Market News and Charts for August 20, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

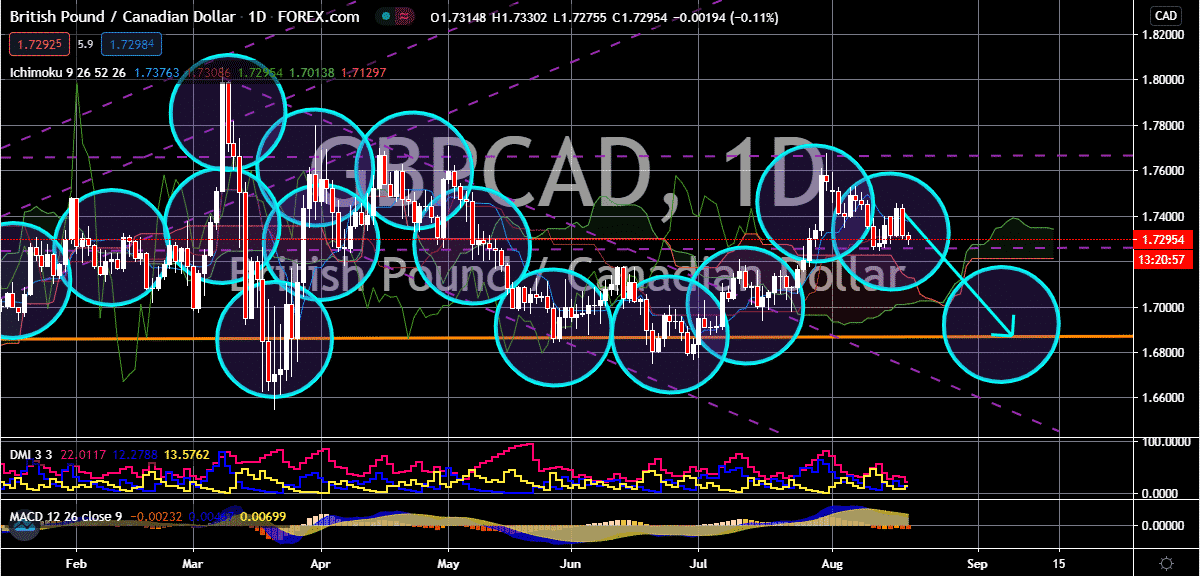

GBP/CAD

Despite the turbulence faced by the Canadian dollar, Brexit-related concerns are still heavier, weighing on a ton of burden for bulls. As of writing, the trading pair is somehow steady, and prices are now projected to crash towards their support level by the first half of September. The main factor that’s affecting the direction of the Canadian dollar now is the resignation of the country’s finance minister amidst friction with Canadian Prime Minister Justin Trudeau over the spending policies and charity scandal. Earlier this week, Bill Morneau said that he will never run for parliament again and would instead aim to become the next secretary general for the Organization of Economic Cooperation and Development. The news coupled with the conditions in the crude market has been both beneficial and problem for the Canadian loonie this week. Meanwhile, the stalemate in Brexit negotiations is making it rough for the British pound.

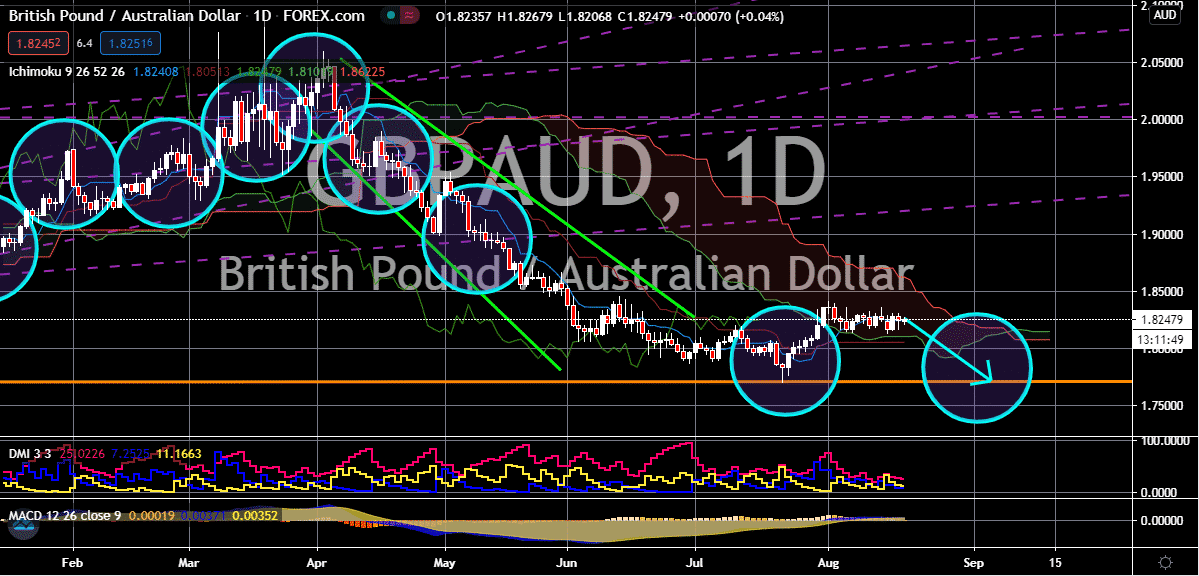

GBP/AUD

As the number of new cases in Australia finally start to ease, the Australian dollar starts steadily gathering strength to bring the exchange rate’s prices lower. See, since the lockdown was reinforced in Australia, the antipodean currency slightly lost its footing and its dominance. And during those times, investors of the British pound were eager to restart the trade-deal negotiations with the European Union. However, judging by the stalemate, the odds that are in favor of bears are back. Prices should go down towards their support level by the first few days of September, hitting ranges last seen in late-June. Earlier this week, it was reported that the Reserve Bank of Australia crossed out the possibility of further easing, which signaled bears to floor their gas pedals. Looking at it, further interest rate cuts would be detrimental to the Aussie’s strength, and the status of the currency itself now is already acting like a monetary tool.

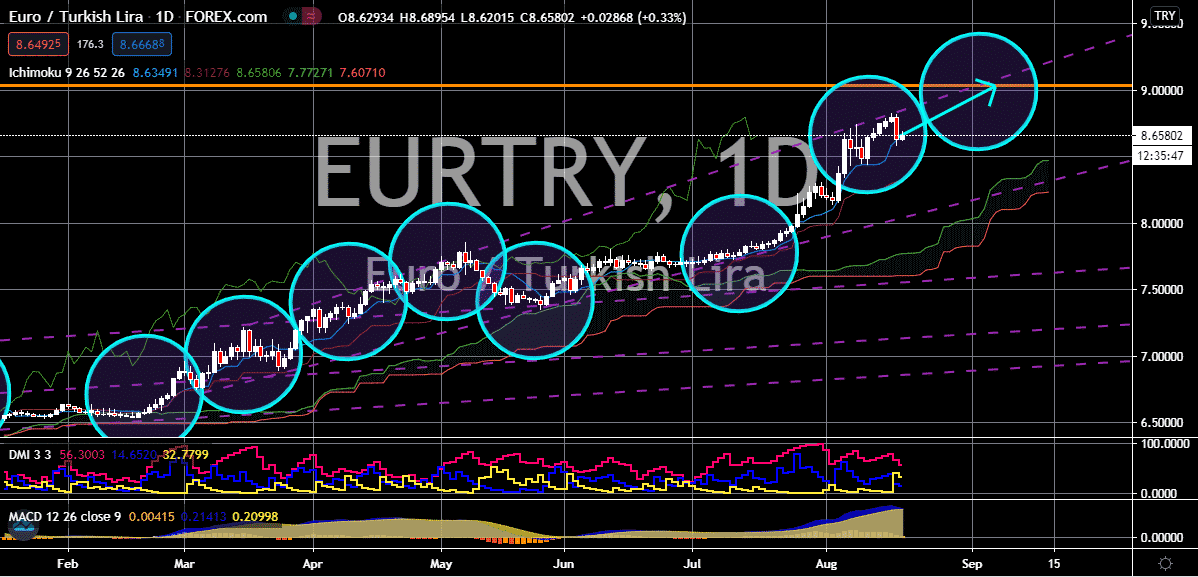

EUR/TRY

Bears are in deep trouble. Prices are extremely bullish, and the euro is widely popular and desirable in the foreign exchange market now. The pair has already soared past its ranges from the Turkish financial crisis period and it isn’t looking like it would slow down anytime soon. Investors of the pair are closely watching the Turkish central bank and its decision. Earlier this week, Turkish President Recep Tayyip Erdogan told the public that he would announce a “surprise” tomorrow that would help Turkey enter a new era. According to reports, a source close to the matter said that the Turkish president would unveil a new hydrocarbon discovery that would help Turkey and the lira recover from its critical position. Moreover, most economists believe that the Turkish central bank would leave its interest rates unmoved as further cuts would be detrimental to the lira and further hikes would hurt the chances of the country’s economic recovery.

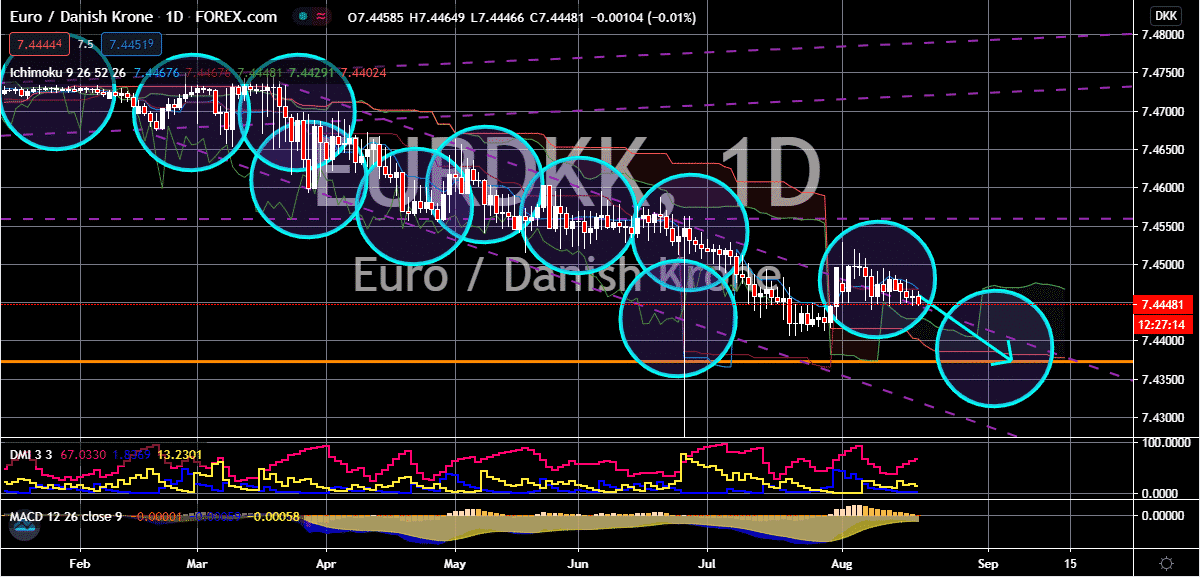

EUR/DKK

Considering the favorable outcome of the Danish government’s coronavirus response, the euro to Danish krone remains bearish. The euro to Danish krone exchange rate is projected to head down to its support level in the coming sessions but there are a few fundamentals that could slow down its pace. See, Denmark is heavily affected by the ongoing Brexit, and its facing troubles without the United Kingdom’s waters. Brexit trade talks are ongoing, and the European Union is pushing to maintain its access to British waters. Denmark would be left vulnerable is a no-deal divorce is an outcome. An expert on fisheries in the country said that Denmark would struggle to catch its quotas of mackerel and herrings if fishermen won’t be granted access to British waters. And the consequences are expected to be dire. As for the euro, there are positive forecasts for its fate, but it’s not expected to take effect until after the presidential election in the United States.