand dollar. The exchange rate is widely projected to continue its uphill climb in the coming weeks, hitting its resistance level in the first few days of October. Investors of the kiwi immediately noticed the upside potential of the pair as the public worries about the strength of the US economy. Aside from that, traders have also been brushing off the pessimistic news reported about the New Zealand economy, remaining determined to force prices higher. Experts are actually concerned that the US Federal Reserve may be running out of ammunition, putting the fate of the US economy on the hands of the next president and the feuding lawmakers of the nation. Looking at it, the price’s upward pace isn’t that strong yet as investors are still wary of the Reserve Bank of New Zealand.

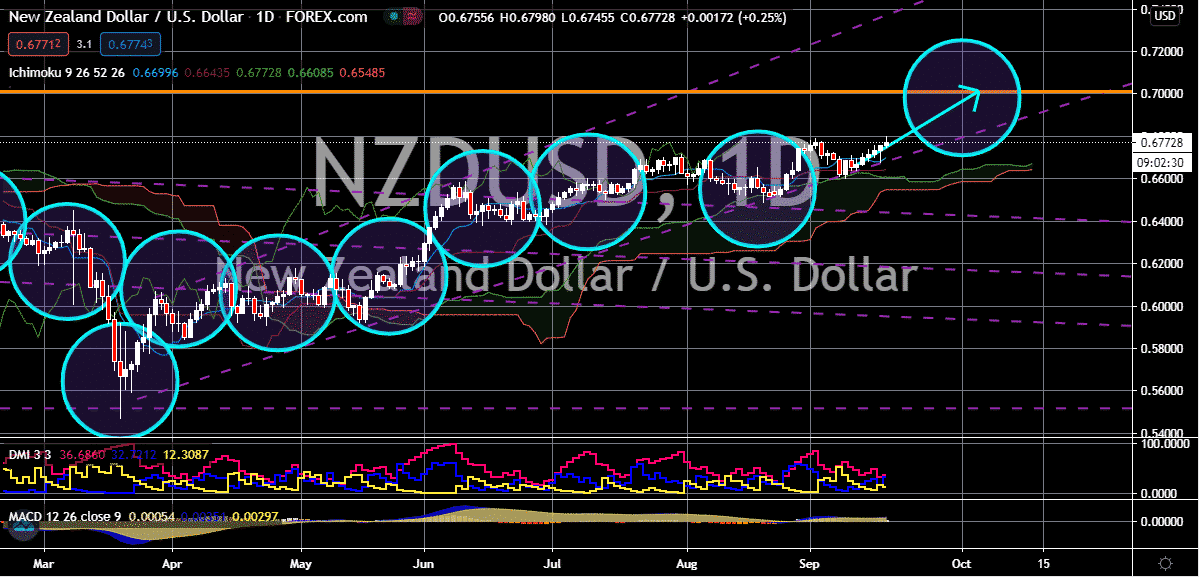

AUD/JPY

The Australian dollar is losing its footing against the Japanese yen and bearish investors of the pair are seizing the moment. It is now projected that the exchange rate’s prices would eventually crash towards its support level on the first few days of October. Perhaps the tension between the United States and China is causing the Aussie to weaken and the Japanese yen to prosper. See, China is one of the most important market for Australia and negative news about it could really hurt the Aussie. On the other hand, geopolitical tensions should buoy the safe-haven appeal of the Japanese yen. Just recently, it was reported that thanks to the concerns over TikTok, companies from both sides of the Pacific could soon look to sell their cross-border holdings. This could be a major blow to China and a massive sign of escalation for the intense trade tensions between the two economic powerhouses. If that would be the case, the downside potential of the Aussie is strong.

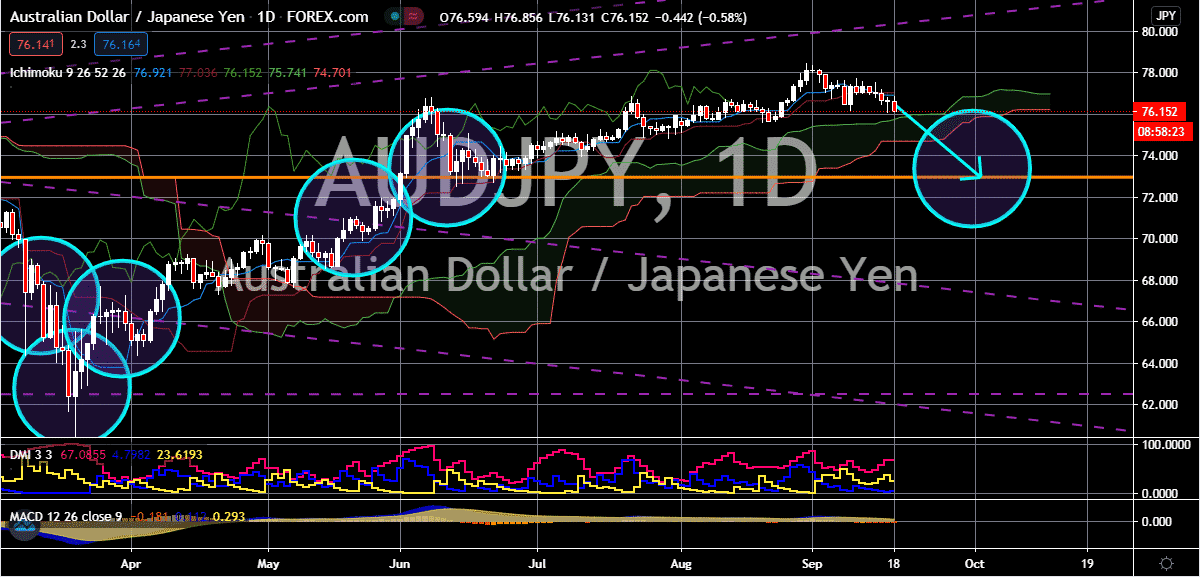

AUD/USD

In spite of the massive hurdles faced by the Australian dollar and the recent upside seen by the US dollar against other currencies in the market, the AUDUSD trading pair retains its bullishness. The minimal reaction of the United States Federal Reserve to the American economy earlier this week is actually holding back the greenback against the resilient antipodean currency. It is now widely expected that the trading pair’s prices would climb up towards their resistance level by the first few days of October. The Australian dollar is receiving mixed signals from China, the first is the escalating tensions between Beijing and Washington and the second is the recovery of the Chinese economy. It appears that the latter one is prevailing over the exchange rate, but it’s also slowed down by the first one. It’s quite clear to the markets that the Chinese economy is finally picking up, suggesting that Australia’s trading businesses with the country should also recover.

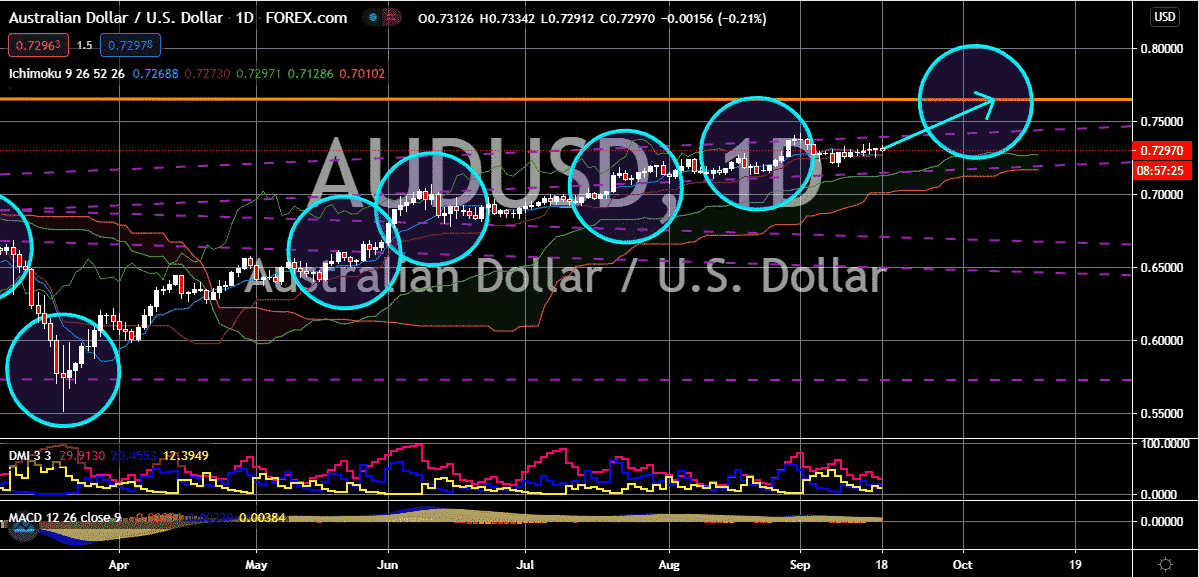

AUD/CAD

After multiple failed attempts to break through the trading pair’s resistance level, experts now believe that the prices would fall down to their support level instead. Although the Canadian dollar softened thanks to the subtle outcome of the US Federal Reserve’s September meeting. The tug of war seen by crude prices in the commodity market is helping the Canadian loonie to somehow remain steady. Of course, oil prices aren’t actually stable and there is still an unfortunate probability that it could turn bearish. Luckily, today, prices were seen climbing up on spot demand. Considering that Canada is a major exporter of crude, its strength is highly affected by the fluctuating sentiment of the commodity market. Recent reports say that the Organization of the Petroleum Exporting Countries is seeing remarkable signs of economic recovery in some nations and that is helping the prices of crude to remain buoyant, supporting the CAD along with it.