Market News and Charts for February 28, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

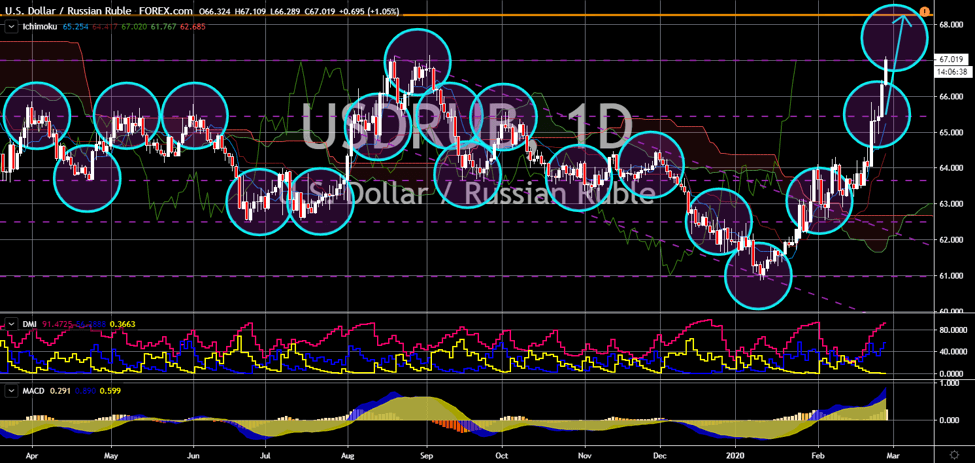

USD/PLN

The pair will continue its uptrend movement towards its previous high. Poland is set to publish its fourth and final quarter gross domestic product (GDP) growth for fiscal 2019. Analysts anticipate the country to post lower figures following a downgrade from Bank Polski. State-controlled PKO BP said it is expecting the country to grow 3.5%, down by 0.2% from earlier forecast. The reason for the revised growth forecast was due to rising inflation. In January, Poland had a 4.4% interest rate which is higher than the inflation target of 2% to 4%. The figure is the highest recorded data since 2013. The country also came under pressure from the withdrawal of the United Kingdom from the European Union. Poland is among the countries who benefited from the EU budgets. The withdrawal of the UK, however, will leave a hole in the budget. This could spell trouble for the Polish economy. Meanwhile, America will continue its longest economic expansion in history.

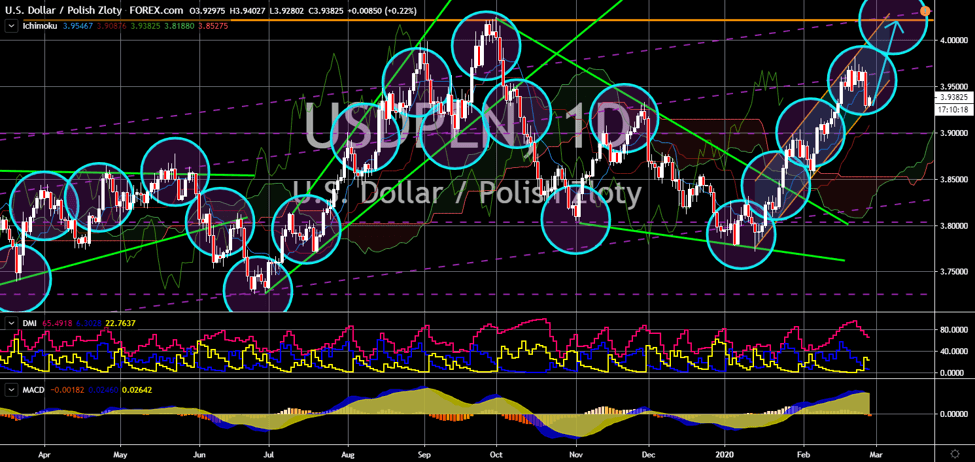

USD/SEK

The pair will continue to move higher, sending the pair towards an uptrend channel middle resistance line. Sweden will be among the countries to publish their gross domestic product (GDP) growth today, February 28. Since January 2019, the country’s GDP continue to decline. This resulted to analysts forecasting Sweden’s fourth quarter result to continue declining. During the third quarter, the country had a 0.3% GDP growth, higher than the forecasted 0.2% and 0.2% result prior. However, investors are worried if Sweden can continue beating expectations. Including to the bearish sentiment for the fourth quarter was the slowdown in Germany, the EU’s economic powerhouse. Despite this, manufacturing and consumer confidence in the country remains high. Meanwhile, the US enjoys higher personal spending, further driving the consumption-driven economy. From 1960 to 2013, consumer spending as part of GDP rose from 62% to 71%.

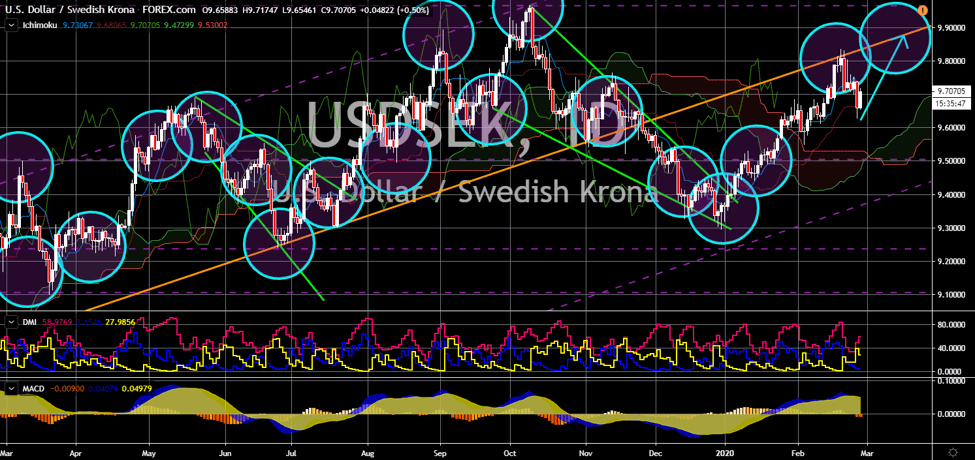

USD/ZAR

The pair will continue its rally after it broke out from a major resistance line. South Africa is on the verge of an economic disaster. Its M3 Money Supply report – which includes coins, notes, cash convertible assets, and short-term and long-term deposits – increased for the current month. Data shows M3 increasing by 7.02%, higher than 6.15% prior. Despite easing its monetary policy, the private sector is reluctant to borrow money. Moreover, these figures don’t match the 4.6% increase in the country’s Producer Price Index (PPI). Its heavy exposure to China could further add to the sluggishness in ZA economy. The coronavirus will affect countries heavily reliant on the second largest economy. America could also take advantage of the weak Chinese economy to further its own cause, thus further dragging the rand. On the other hand, US companies continue to soar in the market amid better-than-expected quarterly earnings result.

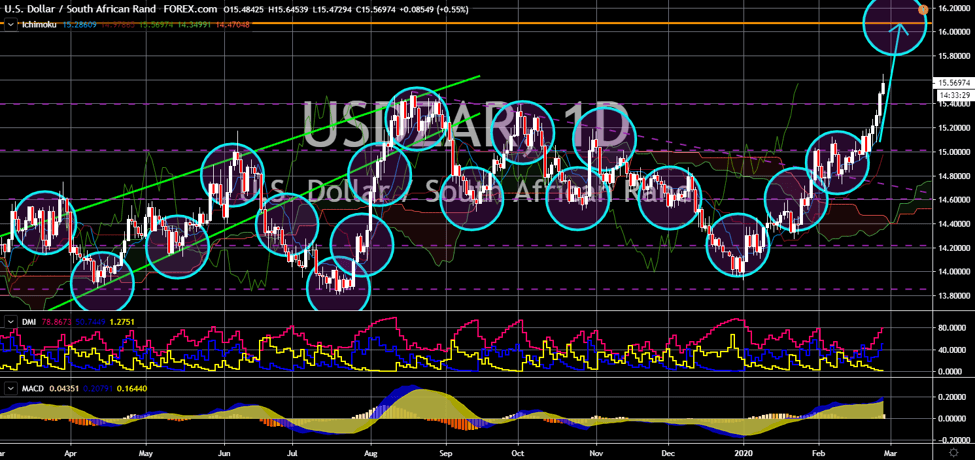

USD/RUB

The pair will break out from its 6-month high, sending the pair higher towards its nearest resistance line. Despite being popular abroad, Russian President Vladimir remains unpopular in his country. Russians are particularly skeptical about Putin’s handling of the country’s economy. Russia only recorded a 0.8% gross domestic product (GDP) economic growth for the third quarter of 2019. Aside from this, then military ally – Turkey – is now turning back against Russia in favor of the United States. This was after the Assad government killed Turkish soldiers in Syria. Despite losing it military might, the United States will remain as the economic powerhouse. Its position as the largest economy in the world remains amid the slowdown in China. The coronavirus will further drag the already sluggish Chinese economy. The military tension between the United States and Russia will continue as Russia conducts its first ship-based hypersonic missile test.