Gold and Silver: The price is falling

- The price of gold continues its bearish trend during both the Asian and European sessions.

- During the Asian trading session, the price of silver continued the bearish trend of the previous days.

- India has raised its basic import duty on gold to 12.5 percent from 7.5 percent.

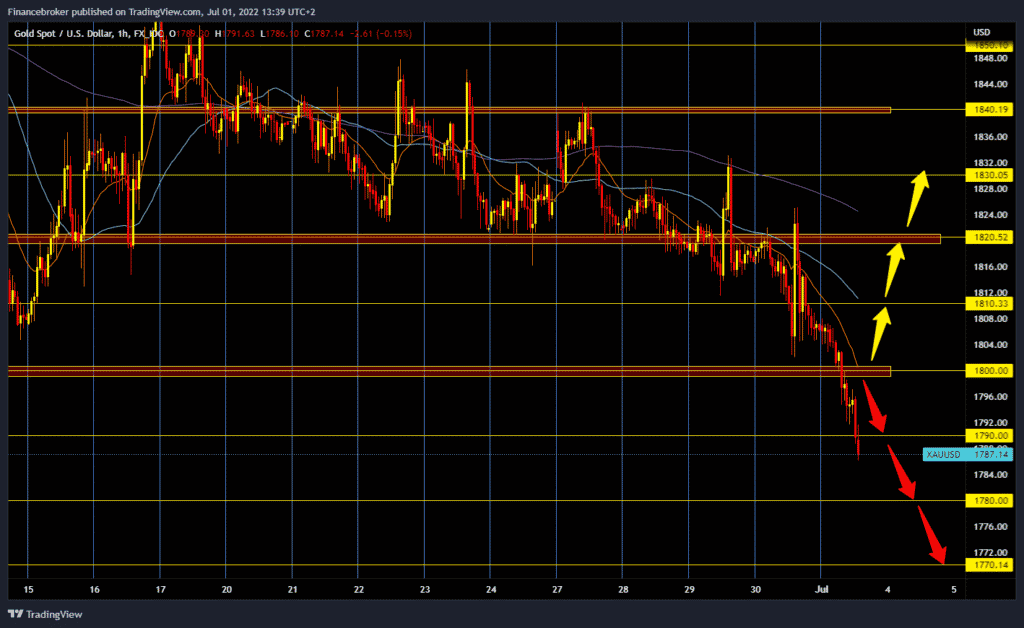

Gold chart analysis

The price of gold continues its bearish trend during both the Asian and European sessions. Gold is now trading at $1,788, down 1.02% since the start of trading last night. The bearish pressure is huge, and we will likely see a continuation of the price decline by the end of the day. The potential next lower targets are $1780 and $1770 level. For a bullish option, we need a new positive consolidation and a return above the $1800 level. A break above would at least temporarily take the pressure off the gold price. Potential next higher targets are the $1810 and $1820 levels.

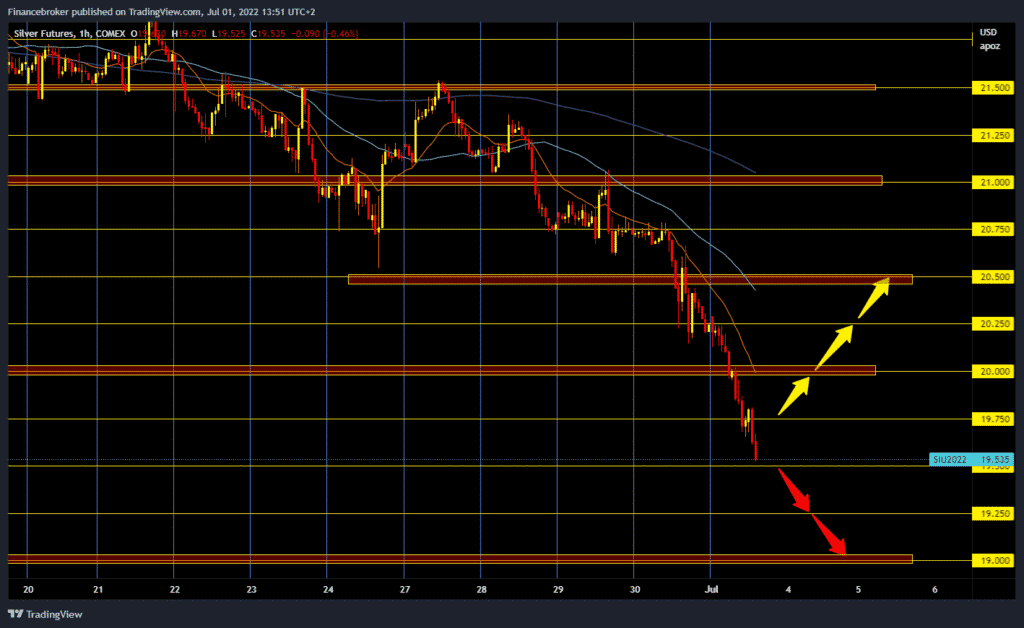

Silver chart analysis

During the Asian trading session, the price of silver continued the bearish trend of the previous days. The price broke the $20.0 level and continued further to the current $19.56. Our next bearish target is the $19.00 price, and in the meantime, the $19.50 and $19.25 levels are potential supports. For a bullish option, we now need a new positive consolidation and a return above the $20.00 level. At that level, we could expect the next consolidation. If we manage to hold on to that level, we could continue towards the $20.50 resistance zone.

Market overview

India has raised its basic import duty on gold to 12.5 percent from 7.5 percent, the government said on Friday, as the world’s second-largest consumer of precious metal tries to reduce demand and narrow its trade deficit. India meets most of its demand for gold through imports. That put pressure on the rupee, which hit a record low earlier on Friday. The tariff hike should lift prices and moderate demand in India, which could weigh on global prices. But it could encourage uncontrolled buying and increase the smuggling of precious metals into the country, industry sources said.