Gold and Silver: Confirming the October Low

- Yesterday, the price of gold began to recover but was stopped at the $1,684 level.

- During the Asian trading session, the price of silver fell to the $19.00 level,

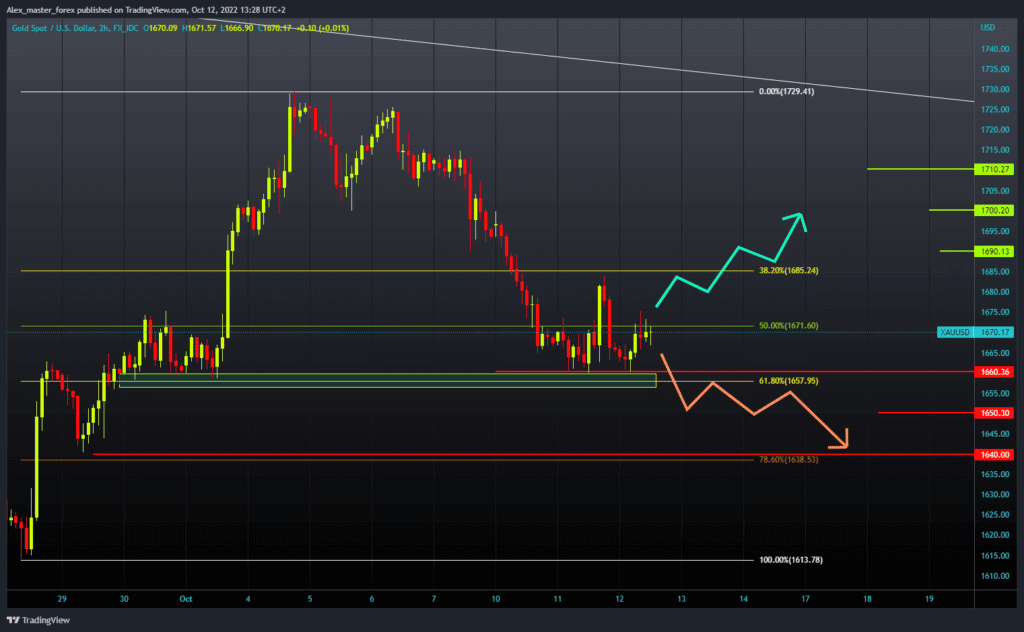

Gold chart analysis

Yesterday, the price of gold began to recover but was stopped at the $1,684 level. After which, there was a new pullback to the $1660 support level. During the Asian trading session, the price of gold started a new bullish impulse and climbed to the $1670 level. We are now consolidating here and watching gold’s potential next move to determine the next trend move. We need positive consolidation and a return to yesterday’s high for a bullish option. A price crossing above would signify to us that gold would have the strength to continue its recovery. Potential higher targets are $1690 and $1700 levels. We need a negative consolidation and a drop below the $1660 level for a bearish option. After that, we would see a further retreat in the price of gold. Potential lower targets are $1650 and $1640, the next lower low.

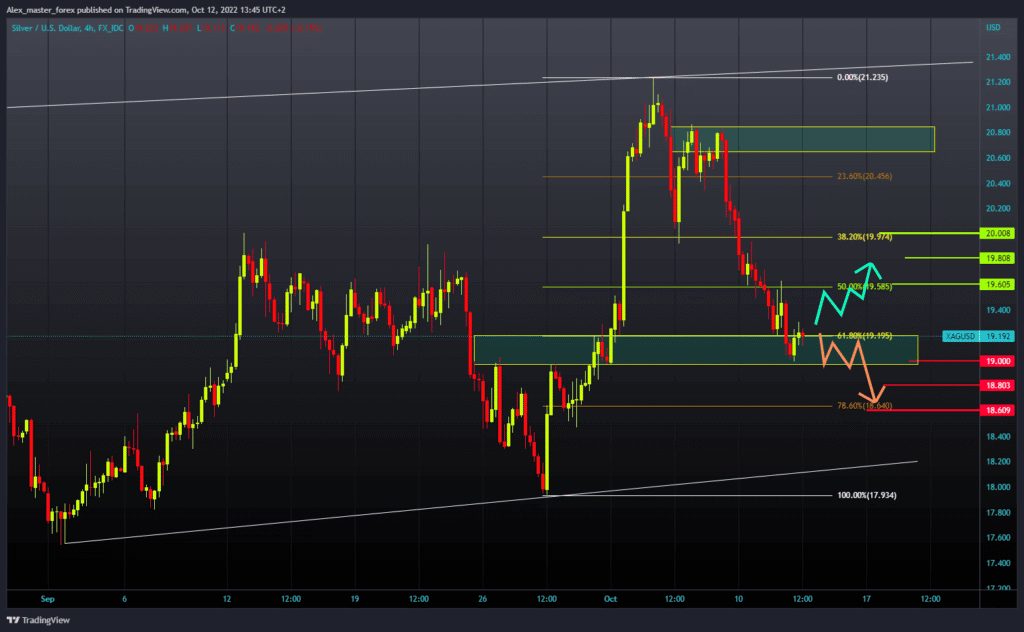

Silver chart analysis

During the Asian trading session, the price of silver fell to the $19.00 level, confirming the October low. After that, we see a silver price recovery to the $19.20 level. For a bullish option, we need a continuation of the negative consolidation and a return to $19.60 at the 50.0% Fibonacci level. Here we should look for new support and form a new higher low. Then with a bullish impulse, we should see a recovery in the price of silver. Potential higher targets are the $19.80 and $20.00 levels. We need a negative consolidation and a drop to the $19.00 level for a bearish option. A price drop below would form a new October low. Potential lower targets are the $18.80 and $18.60 levels.