Market News and Charts for July 06, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

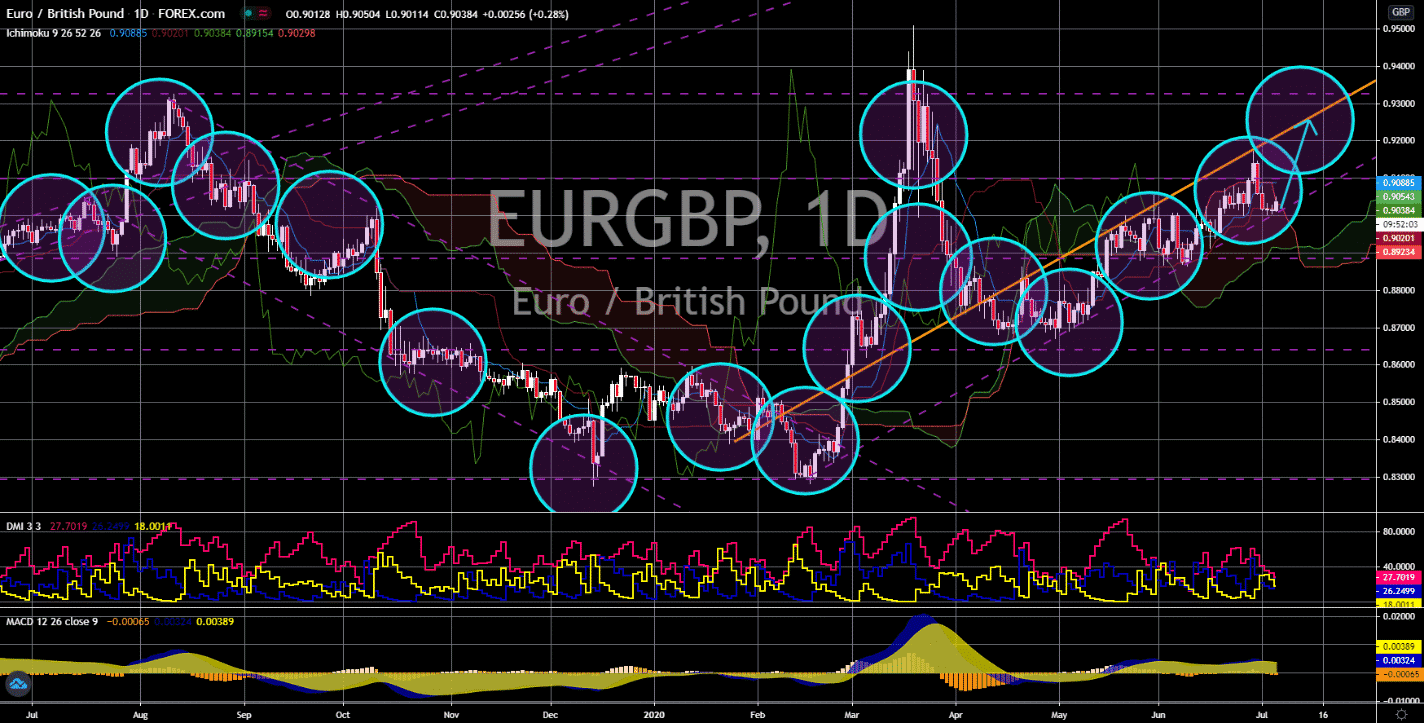

EUR/GBP

The EURGBP pair is expected to see above its recent lows to a long-term bear market lasting 3 months. This was after it met a similar period in the bear market starting mid-August last year. The EU rejected the Brexit proposal to smoothen London’s access to European trade customers with a warning that both sides should prepare for “big changes” from the beginning of the year. Moreover, German Chancellor Angela Merkel also reclaimed that the UK should be prepared not to receive an agreement with its country anytime soon. German factory orders also brought positivity to the currency as data showed that factory orders by more than 10% in May from April. This was largely because of an increase in domestic orders month-over-month increase in foreign orders by 12.3% and 8.8%, respectively. Manufacturers of capital goods also saw a 20.3% increase. Meanwhile, German intermediate goods rose by 0.4%.

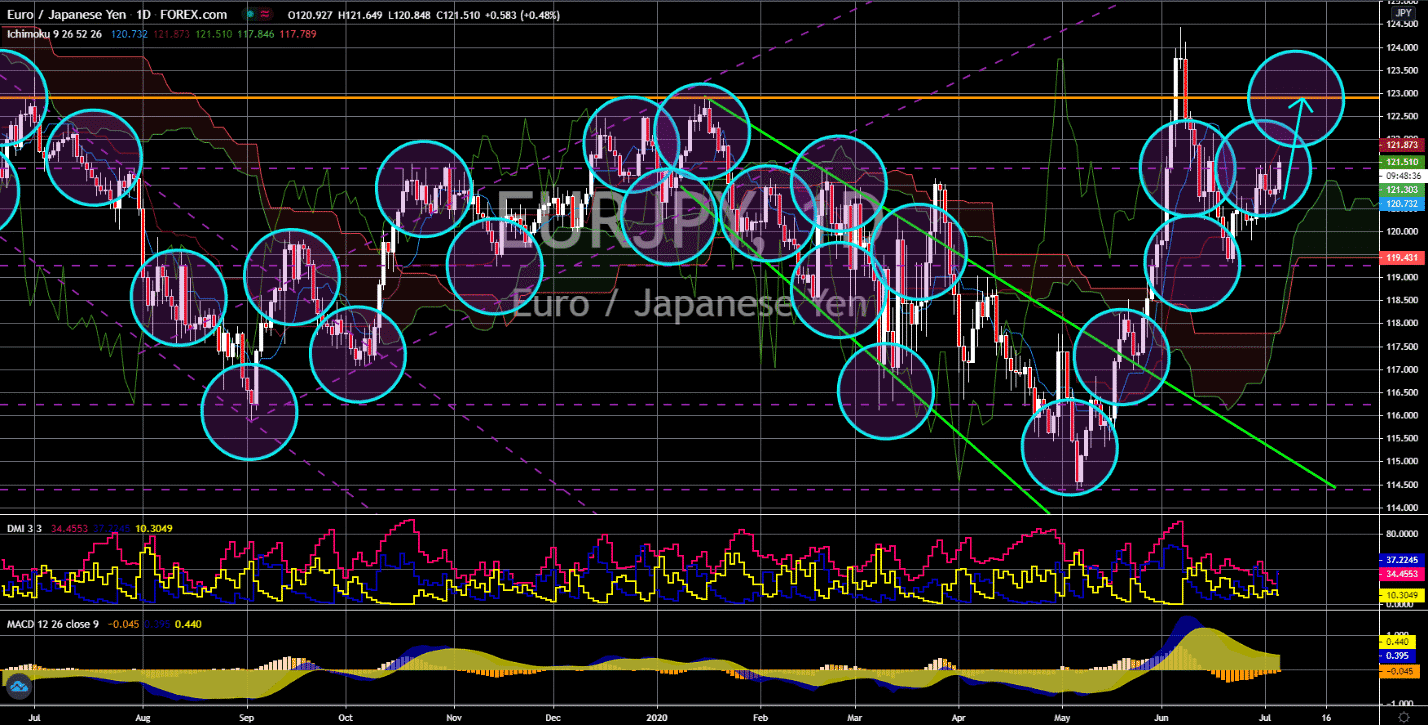

EUR/JPY

Investor confidence on the eurozone is expected to boost the single currency against the Japanese yen near-term. Upbeat sentiment in riskier assets still prevails despite the coronavirus impact. Support for the pair came in when positive data from the broader Euroland claimed that it would experience a V-shaped recovery, which eased earlier fears or an irrevocable economic recession from the coronavirus outbreaks. Confidence in the bloc improved recently, although still in the negative territory. Retail sales figures are expected to push this up, however, when the sector expanded more than expected. German Factory Orders saw a rebound in May to push the euro, although still lower than what was expected in the market. Investors’ interest on the euro is dependent on its upcoming ISM Non-Manufacturing figures, as well as the final print of Markit Services PMI seen during the month of June.

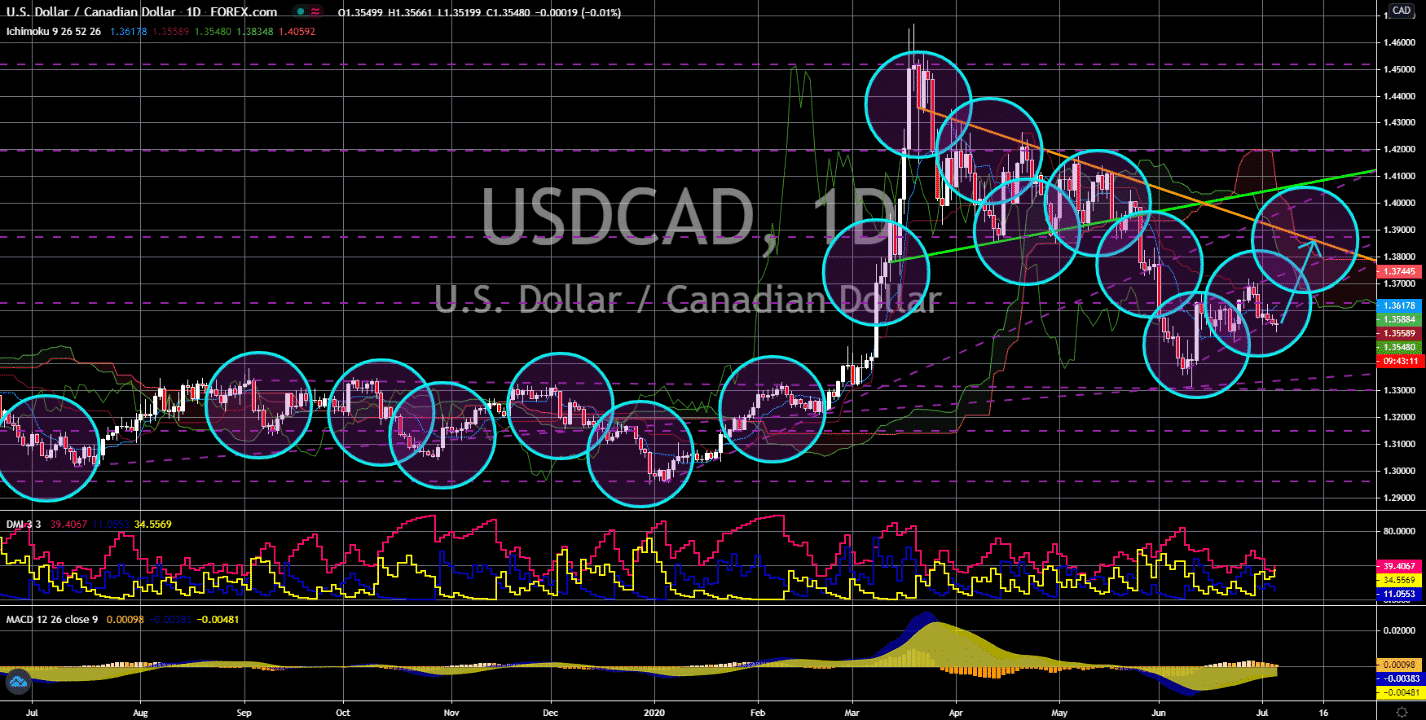

USD/CAD

As risk appetite towards oil subsides in the market, the US dollar is set to see more engagament against the loonie near-term. The USDCAD pair first surged mid-March when the pandemic began to dominate economic outlooks, but then slumped between May and July for good news brought by the OPEC agreement made in earlier days of the global turmoil brought by the coronavirus. Now, investors are expected to remain interested on safer, non-oil reliant markets such as the US dollar until uncertainty about the demand for oil continues to worry investors worldwide. Moreover, investors also expect the loonie to fail over higher crude oil prices after sentiment boosted the commodity alongside emerging market currencies. Optimistic US economic data from the service sector also helped the greenback, as opposed to bad news released by the Bank of Canada on Monday, saying its business outlook isn’t doing so well, either.

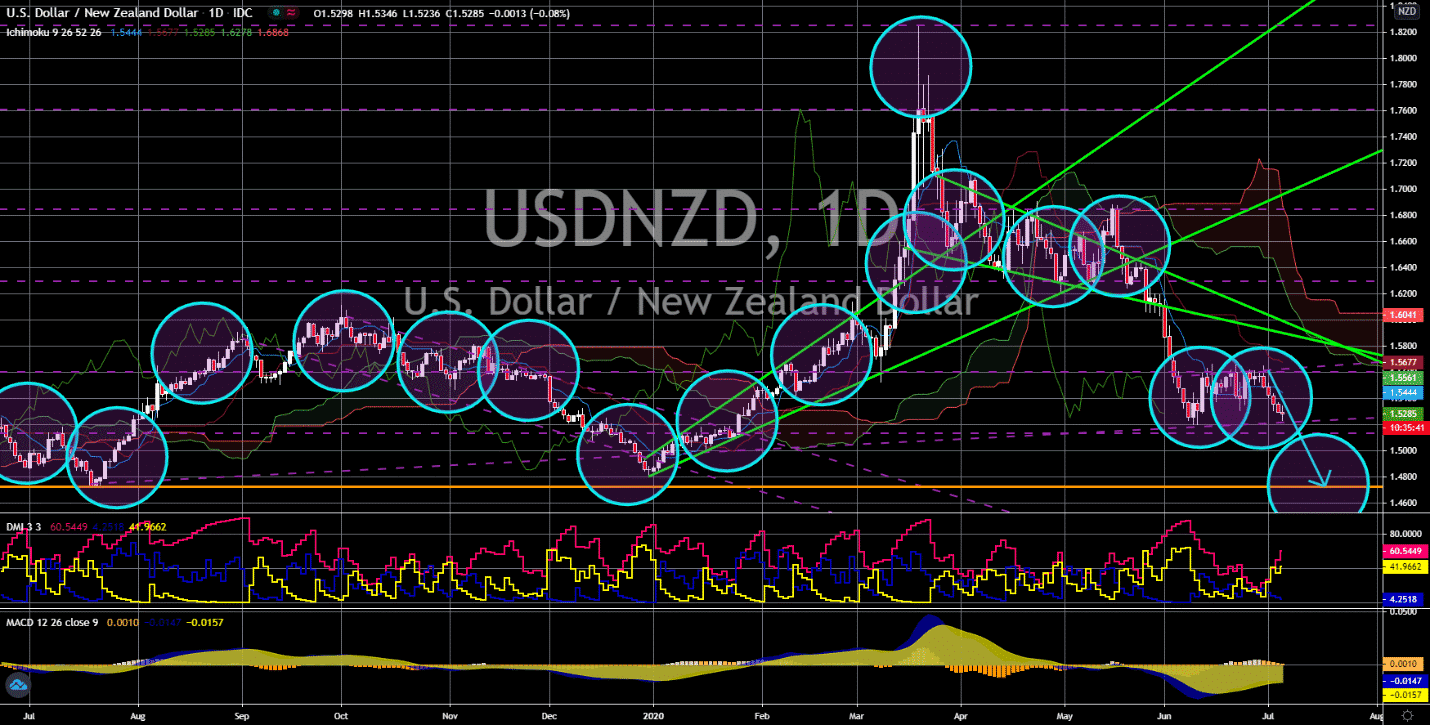

USD/NZD

The US dollar is expected to touch familiar lows near-term as the New Zealand economy looks forward to consecutive positive economic data thanks to its near-full reopening from the coronavirus-led lockdowns. Moreover, investors have high confidence in the kiwi’s economy near-term. The Chartered Accountants and New Zealand’s latest investor confidence survey indicated 83 percent have at least confidence for the economy. However, still be weary – CAANZ’s assurance leader Amir Ghandar said uncertainty remains with the speed and depth of an actual economic recovery. Meanwhile, the US is still struggling with nationwide protests, interrupting businesses and its economic recovery. Other markets are also making broad-based risk-on moves focusing, especially on currencies opposite from the greenback as even the Chinese yuan came on track towards its best day against it since December 2019.