Oil and Natural Gas: Down or up trend

- The oil price continues to consolidate in place of last week’s low.

- The price of natural gas has been falling for the ninth day in a row after reaching a high of $ 9.60 on June 8.

- Bloomberg reported on Friday that OPEC + delegates are trying to decide what to do when the oil pact ends in August.

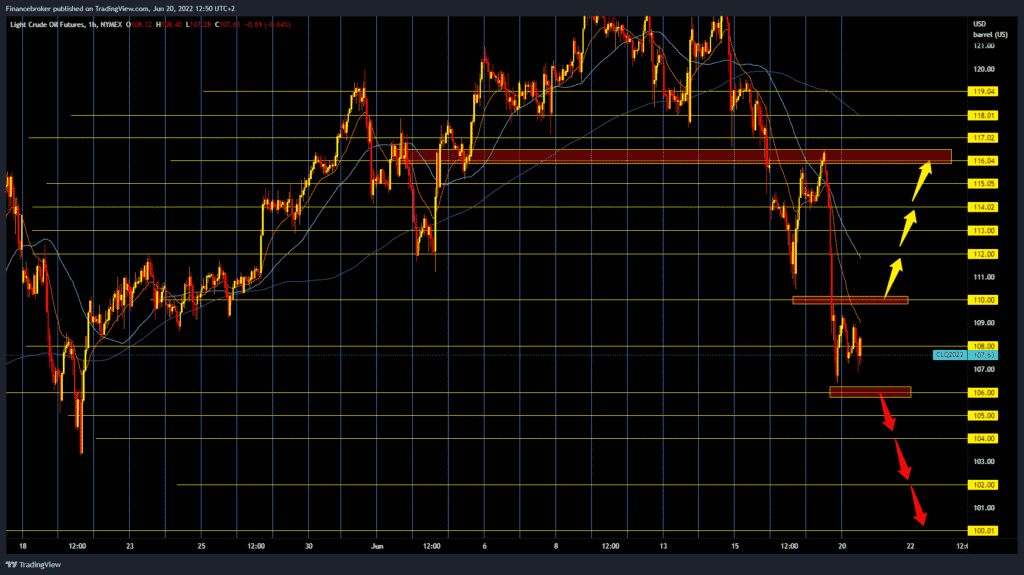

Oil chart analysis

The oil price continues to consolidate in place of last week’s low. The price fell from $ 116.50 to $ 106.40, losing $ 10 in value. During the Asian trading session, oil was in the range of $ 107.50-109.00. We now see continued negative consolidation and increased bearish pressure that could bring the price down to $ 106.40 again. A price break below would bring us down to potential support in May. Our targets are $ 105.00, $ 104.00 and $ 103.20 levels. For the bullish option, we need a new positive consolidation and a return above the MA20 moving average and $ 109.00 price. After that, a bullish recovery could follow and above the $ 110.00 level. At $ 112.00, we come across the next MA50 moving average, and a break above would certainly boost optimism in continuing the bullish trend.

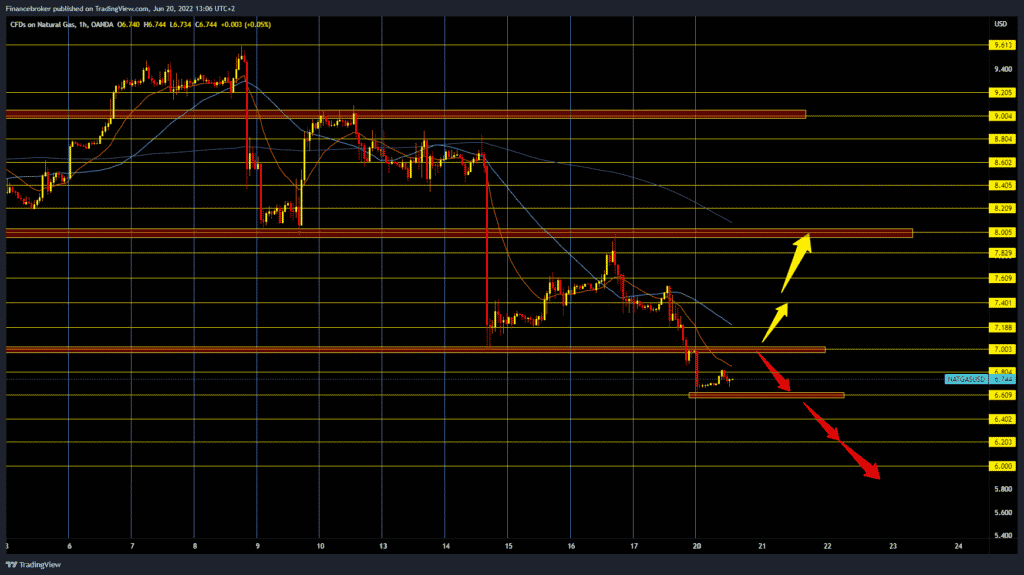

Natural gas chart analysis

The price of natural gas has been falling for the ninth day in a row after reaching a high of $ 9.60 on June 8. Initially, the price dropped to $ 8.00, then pullback to $ 9.00. After that, the price was in bearish consolidation for three days, and a drop to $ 7.00 followed. The new pullback was up to $ 8.00. This is followed by another consolidation and a drop to $ 6.60 this morning. If the price moves according to the template, we should now see a drop to the $ 6.00 level if we do not find support here. Otherwise, a recovery and break above $ 7.00 could occur. And the price of gas would get additional support in the MA20 and MA50 moving averages.

Market overview

Bloomberg reported on Friday that OPEC + delegates are trying to decide what to do when the oil pact ends in August. The pact is facing numerous uncertainties and difficult situations – including its relationship with one of the group’s largest members – Russia. Saudi Arabia pointed out that Russia is an integral part of OPEC + despite the Russian aggression in Ukraine, emphasizing that OPEC + is not an alliance formed from politics but for market management.

Despite isolation in China, which is slowing domestic oil demand, black gold prices have remained above $ 100.00. Deutsche Bank economists expect oil prices to remain high. As blockades in China are eased, we expect Chinese demand to recover quickly, especially given the likely political stimulus. Restrictions on Russian supplies will remain in place, and an increase in global supplies seems unlikely. The continuation of capital discipline in the United States means that only a limited increase in American production seems likely in the next 12 months, and production remains below pre-Covid levels. We expect OECD stockpiles to take some time to return to pre-Covid levels.