Bank of Japan’s Limited Influence on USD/JPY Trend

Quick Look:

- BOJ interventions in USD/JPY may slow trends but can’t alter long-term direction;

- Technical levels suggest the potential for deeper pullbacks towards 152.25;

- Long-term bullish trend remains strong, with targets near 164.94.

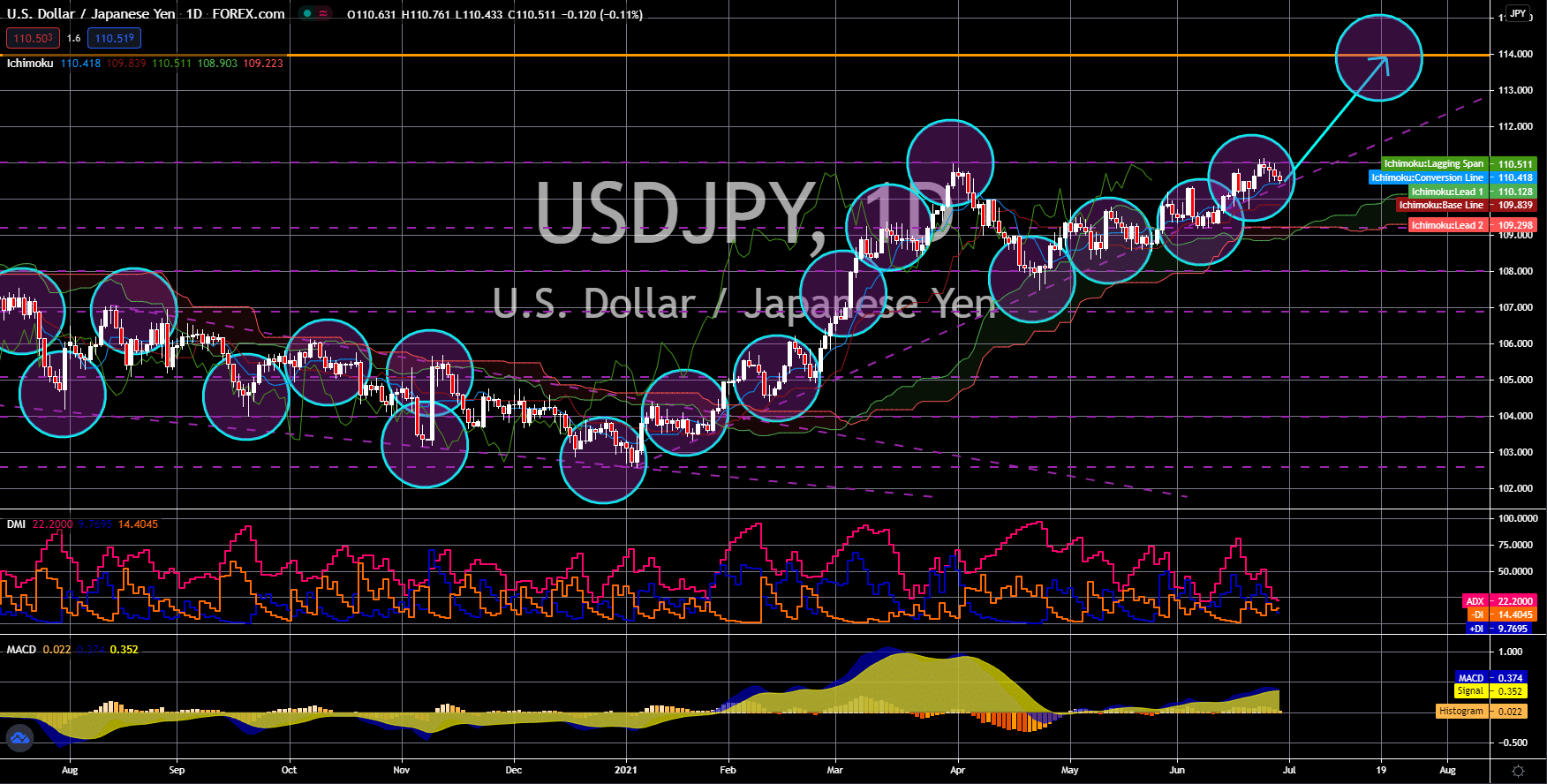

The Bank of Japan (BOJ) may occasionally intervene in the forex markets to try and steer the USD/JPY currency pair in the desired direction. However, recent trends suggest that while such interventions can delay the inevitable, they are unlikely to alter the course of the currency’s trajectory fundamentally. The USD/JPY has seen a notable correction from its peak at 160.20, indicating a shift in momentum that the central bank’s efforts can only moderate, not prevent.

As the pair continues its correction, the resistance level at 157.98 emerges as a critical marker. Should this level hold, it signals that the risk remains skewed to the downside. Analysts are eyeing a deeper pullback towards the 55-day Exponential Moving Average, currently positioned at 152.25. This pullback could potentially extend to the 61.8% Fibonacci retracement of the rise from 146.47 to 160.20, which is located at 151.71. Despite these downward pressures, there’s a consensus. Robust support around 150.87 could catalyze a significant rebound. This would affirm the resilience of the upward trend observed since the beginning of the year.

Technical Indicators and Market Sentiment

The USD/JPY pair has recently demonstrated a rebound off the 200-period Simple Moving Average on the 4-hour chart. It crossed above the 38.2% Fibonacci retracement level. This movement suggests a prevailing bullish sentiment among traders, albeit with a note of caution. Additionally, the mixed signals from oscillators across hourly and daily charts call for careful analysis. These signals could indicate potential resistance near the 50% Fibonacci level at 156.55. Consequently, traders would do well to monitor these technical indicators closely. Doing so will help them gauge the strength of the current bullish sentiment and adjust their strategies accordingly.

Long-Term Outlook Remains Bullish

In the broader perspective, the current rise from 140.25 is seen as the third leg of the uptrend that began from the 2023 low at 127.20. This pattern underscores a strong bullish phase. Consequently, the pair could be aiming for the 100% projection target of 164.94. This target is calculated from the rises starting at 127.20 to 151.89 and resuming from 140.25. Moreover, the long-term outlook for USD/JPY remains positive as long as the support-turned-resistance level at 150.87 holds firm, even in the event of a deep pullback.

This resilience in the face of potential setbacks highlights the underlying strength of the bullish trend. Investors and traders should consider the implications of central bank interventions, technical indicators, and fundamental economic factors when planning their moves in this volatile pair. Despite the challenges and potential setbacks, the path ahead for USD/JPY appears predominantly upward, supported by strong technical foundations and ongoing market dynamics.