Market News and Charts for September 09, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good luck!

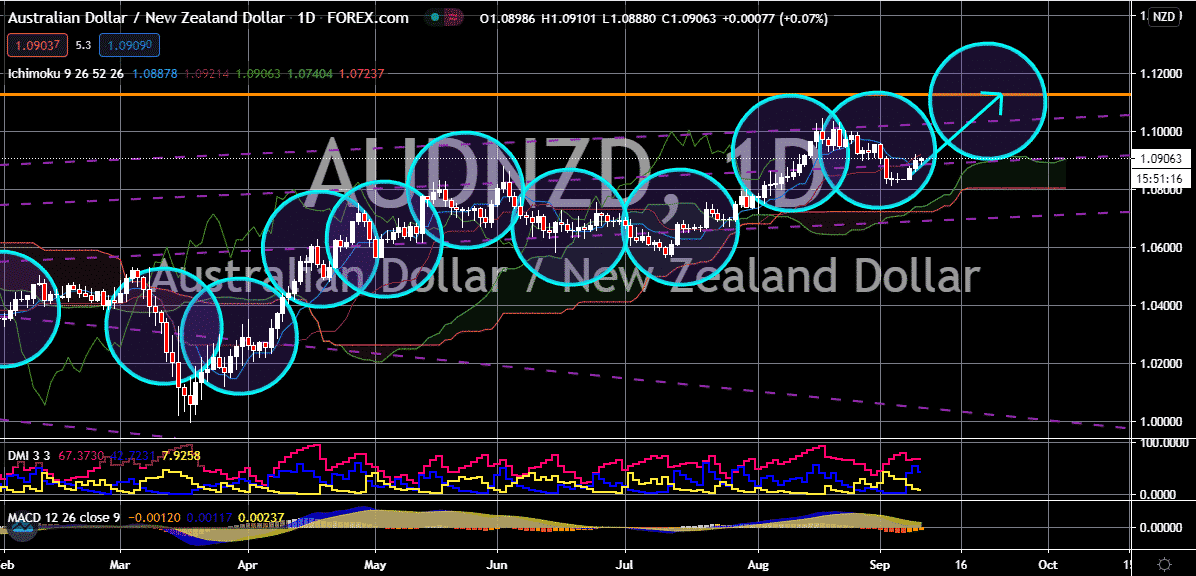

USD/CNH

Despite the recent upside faced by the exchange rate, it looks like the bearish trend isn’t over yet. The prices of the US dollar to Chinese yuan exchange rate should continue to buckle and get lower, hitting its support line in the latter half of the month. The positive sentiment in China’s recovering economy is helping bearish investors keep the pair grounded in the trading sessions. Meanwhile, it was just recently reported that the United States President, Donald Trump, raised the idea of decoupling the two biggest economies. Trump suggested that separating the United States from China would not hinder the two powerhouses economically. This idea could hurt the US dollar as the recovery of the American economy can be tied to some of its businesses and activities with mainland China. With the presidential elections fast approaching in the US, the market is bracing itself to the possible outcome, whether it would be Biden or Trump again.

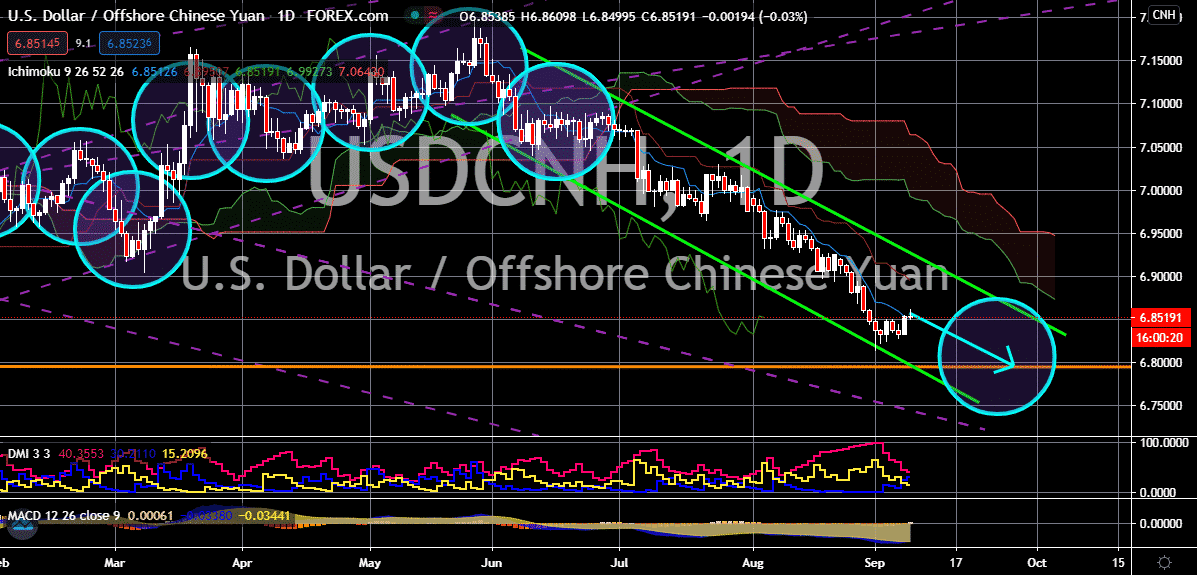

USD/TRY

The Turkish lira is on a critical spot against the US dollar. Bears have lost their touch and are absolutely helpless against bullish investors of the trading pair. In fact, prices are still projected to climb even higher in the coming weeks. Looking at it, the rally of the US dollar to Turkish lira exchange rate comes despite the broader weakness faced by the greenback in the overall market. Aside from that, the concerns of investors for emerging market currencies add to the negative sentiment towards the Turkish lira. The inflation in Turkey is causing the lira to devaluate in the market, and the other problems faced by the country isn’t helping its cause. Just recently, the country reports more than 1,700 new cases of the coronavirus, raising the total number of infections to over 283,000. According to Turkish Health Minister Fahrettin Koca, the number of patients in critical continues is still rising and the situation is getting direr.

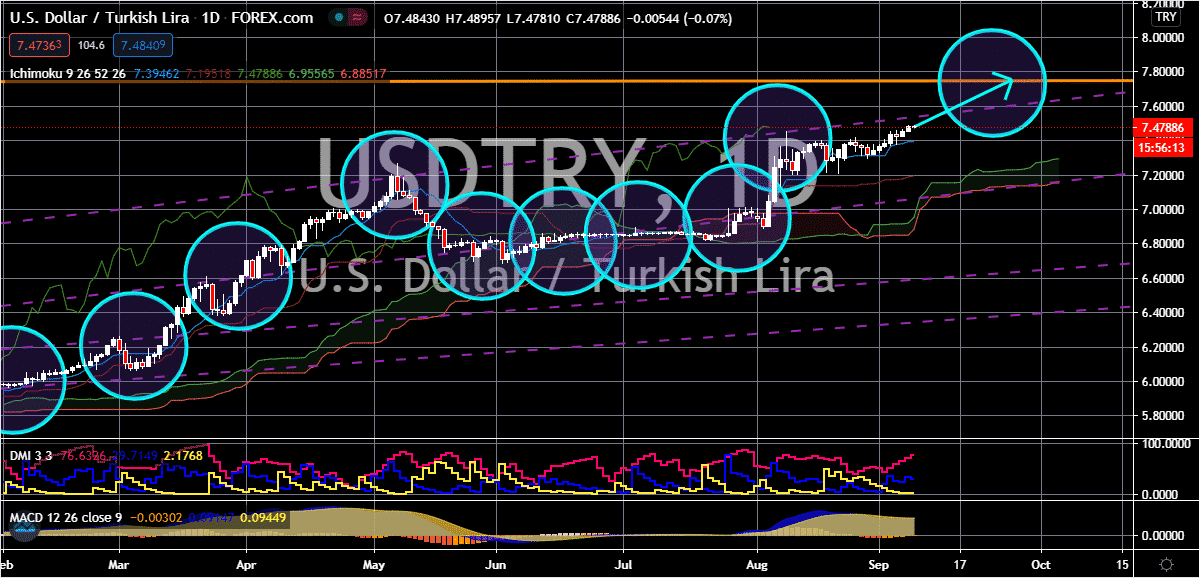

EUR/NZD

As of writing, the euro is forced to steady as investors wait for the highly anticipated meeting of the European Central Bank. The single currency should be affected by the meeting due later this week. However, most experts argue that there won’t be any major policy change from the meeting. Hence, expectations that the euro would remain stronger than the New Zealand dollar. The trading pair’s prices are expected to climb up towards their resistance level as bulls look to redeem themselves in the sessions. Moreover, the American banking giant, JPMorgan predicted that the antipodean currency will continue to underperform as the market continues to turn their attention to the upcoming interest rate decision of the Reserve Bank of New Zealand this November. Investors are preparing for the worst as the RBNZ is forecasted to cut its rate to zero or into negative territories as the country battles the harsh impact of the coronavirus pandemic.

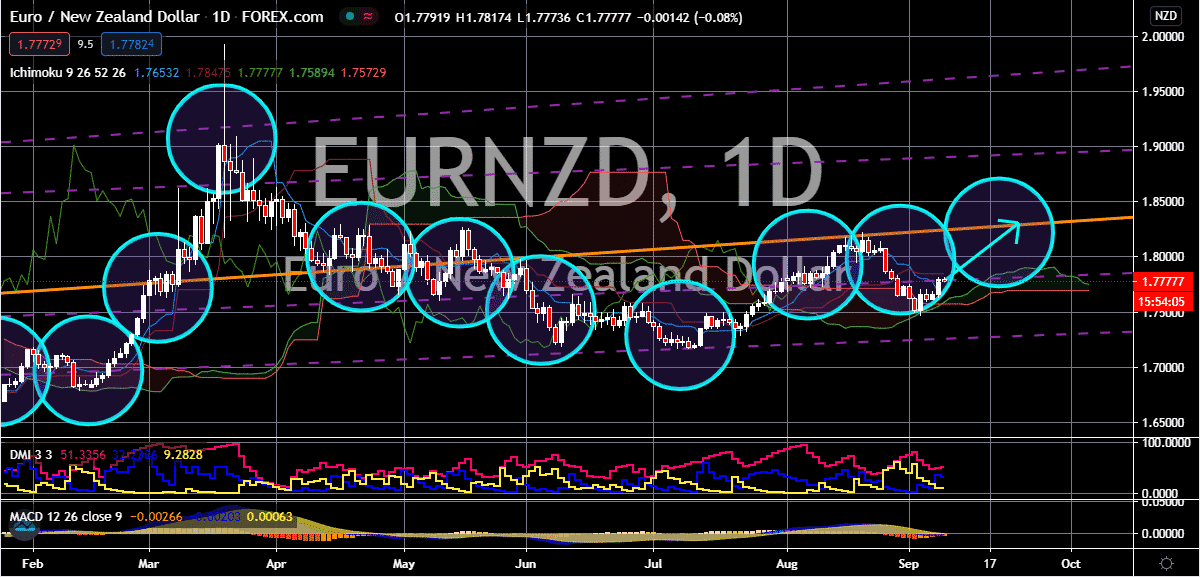

AUD/NZD

The difference in the stance of the Reserve Bank of Australia and Reserve Bank of New Zealand is the main factor that drives the AUDNZD pair upwards. The trading pair is projected to climb up higher towards its resistance level as the Australian dollar benefits from the positive economy activities recorded by the Australian economy. Meanwhile, it was just reported that banks in Australia will be directed by financial regulators to purchase up to 240 billion US dollars of additional federal and state government debt. This should help the economy of the country and the currency. And on the other hand, investors of the New Zealand dollar are losing their confidence as some experts believe that the Reserve Bank of New Zealand may cut its interest rates to zero or to negative territories by the latter part of the year. Although the expectation is still for November, the impact it has on the antipodean currency can already felt even this September.