Gold and Silver: Tried to recover

- During the Asian trading session, the price of gold consolidated at around $ 1840.

- On Friday, the price of silver failed to break the $ 22.00 level, followed by a pullback to $ 21.45 early this morning during the Asian trading session.

- Due to today’s holiday on June 16 in the USA, poor liquidity conditions also leave dollar bulls at a distance, helping gold to find the bottom.

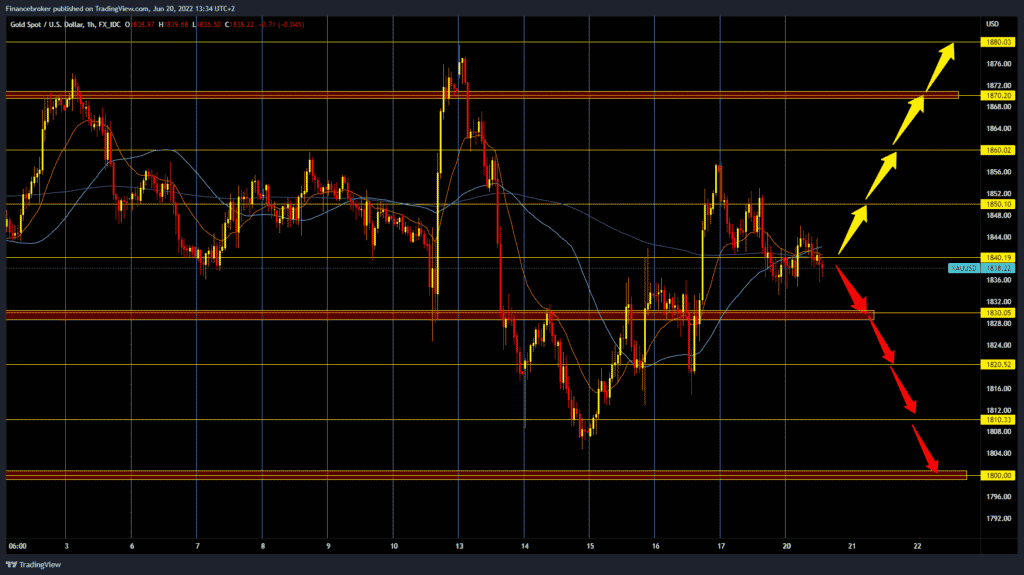

Gold chart analysis

During the Asian trading session, the price of gold consolidated at around $ 1840. Today’s movement was in the range of $ 1835-1845. What is important to us is the formation of a new lower high, and that is a sign for us to continue the bearish trend and descend towards the $ 1830 support zone. A break in the price of gold below this support zone could further cause the price to continue falling towards $ 1820 and try to find further support there. Potential lower targets are our $ 1,810 and $ 1,800 support levels. For the bullish option, we need a new positive consolidation and the formation of a new higher low. Our first hurdle is the $ 1850 level. Break prices above could form a new higher high at $ 1860. Below we could once again test the $ 1870 resistance zone.

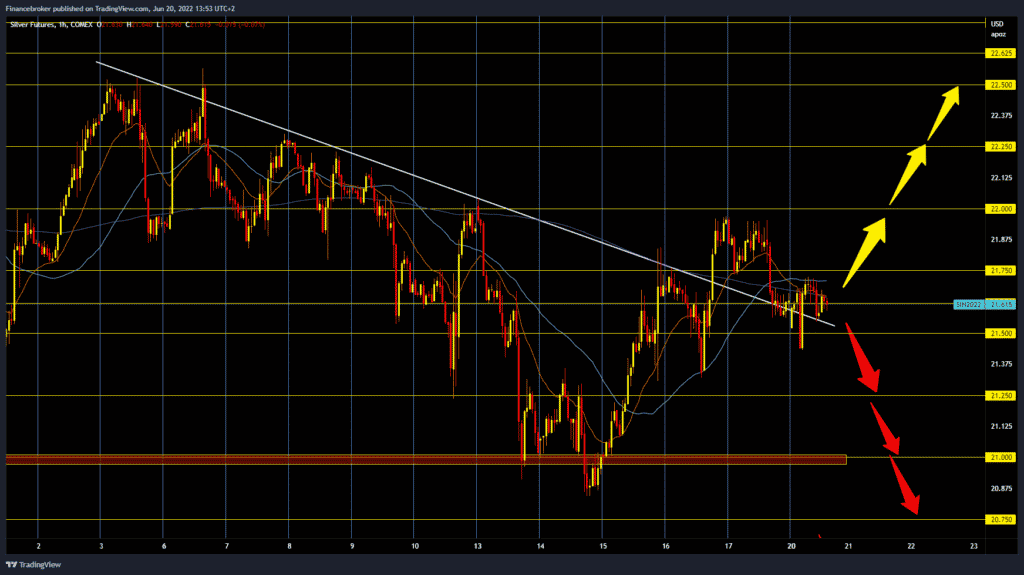

Silver chart analysis

On Friday, the price of silver failed to break the $ 22.00 level, followed by a pullback to $ 21.45 early this morning during the Asian trading session. The price of silver tried to recover and encountered an obstacle at the $ 21.70 level, forming a new lower high on the chart. We are now in a potential new bearish consolidation, and it is possible that we will see a continued decline in prices and the formation of a new lower low below the $ 21.45 level. Potential lower targets are $ 21.25, $ 21.12 and $ 21.00 level. For the bullish option, we need positive consolidation and a break above $ 21.75. After that, the pair could once again test the $ 22.00 level.

Market overview

Due to today’s holiday on June 16 in the USA, poor liquidity conditions also leave dollar bulls at a distance, helping gold to find the bottom.

However, the rise in the price of gold remains limited, as investors remain cautious amid the Fed’s aggressive tightening. The Fed raised reference interest rates by 75 basis points last week, leaving the door open for an increase of 75 basis points in July, as the World Central Bank remains committed to fighting inflation.

Markets are now still focused on the speech of the President of the ECB, Christine Lagarde, about fresh hints about monetary policy, which could have a significant impact on the sense of risk, which may affect the dynamics of gold. The next thing about metal is the speech of Fed President Jerome Powell, which should be later this week.