Gold and Silver: The Strong Dollar Pressured The Prices

- The price of gold jumped to $1729 yesterday due to the weak dollar.

- The price of silver formed its October high at the $21.23 level. It did not stay there for long, as a pullback below the $21.00 support followed.

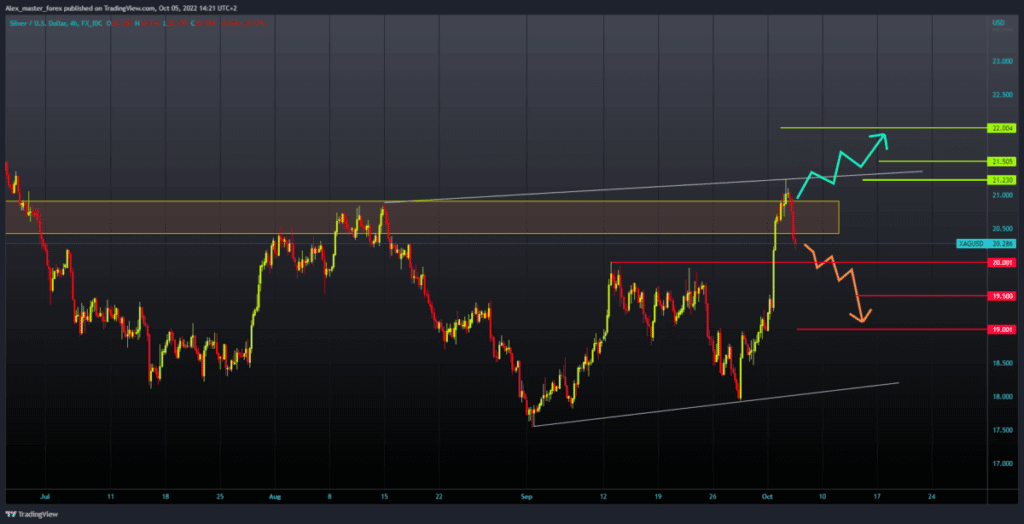

Gold chart analysis

The price of gold jumped to $1729 yesterday due to the weak dollar. The dollar managed to consolidate and begin recovery, and thus gold began to retreat. The price of gold dropped very quickly to the $1,720 level. The strong dollar pressured the price even more and is now at the $1706 level. Yesterday’s high coincides with the 61.8% Fibonacci level, and based on the current state of the chart, we will look for support at the 38.2% Fibonacci level, $1690. For a bullish option, we need a new positive consolidation and a return to the previous resistance zone of $1725-1730. If we see a break above the price of gold, it could test the 61.8% Fibonacci level. Potential higher targets are $1740 and $1750 levels.

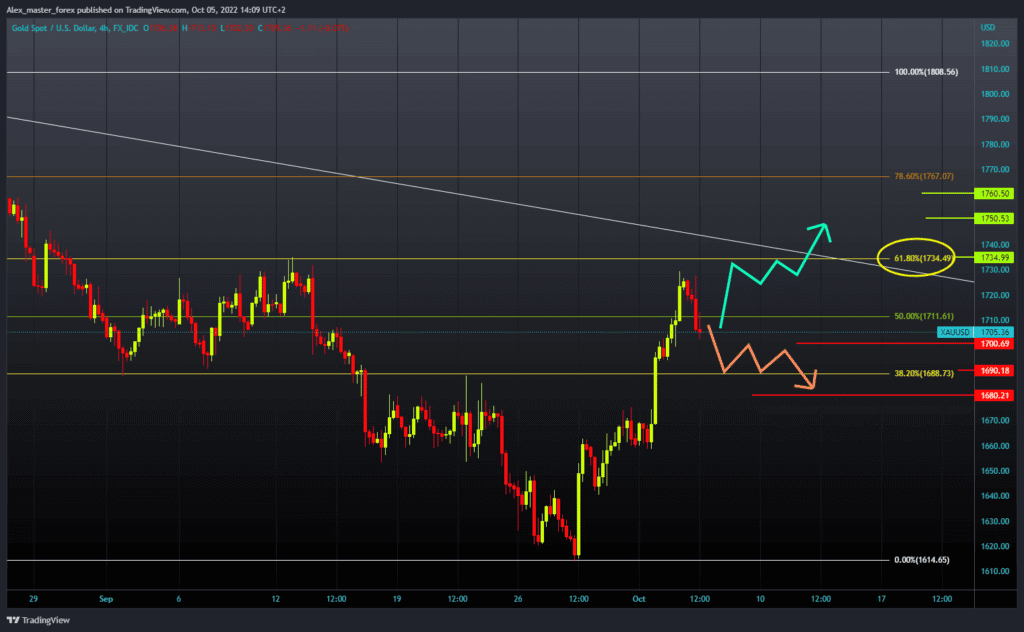

Silver chart analysis

The price of silver formed its October high at the $21.23 level. It did not stay there for long, as a pullback below the $21.00 support followed. During the Asian trading session, the price of silver continued to fall, to now be at the $20.25 level. We are very close to the $20.00 level, where we could expect the decline to slow down, find potential support, and form a new higher low. Potential lower targets are $19.50 and $19.00 levels. We need a positive consolidation and price return to the previous resistance zone for a bullish option. After that, if we manage to hold up, we could see a new bullish impulse and continued recovery. Potential higher targets are $21.25, $21.50.