Market News and Charts for August 05, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

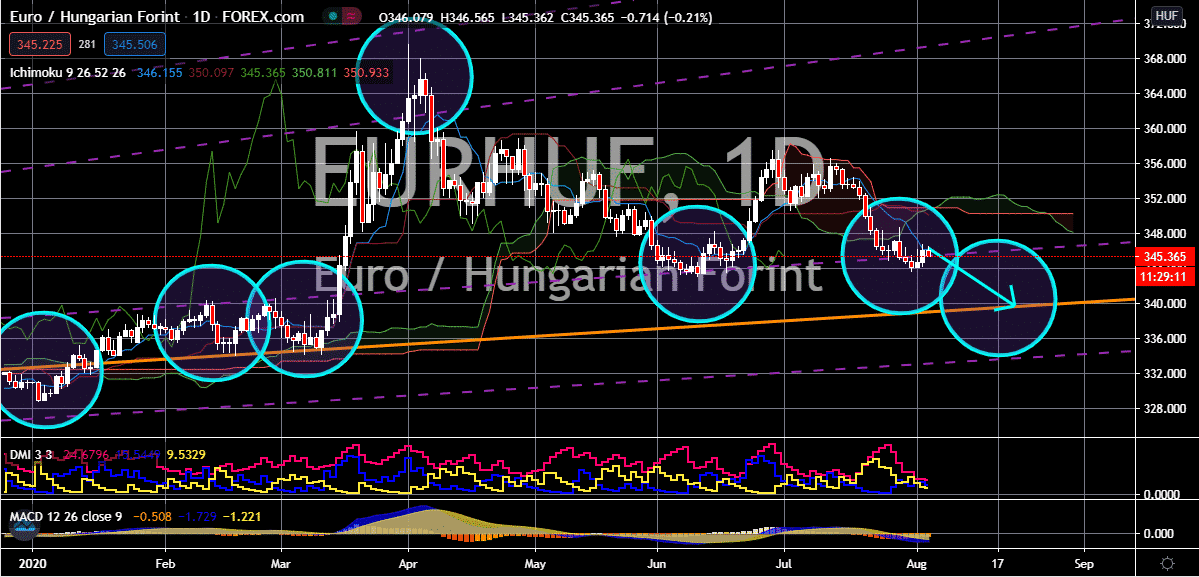

USD/RON

The Romanian leu continues to drag the US dollar following the failed attempt of bullish investors to regain the momentum. The price should go down to its support level, hitting ranges last seen in September 2018, erasing almost two years-rally by bulls. It’s no new news that the US dollar is currently weakening against most assets because it’s pressured by a ton of factors. This includes the political uncertainties ahead of the much-awaited presidential elections in November. In the past, the United States President Donald Trump suggested that the elections could be delayed until people can safely and securely vote. However, just this week, Trump’s advisers clarified that the elections will continue on November 3 as initially planned. As for the Romanian leu, its primary strength comes from its correlation to other currencies in the region. Most Central European currencies are rallying and the positive sentiment in the bloc is expected to last longer.

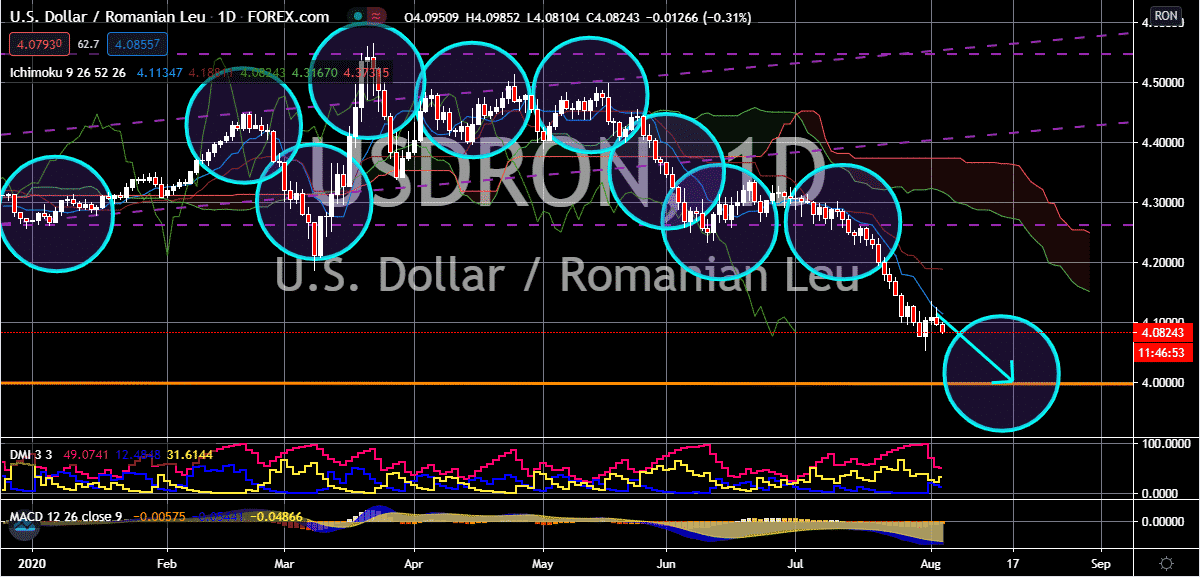

EUR/RUB

The Russian ruble is in a tough predicament against the euro. But bearish investors are looking for ways to recharge the commodity-linked currency in the trading sessions. The euro to Russian ruble exchange rate is forecasted to go down to its support level as bears hope for support from Russia. Just recently, it was reported that the Russian government is seeking to add around 1.9 billion US dollars in taxes from oil and gas. Reports say that the finance ministry of the country is looking to gain more tax proceeds by officially amending the tax code and the profit-based tax. This creates a rift between the government and the Russian oil industry, but bears are hoping that it could generate more funds to support the economy and buoy the ruble. And as for the euro, the notable performance of the eurozone’s economy is buoying the single currency against the Russian ruble, putting up a much tougher fight for bearish investors.

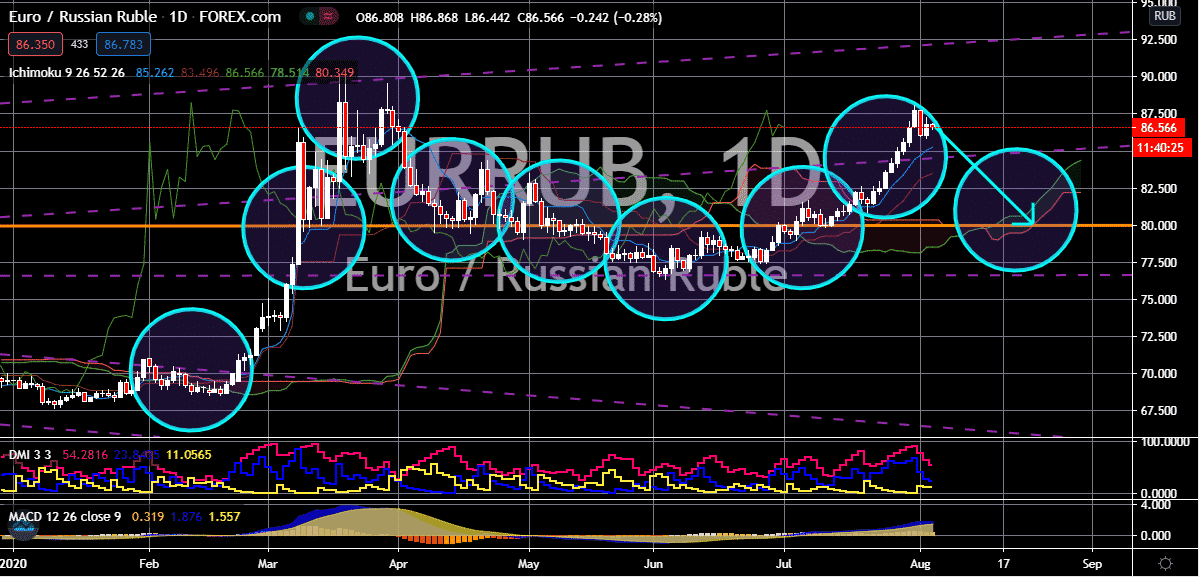

EUR/NOK

The euro to Norwegian krone exchange rate is having some difficulties climbing up in the trading sessions. But luckily for bears, the odds are looking better for the Norwegian krone. Looking at it, the strength of the Norwegian krone is mainly driven by crude prices and it’s also affected by the single currency and the performance of other currencies in the region. As of writing, oil prices continue to hold on despite the heavy pour of bearish news. It was recently reported that the Organization of the Petroleum Exporting Countries finally relaxed its historic production cut and the markets are bracing for more. This comes as major economies continue to open their economy and ease their travel restrictions despite the still increasing number of covid-19 cases around the world. Earlier this year, the group agreed to dramatically reduce their production to prevent oil prices from plummeting, this also helped the cause of the Norwegian krone.

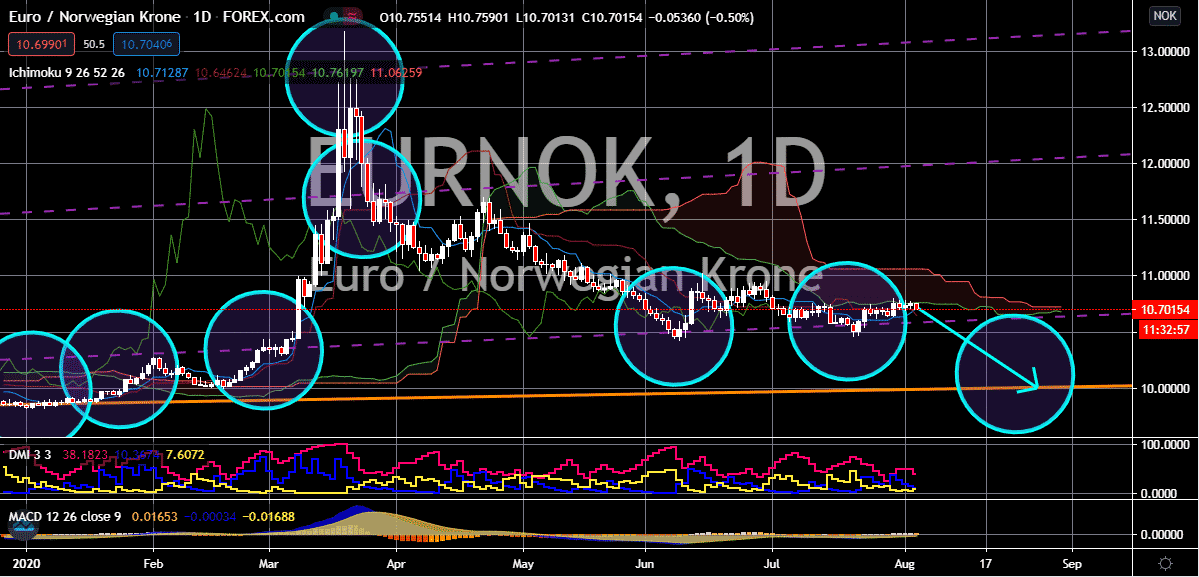

EUR/HUF

The Hungarian momentarily lost its footing against the euro once the month kicked off. But as of today, it manages to ease thanks to stimulus hopes and the performance of the stock market. The global sentiment improved which helped the Hungarian forint and major stock indices. And all of these are because investors are looking forward to further stimulus measures in the United States and the positive results produced by the eurozone. Moreover, Hungarian Prime Minister Viktor Orban confidently said that the country’s economy will benefit from an upcoming investment boom by next year. This will be the evident result of the government’s programs to help domestic firms. Through government aid, hundreds of companies have undertaken to invest in machinery and factories that should start production or manufacturing within a year. However, Orban warned the citizens to stay cautious to prevent a second wave of coronavirus infections.