Market News and Charts for August 30, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

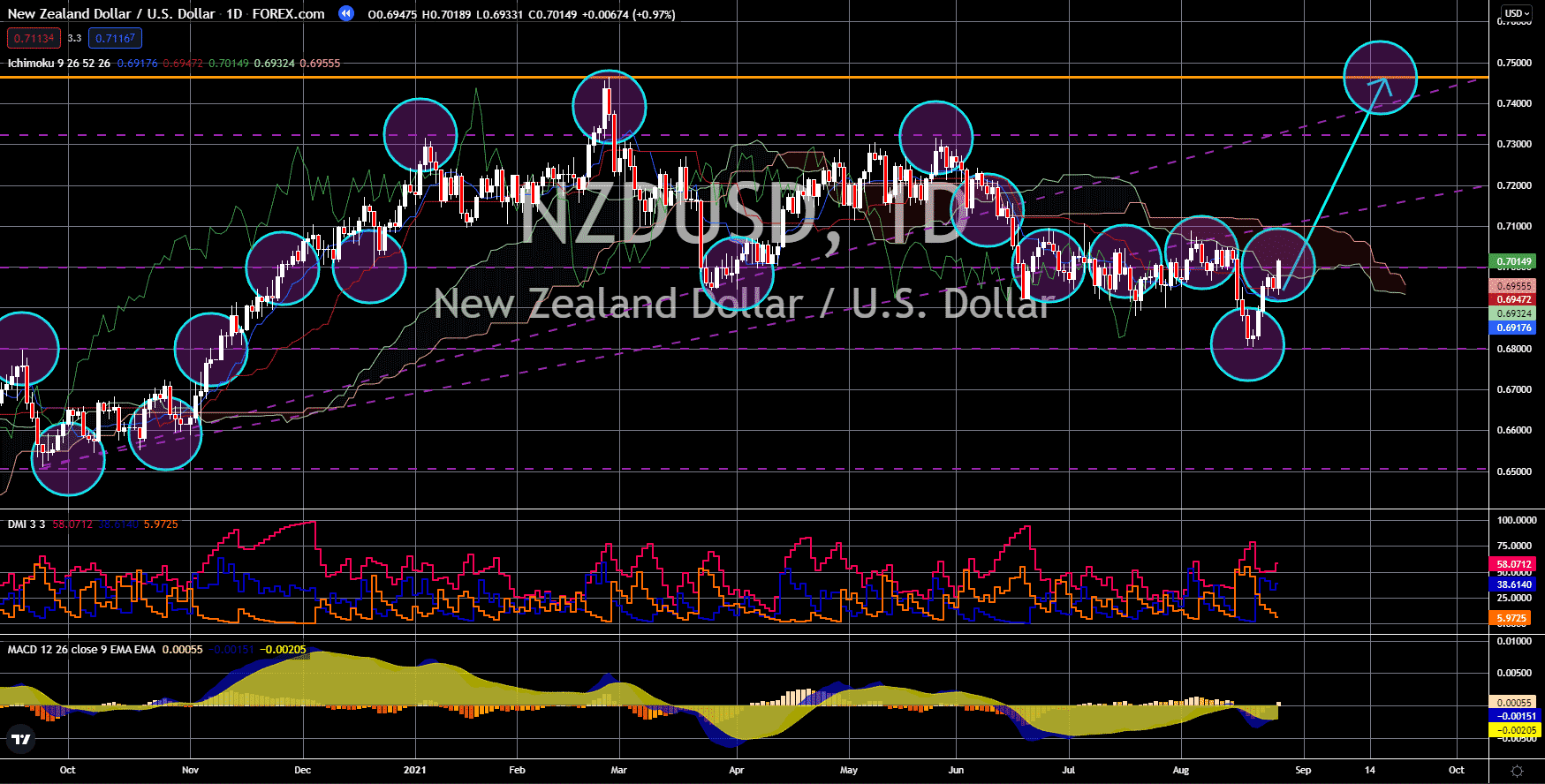

NZD/USD

The pair will extend its short-term rally to retest 2021’s high of 0.74647. On August 17, NZ Prime Minister Jacinda Ardern imposed a nationwide lockdown to contain the new case for almost six months. In response, the Reserve Bank of New Zealand held its planned interest rate hike until the next meeting. In addition, the central bank reaffirmed that rising cases would not stop RBNZ from tightening its monetary policy. The hawkish statement continues to benefit the New Zealand dollar in the last days of August. Investors are moving their capital to NZD as the bleak data pushes the investors to look for safer bets. On Monday, the ANZ Business Confidence recorded a massive decline to -14.2 points. The reported data represents the lowest figure in nine months. Meanwhile, the National Bank of New Zealand’s Own Activity index posted its second consecutive drop to 19.2%. Other reports in recent days include July’s Business Consent, which slowed down to 2.1%.

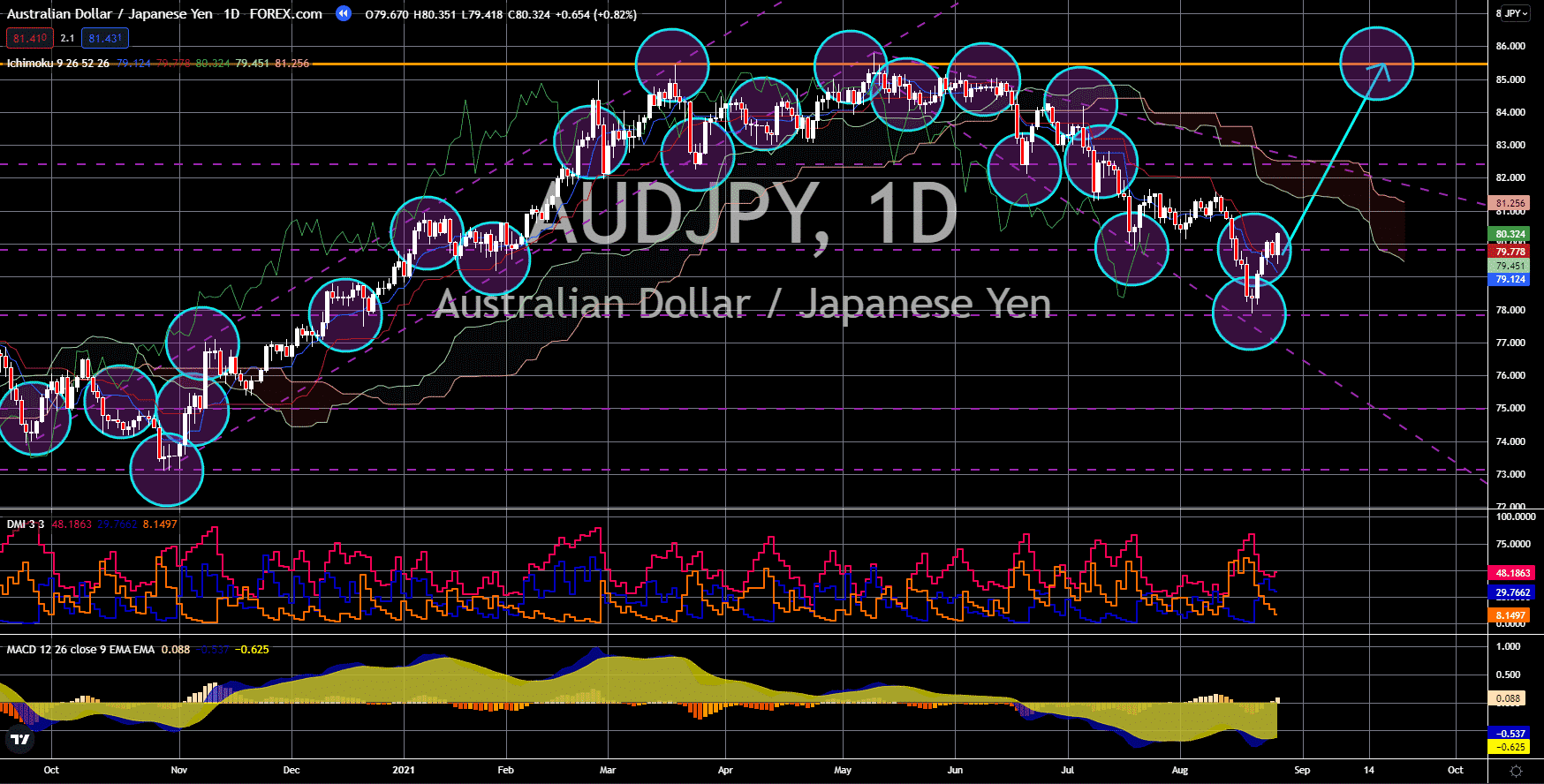

AUD/JPY

The pair will move past a key resistance at 79.809 to challenge a major support line of 85.500. The strong data from Japan will push shares higher at the expense of the Japanese yen. On August 30’s labor data, the unemployment rate fell to 2.8%, while the jobs/application ratio inched higher to 1.15%. The reports beat estimates of 2.9% and 1.12%. Meanwhile, the industrial production for the next three months is forecasted to improve by 3.4%. On the consumer side, retail sales improved 2.4% in July. Analysts see a further increase in the report next month as Tokyo’s August Core Consumer Price Index settled at zero percent. As for concerns over rising covid infections in the country, the government reaffirmed its August assessment. However, it warned of weaker data for the succeeding months if the pandemic continues to escalate in the economy. In other news, the candidates for premiership are courting voters with promises of stimulus to help the economy.

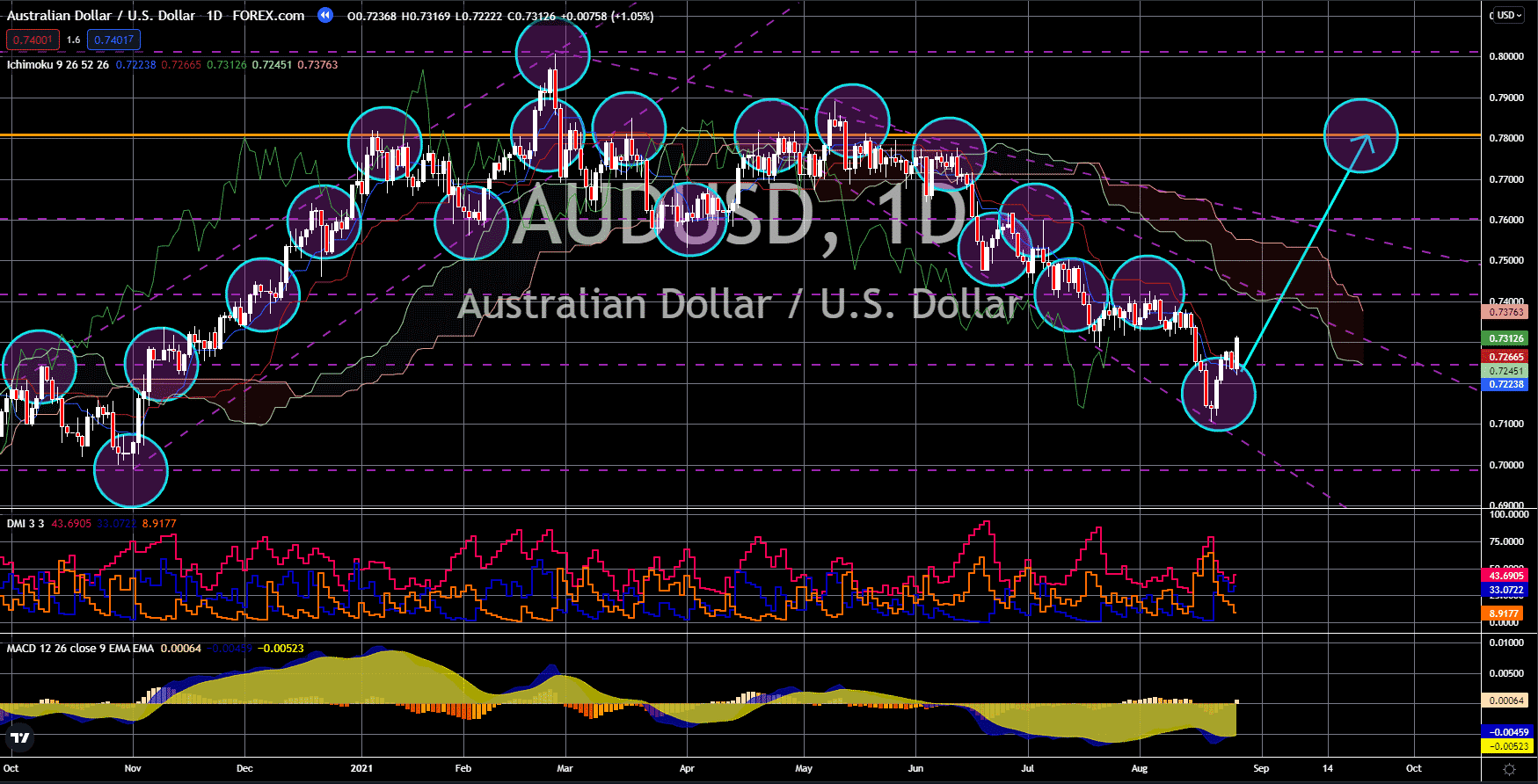

AUD/USD

The US dollar will underperform against its Australian counterpart in sessions. On August 28, US President Joe Biden declared a state of emergency in Louisiana, followed by Mississippi. This is as Hurricane Ida gained the strength to become the fifth strongest typhoon to land the Gulf Coast. Some cities have no power, resulting in the disruption of the supply chain. In turn, the decline in economic activity will weigh down on the US dollar. The negative news is no new as economic data in recent days also disappoint investors. Personal income in July improved by 1.1%, a major upside from the expected 0.2% increase. However, spending fell to 0.3% from 1.1% previously. Meanwhile, the number of unemployed Americans claiming benefits soared by 353,000. For the continuing jobless claims, the result came in at 2.86 million. The most important economic report is the GDP. In the second reading for Q2 2021, the GDP is seen growing at a slower pace of 6.6%.

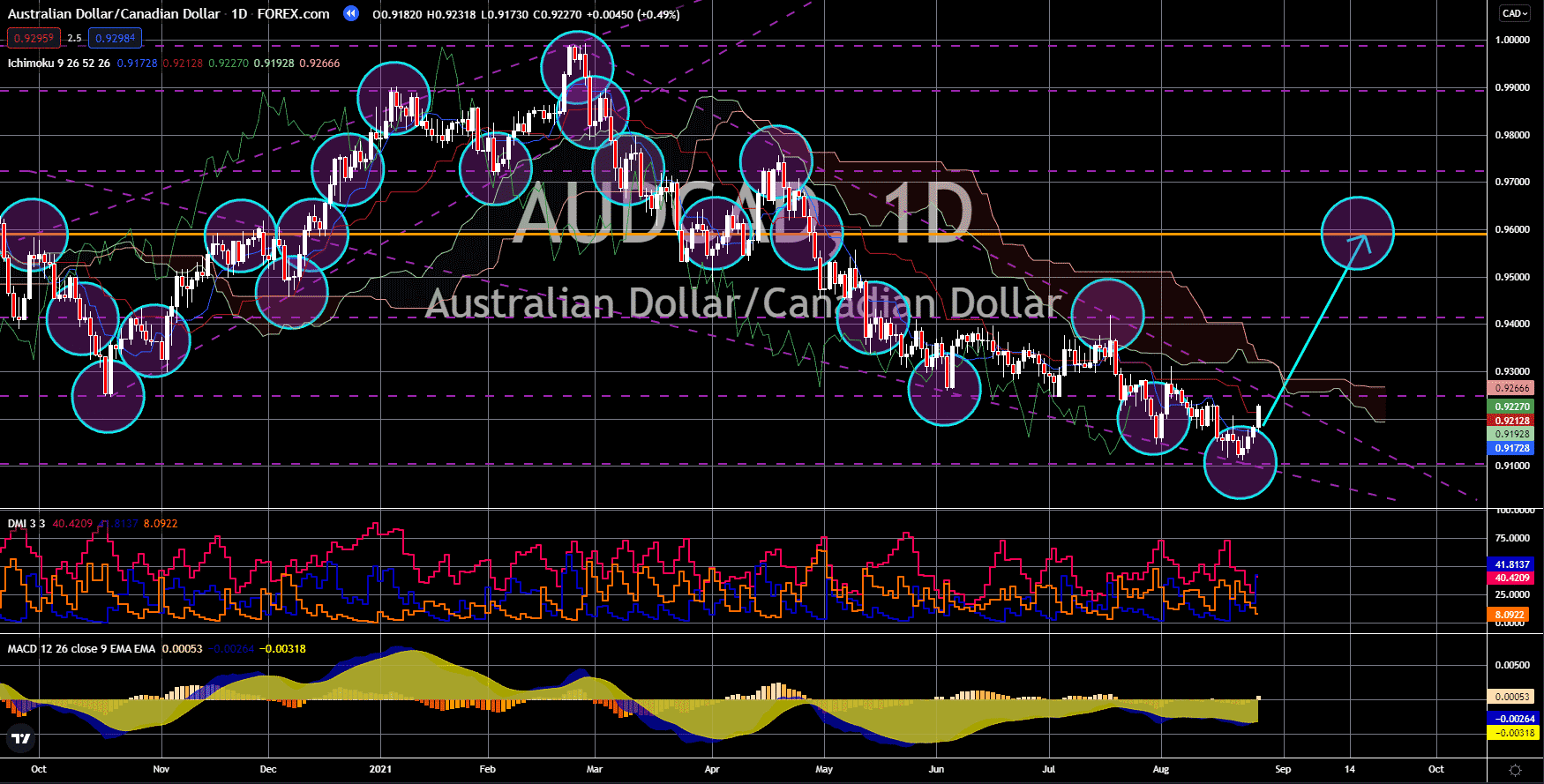

AUD/CAD

The pair will break out of the “Falling Wedge” pattern resistance line this week. Demand for the Australian dollar picked up as investors fled from the stock market. The pessimism in shares is due to weak economic data, which threatens to impact corporate earnings and revenue. Retail sales in July fell -2.7% to their steepest monthly decline since February 2021. This is as inflation continues to increase as the lockdown in several US states pressures local prices. The Melbourne Institute (MI) inflation index jumped by 0.5%. This increases the need for the Reserve Bank of Australia to tighten its monetary policy. Despite concerns over the delta variant, the central bank reaffirmed its commitment to taper the bond purchases by September. In relation to this, the private sector credit slowed down to 0.7% amid concerns of higher interest in the near term. The housing credit is also lower at 0.6% as private houses and buildings approval shrink -8.6% and -5.8%.