Market News and Charts for December 23, 2019

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

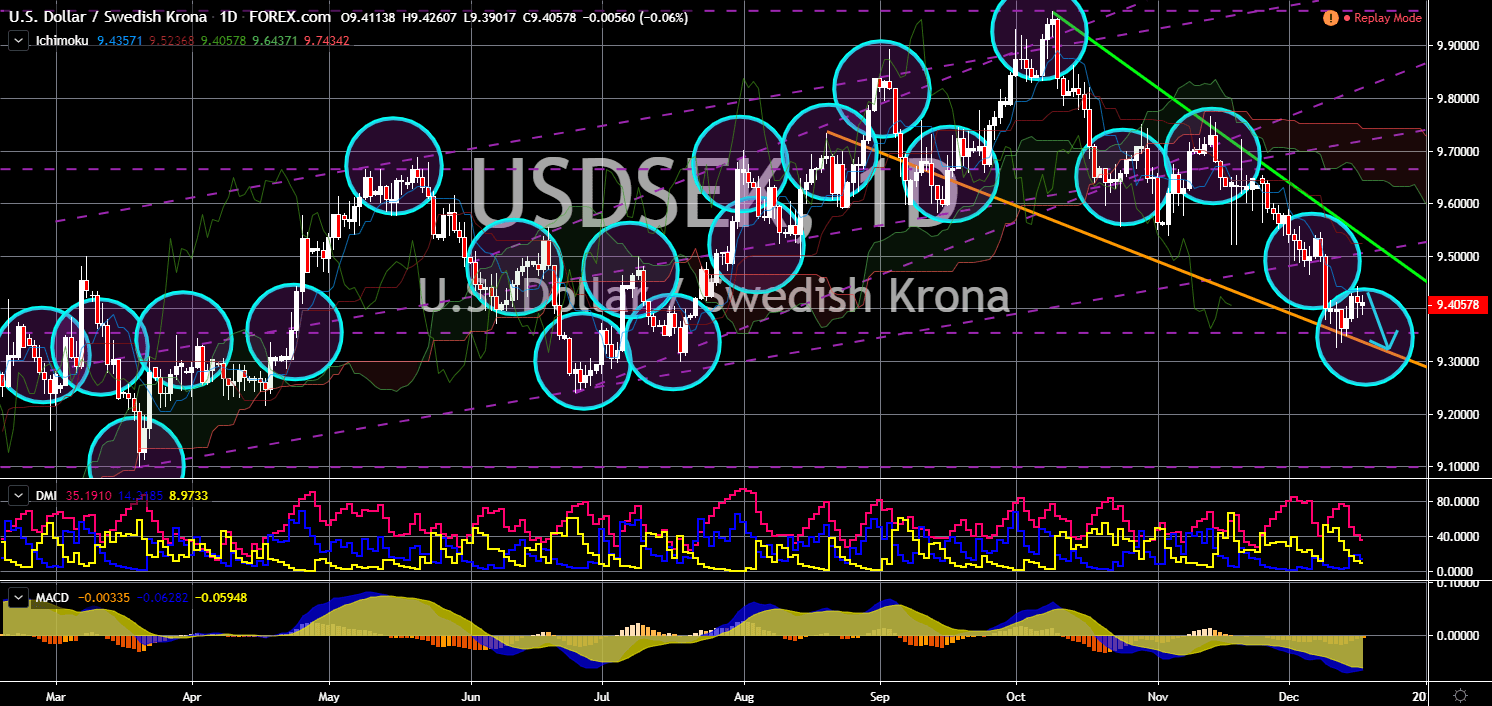

USD/SEK

The pair will continue to move lower in the following days and head towards the “Falling Wedge” pattern support line. The Sveriges Riksbank or Swiss National Bank (SNB) ended its five (5) year experimental negative rates, leaving Japan, Denmark, and Switzerland the only countries with a negative interest rate. In December 19, SNB raised its interest rate from negative 0.25% to a flat zero (0) rate amid signs that inflation has been picking up. Switzerland also announced that it is planning to leave the negative rates anytime in the future, while other economies has been racing to cut their rates. This is expected to boost the strength of Swedish Koruna against the US dollar. The United States had cut its rates three (3) times this year amid global economic uncertainty and its trade war with China, though the two (2) largest economies in the world had recently signed a phase one trade agreement to end their year-long trade war.

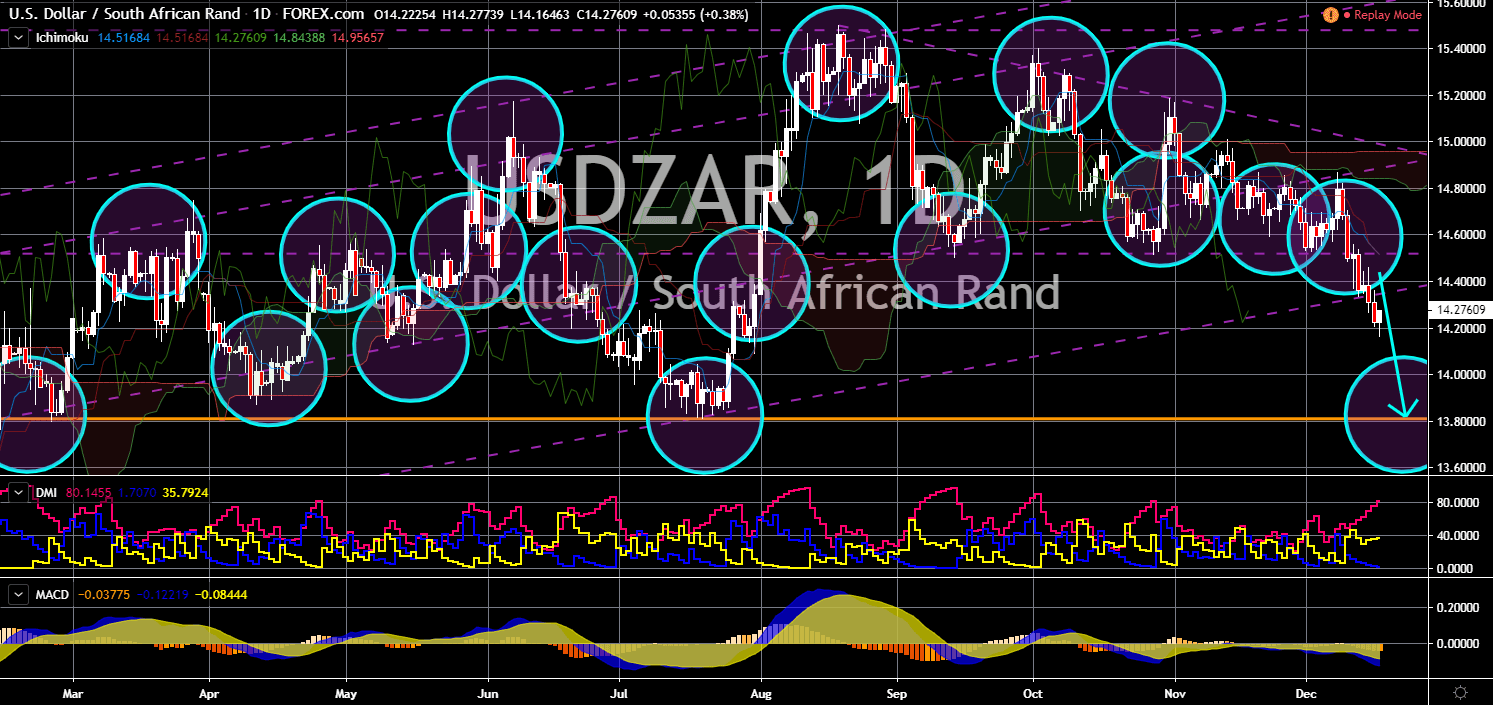

USD/ZAR

USD/ZAR

The pair is expected to continue to fall lower in the following days towards a major support line. The recent report in South Africa showed that nearly half of the country’s companies had no taxable income in 2017. The South African Revenue Services (Sars) said this reason was why South Africa was having a weak economic growth for the past few years. This failure to collect taxes from companies resulted to a 27.4% loss for the country’s economy. This 2019, South Africa is expecting to grow only at 0.5%, which is a significant drop from its previous forecast. However, as trade war between the United States and China remains uncertain, investors and traders are dragging the US dollar lower against the South African rand. Furthermore, analysts are worried that despite signing the phase one of the US-China trade deal, these countries were still not be able to resolve other conflicts and could result in the failure of a US-China trading agreement.

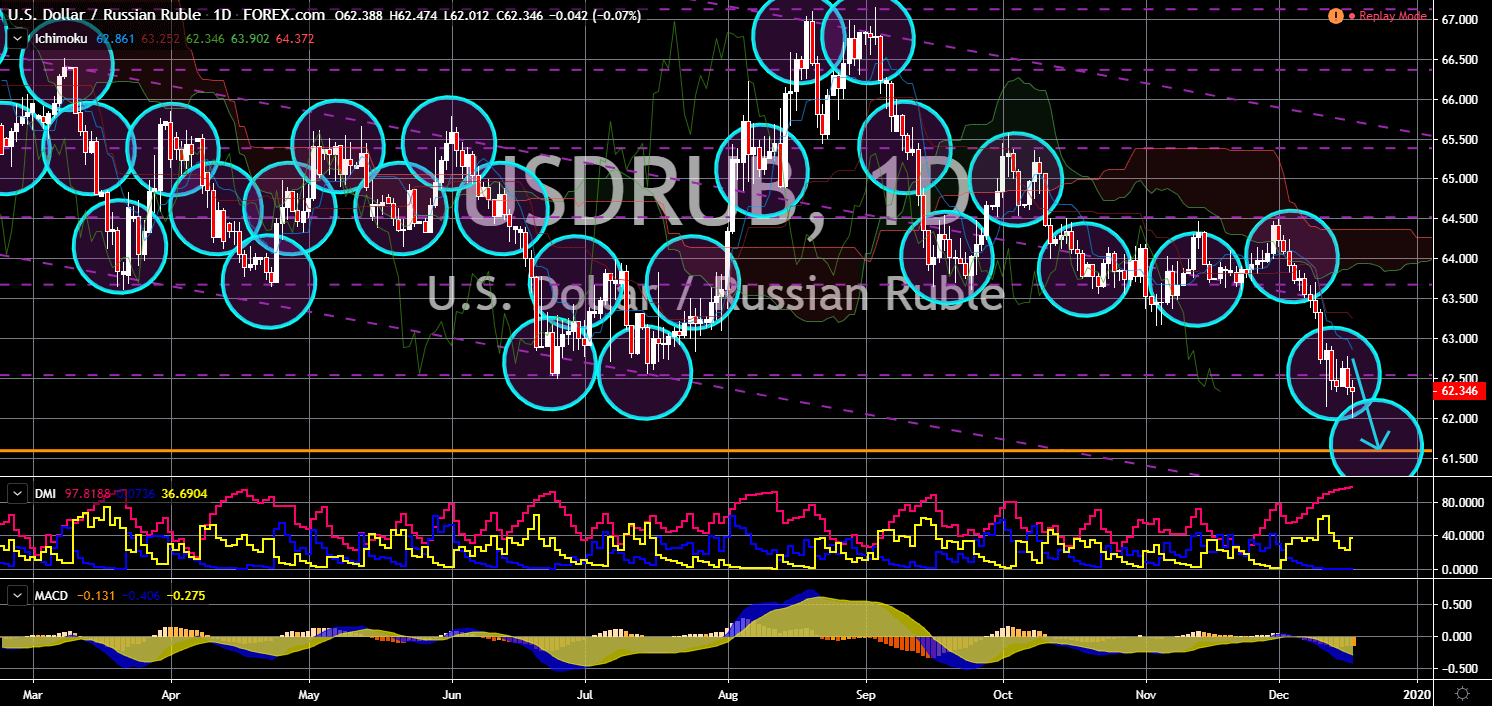

USD/RUB

The pair will continue to move lower in the following days after it broke down from a major support line. The United States and the European Union recently extend sanctions to Russia for another six (6) months. This was relating to Russia’s annexation of Crimea, a Ukrainian territory, in 2014. However, Russia seemed not bothered by this as it has recently inaugurated a bridge to Crimea led by Russian President Vladimir Putin. The bridge directly links mainland Russia closer to Crimea. In December 09, President Vladimir Putin, German Chancellor Angela Merkel, French President Emmanuel Macron, and Ukrainian President Volodymyr Zelensky failed to reach an agreement for ending the Crimea conflict. In other news, US President Donald Trump gave a greenlight to a new sanction to Russia to prevent the country from building Nord Stream 2 pipeline in US allies in the European Union.

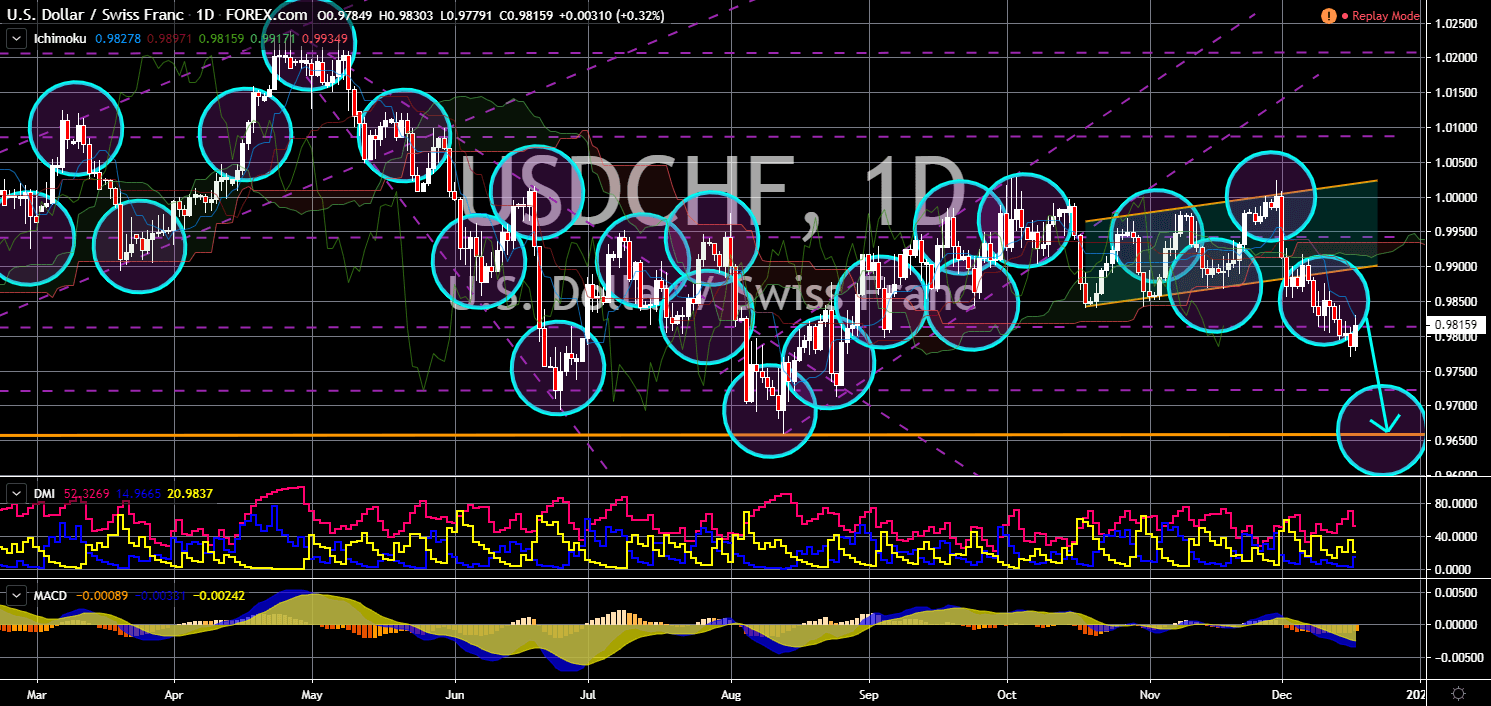

USD/CHF

The pair is expected to breakdown from a key support line, sending the pair lower toward its previous low. Switzerland announced its willingness to get out of the negative territory by 2020 following the end of Sweden’s five (5)-year ultra-monetary easing policy experiment this month. Sweden’s central bank raised its interest rate from negative 0.25% to a flat zero (0), leaving Denmark, Japan, and Switzerland to be the only remaining countries with a negative interest rate. Switzerland has the lowest interest rate in the world at negative 0.75%. Meanwhile, the United States cut its benchmark interest rate for three (3) times this 2019 amid global economic uncertainty and its trade war with China. The looming withdrawal of the United Kingdom from the European Union on January 31 is also adding appeal to safe-haven currencies like the Swiss Franc. Investors expected the Federal Reserve to cut another rate on 2020.