Market News and Charts for November 29, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

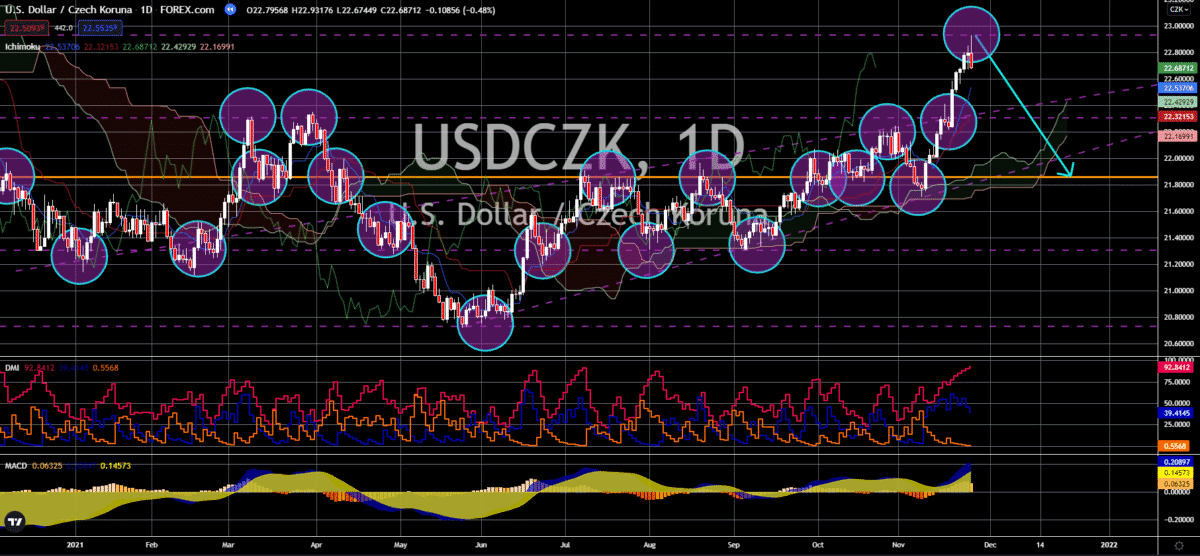

USD/ZAR

The South African economy is in jeopardy after a first case of the new covid variant Omicron has been first detected in its borders. The problem joints its long list of economic challenges including inflation and political instability. Last week, the country updated its October Producer Price Index (PPI) which showed an 8.1% year on year advance, exceeding analysts’ expected 8.0% hike. This pace also follow’s September’s 7.8% increase. On a month-on-month basis, the indicator recorded a 0.7% jump, in line with analysts’ expectations but significantly lower than the previous month’s 0.9%. Analysts are worried about the economic impact that travel bans will pose on South Africa’s recovery. This is due to the fact that the country’s local economy is highly dependent on travel and tourism revenues. More nations have imposed restrictions on incoming travelers from the country during the supposed to be peak season this December which will hammer down economic growth.

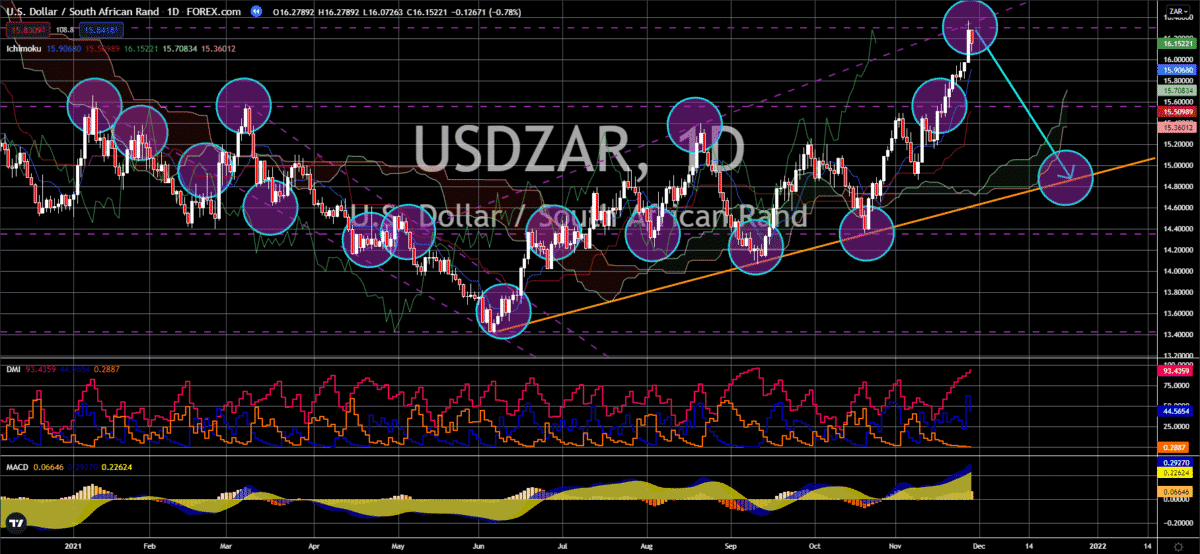

USD/RUB

Russian economy made significant milestones during the month as global trade revamps steadily. Due to the relative stability in economic growth, the Central Bank of Russia increased its reserves by a notch to 626.3 billion from 626.2 billion previously. Moreover, the country’s national carrier Aeroflot updated its first quarterly earnings in two years. The flag bearer unveiled $150.00 billion in net income for the third quarter, boosted by increased appetite for travel and relaxing of border restrictions. On the other hand, the current upward move could reverse depending on the country’s handling of the Omicron variant. Russia’s primary export, oil, is in jeopardy given that prices have fluctuated due to the overall uncertainty in the demand. In response, Deputy Prime Minister Novak assured that there is no need for emergency measures on oil market. Novak added that the OPEC+ member states are not bothered and did not call for a joint review of its current oil supply deal.

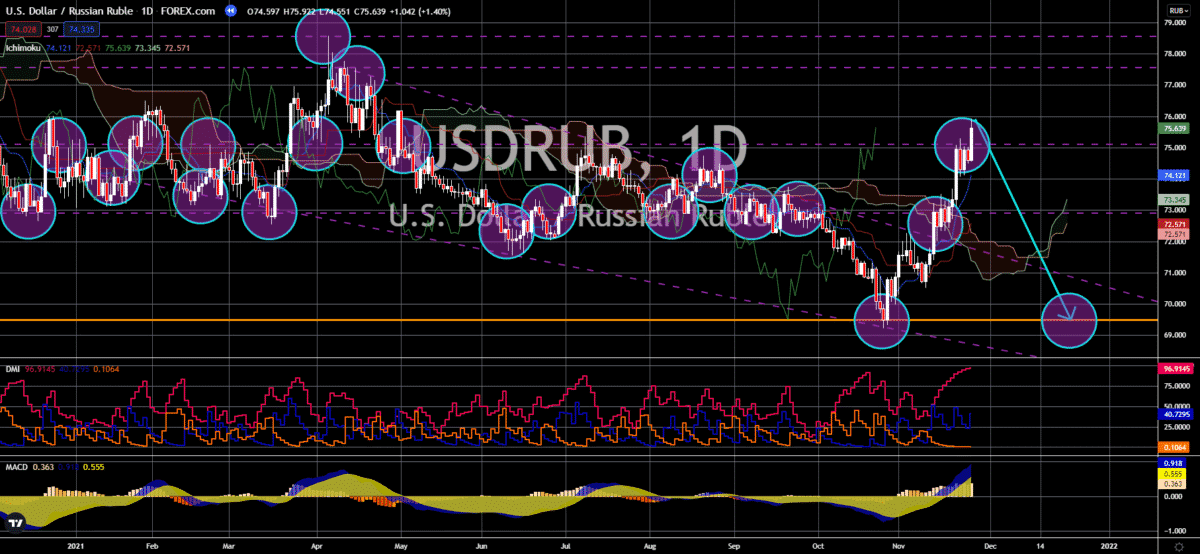

USD/CHF

Switzerland brazes for a cold winter after detecting its first case of the worrisome Omicron variant over the weekend. The government confirmed that the infected is a returning citizen from South Africa. With this, the administration is quick to put entry restrictions on the inbound travelers. This also includes ordering travelers from 19 countries, which have confirmed cases of the new variant, present a negative swab result and a quarantine period of 10 days. The recent action is expected to put a strain on trade and tourism anew and push Swiss economy to end the year in a very lukewarm tone. Last week, the country updated on its economic health thus far, which showed a 4.1% YoY growth for the third quarter. The actual figure exceeded analysts’ expected yearly growth of 3.2% although it is lower than Q2’s solid 8.6% pace. On a month-on-month figure, the indicator showed a 1.7% increase, which is higher than the 1.8% forecasted. Also, employment level hit 5.2 million.

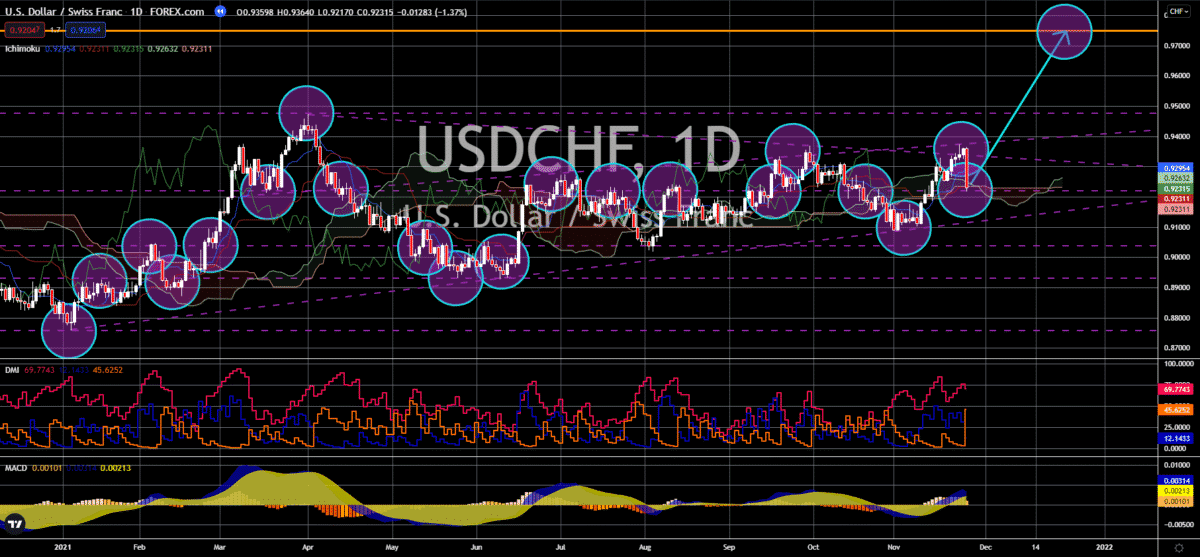

USD/CZK

Federal Reserve Chairman Jerome Powell is scheduled to testify on a virtual meeting on Monday, November 29, along with Canada and New Zealand’s central bank governors. Earlier, analysts are becoming more vigilant about the US central bank’s monetary policy updates and expects a bolder tone in the remaining days of the year. On its upcoming December 14 to 15 meeting, officials are expected to decide on whether to put a cap on its quantitative easing program. The monetary body could start cutting its monthly bond purchases in December by $15.00 billion as the US economy regains leverage to recover. On the other hand, the Fed kept its interest rates near to zero, as usual, and could only start raising rates by mid-2022 after bond tapering ended. Despite the status quo in rates, economists are certain that the US economy will remain on a steady path towards expansion this year. Last week, the US initial jobless claims stalled to 199,000 which is the lowest since 1969.