Market News and Charts for July 03, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

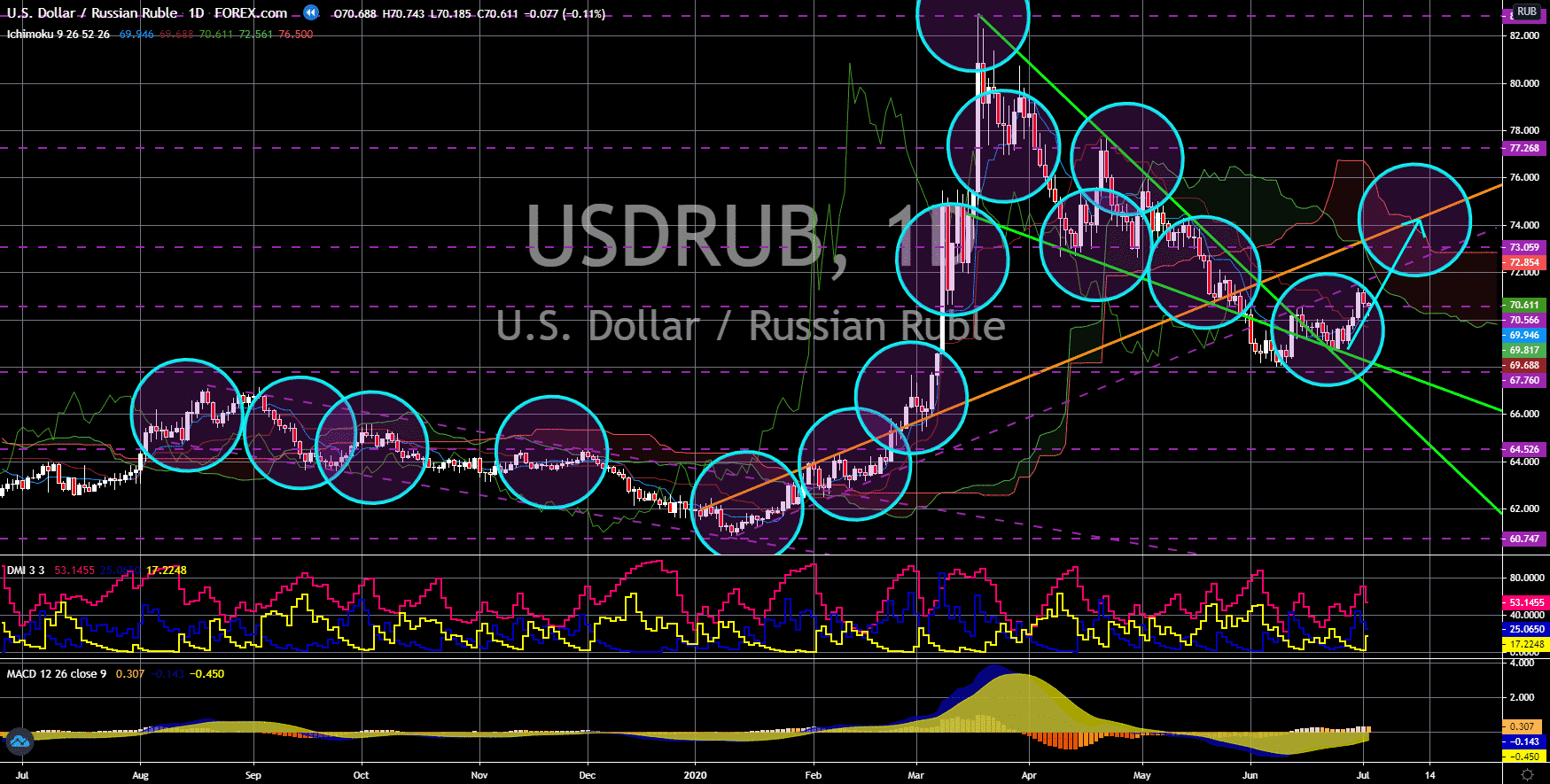

USD/RUB

The pair will bounce back from its support line, sending the pair higher towards an uptrend resistance line. Russia made 11.9 points jump on its Markit Services Purchasing Managers Index (PMI) report today. This signifies recovery for the Russian economy. However, the figure is still below the 50 points mark which indicates that Russia’s Markit Services is still contracting. On the other hand, the US reported three (3) major reports yesterday, July 02, on employment. The United States saw millions of job losses in March and April following the lockdown brought by the coronavirus pandemic. However, following the reopening of the largest economy in the world in May, employment starts to pick up. Yesterday, the initial jobless claims reported additional an 1,314K figure, lower than the prior week. Aside from that, the non-farm payrolls (NFP) report for the month of June doubled from its May figure of 2,509K.

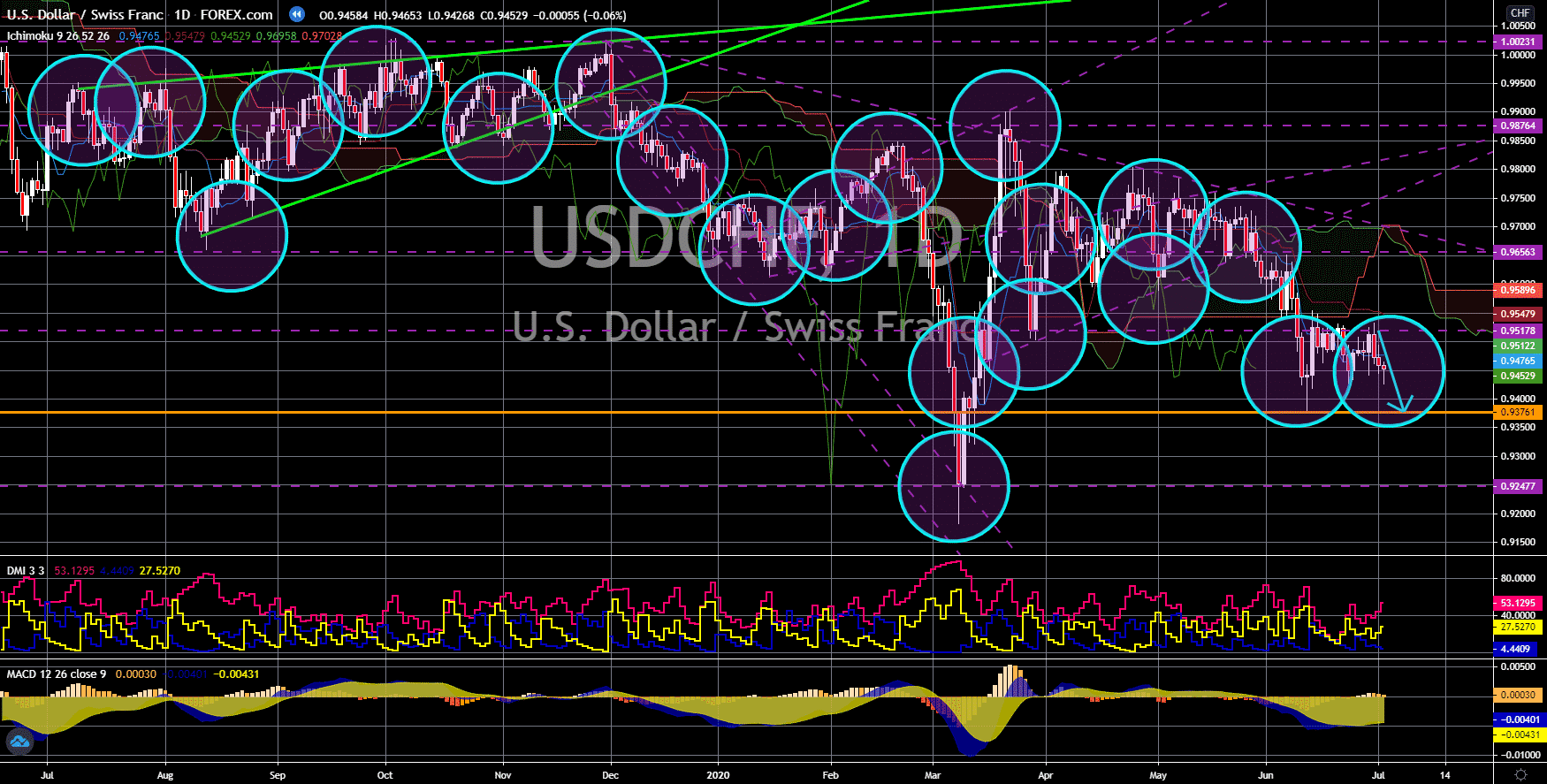

USD/CHF

The pair failed to break out from a key resistance line, sending the pair lower towards its previous low. Despite the positive figure for the US unemployment rate, the US dollar is still bound to fall. Unemployment rate for the month of June dropped to 11.1% from 14.7% during the heights of the coronavirus pandemic. However, investors and traders prefer putting their money on safe-haven assets like the Swiss franc. As Europe began to reopen its borders and economy, investors started flocking back. This, in turn, resulted in a strong surge in the demand for European currencies and stocks. Also, the rising tension between the United States and China offsets the economic recovery seen in the two (2) largest economies in the world. Moreover, Fitch Ratings reaffirm its AAA or stable outlook for the Swiss economy, representing a diversified and high value-added economy. This was despite its economic impact in the local and neighboring economies.

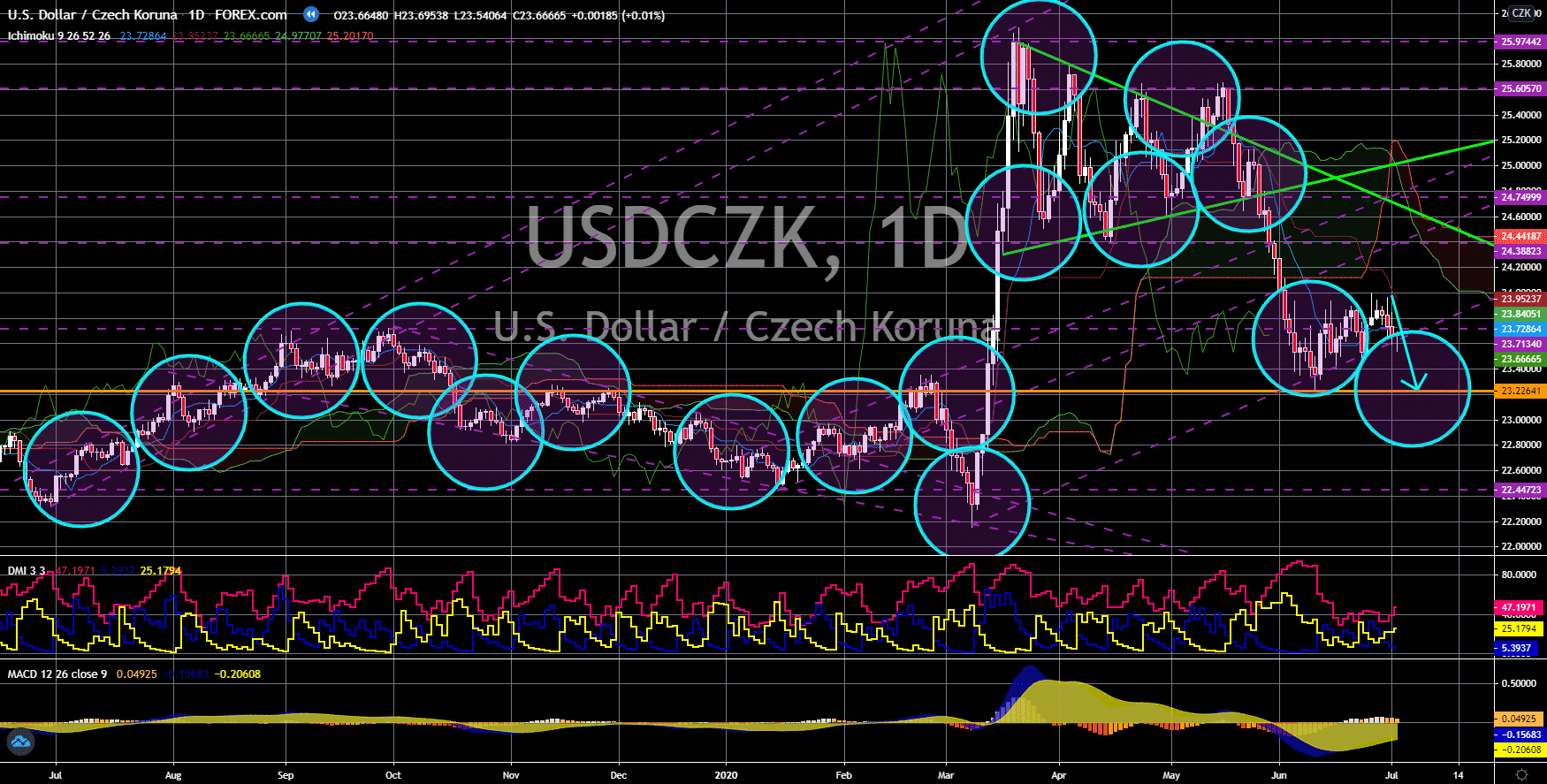

USD/CZK

The pair will break down from an uptrend support line, sending the pair lower towards its previous low. The actively seeking Czech citizens will trigger an economic recovery for Czech Republic in the coming months. A recent study shows that 20% of the country’s working class are expecting to find new jobs by 2021 making companies and individuals more competitive. Meanwhile, the coronavirus pandemic is still being felt in the United States with the additional 1,314K people who file for jobless claims. The continuous lockdown in other US states is also not helping to employ people who lost their jobs. Aside from that, the tension between the United States and China could further increase the number of unemployment in the United States. On the other hand, Europe is recovering physically and economically. The region is no longer the epicenter of the virus and some member states already began lifting several restrictions in the country.

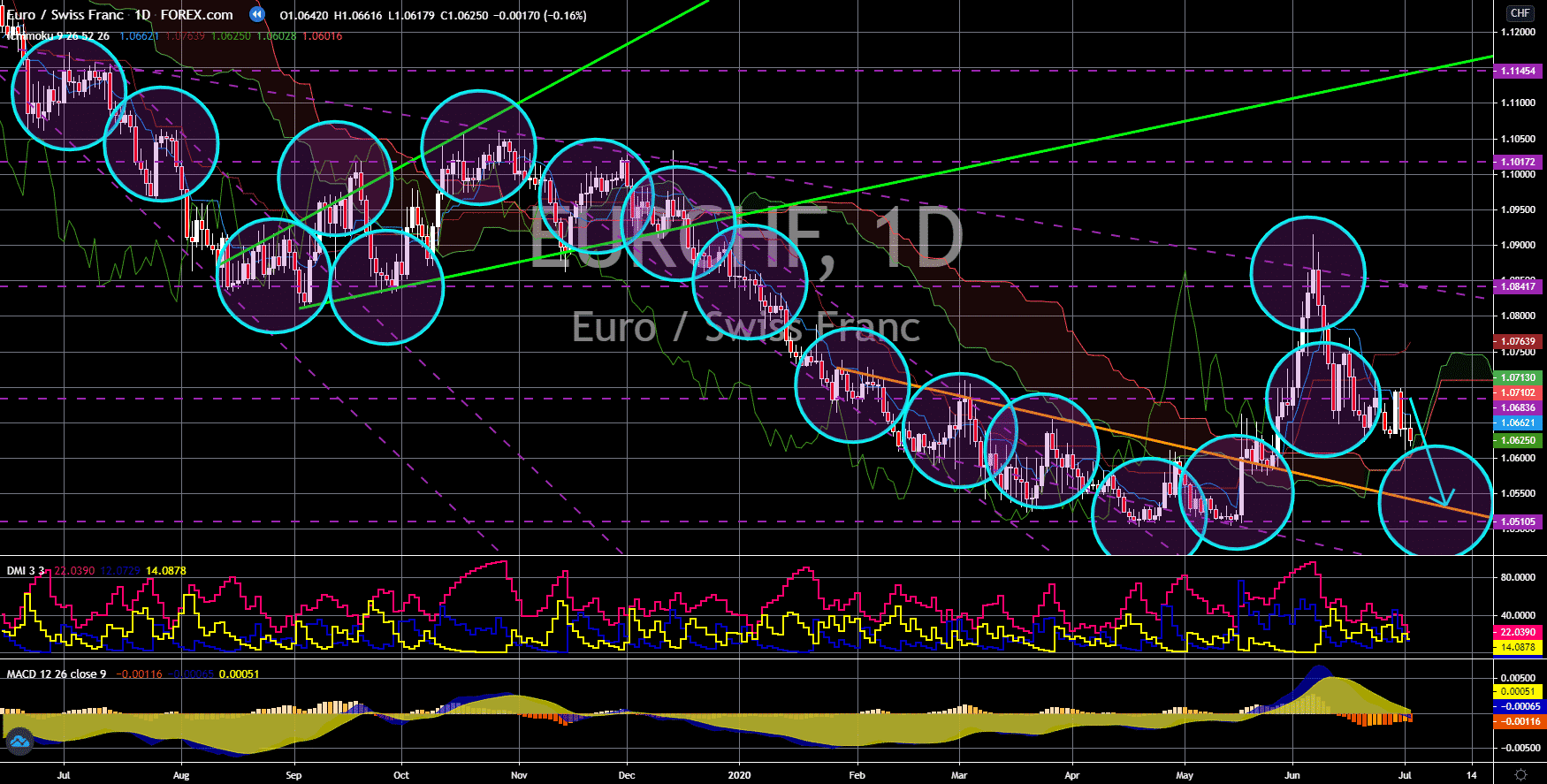

EUR/CHF

The pair will continue to move lower in the following days towards a downtrend support line. Major reports for the EU member states’ Markit and Services PMI posted above 50 points which represents an economic expansion. The same figures were last reported prior to the coronavirus pandemic. Despite the positive results, the single currency is still expected to dive near-term. The European region is recovering from the recent plunge but not as fast as to recover all the losses made in the three (3) months of hard lockdown. In fact, major EU economies are still expected to post negative GDP growth for 2020 and might continue until 2021. This scenario is increasing the demand for Europe’s safe-haven currency, the Swiss franc. Fitch Ratings maintain its AAA rating for the country’s economic outlook despite the economic impact of COVID-19. Fitch Ratings also identified Switzerland as the most resilient among countries with similar AAA outlook.