Bitcoin and Ethereum: Negative territory

- Over the weekend, the price of Bitcoin was in negative territory, below $ 20,000.

- On Saturday, the price of Ethereum fell below the $ 900 level to $ 880.

- The Russian government considers bitcoin as an option for payments for small business transactions and not for oil exports, the country’s finance ministry said.

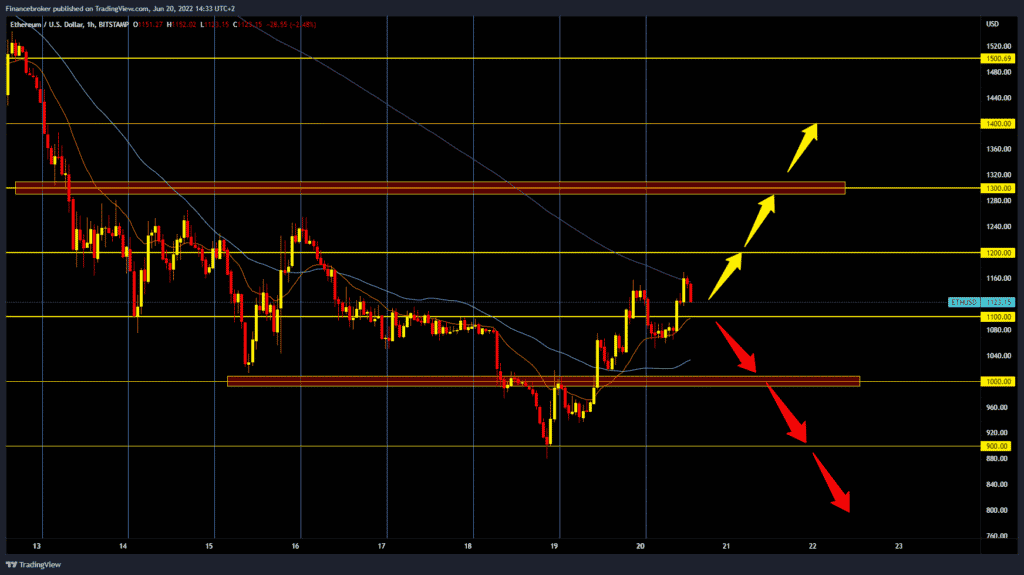

Bitcoin chart analysis

Over the weekend, the price of Bitcoin was in negative territory, below $ 20,000. After that, we see a recovery and a return above $ 20,000. Price is currently facing resistance at $21,000. The positive thing about the price of Bitcoin is that a new higher high has been formed, and now we have to pay attention to whether the price will form a higher low. If that doesn’t work, we return to the bearish trend and new testing of the $ 20,000 level. For the bullish option, we need a continuation of this positive consolidation and a break above $ 21,000. Our next target is a zone around $ 22,000; the additional resistance at that level may be the MA200 moving average. Our potential next target is the $ 23,000 level, the resistance zone from June 16.

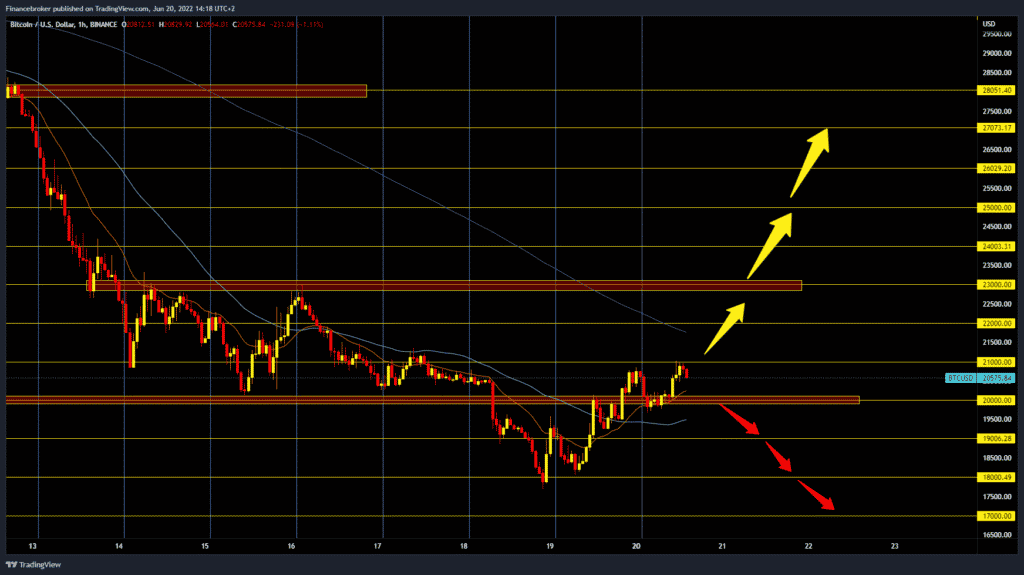

Ethereum chart analysis

On Saturday, the price of Ethereum fell below the $ 900 level to $ 880. Yesterday we saw a recovery above $ 1,000 and then a jump above $ 1100. During today’s first part of the day, the price of Ethereum found support at $ 1080; after that, we see a bullish impulse up to $ 1160. Additional resistance at that level is the MA200 moving average. If we see the break above, our next target is the $ 1200 level, then $ 1300 and the formation of a new higher high. We need a negative consolidation and a return below the $ 1100 level for the bearish option. After that, we will test the $ 1000 level again. If we see a break below again, Ethereum will again test its low last week.

Market overview

The Russian government considers bitcoin as an option for payments for small business transactions and not for oil exports, the country’s finance ministry said. The high official emphasized that the department means that cryptocurrencies can be used in barter transactions but not as a legal tender. The ministry proposes that cryptocurrency be used as a means, not as a means of payment, the senior official noted. This means that digital currencies can be used in barter transactions – when a customer formally exchanges bitcoins or other cryptocurrencies for a product or service, he explained. Cited by RTVI, Chebeskov elaborated:

The task is to provide an alternative, not to say that Russia now pays for everything with cryptocurrencies. It is not about state settlements but only about private business.

The Central Bank of Russia has softened its position on crypto payments in the context of foreign trade relations. A provision was passed in May that allows Russian companies to conduct such transactions for import and export purposes.