Market News and Charts for August 19, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

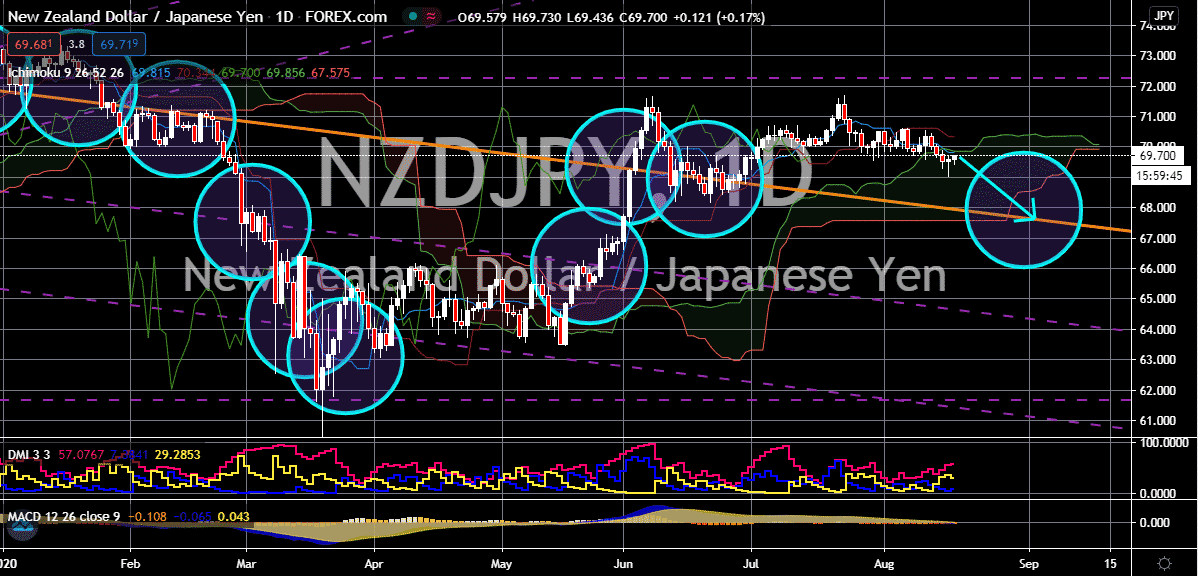

NZD/CAD

The recovery of the New Zealand dollar is short-lived. And by short-lived, just a couple of days. Right now, the trading pair is steady as the Canadian dollar regains support from the crude market. It is believed that the pair would go down to its support level soon, hitting ranges last seen in early June. As of today, crude prices are slightly retreating thanks to the recent report of the American Petroleum Institute, this strained the Canadian dollar this Wednesday. Fortunately for bearish investors of the pair, the downward momentum is expected to continue in the coming weeks, forcing prices to go down. The dovish stance of the Reserve Bank of New Zealand will ultimately hurt the New Zealand dollar. Just recently, it was reported that the American investing giant, JPMorgan expects the RBNZ to ease its monetary policies even further as it tries to counter the negative impact of the coronavirus pandemic to the country’s economy.

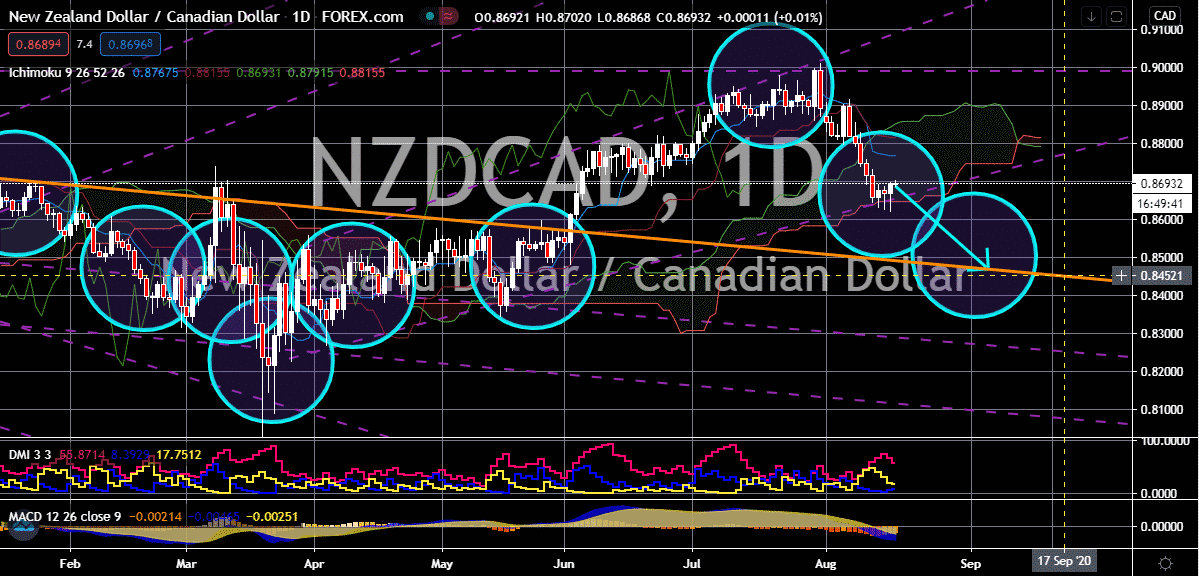

GBP/USD

The pound broke out against the US dollar and signs say that its bullish run isn’t over yet. Investors of the British pound are taking advantage of the broader weakness faced by the greenback and are using it to force prices to their highest level since December 2019. Brexit-deal negotiations between the United Kingdom and the European Union are keeping bulls alive. However, there is a huge potential for a reversal as the negotiations don’t look like their getting better. According to a new poll, most critics and experts believe that Britain should walk away from its post-Brexit trade deal negotiations with the EU and should just prepare for a no-deal situation. Brussels has also said that the United Kingdom’s demand for haulage access is actually too close to the single market’s rights and that it was fundamentally unbalanced. The recent Brexit talks kicked off yesterday in the Belgian capital and it failed to appease investors.

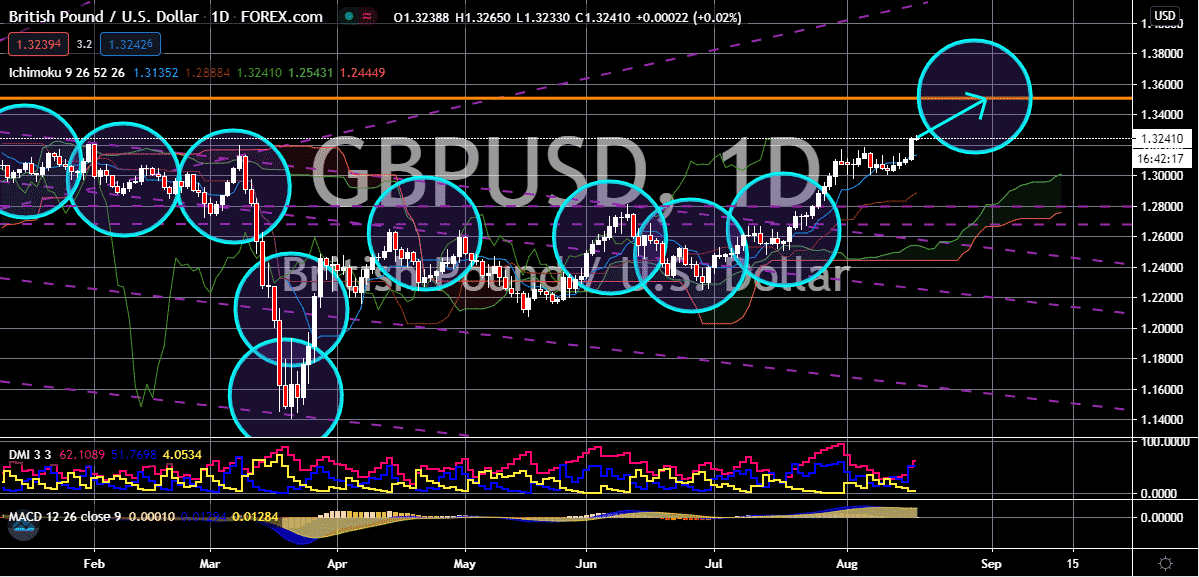

EUR/CAD

Despite the hurdles faced by the eurozone, the single currency remains strong against the Canadian dollar. The fundamentals around the loonie aren’t enough to prevent the euro from running away with gains. Prices are projected to climb to its resistance level by the end of the month or by the first few days of September. Just recently, former chief of the European Central Bank, Mario Draghi called on the countries in the region to ensure the colossal amounts of debts by countries. According to the former ECB boss, the debt created by the coronavirus pandemic is unprecedented and will be carried on by the younger generation. Draghi also said that in the case of the virus, the funds will be seen as “good debt” but if it’s used for unproductive purposes that it can be considered “bad”. Last month. The European Commission announced that it expects the 19-nation bloc’s economy to contract by 8.7% this 2020 thanks to the pandemic.

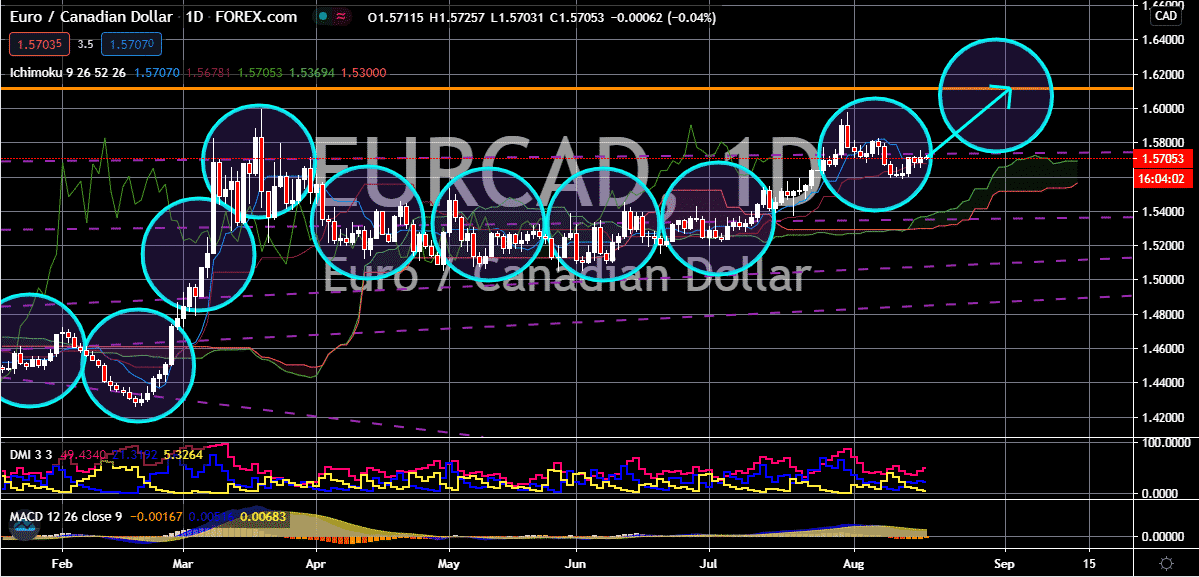

NZD/JPY

As of writing, investors of the trading pair are struggling to gain proper momentum and prices are seen flat. However, it’s expected that the tides will eventually turn in favor of bearish investors and that the exchange rate would fall to its support levels. Economists are getting concerned about the hints of the Reserve Bank of New Zealand, which ultimately signals bearish investors to take over. According to recent reports, most economists now believe that the RBNZ will slash its benchmark rates below zero, further weakening the New Zealand dollar. However, the predictions are for the first few months of 2021, meaning to say that it’s not going to have an immediate impact on the New Zealand dollar. Just last week, the bank announced that it’s expanding its bond-buying program, warning the possibility of negative rates as the country enters another unfortunate lockdown again. Markets were surprised when the bank dropped the news.