Market News and Charts for November 08, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

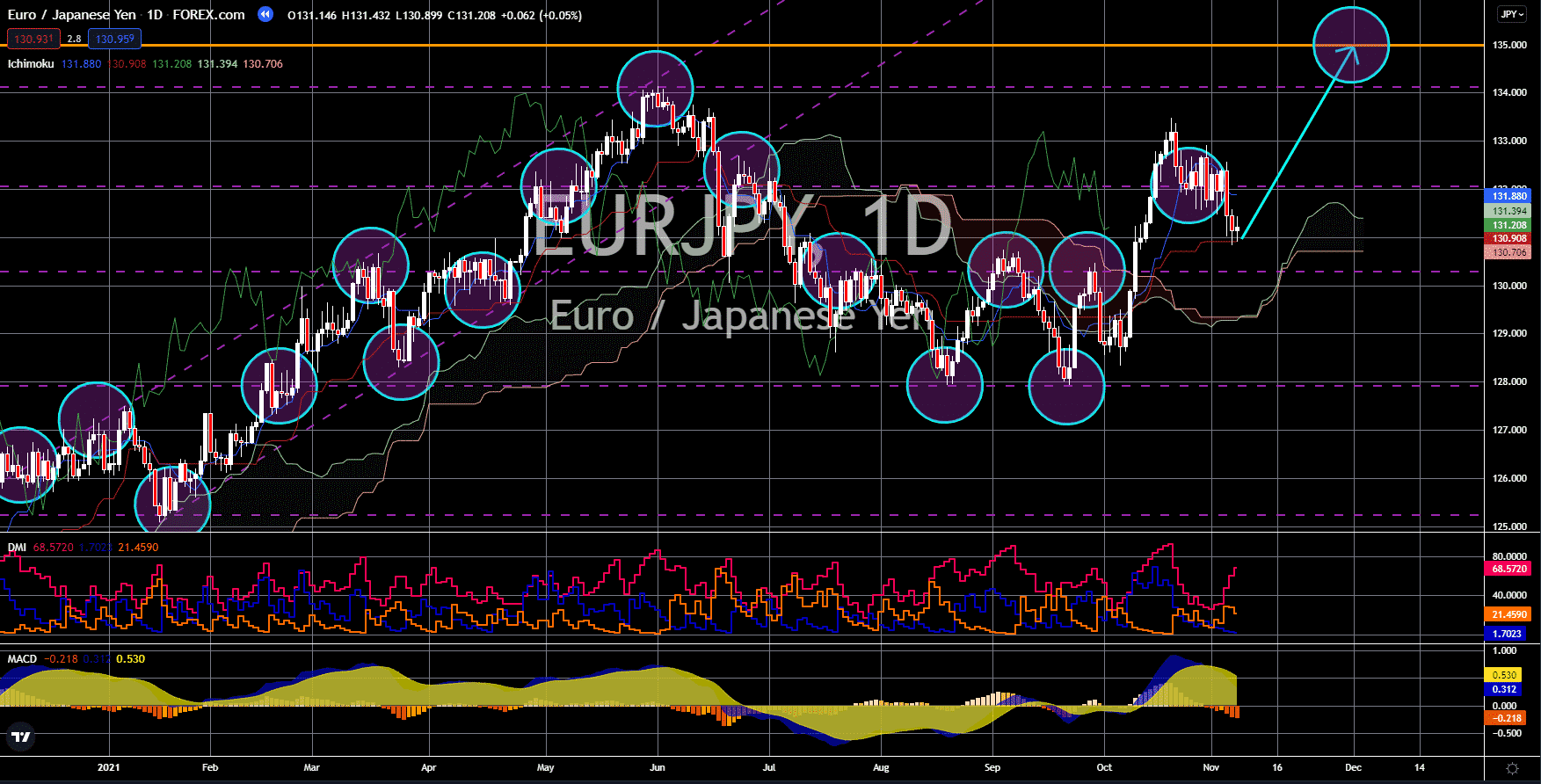

USD/CZK

The United States’ labor market is showing steady signs of recovery, much to the delight of many spectators. The country’s unemployment rate in October went down to 4.6% and has become a new pandemic low. This result is also lower than the 4.7% expected and September’s 4.8% hit. Traders have also taken a liking for the Nonfarm Payrolls data which had grown to 531,000. This is higher than September’s 312,000 and the forecasted 450,000. The result shows that the country achieved a healthy hiring rebound last month amid the bettering domestic and global trade. Since the start of the year, analysts have pointed out that the US job market has been on the right track all along. This is reflected in how it managed to recapture 80% of the jobs lost to the pandemic last year in a short period of time. Due to the bettering outlook, the jobless claims fell to 269,000 last week from 283,000 previously. Continuing claims also fell to 2.1 million from 2.2 million.

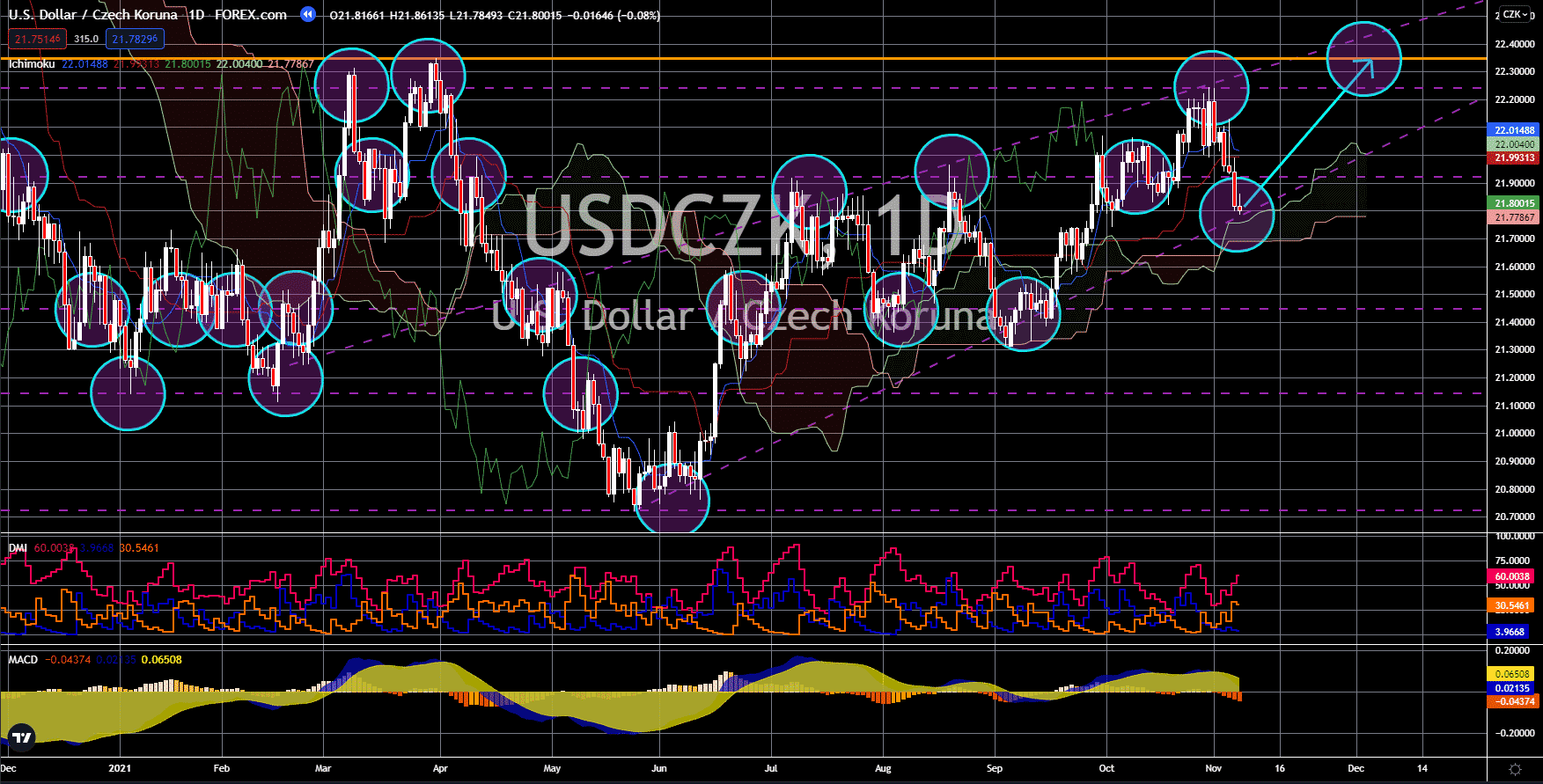

EUR/CHF

Switzerland’s unemployment data will be up for viewing on the first day of the week. The measure is forecasted to fall to a seasonally adjusted result of 2.7%. This is lower than October’s 2.8% hit. On a non-seasonally adjusted measure, analysts are eyeing a 2.6% settlement for the period. In a measure on Swiss confidence, the SECO Consumer Climate Index recorded 8 points in Q4. This is in line with the previous quarter’s revised number. This is also the highest recorded so far since the start of the covid pandemic, indicating the dominance of optimism in the market. The revamp in global trade has benefited Switzerland’s economic recovery. On the other hand, Switzerland’s central bank reiterated the need for loose monetary policy. This is under the notion that the country still has an underutilized macroeconomic capacity which weighs in 2021’s sustained advancement. Similarly, current moderate inflation will keep the SNB’s interest rate at -0.75% in the near term.

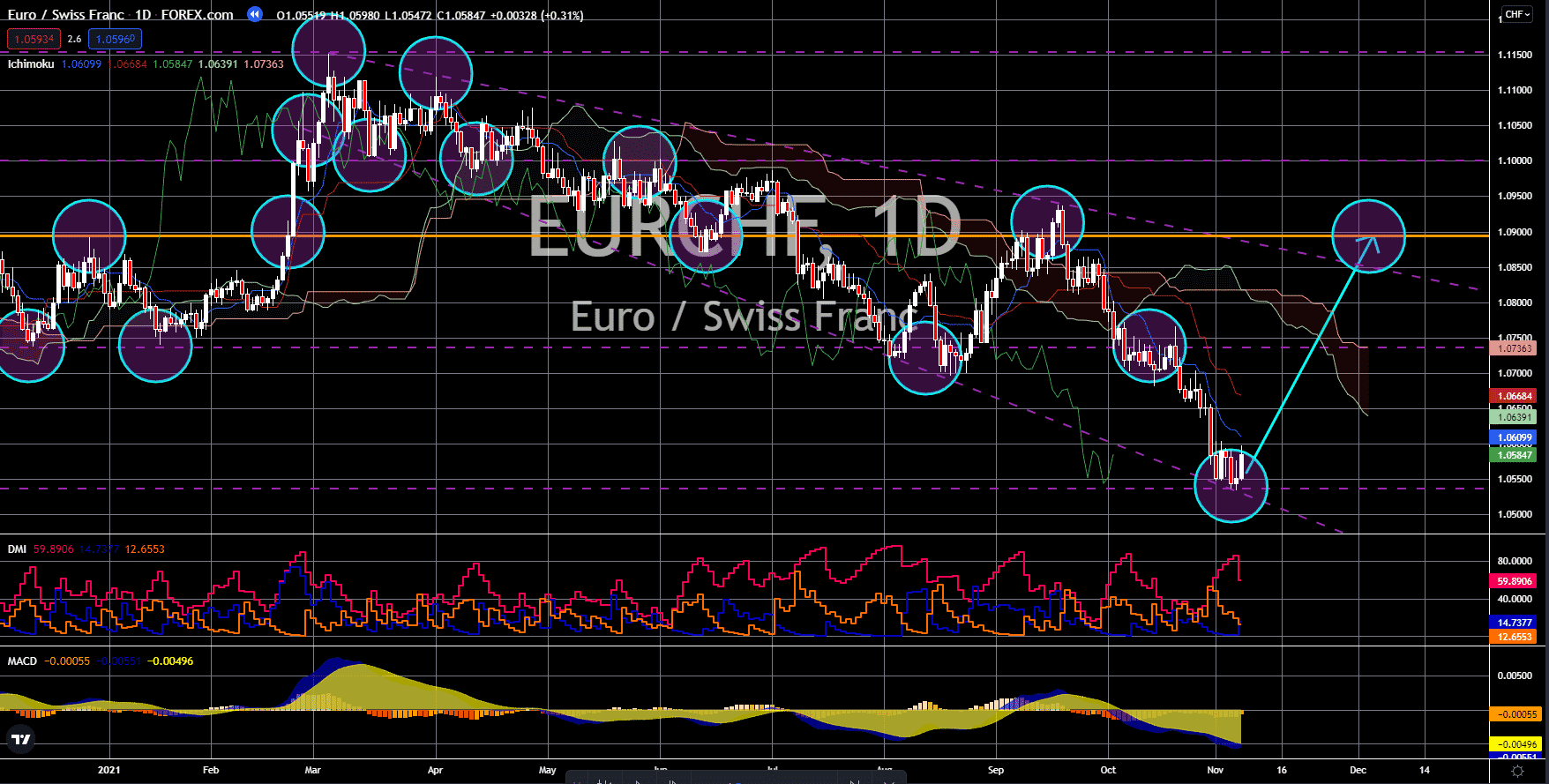

EUR/GBP

The European Union’s retail sales in September fell to the negative territory and settled at negative 0.3% MoM. The recent stall disappointed analysts’ 0.3% growth forecast for the month. Likewise, this is a sharp downgrade from the previous month’s 1.0% hit. Nevertheless, the year-on-year basis made up for the lukewarm sentiment after showing a 2.5% expansion. This is higher than the 1.5% jump forecasted by experts. For the record, the bloc’s most powerful economy, Germany, became the main reason behind the laggard. German Retail Sales declined -2.5% on a monthly basis as shoppers stayed at home due to a number of factors. One of it is the rising inflation which derails consumers’ purchasing power while the ongoing pandemic continues to support. Meanwhile, other economies namely Finland and the Netherlands also recorded negative results in the same month. Eurozone’s Investor Confidence Index will be released on November 08 with a 15.5-point forecast.

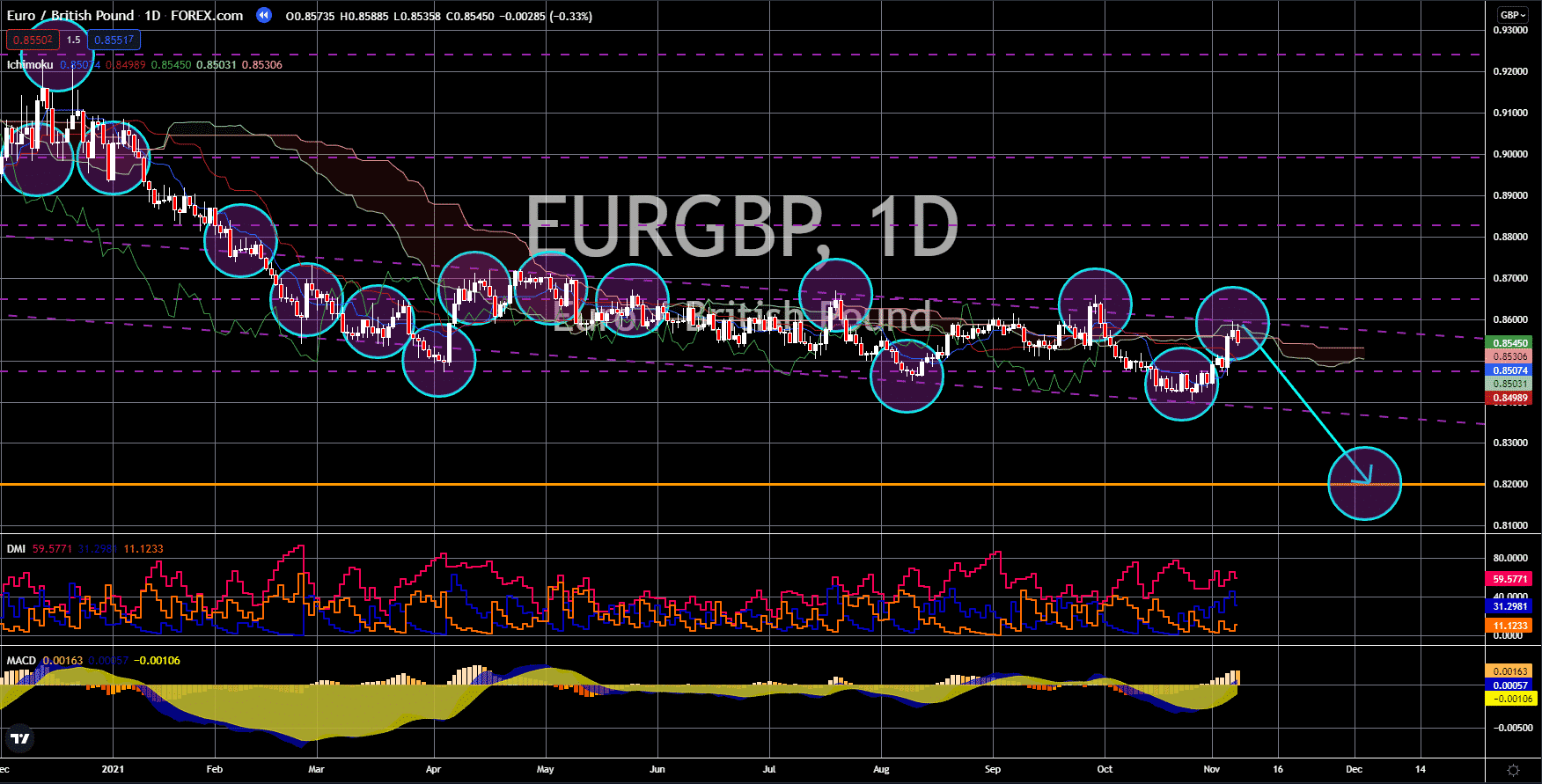

EUR/JPY

Japan’s Household Spending showed mixed results in September. On a monthly basis, the measure recorded a solid 5.0% jump. This is higher than the 2.8% hike shown in the average consensus. However, the year-on-year data remained on the negative side as consumers continue to make very conservative purchases. Household Spending during the month settled at -1.9%. Nevertheless, this is better than analysts’ expectations which is at -3.9%. It also moved past August’s -3.0% decline. The Japanese government recently announced plans to spend $265.00 billion in economic stimulus to aid the ailing business sector. In local currency, the new thrust is worth 30 trillion yen which reportedly will require issuing another debt. The current administration is targeting to get the bill approved by the end of the year and will include cash payments to households. Japan’s Leading Index, a measure of forward economic sentiment, stalled anew to -1.6% from the previous -2.8%.